Mediclaim Rebate Under Income Tax Web 26 juin 2018 nbsp 0183 32 1 Medical insurance premium on his policy of Rs 15 000 will qualify for deduction 2 Medical insurance premium on policy of his spouse of Rs 4 000 will qualify for 3 Medical insurance premium on policy of

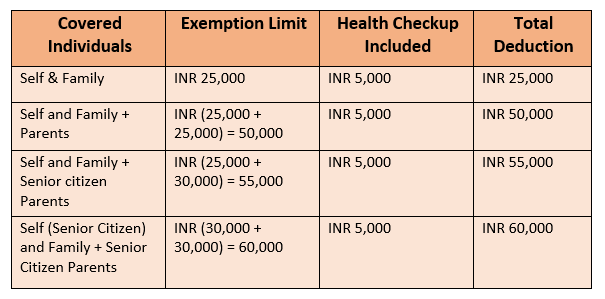

Web 17 mai 2021 nbsp 0183 32 17 May 2021 13 104 Views 2 comments Section 80D Deduction in respect of Medical Insurance Premium Mediclaim Tax deductions can be availed on Web 1 f 233 vr 2023 nbsp 0183 32 As per the Income Tax provisions the tax assessees can claim a deduction under section 80D of the Income Tax for the premium paid towards a mediclaim insurance In this article we will discuss in

Mediclaim Rebate Under Income Tax

Mediclaim Rebate Under Income Tax

https://www.fincash.com/b/wp-content/uploads/2017/01/80c-deductions.png

Mediclaim Deduction U s 80d Under Income Tax Act Health Insurance

https://i.ytimg.com/vi/ur_SJznr2TM/maxresdefault.jpg

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2014/11/Medical-allowance-form-16.jpg

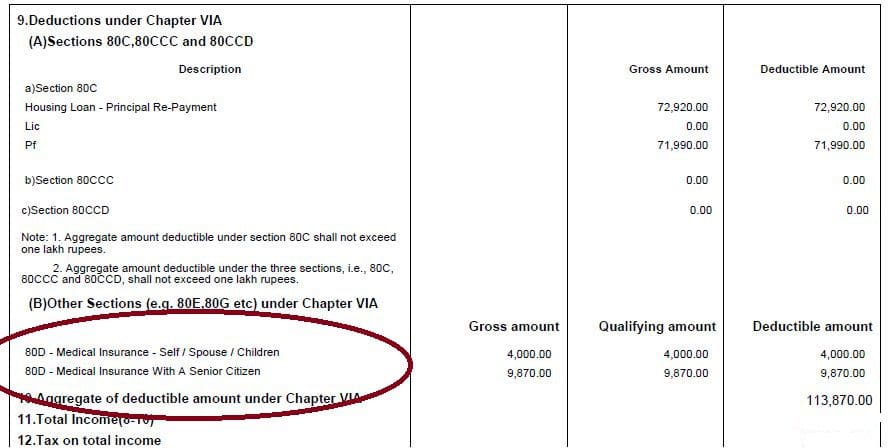

Web 13 juin 2019 nbsp 0183 32 Deduction on Single Premium Medical Insurance Policies What are the factors excluded under Section 80D What is the difference between sections 80D Web 4 ao 251 t 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over the years for which the benefit of health insurance is available While filing the Income Tax

Web Under Section 80DD of the Income Tax Act people can claim a tax deduction of up to Rs 75 000 per financial year on the medical expenses incurred on the treatment of a Web 5 nov 2019 nbsp 0183 32 Having a good mediclaim policy in India not only helps you deal with the huge hospitalization costs but also brings you many tax benefits under section 80D of the

