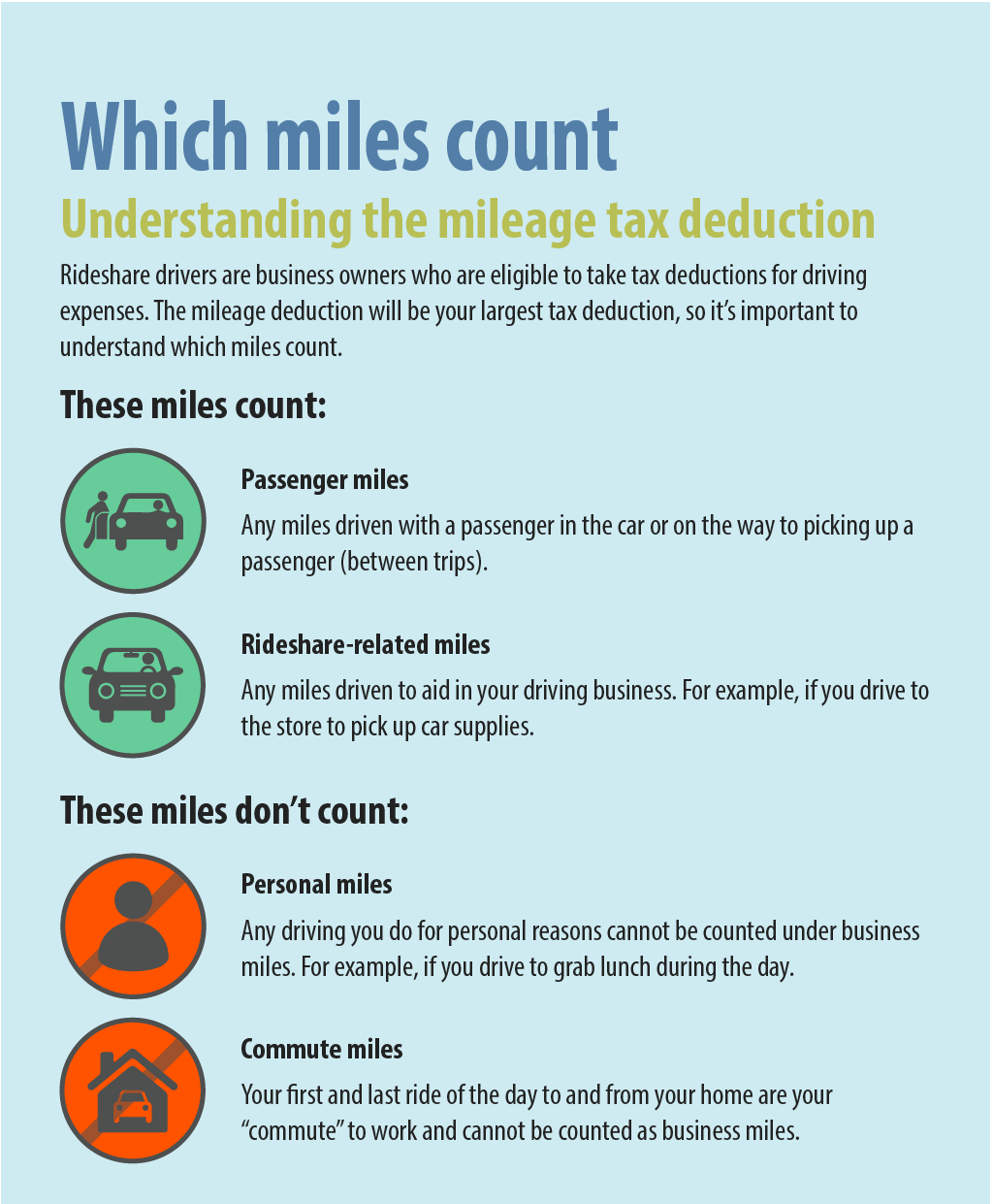

New Vehicle Tax Deduction For Business Verkko No body section that protrudes more than 30 inches in front of the leading edge of the windshield If you use your vehicle for business reasons for more than 50 of the time but less than 100 of the time you may have a limited total deduction of 11 160 for cars and 11 560 for vans and trucks

