Ny State Property Tax Relief The property tax relief credit directly reduced your property tax burden if you were a qualifying homeowner The amount of the credit was a percentage of your STAR savings The

The STAR program provides property tax relief to eligible New York State homeowners and senior citizens throughout the State The dollar amount of each STAR benefit depends on the resident s income level and The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program you ll receive

Ny State Property Tax Relief

Ny State Property Tax Relief

https://s.hdnux.com/photos/01/32/05/62/23616701/3/rawImage.jpg

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

https://files.platteinstitute.org/uploads/2018/10/propertytax2.jpg

N Y Has New Property Tax Relief What About N J Nj

https://www.nj.com/resizer/wwT_I0C8rksX3t7VxgBVokQTM8k=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/RF6P5SE4G5ESJPZS4E3LINQMIU.jpg

The Real Property Tax Relief Credit NY IT 229 RPTR was implemented to provide relief to New York State NYS taxpayers who own qualified real property in the state The Credit takes effect for tax years Property tax credit To claim the credit file form IT 214 which can be done with your NYS income tax or separately Form IT 214 is available online at

ALBANY New York has created a new property tax credit for homeowners who make less than 250 000 a year with about a quarter of the state s estimated 4 5 million owner occupied homes STATEN ISLAND N Y Gov Kathy Hohcul touted New York s efforts to provide nearly 3 million state residents with 2 3 billion in tax relief through the School Tax

Download Ny State Property Tax Relief

More picture related to Ny State Property Tax Relief

Property Tax Relief Remains Ricketts No 1 Priority Arlington Citizen

https://delta.creativecirclecdn.com/enterprise/original/20210119-090800-1.19.21 Governor State of the State 1.jpg

Save Money On Your Home By Applying For Property Tax Relief

https://ptaconsumers.aarpfoundation.org/wp-content/uploads/2021/10/GettyImages-1171173347.jpg

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

https://rfa.sc.gov/sites/default/files/styles/card_regular/public/2020-08/shutterstock_1139203982.jpg?itok=_XW5NOtG

The NYS Property Tax Credit may impact other state level tax credits Taxpayers should evaluate how claiming this credit interacts with programs like the STAR School Tax The School Tax Relief STAR and Enhanced School Tax Relief E STAR benefits offer property tax relief to eligible New York homeowners STAR and E STAR can be issued as a credit by

The newly approved 212 billion state budget includes relief for qualifying homeowners in New York who pay among the highest tax levies in the country But not There are three different property tax exemptions available to Veterans who have served in the United States Armed Forces The exemption applies to county city town and village taxes

Texans Want Property Tax Relief A Homestead Exemption Would Help

https://s.hdnux.com/photos/01/22/31/40/21600258/4/rawImage.jpg

CA Parent Child Transfer California Property Tax NewsCalifornia

https://propertytaxnews.org/wp-content/uploads/2021/10/California-Property-Taxes-scaled.jpg

https://www.tax.ny.gov › pit › property › property-tax-relief.htm

The property tax relief credit directly reduced your property tax burden if you were a qualifying homeowner The amount of the credit was a percentage of your STAR savings The

https://www.governor.ny.gov › news

The STAR program provides property tax relief to eligible New York State homeowners and senior citizens throughout the State The dollar amount of each STAR benefit depends on the resident s income level and

Can You Get Property Tax Relief Based On Vacancy

Texans Want Property Tax Relief A Homestead Exemption Would Help

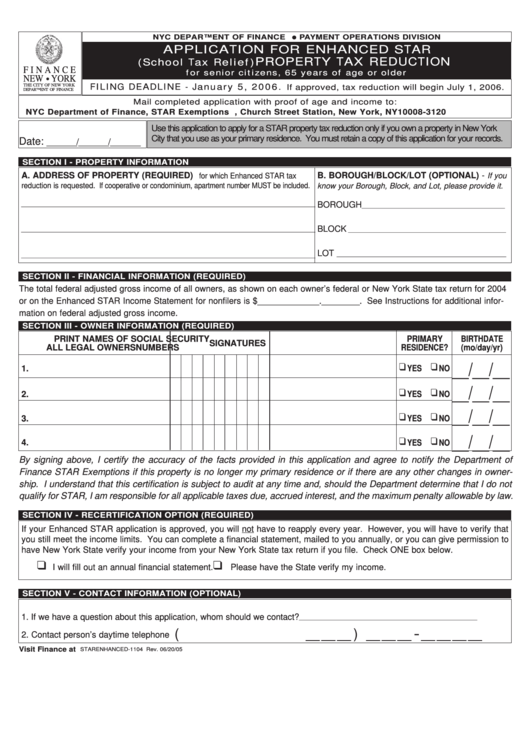

Fillable Application Form For Enhanced Star School Tax Relief

Commercial Property Tax Relief Growth Business

Property Tax Relief LinkedIn

Has The Payment From ANCHOR Property Tax Relief Gone Up NJMoneyHelp

Has The Payment From ANCHOR Property Tax Relief Gone Up NJMoneyHelp

Real Estate Tax Relief Program Official Website Of Arlington County

Credit Versus Exemption In Homestead Property Tax Relief ITR Foundation

Property Tax Reduction Consultants Which Types Of Property Tax Relief

Ny State Property Tax Relief - The Real Property Tax Relief Credit NY IT 229 RPTR was implemented to provide relief to New York State NYS taxpayers who own qualified real property in the state The Credit takes effect for tax years