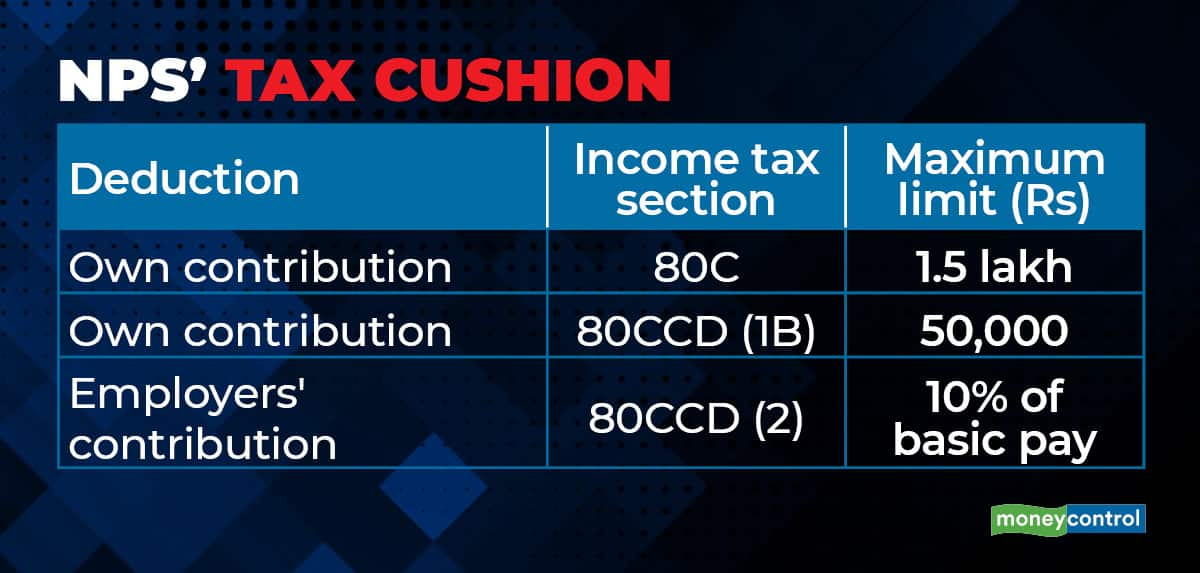

Nps Is Tax Free Under Which Section Investing in NPS Tier I offers three tax deductions Deduction of up to Rs 1 5 lakh from taxable income under Section 80C Additional deduction of up to Rs 50 000

Tax Benefits Under NPS As Per February 2024 The contributions to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian Income Tax Act The NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement The scheme is portable across

Nps Is Tax Free Under Which Section

Nps Is Tax Free Under Which Section

https://business2business.co.in/uploads/2021/02/new/NPS-Tax-Benefits.jpg

Donate Under Section 80G Of Income Tax Receive Deduction

https://www.lyceetrust.org/storage/uploads/2023/01/blog-lyecc.jpg

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

https://www.alankit.com/blog/blogimage/NPS Tax Benefits NPS Rebate in New Tax Regime.jpg

Now there are three sections under which tax benefits can be claimed by individuals First is Section 80CCD 1 where NPS competes with other investments like provident fund PPF life insurance premiums Section 80CCD 1 of Act provides tax deductions to an individual who contributes to National Pension Scheme NPS The deduction under the section is available to both salaried individuals

Contributions made towards Tier 1 are tax deductible and qualify for deductions under Section 80CCD 1 and Section 80CCD 1B This means you can Tax Benefits under NPS A tax exemption of Rs 1 5 lakh can be claimed on the employee s and employer s contribution towards the National Pension System NPS

Download Nps Is Tax Free Under Which Section

More picture related to Nps Is Tax Free Under Which Section

What Are The Tax Benefits That NPS Offers

http://images.moneycontrol.com/static-mcnews/2022/02/NPS-tax_001.jpg

Tax Benefits Under NPS YouTube

https://i.ytimg.com/vi/WgGo2q88Bl0/maxresdefault.jpg

How To Saves Tax Using NPS YouTube

https://i.ytimg.com/vi/iFgymPRRGwY/maxresdefault.jpg

For subscribers under the NPS Corporate Model employer s contribution upto 10 of the employee s basic DA salary p a is also Tax deductible under IT Sec In Income tax NPS is the tax saving investment option that allows you to claim tax deductions of upto Rs 2 lakh Rs 1 5 lakh under Section 80CCD 1 and Rs

