Nps Under Section 80cce Web 21 Sept 2022 nbsp 0183 32 Tax Benefits under Section 80C The National Pension System NPS is one of the listed investment options where you can allocate your funds to avail of tax benefits under Section 80C The deduction limit for this section is Rs 1 5 lakhs

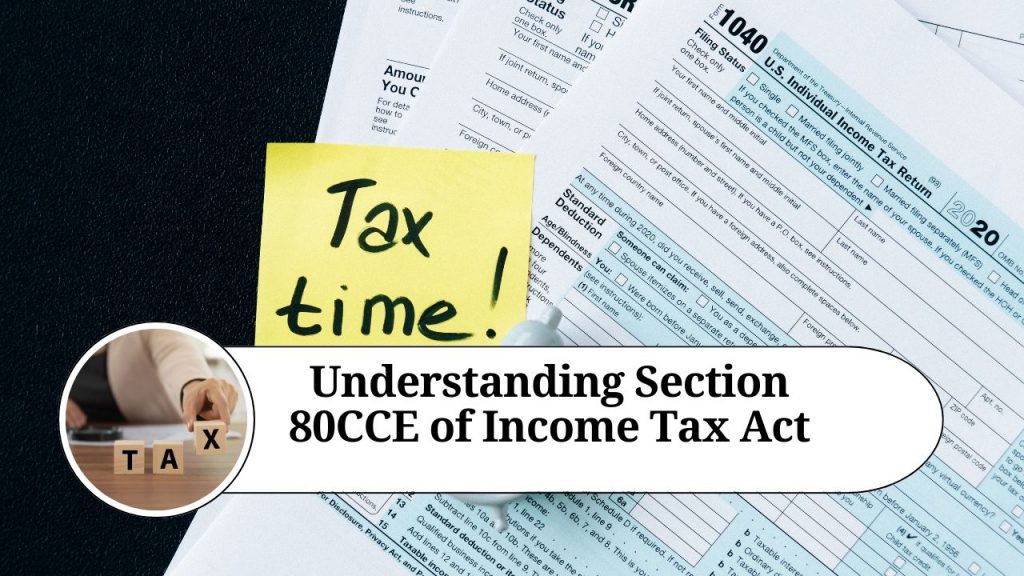

Web nder Section 80CCD Existing NPS subscribers can take benefit of the deduction under section 80CCD for their NPS contributions Section 80 CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total amount of deduction of 80 C and 80 CCD 1 cannot exceed Rs 1 50 Web 80CCE Total deduction under Section 80C 80CCC 80CCD 1 Rs 1 50 000 80CCD 1B Investments in NPS outside Rs 1 50 000 limit under Section 80CCE Rs 50 000 80CCD 2 Employer s contribution towards NPS outside Rs 1 50 000 limit under Section 80CCE Central government employer 14 of basic salary DA Others 10 of basic

Nps Under Section 80cce

Nps Under Section 80cce

https://cdn-static.zep.us/uploads/spaces/65PNQR/thumbnail/7a5c00dd47fc495fb573d16aacb9aa21/0.jpg

