Medical Allowance Exemption In Income Tax Section 10 of the Indian Income Tax Act allows numerous income tax exemptions Under medical allowance exemption Section 10 the medical allowance you receive is not

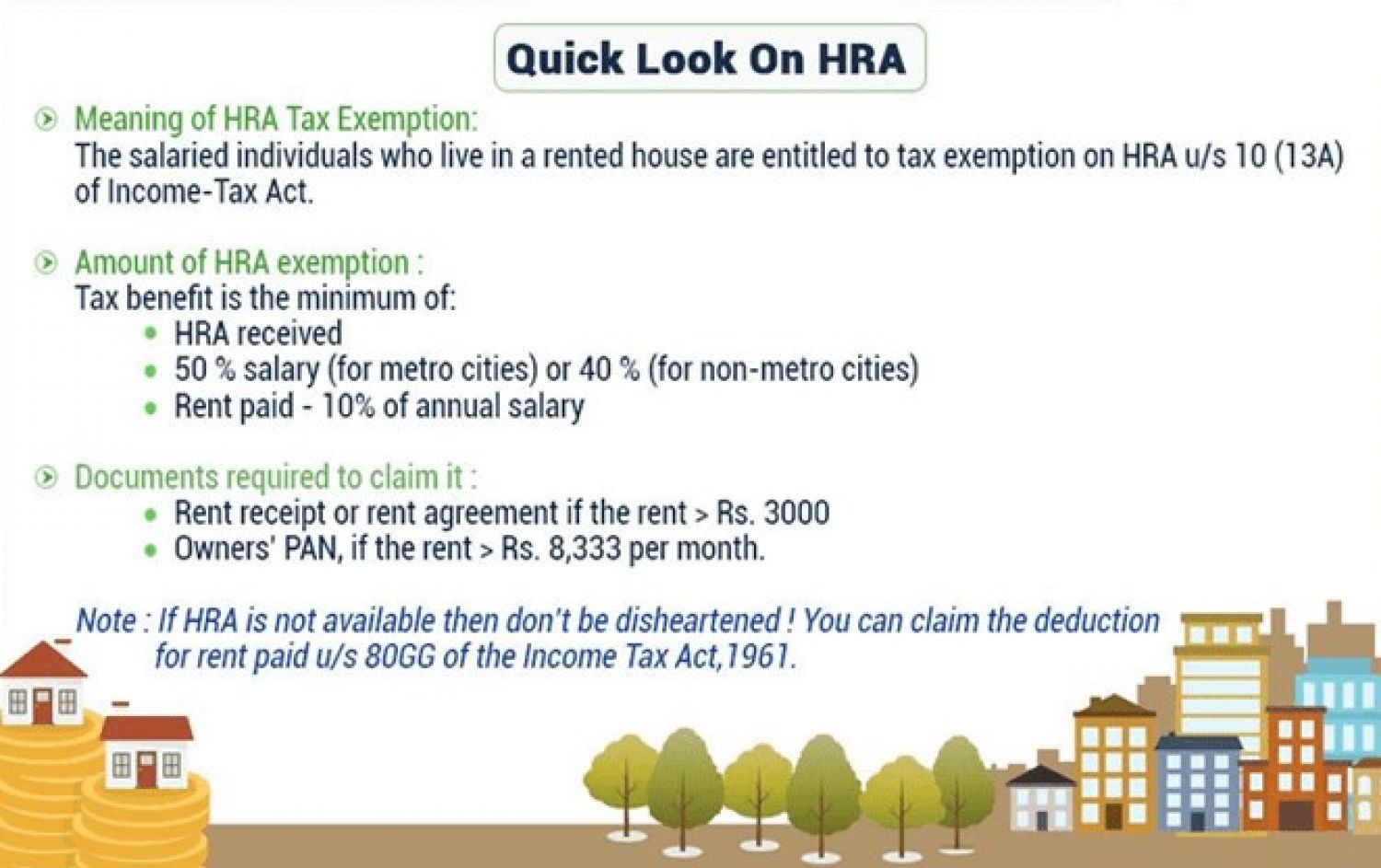

As per section 17 2 of the income tax act reimbursement against medical expenses of Rs 15 000 in a year is exempt from tax Who is Eligible to Claim Medical The exemption is allowed for least of the following amounts Actual HRA received 50 of basic salary DA for those living in Delhi Mumbai Chennai Kolkata

