Nps Deduction Employee Contribution Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such

What are the tax benefits of NPS to employees on Employer contribution As per Section 80 CCD 2 if your employer is also contributing to your NPS account then Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1

Nps Deduction Employee Contribution

Nps Deduction Employee Contribution

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

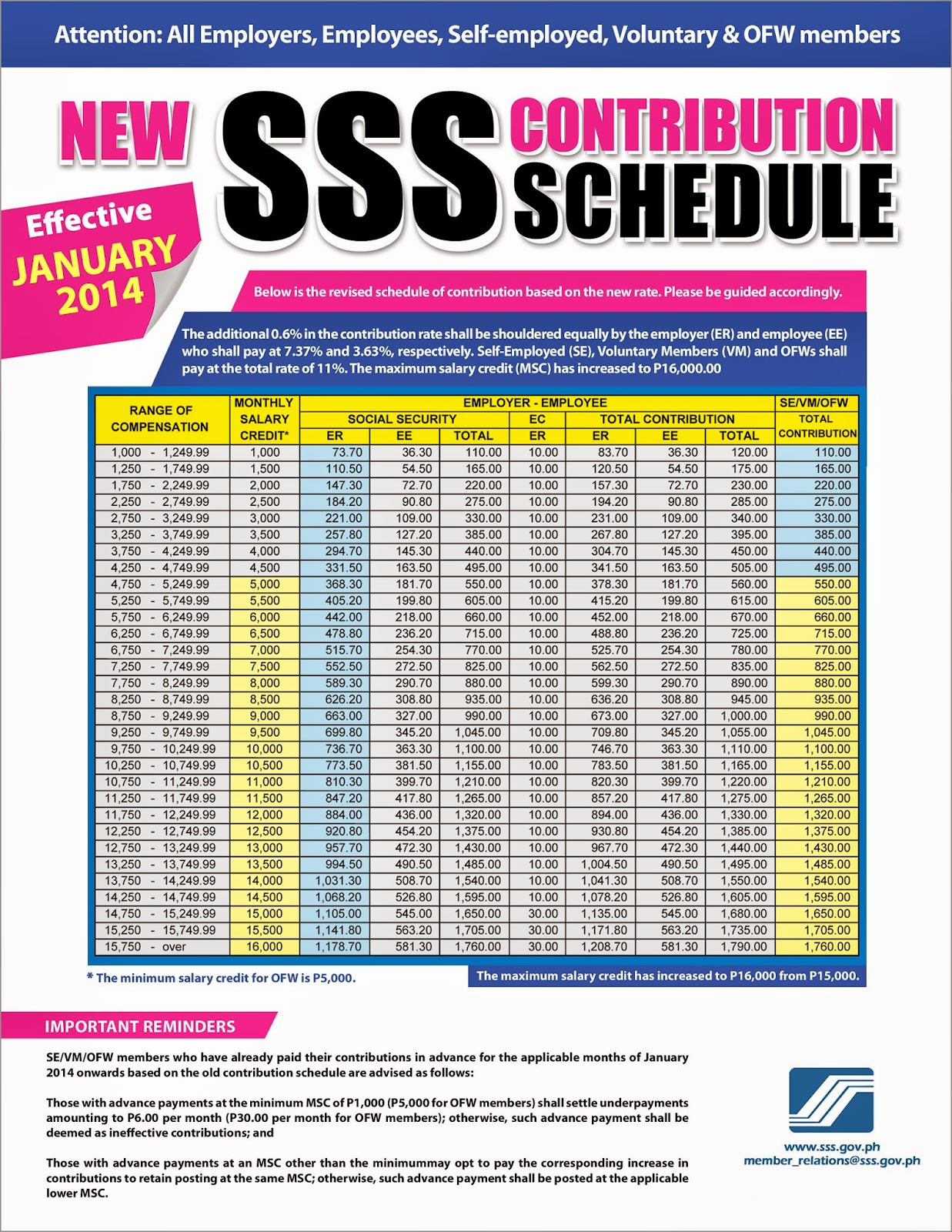

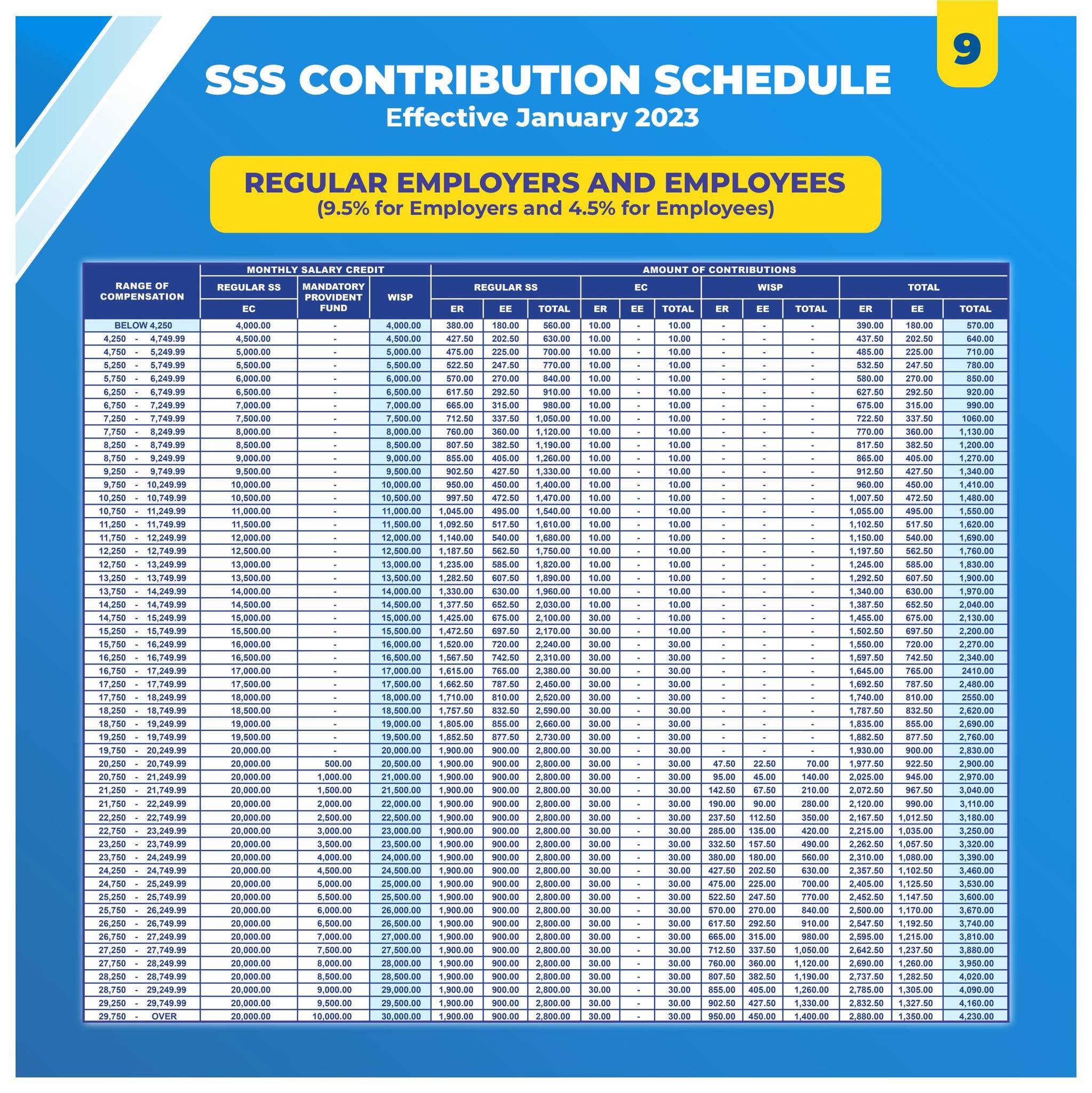

How To Compute For SSS Contribution E PINOYGUIDE

http://1.bp.blogspot.com/-qFtZx1fR8XU/VLuUjtBSW2I/AAAAAAAAFR4/q8MGoohOQKE/s1600/2014_new_sss_contribution_table.jpg

For the contributions made by you i e employee contribution you can claim a deduction under section 80CCD 1 or 80CCD 1B Section 80CCD 1B provides What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible

Employee s own Contribution towards NPS Tier I account is eligible for tax deduction under section 80 CCD 1 of the Income Tax Act within the overall ceiling of A Employee Contribution Deduction upto 10 of salary basic DA within overall ceiling Rs 1 50 Lakh u s 80C B Voluntary Contribution Deduction upto Rs 50 000 u s 80

Download Nps Deduction Employee Contribution

More picture related to Nps Deduction Employee Contribution

Nps Contribution By Employee Werohmedia

https://www.jagoinvestor.com/wp-content/uploads/files/Tax-Benefits-of-contributing-in-NPS.png

Creating NPS Deduction Pay Head For Employees Payroll

https://help.tallysolutions.com/docs/te9rel53/Payroll/Images/1_NPS_Employee_Deduction1.gif

How To Make Online Contributions To NPS Tier I And Tier II Accounts

https://cdn.freefincal.com/wp-content/uploads/2015/12/Online-contribution-NPS.jpg

