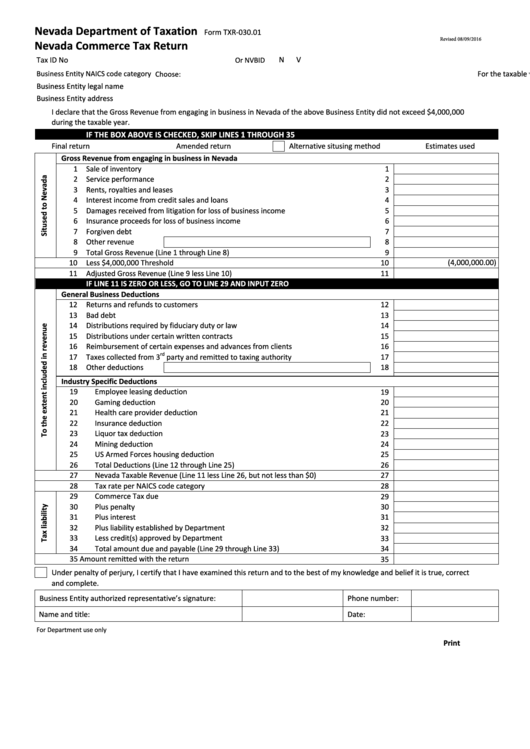

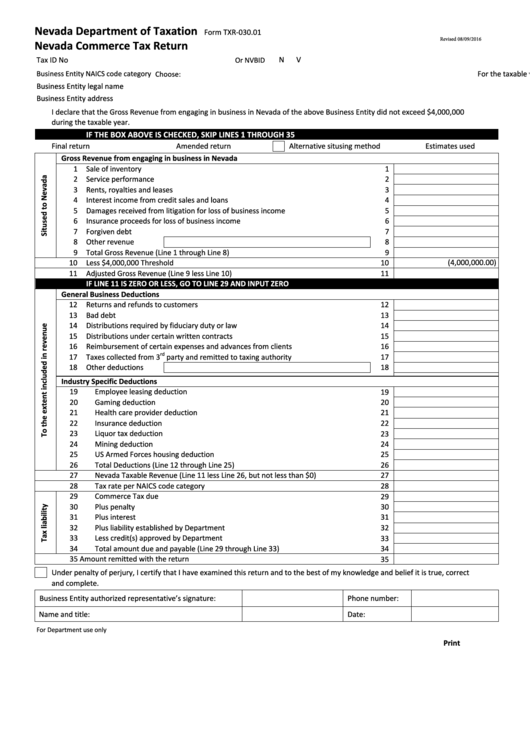

Nv Commerce Tax Return If you file Schedule C with your Federal income tax return and your Nevada gross revenue is over 4 000 000 you must file a Commerce Tax return

Use the Commerce Tax Return form to report the gross revenue from engaging in business in Nevada and deductions of a business entity to arrive at the amount of Nevada Commerce Tax To file Sales and Use Tax Returns or Consumer User Tax Returns use My Nevada Tax The easiest way to manage your business tax filings with the Nevada Department of Taxation Log In or Sign Up to get started with

Nv Commerce Tax Return

Nv Commerce Tax Return

https://data.formsbank.com/pdf_docs_html/169/1697/169741/page_1_thumb_big.png

Video Guide On How To Use E Commerce Tax System YouTube

https://i.ytimg.com/vi/35zrlFdL0U8/maxresdefault.jpg

Point Method Of Measuring Price Elasticity Of Demand Part 7 NV

https://i.ytimg.com/vi/1MFJftTtFhQ/maxresdefault.jpg

The Commerce Tax applies to businesses with Nevada sourced gross revenue exceeding 4 million in a taxable year Under NRS 363C 200 entities surpassing this Each business entity including sole proprietorships engaged in business in Nevada unless specifically excluded by Commerce Tax law NRS 363C has to file a Commerce Tax return

Do I have to file the commerce tax return A Yes Commencing business in Nevada includes registering your business with the Nevada Secretary of State Unless your entity is specifically Now let s talk about the Commerce Tax Return If your business s gross revenue that s money earned only in the state of Nevada ranges from zero to 3 999 999 99 cents during the state s

Download Nv Commerce Tax Return

More picture related to Nv Commerce Tax Return

Proposed Amendments To E commerce Tax Declaration And Payment

https://image.vietnamnews.vn/uploadvnnews/Article/2022/2/21/202296_z_knkz.jpg

Tax For E Commerce E Commerce Blog

https://www.info.com.my/wp-content/uploads/2015/04/e-commerce-tax.jpg

Tax Instruction VAT E Commerce Commerce Cambodia

https://commerce-cambodia.com/wp-content/uploads/2022/02/e-commerce-1-768x436.jpg

Find and download Nevada tax forms including forms for businesses sales tax and more Access comprehensive resources and guidelines to ensure accurate and timely filing with the Nevada Department of Taxation What is the Nevada Commerce Tax The Commerce Tax established by the Nevada Legislature in 2015 is an annual tax applicable to businesses with a gross revenue in Nevada surpassing 4 000 000 during the

Nevada Commerce Tax is a tax that is imposed on business owners that have the rights of a person to earn through a business that is registered in Nevada Only those who have a gross income of 4 million and A new Nevada commerce tax has been enacted on businesses with Nevada source income effective July 1 2015 Here s what you need to know Typically considered a

E commerce Tax Return Www sellersuccess

https://sellersuccess.com/wp-content/uploads/2023/02/E-commerce-Tax-Return-1536x1536.png

Nevada s New Commerce Tax Is A Throwback To The Days Of The Great

https://www.npri.org/wp-content/uploads/2018/09/20160330_Outofbusiness-768x574.jpg

https://tax.nv.gov › faqs › commerce-tax-f…

If you file Schedule C with your Federal income tax return and your Nevada gross revenue is over 4 000 000 you must file a Commerce Tax return

https://tax.nv.gov › wp-content › uploads

Use the Commerce Tax Return form to report the gross revenue from engaging in business in Nevada and deductions of a business entity to arrive at the amount of Nevada Commerce Tax

Nevada Commerce Tax Nevada Policy

E commerce Tax Return Www sellersuccess

Nevada s New Commerce Tax

UNI Report Highlights E commerce Tax Avoidance

Ecommerce Taxes VOIP DSL ISP Cable Wireless Broadband Internet

E Commerce Tax Considerations Small Business Accounting Finance Blog

E Commerce Tax Considerations Small Business Accounting Finance Blog

Repeal The Commerce Tax YouTube

E commerce Tax Must Be Deducted

Commerce Product Tax Conditions Drupal

Nv Commerce Tax Return - Do I have to file the commerce tax return A Yes Commencing business in Nevada includes registering your business with the Nevada Secretary of State Unless your entity is specifically