Download Mediclaim Rebate Under Income Tax

More picture related to Mediclaim Rebate Under Income Tax

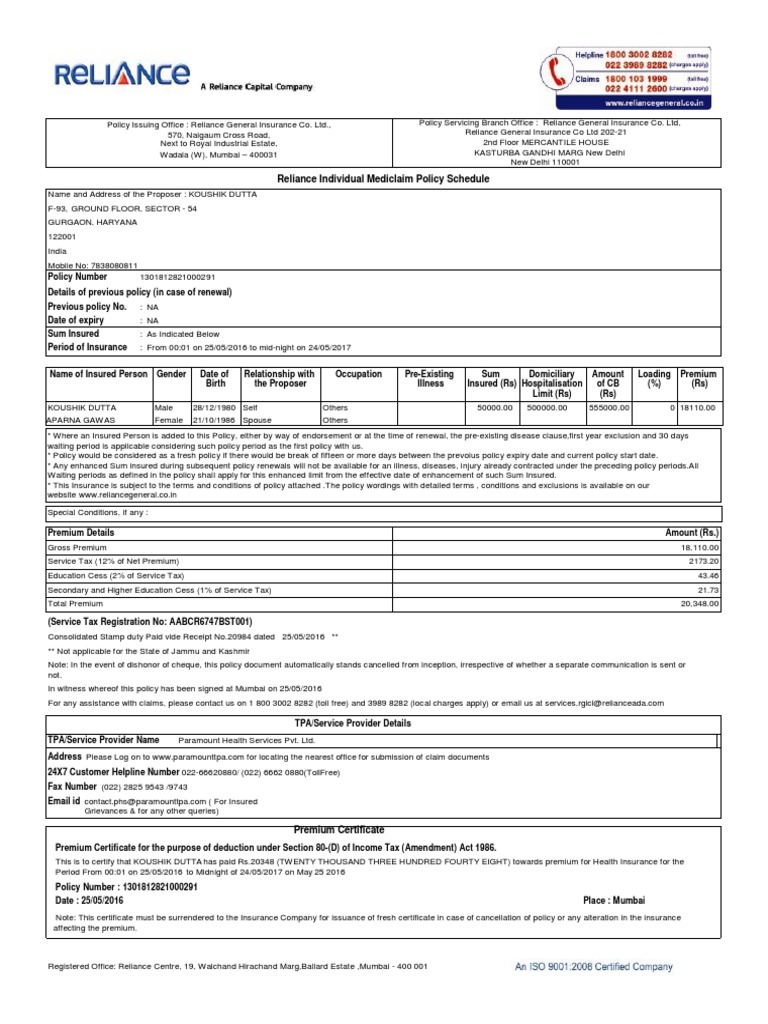

Mediclaim Receipt Insurance Taxes

https://imgv2-2-f.scribdassets.com/img/document/368529097/original/d24413953c/1547041318?v=1

A Step by Step Guide To File For Tax Rebate On Mediclaim Policy

https://www.careinsurance.com/upload_master/media/posts/February2023/image20230201153943.jpg

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

https://www.relakhs.com/wp-content/uploads/2014/11/Mediclaim-section-80d-form-16.jpg

Web 27 janv 2023 nbsp 0183 32 What is Deduction under section 80D Section 80D of Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the Web 17 avr 2021 nbsp 0183 32 Answer Under Section 80D of the Income Tax Act you are entitled to claim deduction for premium paid for health insurance policies popularly known as mediclaim There are two categories for whom

Web 5 juil 2023 nbsp 0183 32 An individual who paid medical insurance premiums for himself or themselves their spouse their dependent children or their parents can claim a deduction under Web 12 sept 2023 nbsp 0183 32 Income Tax Section 80D What is Section 80D Tax Deductions Benefits and Limits Updated On 05 Sep 2023 Medical investments are always a better option