Effectively an employee can claim deduction upto Rs 7 50 lakhs for employer s contribution to his NPS account in a year How is employer s contribution to Employer s NPS contribution for the benefit of employee up to 10 per cent of salary Basic DA is deductible from taxable income up to 7 5 Lakh the NPS

Know the minimum maximum amount contribution to NPS account by employee employer govt NPS Contributions build money for retirement corpus Employer s Contribution Tax benefits can also be claimed if the contribution has been made by the employer into your NPS account This tax exemption is available

NPS National Pension System Contribution Online Deduction Charges

https://www.paisabazaar.com/wp-content/uploads/2018/10/4-1.jpg

Creating Employees NPS Deduction Pay Head

https://help.tallysolutions.com/docs/te9rel50/Payroll/Images_1/1_NPS_Employee_Deduction.gif

https://cleartax.in/s/nps-national-pension-scheme

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such

https://www.etmoney.com/learn/nps/nps-tax-benefit

What are the tax benefits of NPS to employees on Employer contribution As per Section 80 CCD 2 if your employer is also contributing to your NPS account then

What Is Dcps Nps Yojana Login Pages Info

NPS National Pension System Contribution Online Deduction Charges

Contribution CALAMEO Downloader

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

Deduction Under Section 80CCD 2 For Employer s Contribution To

NPS National Pension System Contribution Online Deduction Charges

NPS National Pension System Contribution Online Deduction Charges

Pin On SHAMEEM

New SSS Contribution Table 2023 Schedule Effective January

Payroll Deduction Form Template

Nps Deduction Employee Contribution - A Employee Contribution Deduction upto 10 of salary basic DA within overall ceiling Rs 1 50 Lakh u s 80C B Voluntary Contribution Deduction upto Rs 50 000 u s 80