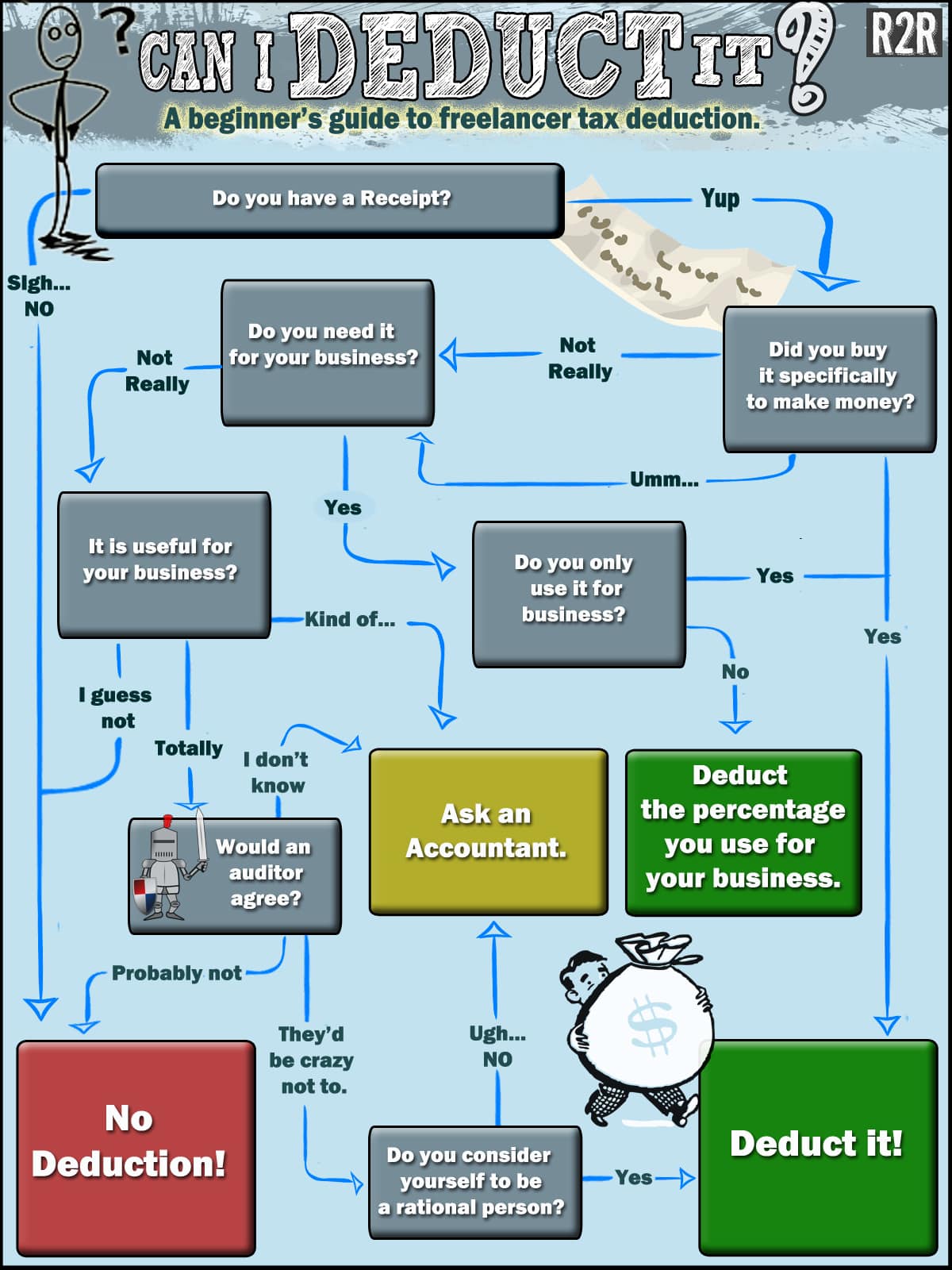

Verkko 16 toukok 2022 nbsp 0183 32 Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the same tax year The deduction limit in 2021 is 1 050 000 For example let s say you spent 20 000 on a new car for your business in June 2021 Verkko 12 tammik 2023 nbsp 0183 32 Section 179 of the tax code lets you write off some or all of the purchase price of a vehicle you buy for your business provided you meet the requirements To take the deduction you must use the car for business more than 50 of the time and you can only deduct the percentage you use for work

New Vehicle Tax Deduction For Business

New Vehicle Tax Deduction For Business

https://genesacpa.com/wp-content/uploads/2019/05/vehicle-car-expenses-cra-canada-846.jpg

How To Claim Your Work Related Car Expenses In 2020 GOFAR

https://www.gofar.co/wp-content/uploads/2019/12/gofar-trips-qualify-tax-deduction.jpg

What Can I Deduct Freelance Tax Deductions Flowchart Rags To Reasonable

https://www.ragstoreasonable.com/wp-content/uploads/2015/03/Tax-Deduction-Flow-Chart-EDIT.jpg

Verkko 28 tammik 2020 nbsp 0183 32 Automobile Tax Deduction Rule Section 179 You can only write off 100 if the vehicle is used 100 for business AND you buy it brand new from the dealer no private party used vehicle It has to be brand new The amount on the example factors in a brand new SUV over 6 000 lbs Verkko 2 marrask 2023 nbsp 0183 32 If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later However if you use the car for both business and personal purposes you may deduct only the cost of its business use

Verkko 14 jouluk 2023 nbsp 0183 32 The deduction for using vehicles in your business can sometimes be significant so it s important to make the following decisions Is it better to use the standard mileage rate as your deduction or the actual expenses incurred for a vehicle used for this business Who should own the vehicle The business the business owner or Verkko 25 elok 2023 nbsp 0183 32 The basis purchase price additional fees and taxes of the vehicle is 40 000 The percentage it was used for business is 60 The basis to be used for depreciation is 24 000 As noted earlier vehicles are classified as a five year property under MACRS Using the 200 declining rate you get to a 40 depreciation rate 200