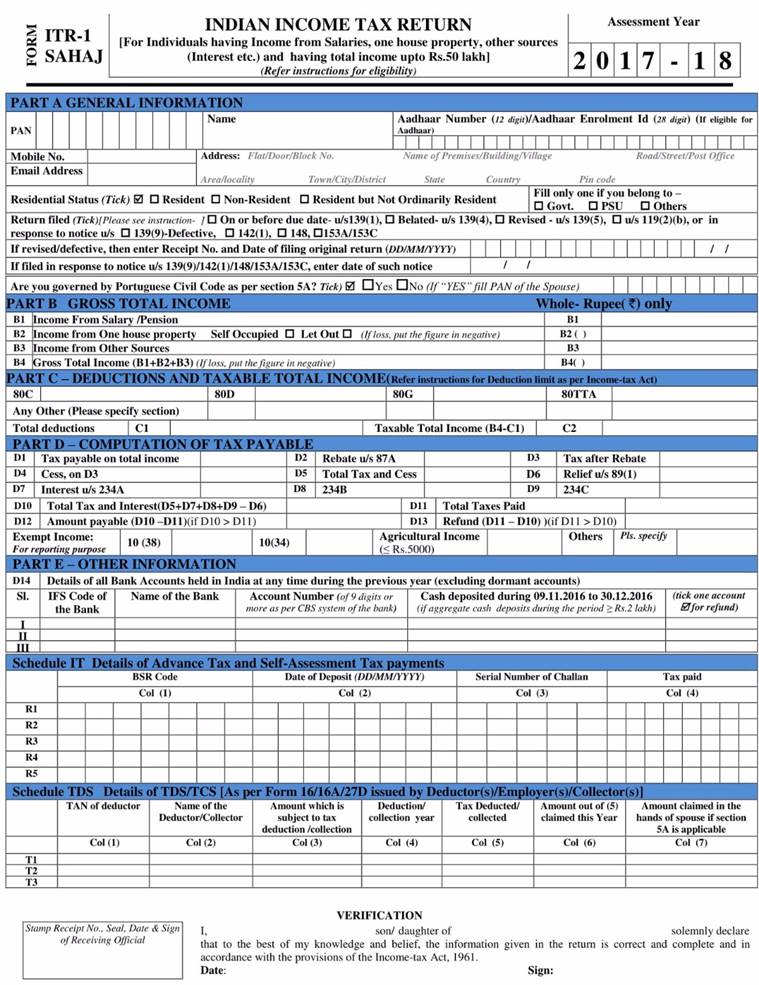

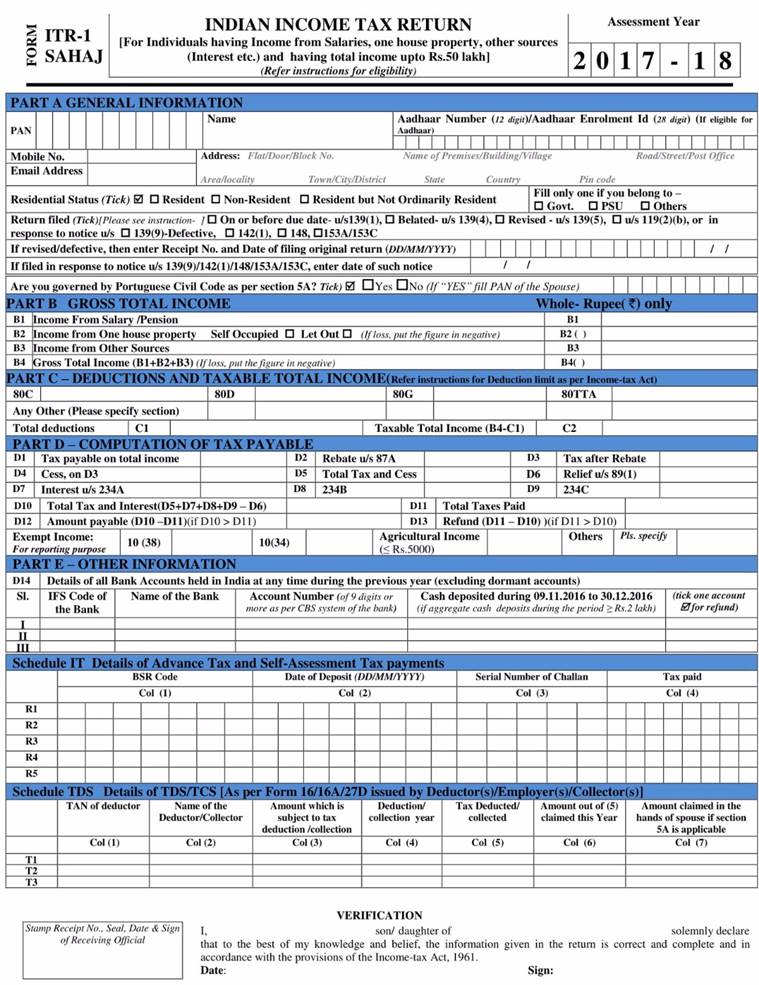

Govt Introduces New Simplified ITR Form All You Need To Know The

http://images.indianexpress.com/2017/03/itr-form.jpeg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

https://taxguru.in/income-tax/all-about-deduct…

Web 26 juin 2018 nbsp 0183 32 1 Medical insurance premium on his policy of Rs 15 000 will qualify for deduction 2 Medical insurance premium on policy of his spouse of Rs 4 000 will qualify for 3 Medical insurance premium on policy of

https://taxguru.in/income-tax/section-80d-deduction-mediclaim-medica…

Web 17 mai 2021 nbsp 0183 32 17 May 2021 13 104 Views 2 comments Section 80D Deduction in respect of Medical Insurance Premium Mediclaim Tax deductions can be availed on

Tax Benefit Without Mediclaim Under Section 80D Income Tax Act How

Govt Introduces New Simplified ITR Form All You Need To Know The

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Conclusion Of Life Insurance Policy Keijupolypuoti

Tax Planning And Wealth Management

Lic Star Mediclaim Income Tax Return GST

Lic Star Mediclaim Income Tax Return GST

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Deduction For Mediclaim And Preventive Health Checkup Under Income Tax

Lic Star Mediclaim Income Tax Return GST

Mediclaim Rebate Under Income Tax - Web 9 juin 2019 nbsp 0183 32 Under Section 80D a resident individual can claim a tax deduction of up to 25 000 in a year for medical insurance premiums If you were to claim tax benefit