New Jersey Homestead Rebate Form This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age Filing Deadline

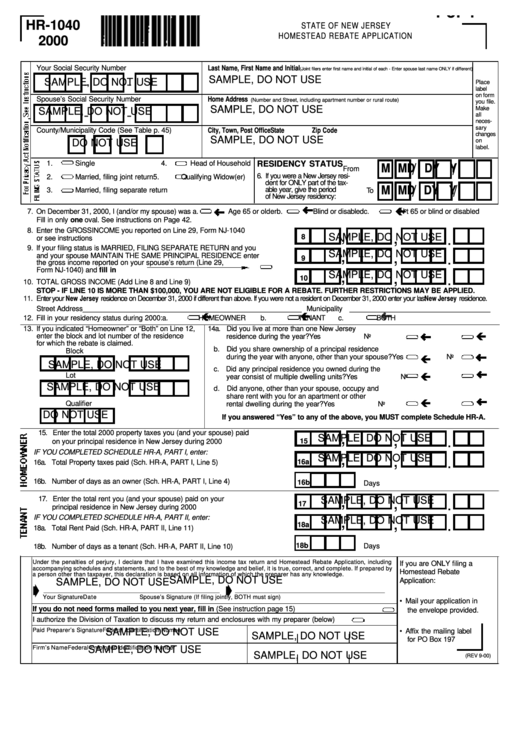

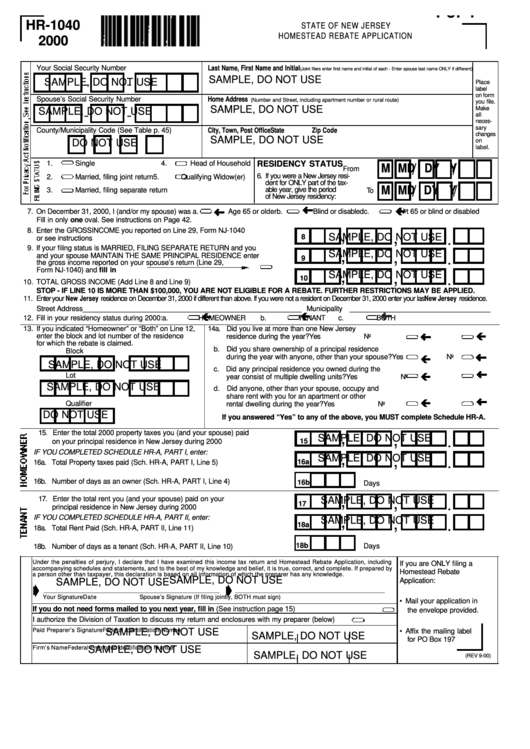

If you do not need forms mailed to you next year fill in See instruction page 15 If you are ONLY filing a Homestead Rebate Application Mail your application in the envelope provided Affix the mailing label for PO Box 197 The inquiry system will tell you if your application is in processing we have no record of processing your application the date we issued a benefit including if it was applied to your property tax bill for tax year 2018 To use this service you will need your valid Social Security Number SSN Individual Taxpayer Identification Number

New Jersey Homestead Rebate Form

New Jersey Homestead Rebate Form

https://www.nj.com/resizer/-85xK-JbbPhrvG35L94dY8LPT04=/1280x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/2H2T2HW3TBGFFJTDB3YEWLCM4Y.jpg