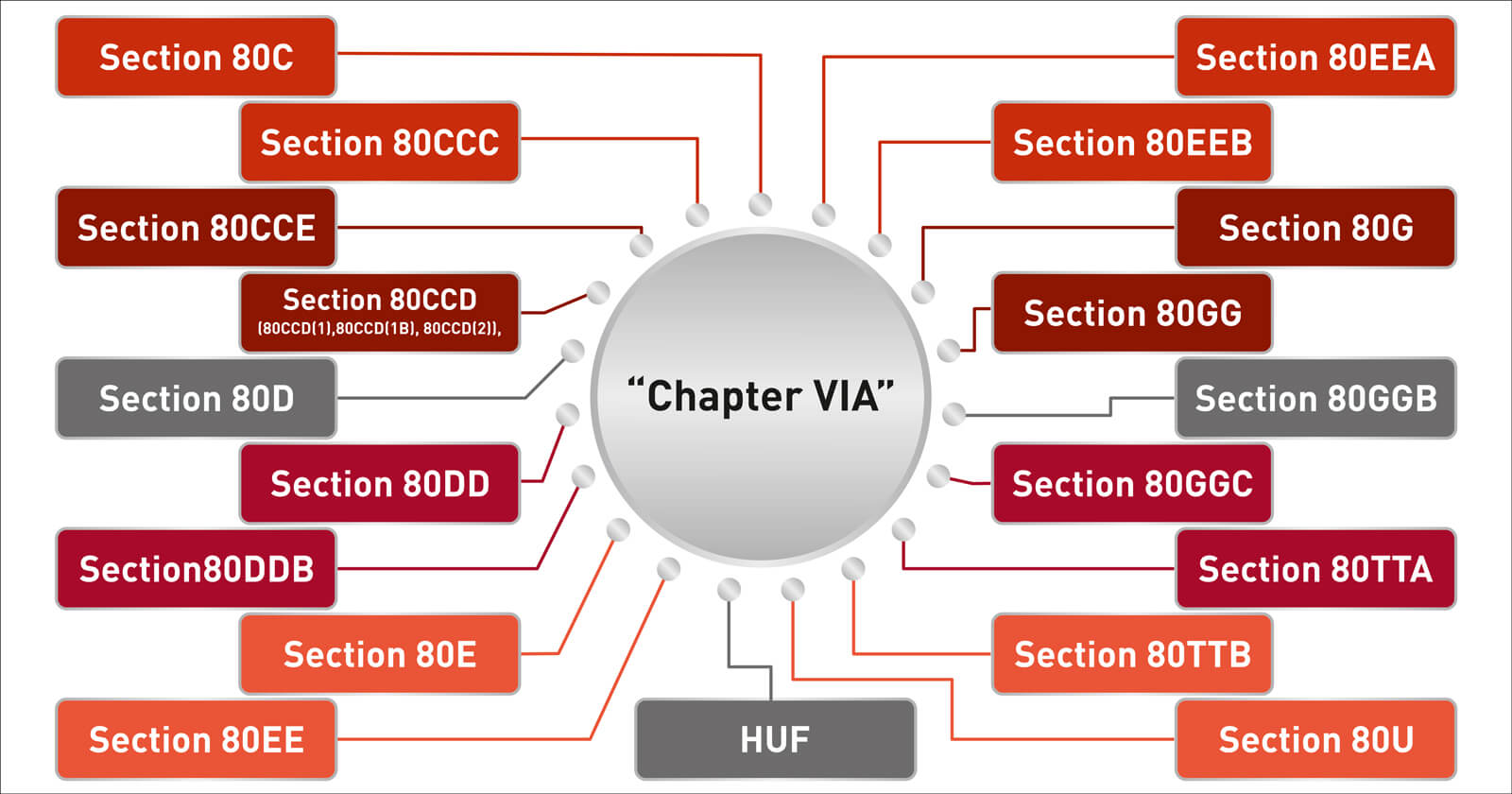

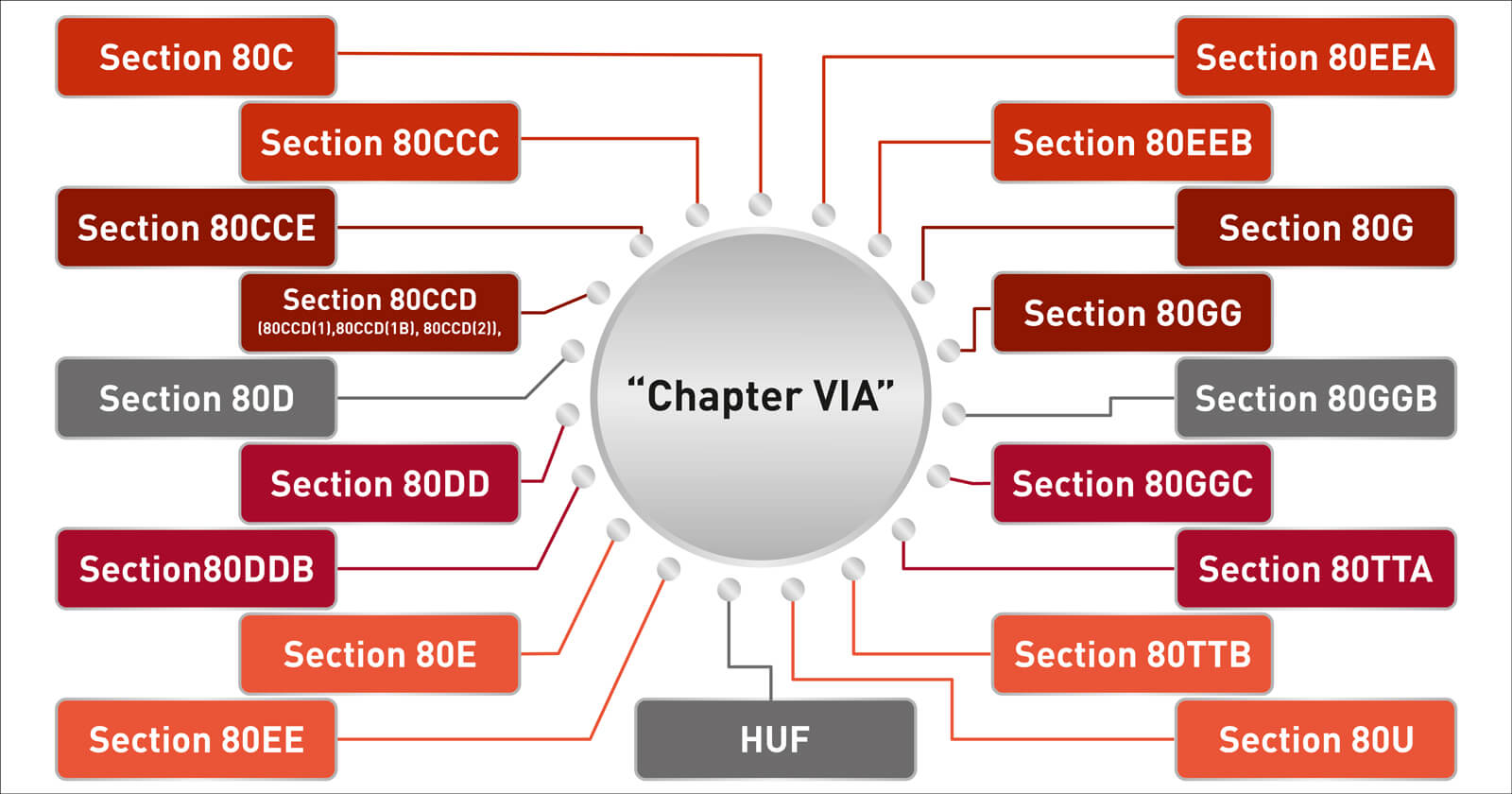

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

3 Deductions From GTI Section 80CCC Section 80CCE YouTube

https://i.ytimg.com/vi/xsupcPxX2NY/maxresdefault.jpg

Web Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD 1 with in the overall ceiling of Rs 1 5 lac under Sec 80 CCE An additional deduction for investment up to Rs 50 000 in NPS Tier I account is available exclusively to NPS subscribers under subsection 80CCD 1B Web July 2 2021 The Finance Act 2015 inserted a new subsection IB under Section 80CCD of the Income Tax Act to stimulate investment in NPS by any individual by permitting an additional deduction of INR 50 000 over and above the INR 1 5lakhs available under Section 80CCE of the Act

Web 30 Jan 2018 nbsp 0183 32 The Finance Act 2015 inserted a new sub section 1B under Section 80CCD of the Income Tax Act to encourage investment in NPS by any individual by allowing an additional deduction of INR 50 000 over and above the INR 1 5 lakhs available under Section 80CCE of the Act Web 17 M 228 rz 2023 nbsp 0183 32 National Pension System NPS NPS is a retirement focused investment scheme that provides tax benefits on contributions Taxpayers can claim deductions up to Rs 1 5 lakhs under Section 80CCE for contributions made to the NPS