Download New Vehicle Tax Deduction For Business

More picture related to New Vehicle Tax Deduction For Business

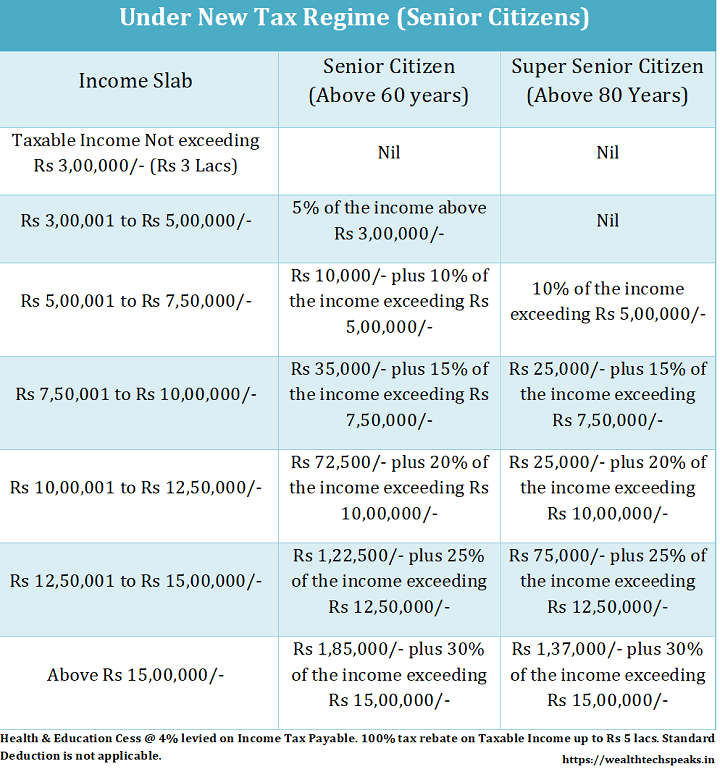

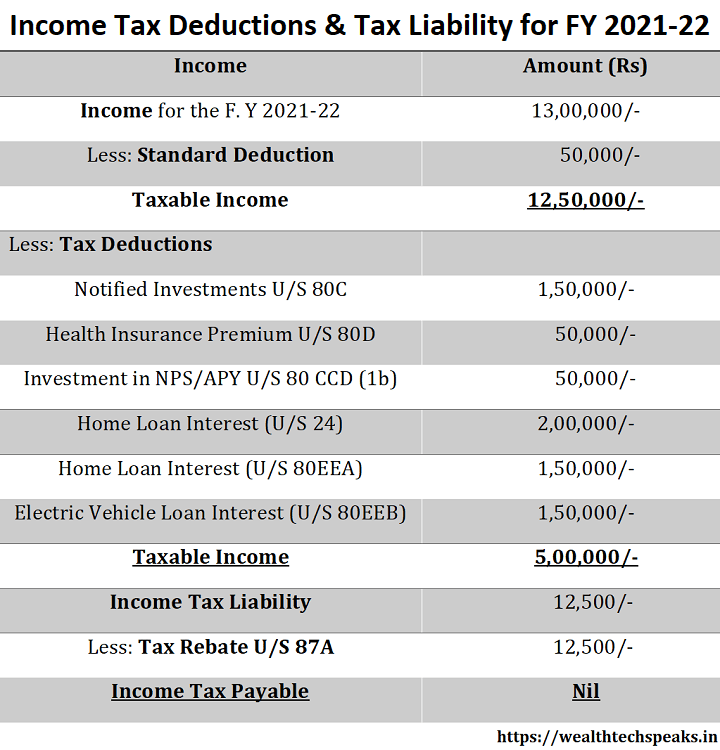

Standard Business Deduction 2022 Home Business 2022

https://wealthtechspeaks.in/wp-content/uploads/2021/02/Senior-Citizen-New-Tax-System-2021-22.png

