Nps Contribution Tax Exemption Under Section NPS tax benefits apart from Section 80CCD include Partial withdrawals made under the NPS account are fully exempt Lumpsum withdrawal at age 60 is fully exempt 40 of the total NPS used to buy

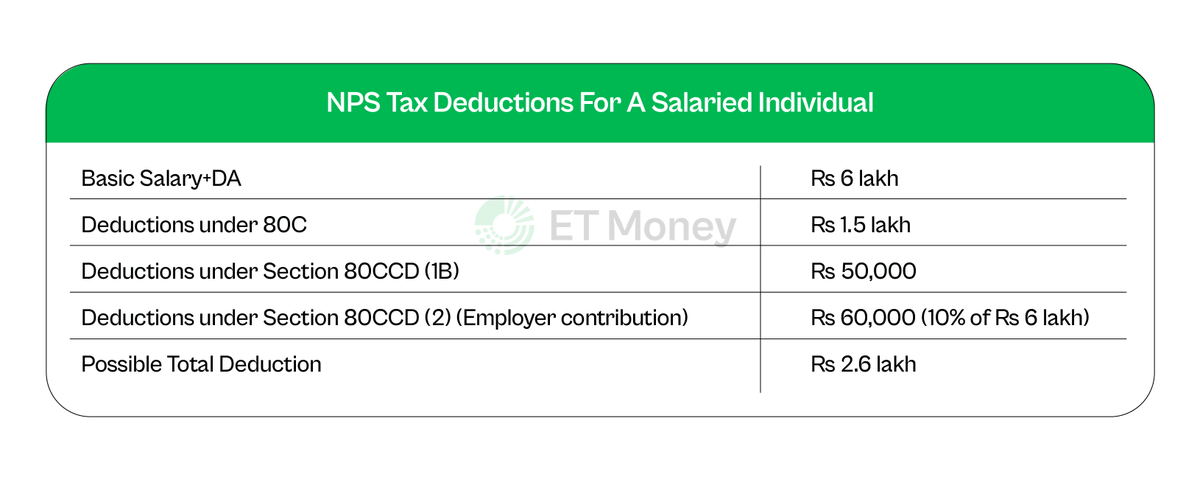

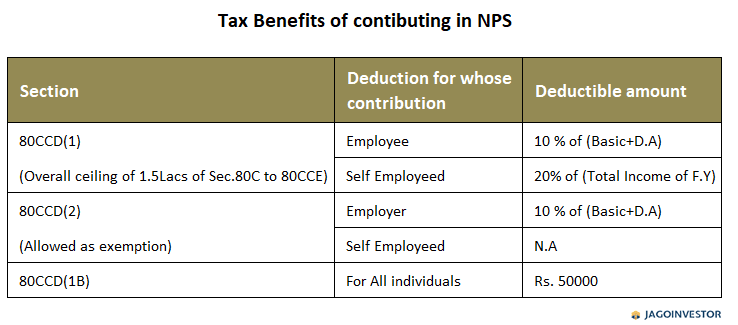

The taxpayer s contribution towards NPS can be deducted from the Gross Total Income under three separate sections of the Income tax Act Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 within the overall ceiling