Download Nps Under Section 80cce

More picture related to Nps Under Section 80cce

How To Save Tax Via NPS By Investing Rs 50 000 Additionally B2b

https://business2business.co.in/uploads/2021/02/new/NPS-Tax-Benefits.jpg

Section 80CCC 80CCD 80CCE YouTube

https://i.ytimg.com/vi/FZ2tvZN4jJ8/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGHIgTSg5MA8=&rs=AOn4CLAipuZzOkz4wd5DwvTjxW7oZbVBfQ

Deductions Under Section 80C Benefits Works Myfinopedia

https://www.myfinopedia.com/wp-content/uploads/2023/01/Deductions-Under-Section-80C.jpg

Web The NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement The scheme is portable across jobs and locations with tax benefits under Section 80C and Web The speciality of the investment under NPS is that the contribution made under 80CCD is over and above the regular limit of Rs 1 50 000 available under section 80CCE The individual can claim a benefit of up to INR 2 00 000 i e Rs 1 50 000 under section 80CCE and Rs 50 000 under section 80CCD 1B 6

Web 1 Sept 2020 nbsp 0183 32 Section 80CCD 1 of Act provides tax deductions to an individual who contributes to National Pension Scheme NPS The deduction under the section is available to both salaried individuals employed by the Government or any other employer and self employed people Below are the tax benefits available under section 80CCD 1 Web 25 Feb 2016 nbsp 0183 32 You can take out the money at any time Only the NPS subscriber can claim tax benefits If you invest in NPS which is in your spouse s name then you cannot claim the tax deduction Your contribution to NPS can be claimed under Section 80CCD1 b as well as Section 80C

Understanding Section 80CCE Of Income Tax Act

https://margcompusoft.com/m/wp-content/uploads/2023/03/7-28-1024x576.jpg

Deduction Under Section 80CCC 80CCD 80CCE

https://d2t4dvw3byq3wi.cloudfront.net/mm/2023/02/9ncwFGrx0qFrOnk6Z6u7h7cNPmy-project-1-3.png

https://www.etmoney.com/learn/nps/nps-tax-benefit

Web 21 Sept 2022 nbsp 0183 32 Tax Benefits under Section 80C The National Pension System NPS is one of the listed investment options where you can allocate your funds to avail of tax benefits under Section 80C The deduction limit for this section is Rs 1 5 lakhs

https://cleartax.in/s/section-80-ccd-1b

Web nder Section 80CCD Existing NPS subscribers can take benefit of the deduction under section 80CCD for their NPS contributions Section 80 CCD 1 gives a tax deduction on NPS contributions up to 10 of their salary basic salary DA made by employees However the total amount of deduction of 80 C and 80 CCD 1 cannot exceed Rs 1 50

Section 80 CCD 80CCD 1 80CCD IB 80CCD 2 80CCE 80CCF

Understanding Section 80CCE Of Income Tax Act

Section 80C 80CCC 80CCD 80CCE Deductions In Computing Total Income

SECTION 2 CONSOLIDATED RULES MADE UNDER SECTION 85

3 8 NPS Female Equal Socket Hydair

DEDUCTION UNDER CHAPTER VI A INCOME TAX SECTION 80CCC 80CCD 80CCE

DEDUCTION UNDER CHAPTER VI A INCOME TAX SECTION 80CCC 80CCD 80CCE

What Is Section 80C Sharda Associates

Connective Tissue Compact Bone Cross Section Ground Huma Flickr

Claim The Deductions Under Section 80 C And Save Your Income Up To Rs 1

Nps Under Section 80cce - Web 22 Sept 2022 nbsp 0183 32 Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of up to 2 lakh in a financial year apart from the employer s contribution as detailed below