Medical Allowance Exemption In Income Tax

Medical Allowance Exemption In Income Tax

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

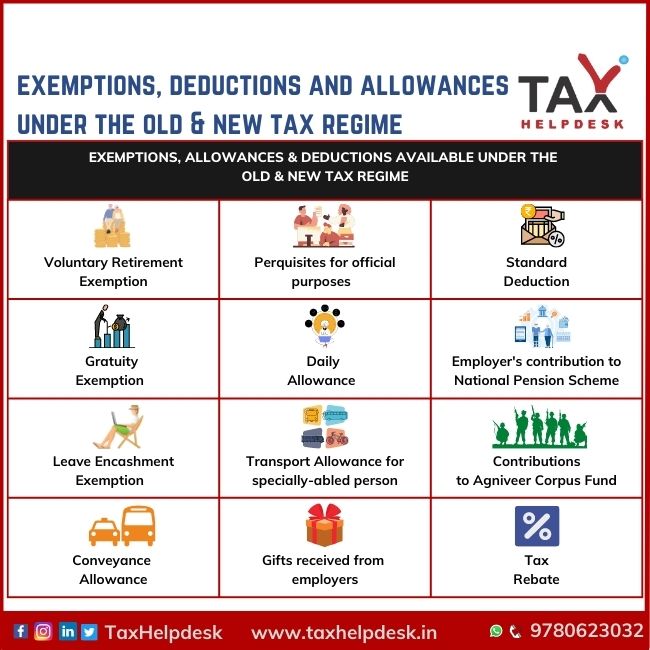

Exemptions Allowances And Deductions Under Old New Tax Regime

https://www.taxhelpdesk.in/wp-content/uploads/2023/06/EXEMPTIONS-ALLOWANCES-DEDUCTIONS-AVAILABLE-UNDER-THE-OLD-NEW-TAX-REGIME-1.jpg