Nps Contribution Tax Exemption Under Section

Nps Contribution Tax Exemption Under Section

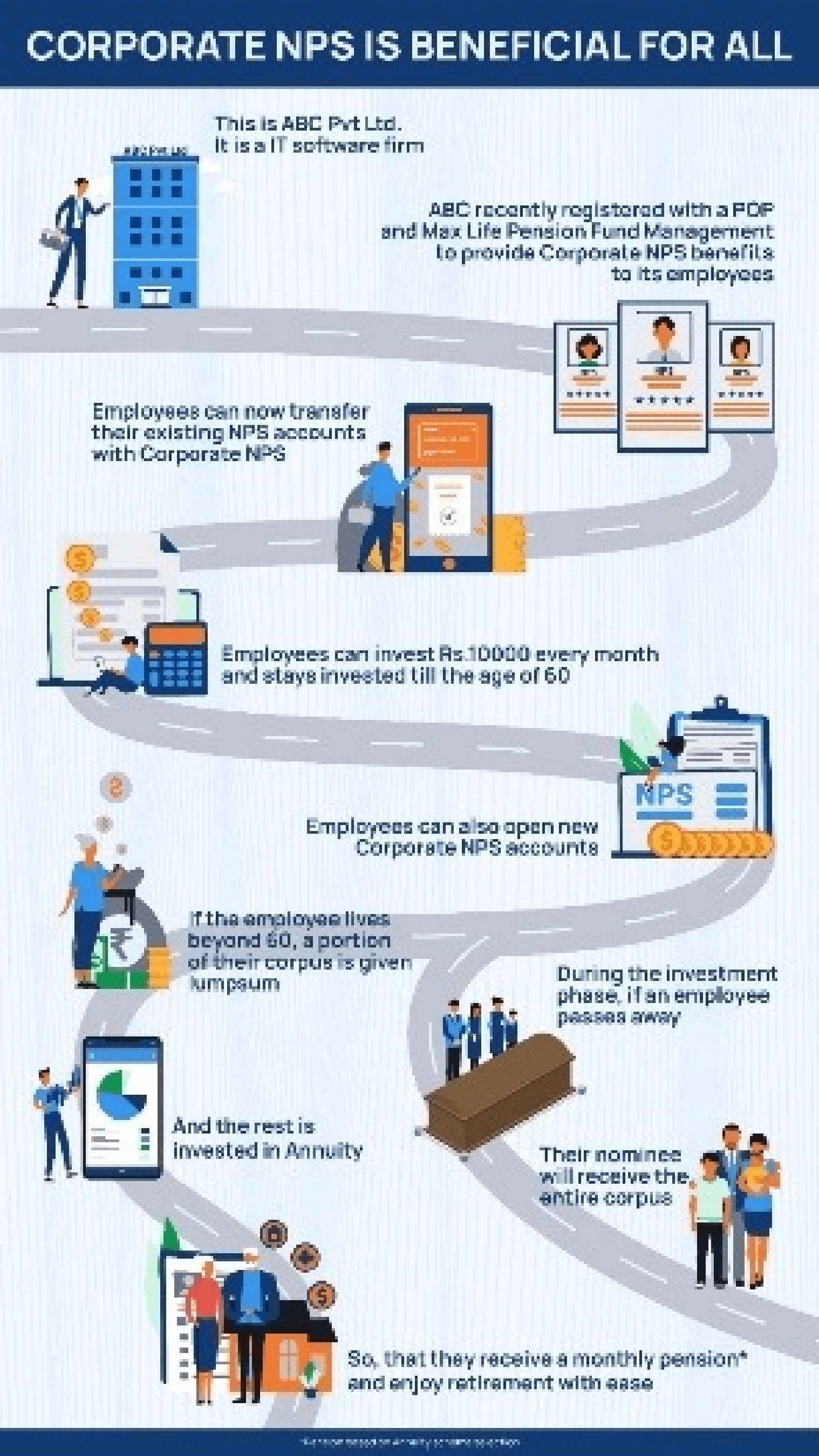

https://www.maxlifepensionfund.com/content/dam/pfm/nps-solutions/corporate-nps-working-image.png

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

What Is The Tax Exemption On The Maturity Of The National Pension

https://qph.cf2.quoracdn.net/main-qimg-483550f20120ffa3f3dc3ab89d20f6a9-lq

FAQ on Tax Benefits in NPS under sections 80CCD 1 80CCD 2 and 80CCD 1B A Govt employee Corporate employee can claim a deduction of your employer s contribution towards NPS under Section 80CCD 2 up to a The contribution made in the National Pension System NPS qualifies for tax benefits under the Income Tax Act 1961 On the amount invested in NPS one can avail tax breaks under Section 80CCD 1 Section

