Nebraska Tax Credit Scholarship Yes taxpayers who contributed to an SGO before October 31 2024 and received a receipt from an SGO will remain eligible to claim the tax credit This includes the five year carryover period

For the taxable year beginning on or after January 1 2024 individuals and entities that made cash contributions to a certified scholarship granting organization SGO between January 1 Nebraska taxpayers who want to support students in need of financial assistance to attend a school that works best for them are now offered a tax credit for contributions to Opportunity

Nebraska Tax Credit Scholarship

Nebraska Tax Credit Scholarship

https://childrenstuitionfund.org/wp-content/uploads/2021/05/Opportunity-Scholarship-Tax-Credit-Program-1024x769.jpg

The Historic Expansion Of Tax Credit Scholarships Is A Win For Our Kids

https://www.commonwealthfoundation.org/wp-content/uploads/2022/08/iStock-1348870264-1254x720.jpg

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

The bill sets up a dollar for dollar tax credit for individuals or corporations who donate to a scholarship granting organization distributing such scholarships for parochial and LINCOLN Neb Governor Jim Pillen signed another bill into law Tuesday penning the Opportunity Scholarships Act creating a tiered system for Nebraska Students It provides

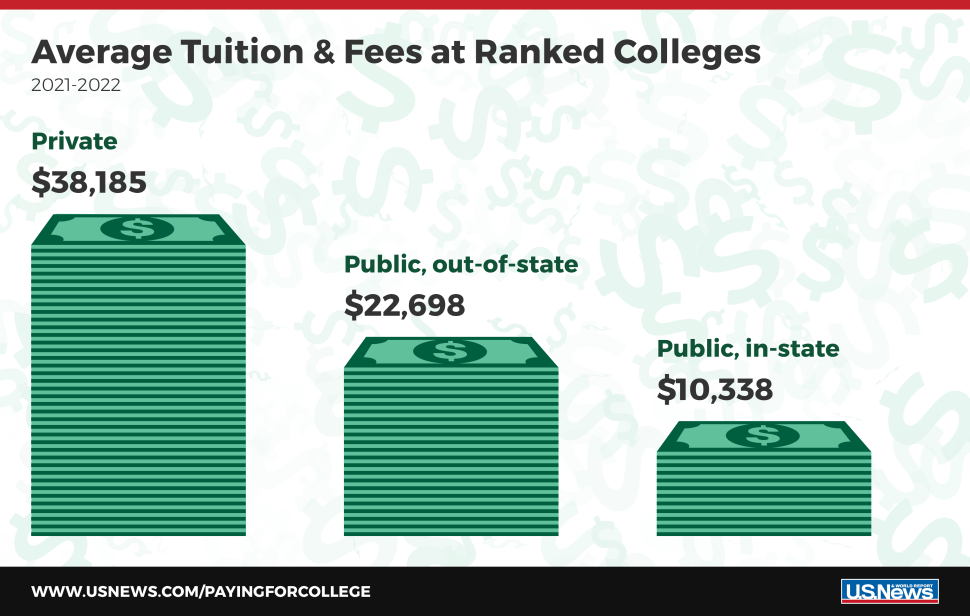

Tax credit scholarships provided expanded school access and taxpayer savings It s all about finding the right educational fit for every Nebraska student and making that choice a family decision To understand how tax credit Donors who contribute to scholarship granting organization may qualify for a dollar for dollar Nebraska tax credit The tax credit available is limited to the lessor of total

Download Nebraska Tax Credit Scholarship

More picture related to Nebraska Tax Credit Scholarship

The Tax ABCs Of Scholarships JMF

https://jmf.com/wp-content/uploads/avgtuitioninfographic-graphic.png

How To Apply For 19 20 Tax Credit Scholarship Empower Illinois On Vimeo

https://i.vimeocdn.com/video/750765572-f6fa582f59f01c6a11410714f11da8b2d845b464243fce37fe69493fc17ed70b-d?mw=1920&mh=1080&q=70

Tax Credit Scholarship Program HighSight

https://www.highsight.org/display/images/000492_FROSH1.jpg

Under the Opportunity Scholarships Act individuals and businesses can receive a dollar to dollar tax credit of 50 of their state tax liability by giving to scholarship granting After repeated attempts to pass school privatization measures had failed Nebraska lawmakers in 2023 approved LB 753 which creates dollar for dollar tax credits eventually totaling up to 100 million for donations by

The scholarships are funded by cash contributions made to scholarship granting organizations which may qualify the donor for a nonrefundable tax credit The following In 2023 the Nebraska State Legislature passed The Opportunity Scholarships Act LB753 which is a scholarship tax credit program Taxpayers in Nebraska whether

Nebraska Microenterprise Tax Credit First Fruits

https://ffptinc.com/wp-content/uploads/2023/10/Nebraska-Microenterprise-Tax-Credit-1.jpg

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

https://revenue.nebraska.gov › about › frequently...

Yes taxpayers who contributed to an SGO before October 31 2024 and received a receipt from an SGO will remain eligible to claim the tax credit This includes the five year carryover period

https://revenue.nebraska.gov › businesses › ...