NPS Tax Benefits 1 Exemption under Section 80C Contributions made towards your NPS Tier I account are eligible for a tax deduction under Section 80C You can claim up to If you contribute to NPS under the All Citizens Model you are eligible for deductions under section 80C with a limit of Rs 1 5 lakh Your contributions as an

How Should You Manage Your NPS Tier 1 Account Under The New Tax Regime

https://www.livemint.com/lm-img/img/2023/04/06/600x338/H364LA44_1641746284136_1680788732333_1680788732333.jpg

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

https://enskyar.com/img/Blogs/Deduction-from-Salary-under-section-16-of-Income-Tax-Act.jpg

https://www.valueresearchonline.com/stories/52395/...

Investing in NPS Tier I offers three tax deductions Deduction of up to Rs 1 5 lakh from taxable income under Section 80C Additional deduction of up to Rs 50 000

https://www.forbes.com/.../retirement/n…

Tax Benefits Under NPS As Per February 2024 The contributions to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian Income Tax Act

NPS Tax Queries Can You Claim Deduction For NPS Contribution Made By

How Should You Manage Your NPS Tier 1 Account Under The New Tax Regime

TAX Benefits On NPS YouTube

NPS Network Power Solutions

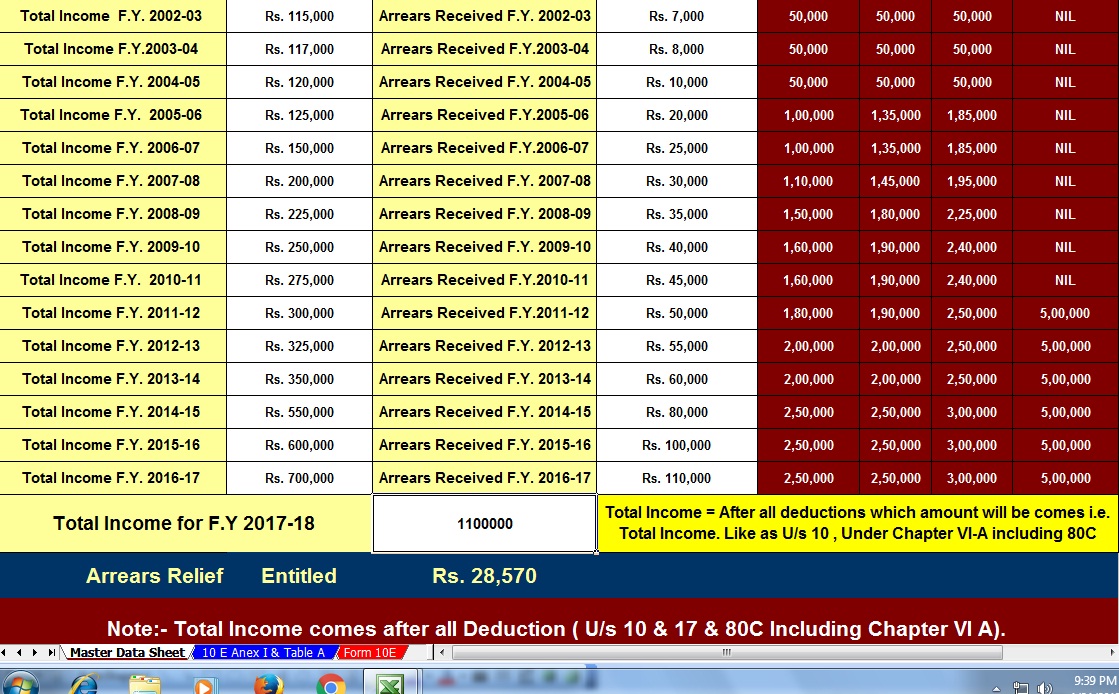

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B With Automated

NPS Investment How To Maximise Income Tax Benefits Business League

NPS Investment How To Maximise Income Tax Benefits Business League

Tackle Tax With NPSInsights

Is NPS Deduction Allowed Under New Tax Regime With Automated Income

SAVE TAX BY INVESTING IN NPS DOP ACCOUNTANT

Nps Is Tax Free Under Which Section - Now there are three sections under which tax benefits can be claimed by individuals First is Section 80CCD 1 where NPS competes with other investments like provident fund PPF life insurance premiums