Learn how to claim tax deductions under Section 80CCD for NPS contributions Explore limits for employees self employed and employers plus additional benefits Enter your email Address NPS Contributions Tax Benefits Under the New Regime While the new tax regime restricts several deductions employer contributions to NPS remain a notable exception

Download Nps Contribution Tax Exemption Under Section

More picture related to Nps Contribution Tax Exemption Under Section

Invest Rs 50 000 Annually In NPS And You Can Create A Retirement

https://pbs.twimg.com/media/FcI0Ex5aAAIs5Uy.png

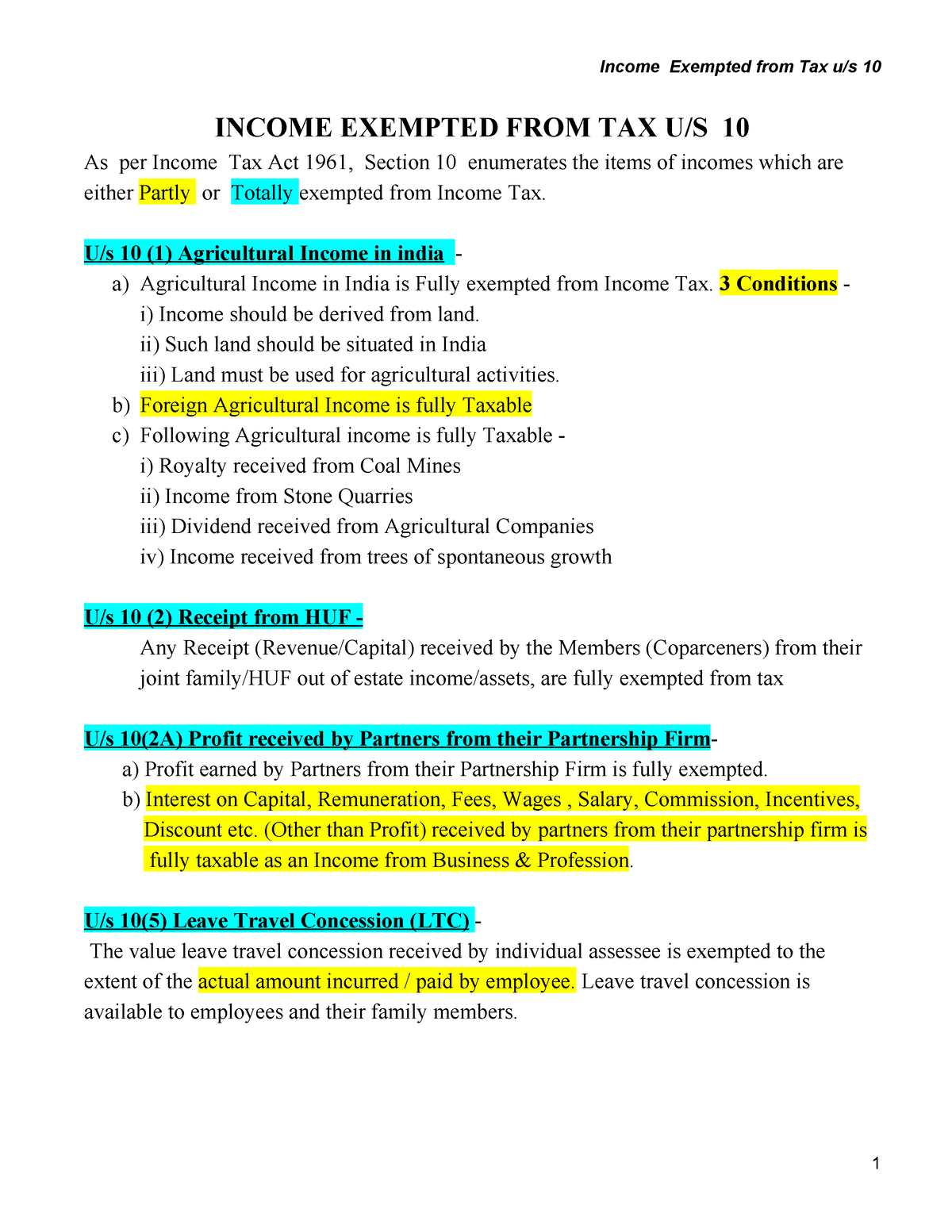

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/1e6ed41ab1579da043d5061a9e55bffc/thumb_1200_1553.png