For the taxable year beginning on or after January 1 2024 individuals and entities that made cash contributions to a certified scholarship granting organization SGO between January 1

Cash Or Credit Free Stock Photo Public Domain Pictures

Nebraska Microenterprise Tax Credit First Fruits

Tax Accounting Services Lee s Tax Service

Tax Credit Bill For Rural Physicians Passes House Committee

Writing A Scholarship Essay

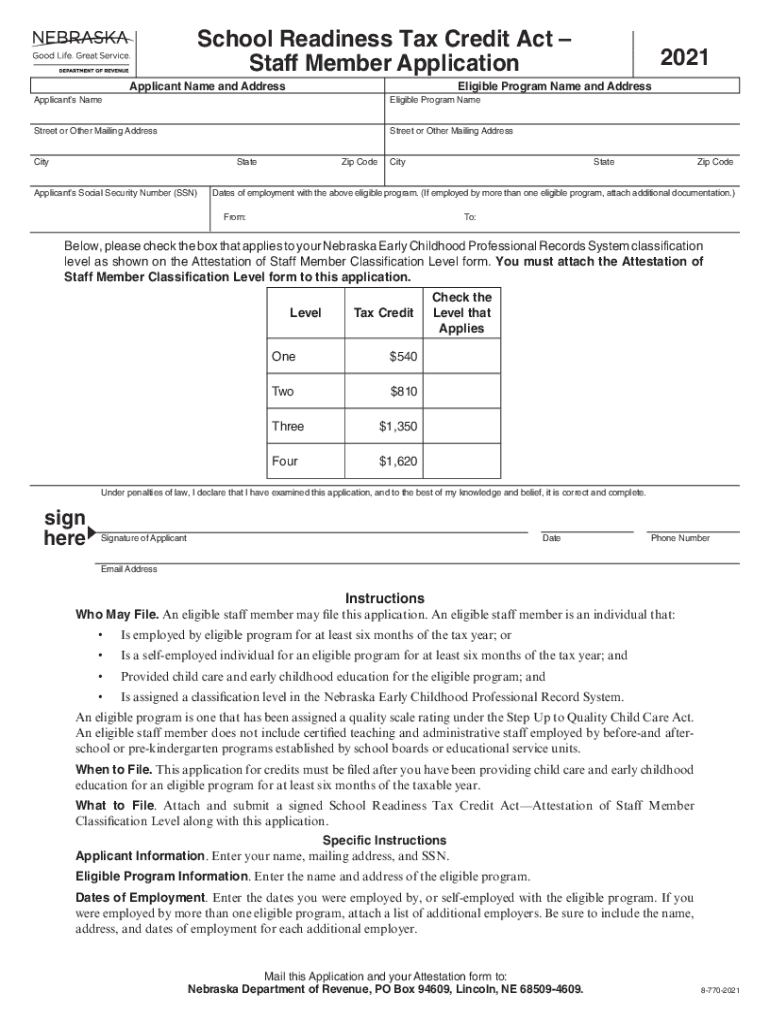

2021 2023 Form NE School Readiness Tax Credit Act Staff Member

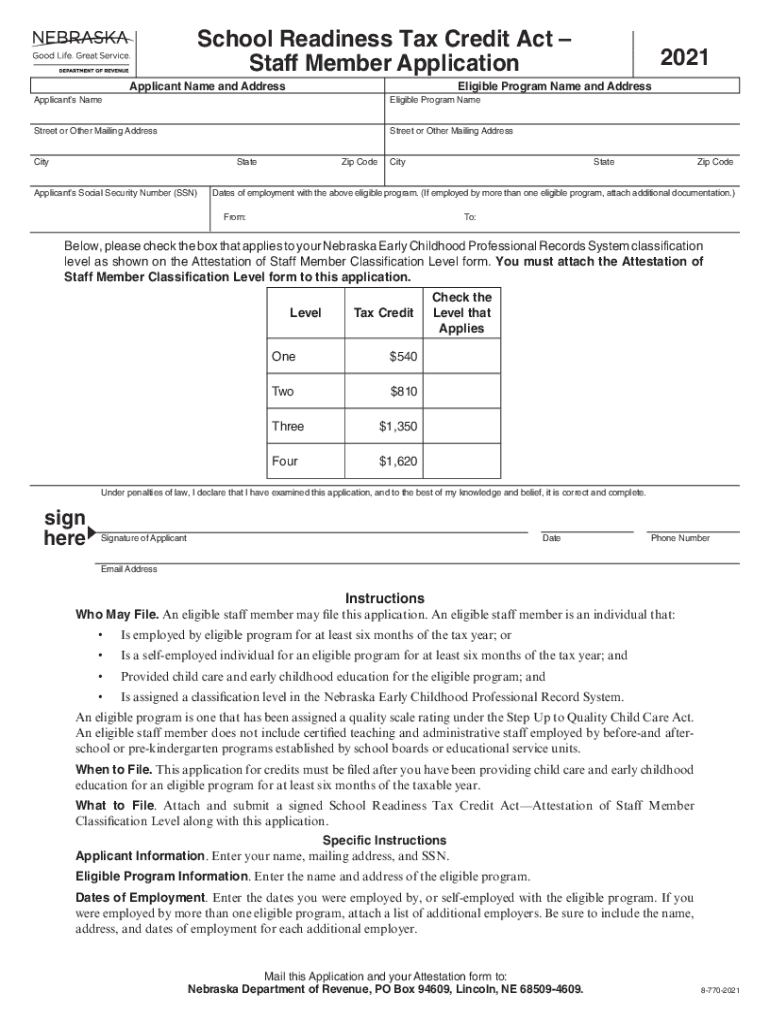

2021 2023 Form NE School Readiness Tax Credit Act Staff Member

Tax Uncomplicated US Expat Taxes In Korea Yongin

POET Applauds Nebraska Tax Credit Boosting Access To Lower Cost Biofuel

Oklahoma Private School Tax Credit Oversight Mostly Unknown Oklahoma

Nebraska Tax Credit Scholarship - Legislative Bill 753 would permit state tax credits for donations to organizations that provide scholarships to kids to attend private and parochial schools An estimated 5 000