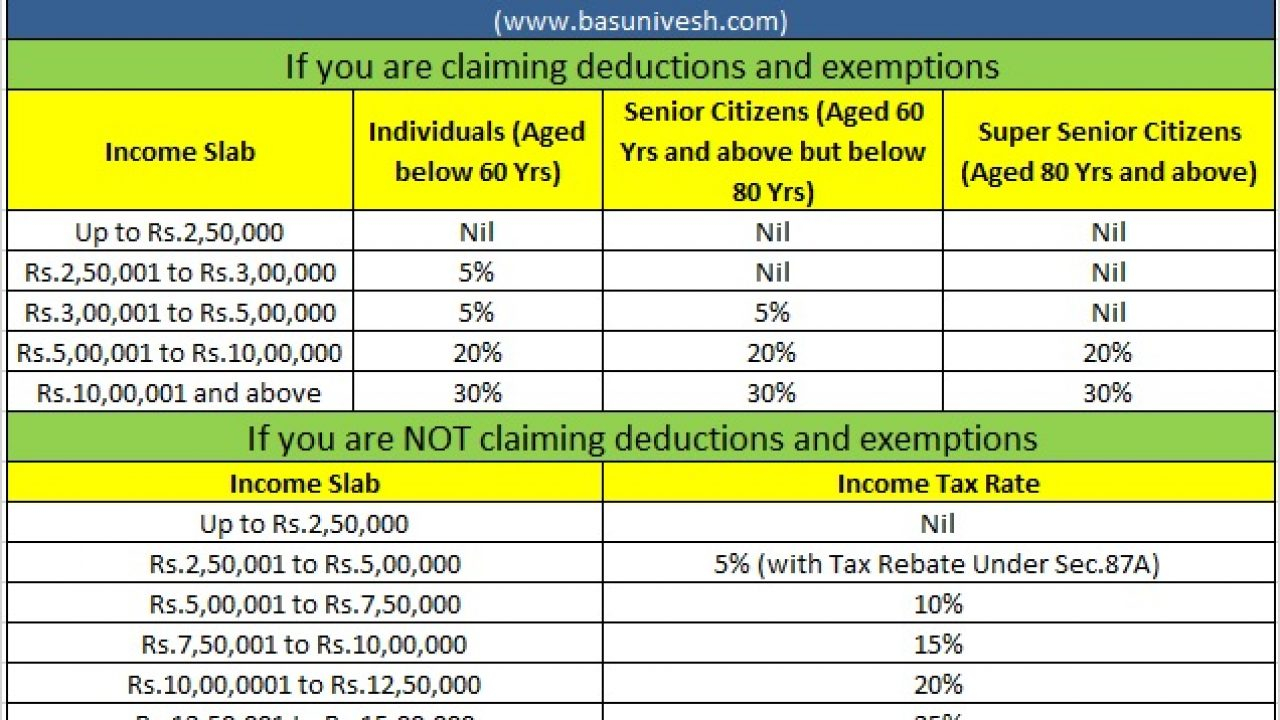

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

Medical allowance expenses Reimbursement of expenses on medical treatment or hospitalisation or both received by an employee is exempt from tax Medical allowance Healthcare reimbursement is exempt from taxation up to Rs 15 000 even if the money was paid before the cost was incurred The exemption from paying for medical

In order to qualify for tax exempt status under the Income Tax Act of 1961 the following conditions must be met The money must have exclusively been used for medical expenditures by the employee For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

Download Medical Allowance Exemption In Income Tax

More picture related to Medical Allowance Exemption In Income Tax

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

https://i.pinimg.com/originals/cd/bf/52/cdbf5266dd5ee6d50226e5e607a73e23.png

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Medical Allowance Exemption For Salaried Is It Allowed In ITR For AY

https://www.financialexpress.com/wp-content/uploads/2023/06/cropped-medical-allowance-exemption.png?w=640

In fact medical cover is also available for the employee s family including spouse and children Speaking about medical reimbursement it is an option available to Medical Allowance Exemption While medical allowance is fully taxable no tax on medical reimbursement is levied up to Rs 15 000 The exemption vis a vis medical

Money News The Financial Express Medical Allowance Exemption Is it allowed in ITR for AY 2023 24 Jun 11 2023 Rajeev Kumar Before filing your Income Under the Income Tax Act medical allowance is not classified as an allowance that qualifies for exemption As a result medical allowance is fully taxable

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

https://wealthtechspeaks.in/wp-content/uploads/2022/02/Income-Tax-Deductions.png

https://fi.money/blog/posts/guide-to-medical...

Section 10 of the Indian Income Tax Act allows numerous income tax exemptions Under medical allowance exemption Section 10 the medical allowance you receive is not

https://learn.quicko.com/medical-allowance-reimbursement

As per section 17 2 of the income tax act reimbursement against medical expenses of Rs 15 000 in a year is exempt from tax Who is Eligible to Claim Medical

Allowance Salary For Calculating Income With Automated Income Tax

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Medical Allowance Exemption Limit Calculation

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

Car Allowance Exemption U s 10 I Financialcontrol in

Tax Free Allowances Income Tax Act IndiaFilings

Tax Free Allowances Income Tax Act IndiaFilings

Section 10 Of Income Tax Act Deductions And Allowances

Annual Allowances YouTube

No Exemption For Transport Allowance And Medical Allowance U s 10 For

Medical Allowance Exemption In Income Tax - In order to qualify for tax exempt status under the Income Tax Act of 1961 the following conditions must be met The money must have exclusively been used for medical expenditures by the employee