Section 80CCD 2 Employer s Contribution To NPS NPS In New Tax

https://i.ytimg.com/vi/EpqXDIqNGX0/maxresdefault.jpg

What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction You can claim tax deductions against NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B and 80CCD 2 Let s take a closer look at each of them

Learn about tax benefits under the National Pension System NPS and deductions available under Section 80CCD 1B Discover how to maximize your savings with additional tax relief on NPS contributions Under the updated tax regulations individuals can avail the advantage of employer contributions to their National Pension System NPS account as per Section 80CCD

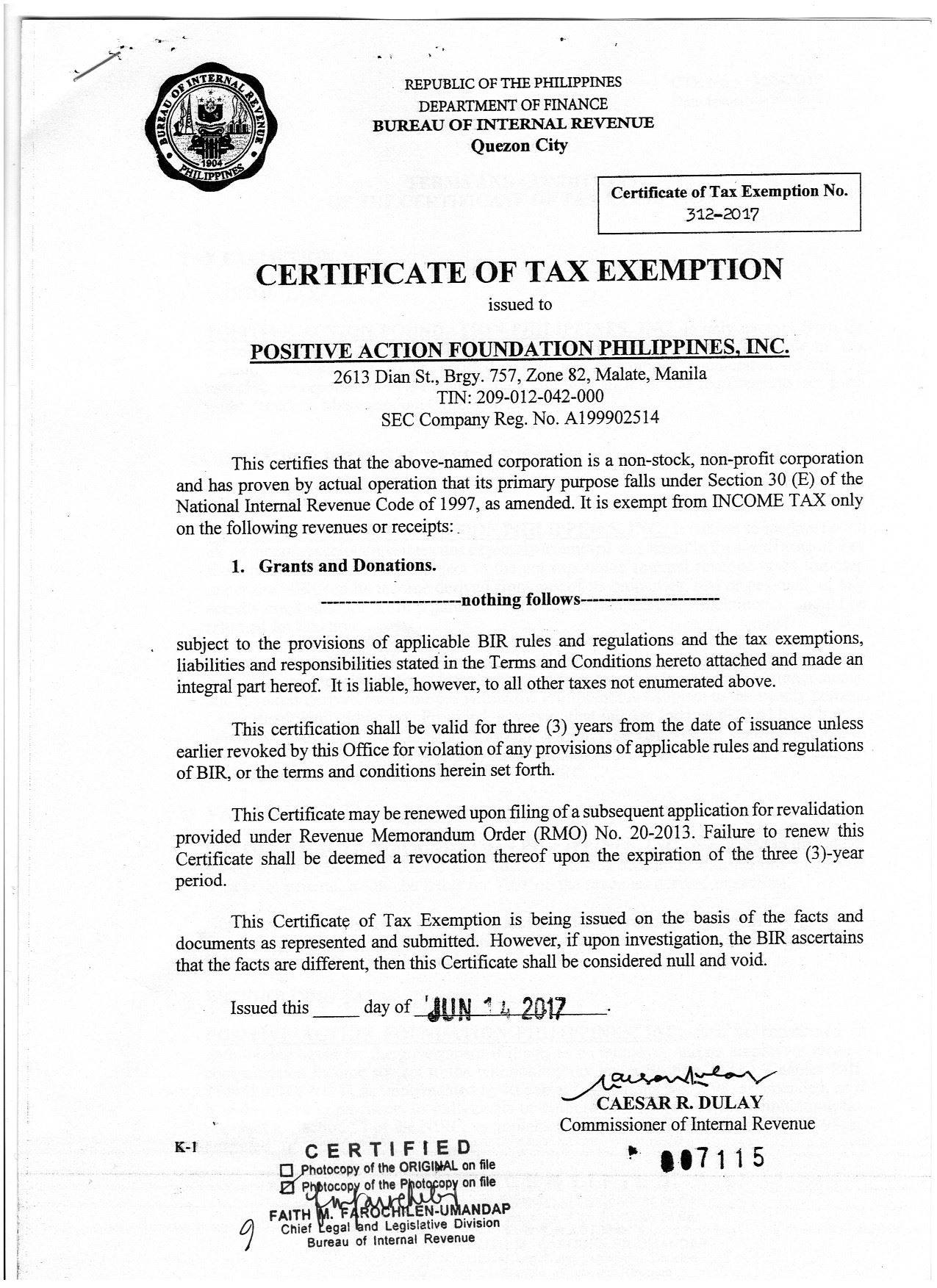

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

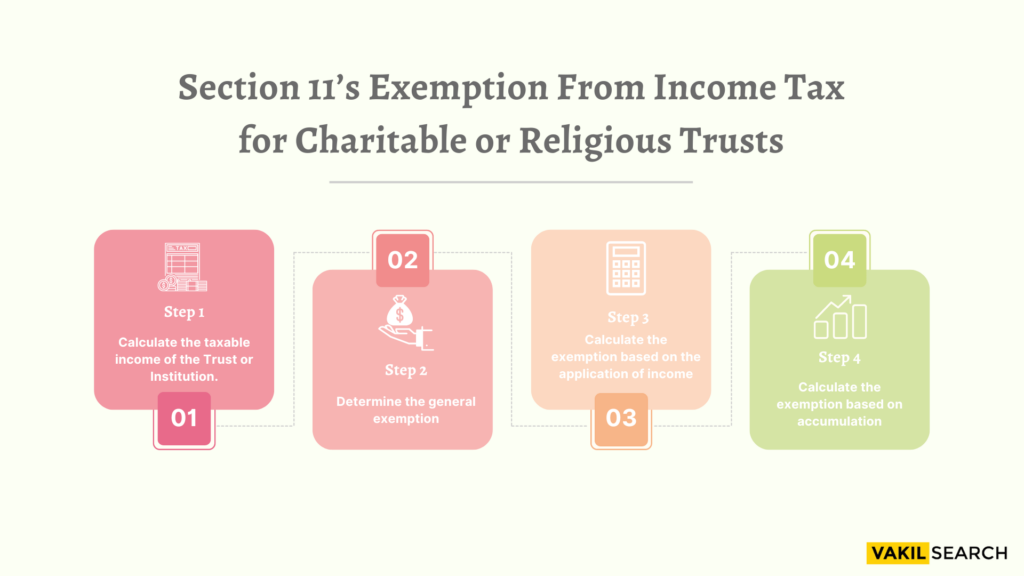

Section 11 Income Tax Act Exemptions For Charitable Trusts

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/08/SECTION-11S-INCOME-TAX-EXEMPTION-1024x576.png

https://www.etmoney.com › learn › nps › nps-tax-benefit

NPS tax benefits apart from Section 80CCD include Partial withdrawals made under the NPS account are fully exempt Lumpsum withdrawal at age 60 is fully exempt 40 of the total NPS used to buy

https://cleartax.in

The taxpayer s contribution towards NPS can be deducted from the Gross Total Income under three separate sections of the Income tax Act

