Medical Bills Income Tax Deductions India Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of Deduction under section 80DDB is allowed for medical treatment of a dependant who is suffering from a specified disease listed in the table below

Medical Bills Income Tax Deductions India

Medical Bills Income Tax Deductions India

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

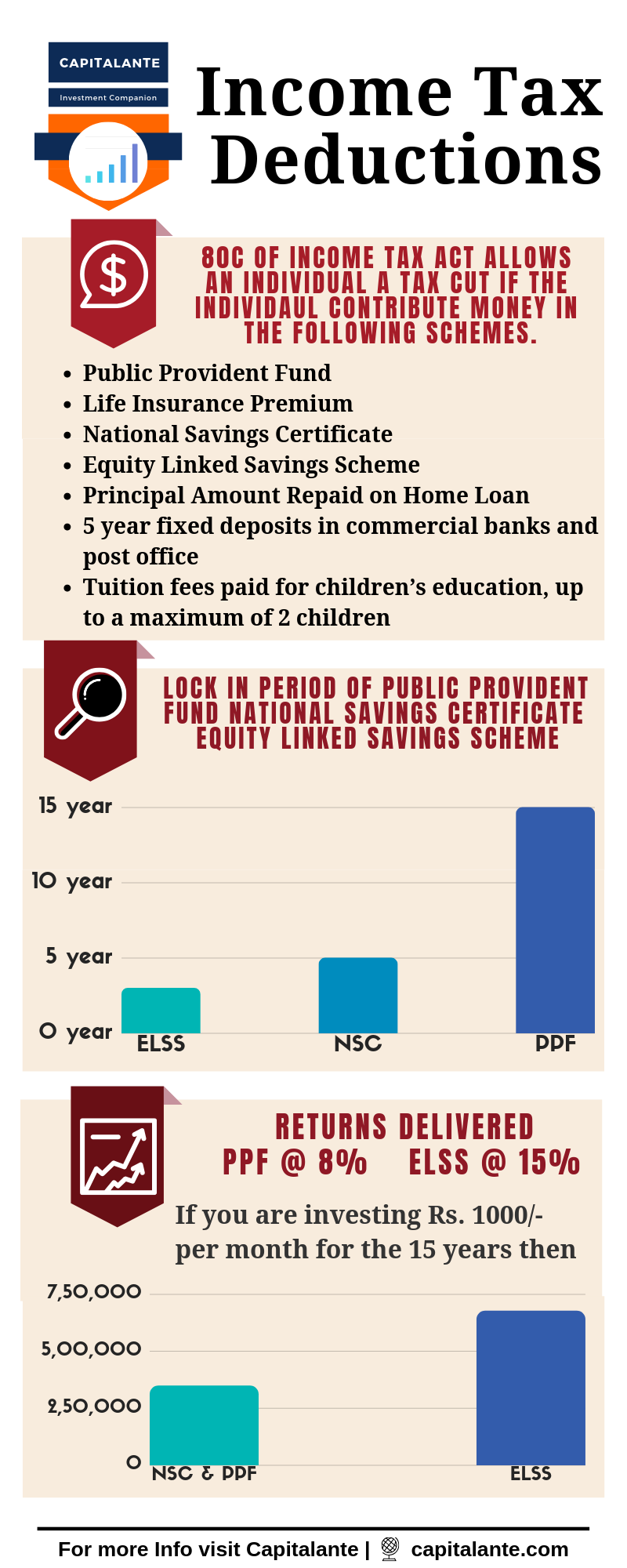

Income Tax Deductions In India Capitalante

https://capitalante.com/wp-content/uploads/2019/02/Income-Tax-Deductions.png

Analysing Tax Deductions In India And Exemptions On Life Insurance

https://www.hdfcsales.com/blog/wp-content/uploads/2018/04/tax-deductions-and-exemptions-on-life-insurance-policies.png

Tax exemption on medical reimbursement and transport allowance has been replaced with a standard deduction of Rs 40 000 The standard deduction has been Let s understand how your medical and health insurance can be used for tax deduction under this clause 1 Eligibility for deductions The deduction under

Medical expenses that can be claimed as tax break under section 80DDB By Preeti Motiani ET Online Last Updated Mar 02 2022 09 18 00 PM IST Synopsis Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If

Download Medical Bills Income Tax Deductions India

More picture related to Medical Bills Income Tax Deductions India

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Standard Deduction For Salaried Employees Impact Of Standard

https://i.pinimg.com/originals/05/8c/32/058c32cbbbd99e3ad8dfee9a313112a1.jpg

Income Tax Deductions In India Capitalante

https://i1.wp.com/capitalante.com/wp-content/uploads/2019/02/Income-Tax-Deductions-In-India.png?fit=945%2C756&ssl=1

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You Can Medical Bills be Claimed Under Section 80D The Income Tax Act s Section 80D is a tax saving provision in India that offers deductions on premiums paid

As a result the Income Tax Act of 1961 lets people deduct their health insurance premiums and medical bills The Income Tax Act of 1961 has a section Under Section 80D of the Income Tax Act an individual can claim a deduction for the following medical expenses incurred during the financial year

The 6 Best Tax Deductions For 2020 The Motley Fool

https://g.foolcdn.com/editorial/images/550999/getty-tax-deductions-irs-return-taxes.jpg

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

https://media.cheggcdn.com/media/030/0303e1cf-89a6-4152-873d-662f043a5484/phpYKsmjZ

https://www. indiafilings.com /learn/income-tax...

Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other

https:// tax2win.in /guide/section-80ddb

Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of

Tax Deductions Exemptions Are No Longer Available

The 6 Best Tax Deductions For 2020 The Motley Fool

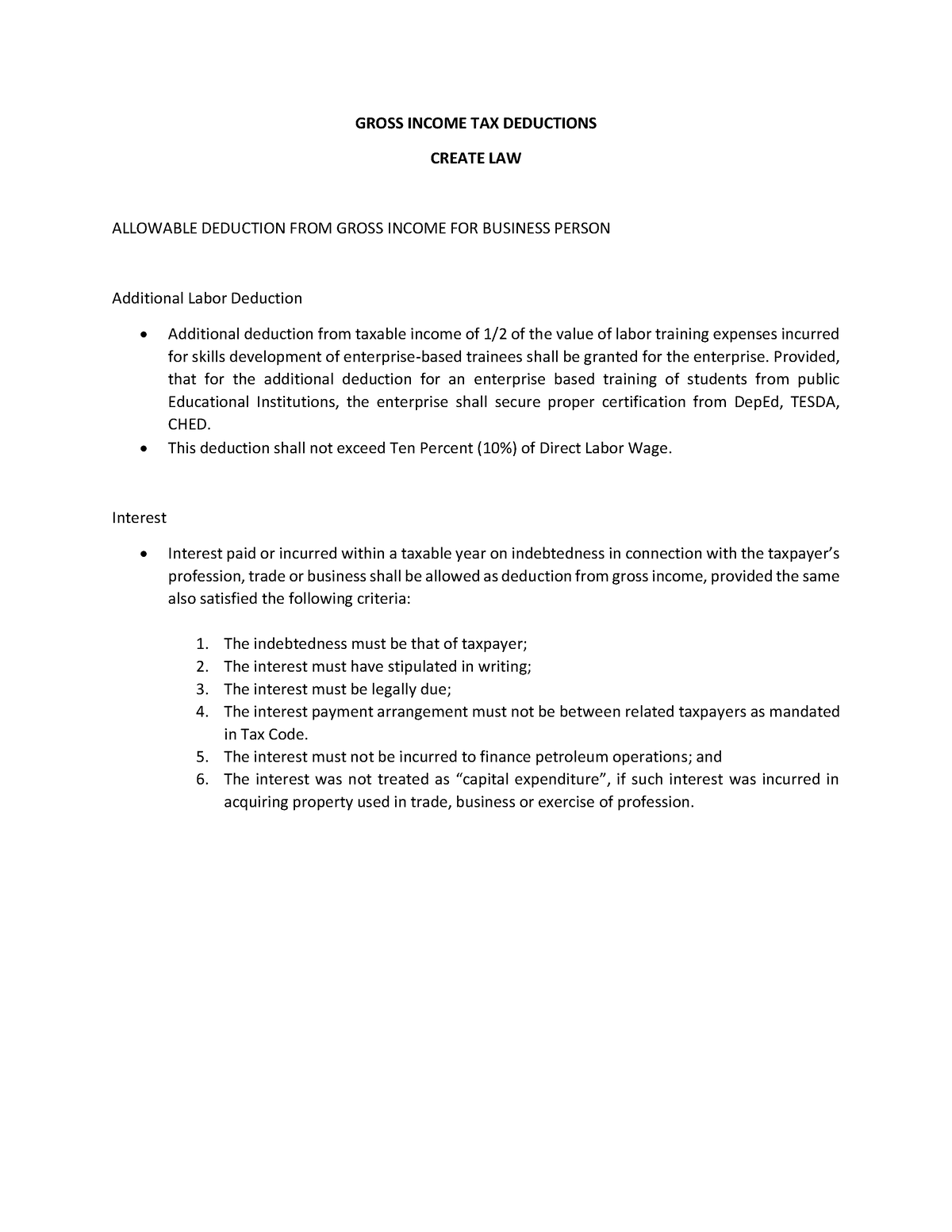

Tax Updates X 3 Tax Update CREATE LAW GROSS INCOME TAX

Income Tax Planning Last minute Tips To Save Tax Using Medical Bills

Epf Contribution Table For Age Above 60 2019 Frank Lyman

14 Best Images Of IRS Itemized Deductions Worksheet Tax Itemized

14 Best Images Of IRS Itemized Deductions Worksheet Tax Itemized

Income Tax Deductions For The FY 2019 20 ComparePolicy

5 Common Income Tax Deductions Every Taxpayer Should Know About

Self Employed Tax Spreadsheet With Self Employed Expense Sheet Sample

Medical Bills Income Tax Deductions India - As per current income tax rules the maximum deduction that can be claimed under Section 80DDB is For taxpayers below 60 years of age 40 000 per year For