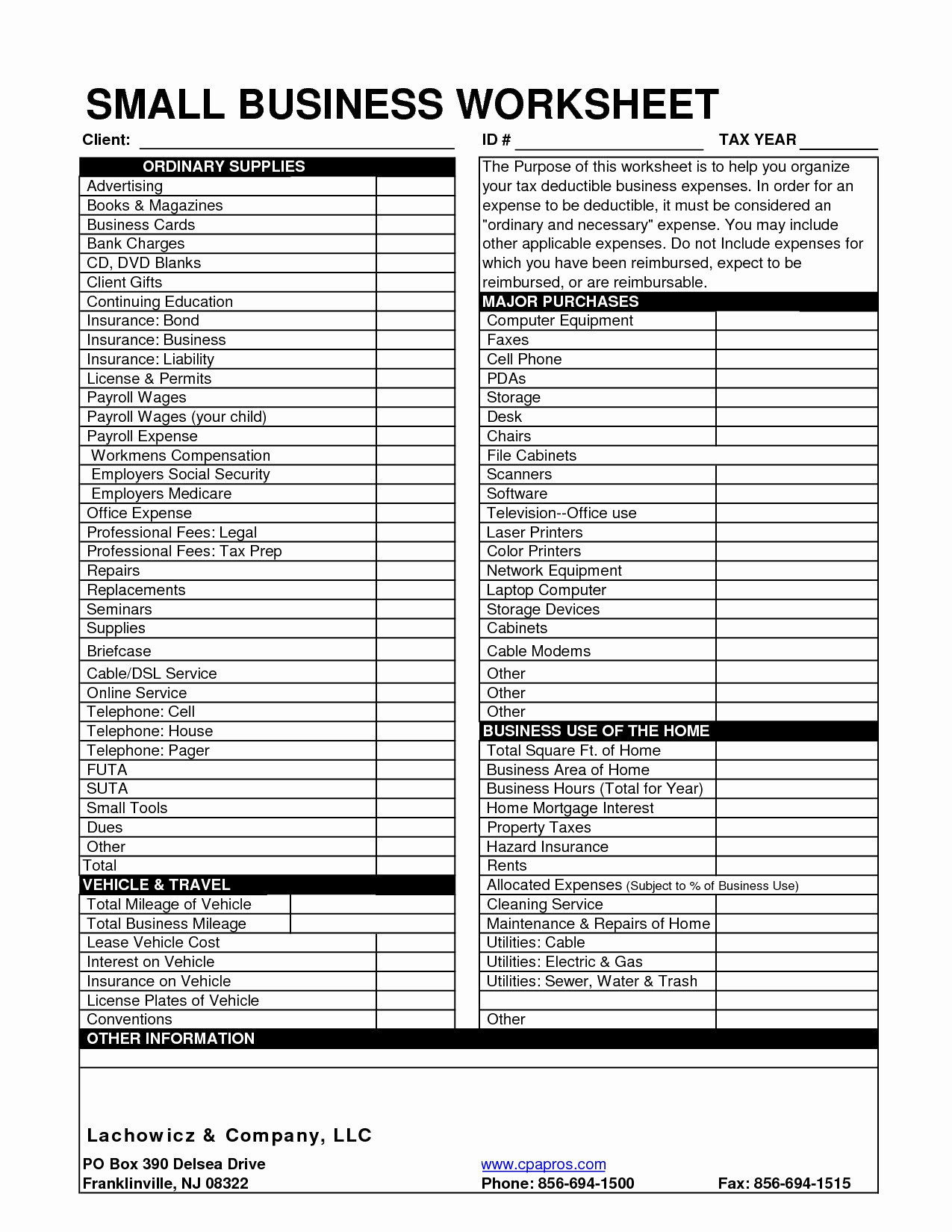

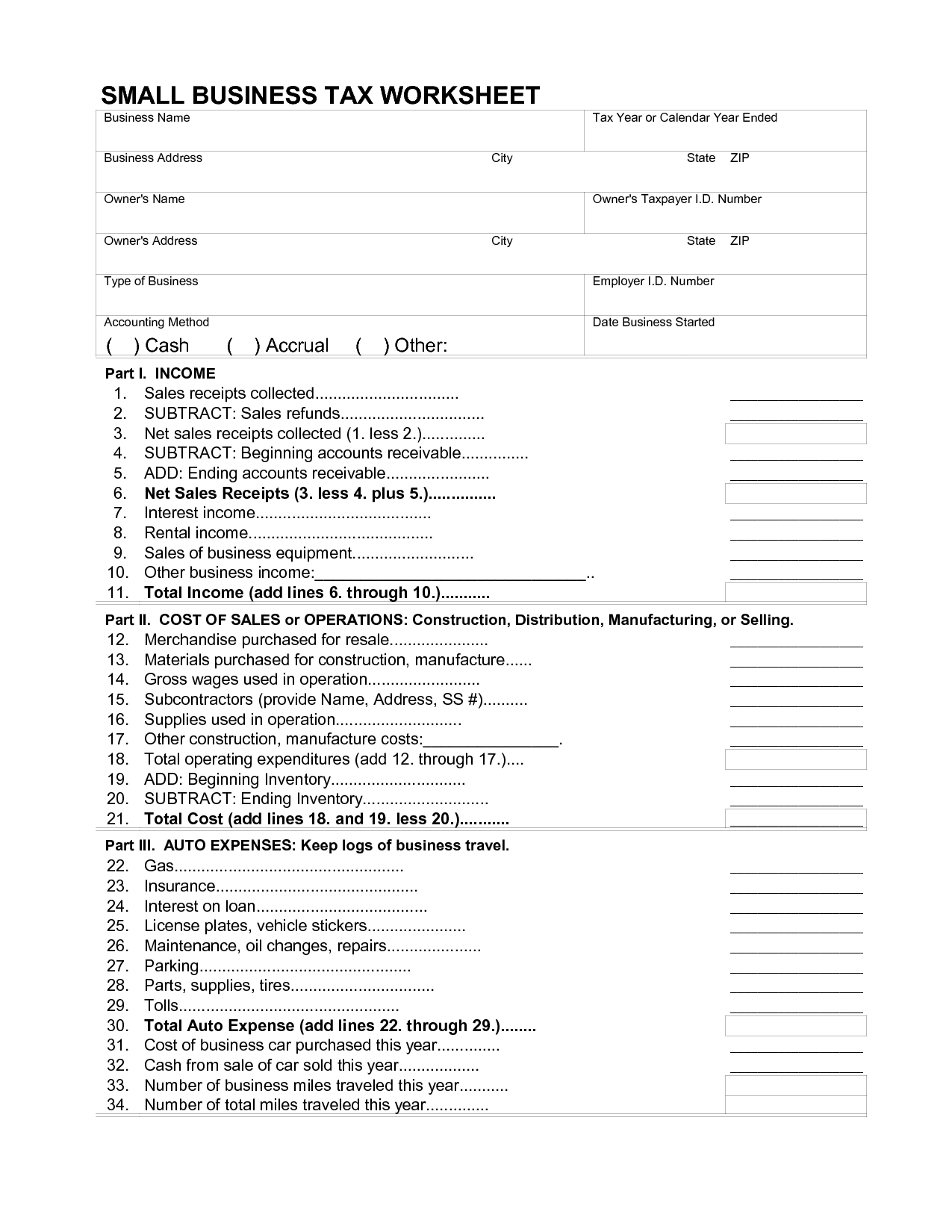

Tax Deduction Spreadsheet Then Small Business Tax Deductions Db excel

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-spreadsheet-then-small-business-tax-deductions.jpg

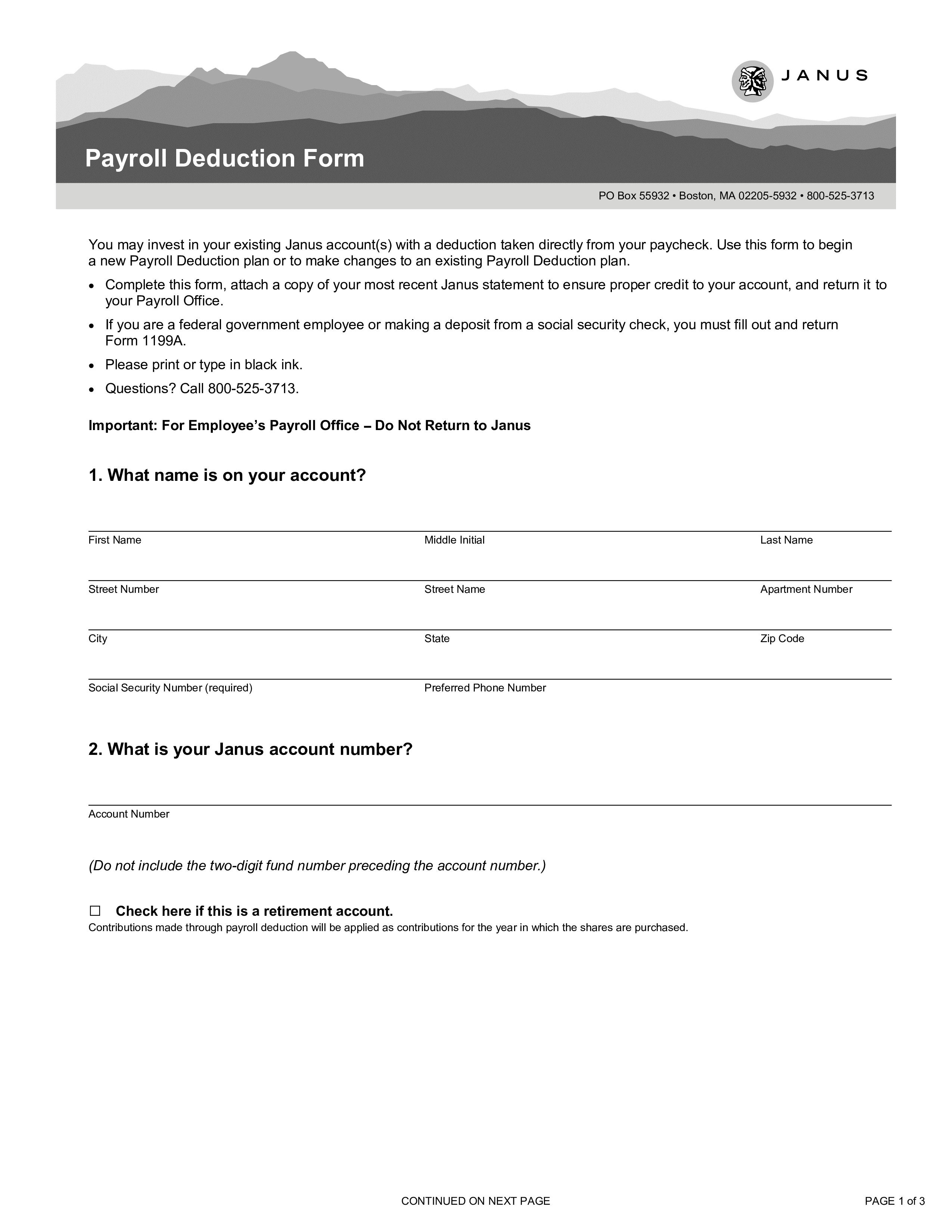

Payroll Deduction Form Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/4598d5a5-6f90-44c2-8e25-6bbdd24604b0_1.png