Nps Contribution By Employee Werohmedia

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

Section 80C Deductions List To Save Income Tax FinCalC Blog

2017 PAFPI Certificate of TAX Exemption Certificate Of

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

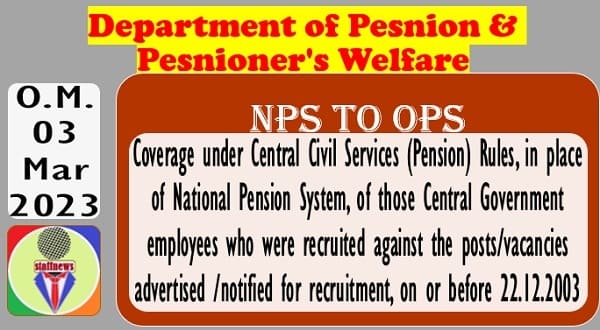

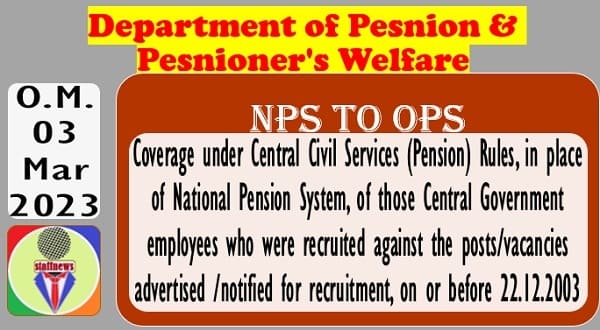

Coverage Under CCS Pension Rules In Place Of NPS For Recruited

Coverage Under CCS Pension Rules In Place Of NPS For Recruited

A Comprehensive Guide To Section 43B Of The Income Tax Act Ebizfiling

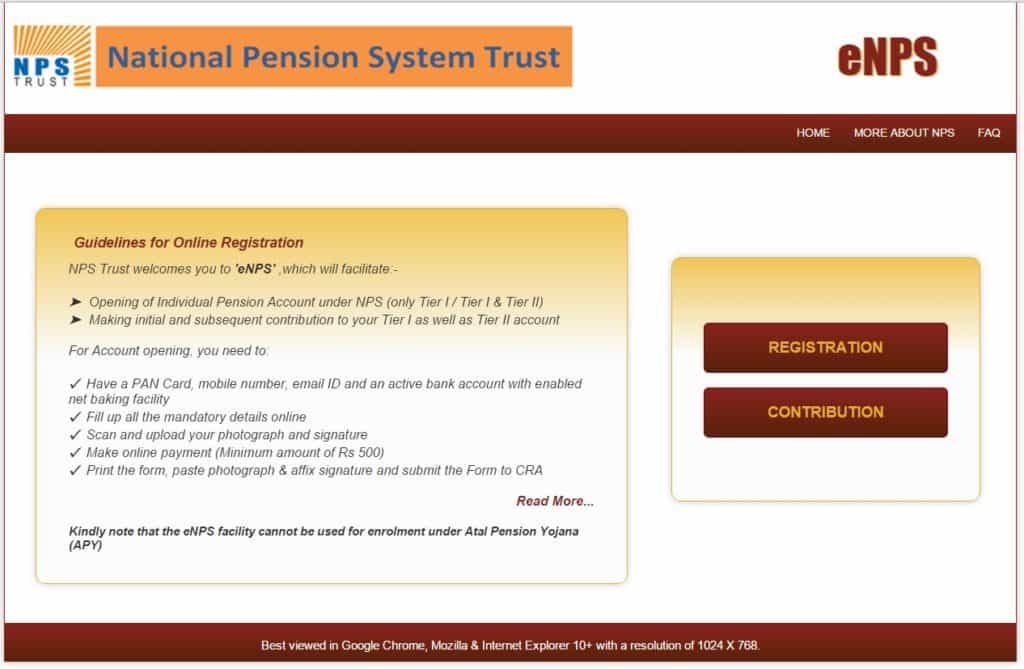

How To Make Online Contributions To NPS Tier I And Tier II Accounts

New Tax Regime Exemption List 2024

Nps Contribution Tax Exemption Under Section - The contribution made in the National Pension System NPS qualifies for tax benefits under the Income Tax Act 1961 On the amount invested in NPS one can avail tax breaks under Section 80CCD 1 Section