Form Hr 1040 Sample Homestead Rebate Application 2000 Printable Pdf

https://data.formsbank.com/pdf_docs_html/275/2756/275601/page_1_thumb_big.png

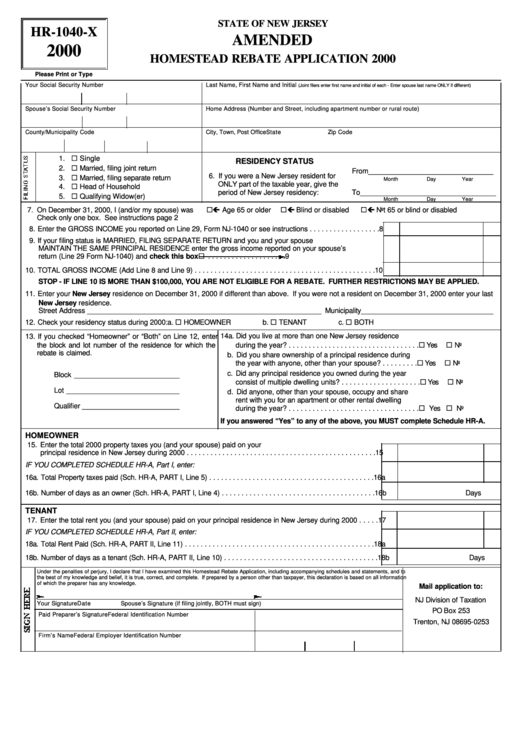

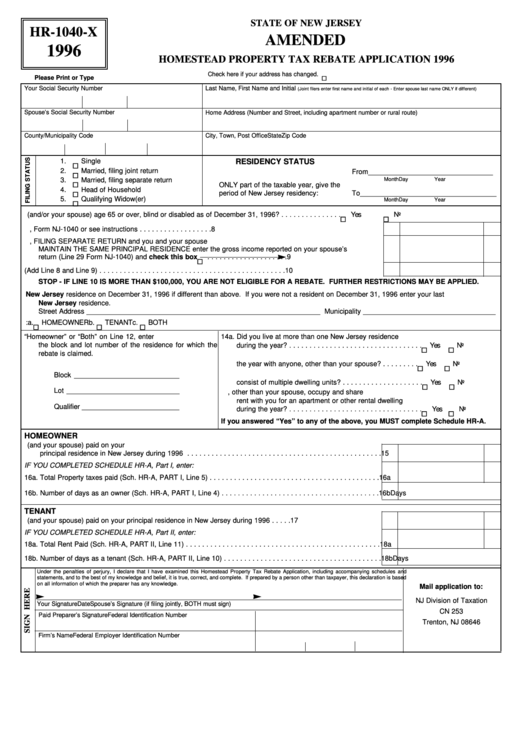

Fillable Form Hr 1040 X Amended Homestead Rebate Application 2000

https://data.formsbank.com/pdf_docs_html/317/3170/317062/page_1_thumb_big.png

Tenant If you were a tenant on October 1 file a Form TR 1040 tenant homestead rebate application contained in the resident income tax return booklet Homeowner If you were a homeowner on October 1 a homestead rebate application will be mailed to you The Homestead Rebate program requires you to file annually to receive this benefit But now a new program called the Affordable New Jersey Communities for Homeowners and Renters or ANCHOR will expand

The more than 2 billion in funding would pay up to 1 500 for eligible homeowners and 450 to renters with an extra 250 for seniors The state Treasury Department has already been at work on how Senior Tax Freeze NJ eligibility requirements Must be 65 or older on Dec 31 2022 Or you must be receiving federal Social Security disability benefit payments on or before Dec 31 2022 Have

Download New Jersey Homestead Rebate Form

More picture related to New Jersey Homestead Rebate Form

NJ Homestead Rebate Due 11 30 2018 YouTube

https://i.ytimg.com/vi/GvEfUWo4XYI/maxresdefault.jpg

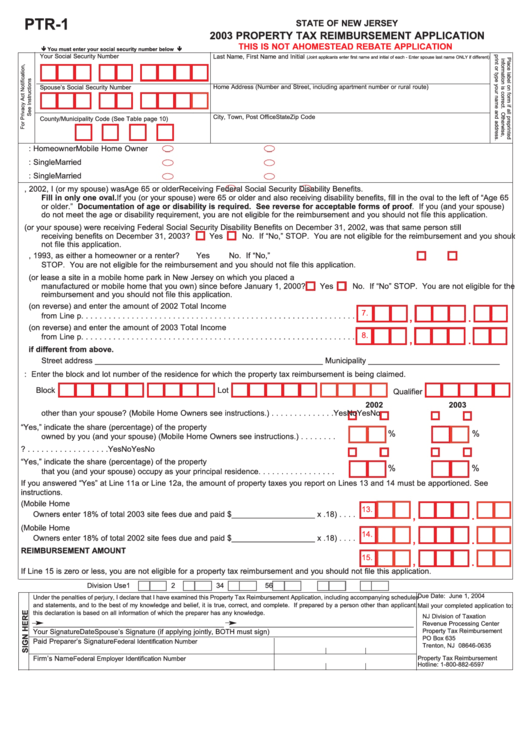

Fillable Form Ptr 1 Property Tax Reimbursement Application State Of

https://data.formsbank.com/pdf_docs_html/342/3422/342230/page_1_thumb_big.png

I ve Never Applied For The Homestead Rebate Can I Nj

https://www.nj.com/resizer/ATuBgQpKJjQABDbRgnzz_xx3EwA=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/FJH2SEE4DZCJDDJC4WV3XMTTXA.jpg

The new ANCHOR program Affordable New Jersey Communities for Homeowners and Renters provides tax rebates to NJ residents who owned or rented their home as of October 1 2019 filed state income taxes and meet income requirements You are eligible for a 2018 Homestead Benefit as a home owner if You were a New Jersey resident and erty should file the application Follow the instructions You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2018 and The 2018 property taxes were paid on that home and

The Affordable New Jersey Communities for Homeowners and Renters ANCHOR Program has replaced the Homestead Rebate program This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2020 and met the income limits The application is part of the NJ1040 income tax form Anyone who doesn t file a 1040 can get a specific application and file online Or people can file by phone Eligibility The eligibility criteria today are strict

What s The Maximum For The Homestead Rebate Nj

https://www.nj.com/resizer/FP-9_AOC9tQclFc-fQSuX5aG2Dg=/1280x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/WXCOADJAKREWPHN56T4KBMGARY.jpg

Nj Homestead Rebate 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/homestead-rebate-not-received-this-year-hackettstown-nj.png

https://nj.gov/treasury/taxation/anchor/index.shtml

This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age Filing Deadline

https://www.nj.gov/treasury/taxation/pdf/other...

If you do not need forms mailed to you next year fill in See instruction page 15 If you are ONLY filing a Homestead Rebate Application Mail your application in the envelope provided Affix the mailing label for PO Box 197

When Will I Be Eligible For The Homestead Rebate Nj

What s The Maximum For The Homestead Rebate Nj

Nj Homestead Rebate 2022 Renters RentersRebate

Fillable Form Hr 1040 X Amended Homestead Property Tax Rebate

NJ Homestead Rebate What To Know Credit Karma

State Freezes Payments For Homestead Rebate Program Video NJ

State Freezes Payments For Homestead Rebate Program Video NJ

Getting The Homestead Rebate After Moving Biz Brain Nj

Can I File An Appeal For The Homestead Rebate Nj

When Can I Apply For The Homestead Rebate Nj

New Jersey Homestead Rebate Form - New Jersey s homestead rebate program aids homeowners in paying their property taxes The rebate s amount is determined by the proportion of the home s property taxes that were paid You must fulfill specific income requirements and remain in the home as your primary residence in order to qualify