Verkko 18 elok 2023 nbsp 0183 32 When you finance a new vehicle that you intend to use for work you can t deduct the entire monthly bill from your taxes However you can write off part of your car loan interest Remember you can only Verkko 8 maalisk 2023 nbsp 0183 32 Purchased vs Leased Vehicle Expenses Some expenses differ between purchased and leased vehicles using the actual expense rules and because you don t own a leased vehicle you can t depreciate it However you can deduct the business percentage of your lease payments So if your yearly lease payment is

Verkko 22 lokak 2023 nbsp 0183 32 Section 179 Heavy Vehicles Any vehicle falling within the weight range of 6 000 to 14 000 pounds or 3 7 tons is categorized as heavy Various commercial vans full sized SUVs and pickup trucks fall under this category Vehicles in this weight class are subject to a Section 179 tax deduction limit of 28 900 in 2023 Verkko 24 elok 2023 nbsp 0183 32 8 000 10 000 0 8 0 8 215 100 80 Now multiply the actual expenses times the percentage to get the deduction of 3 600 4 500 215 80 3 600 Another expense you may be able to include in the actual expense method is depreciation which represents a set portion of the purchase price of the vehicle

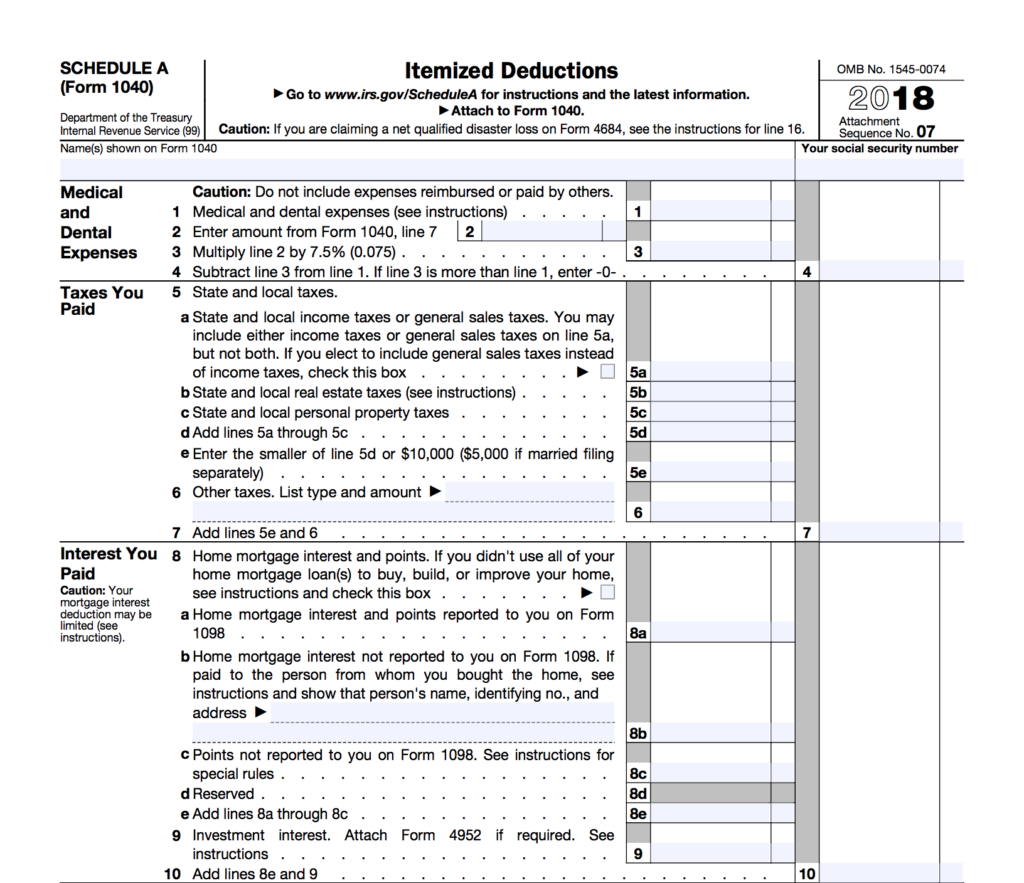

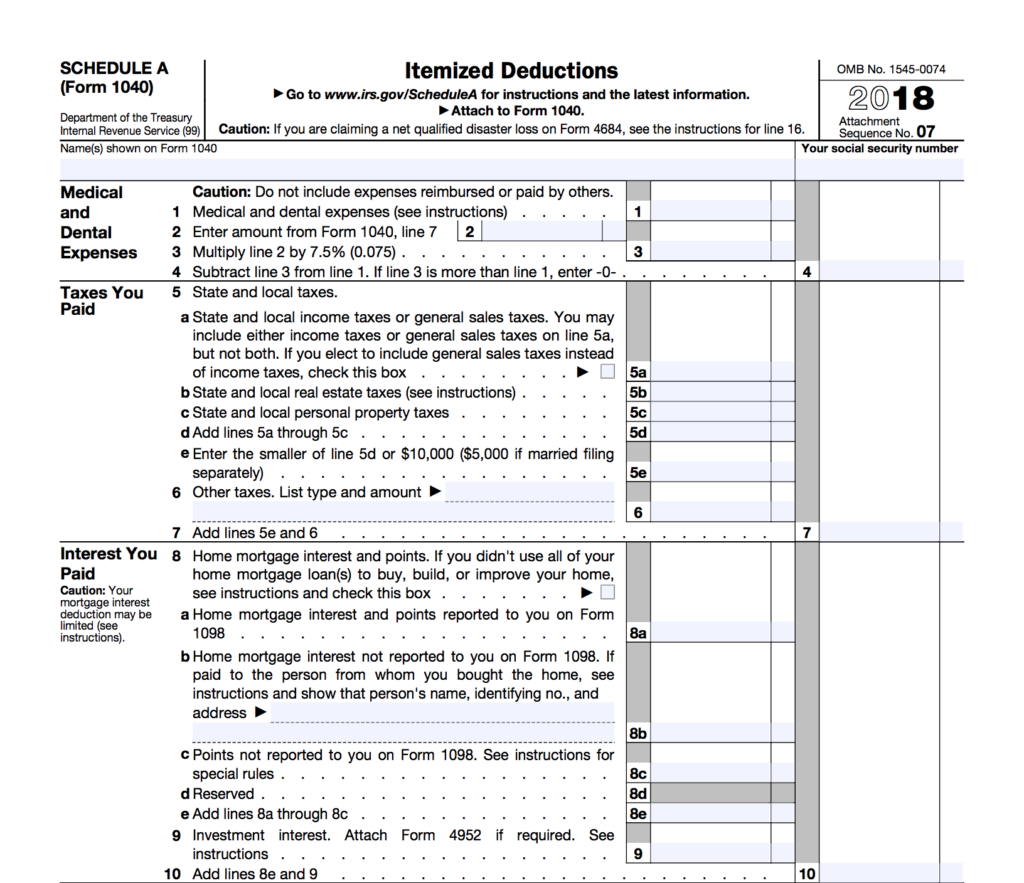

Itemized Deductions Spreadsheet In Business Itemized Deductions

https://db-excel.com/wp-content/uploads/2019/01/itemized-deductions-spreadsheet-in-business-itemized-deductions-worksheet-tax-deduction-worksheet-for.jpg

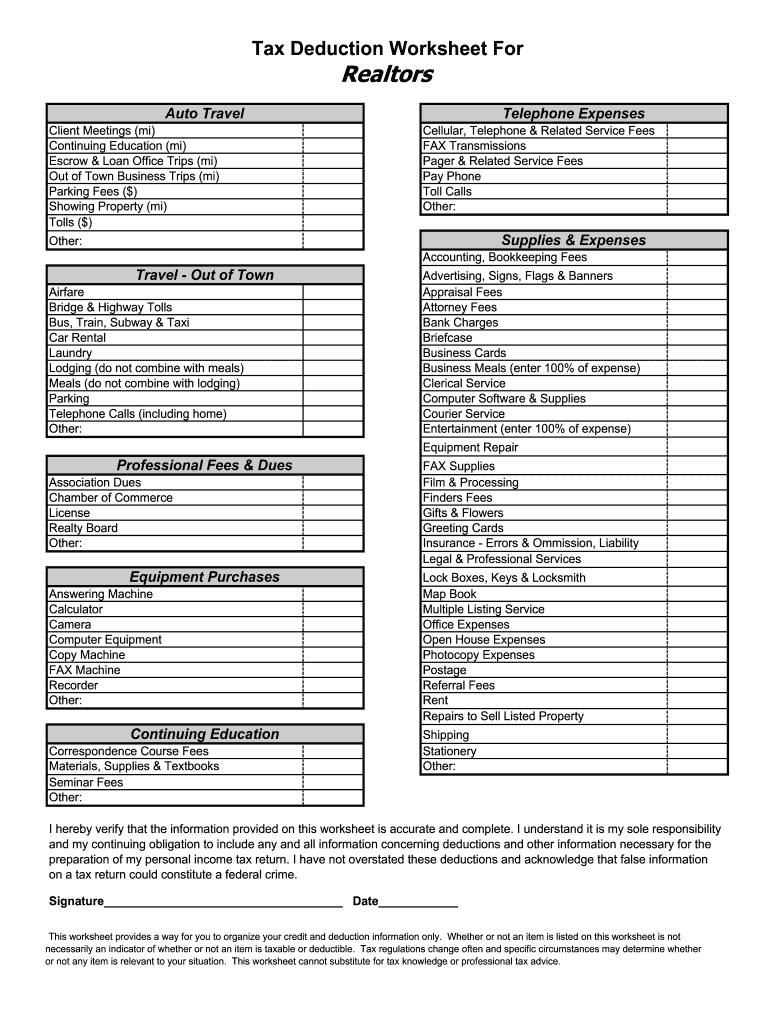

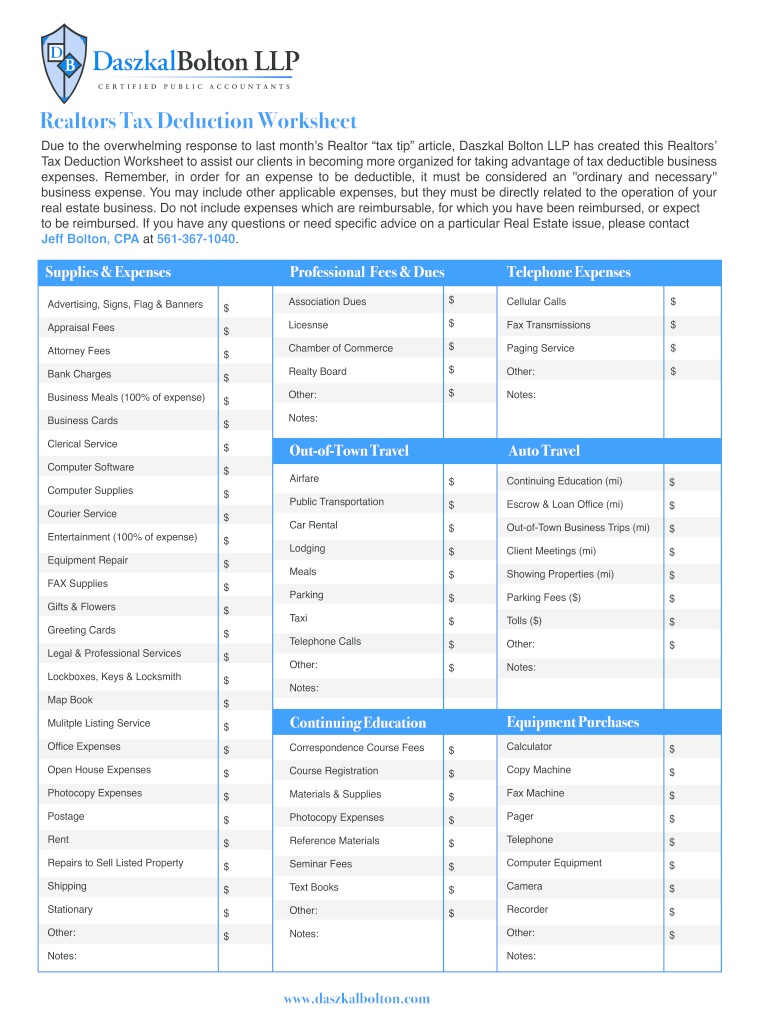

Real Estate Agent Tax Deductions Worksheet 2022 Fill Online

https://www.pdffiller.com/preview/354/967/354967762/large.png

https://taxsharkinc.com/business-vehicle-tax-deduction

Verkko No body section that protrudes more than 30 inches in front of the leading edge of the windshield If you use your vehicle for business reasons for more than 50 of the time but less than 100 of the time you may have a limited total deduction of 11 160 for cars and 11 560 for vans and trucks

https://www.thebalancemoney.com/vehicle-tax-deductions-and-write-offs...

Verkko 16 toukok 2022 nbsp 0183 32 Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the same tax year The deduction limit in 2021 is 1 050 000 For example let s say you spent 20 000 on a new car for your business in June 2021

24 Vehicle Lease Mileage Tracker Sample Excel Templates

Itemized Deductions Spreadsheet In Business Itemized Deductions

8 Tax Itemized Deduction Worksheet Worksheeto

5 Best Images Of Itemized Tax Deduction Worksheet 1040 Forms Itemized

Daszkal Bolton Realtors Tax Deduction Worksheet Fill And Sign

Irs Standard Deduction 2019 Over 65 Standard Deduction 2021

Irs Standard Deduction 2019 Over 65 Standard Deduction 2021

New Tax Rates For Fy 2021 22 Pay Period Calendars 2023

13 Car Expenses Worksheet Worksheeto

2022 Deductions List Name List 2022

New Vehicle Tax Deduction For Business - Verkko 25 elok 2023 nbsp 0183 32 The basis purchase price additional fees and taxes of the vehicle is 40 000 The percentage it was used for business is 60 The basis to be used for depreciation is 24 000 As noted earlier vehicles are classified as a five year property under MACRS Using the 200 declining rate you get to a 40 depreciation rate 200