Ny State Property Tax Deduction For New York purposes Form IT 196 lines 5 6 and 7 your state and local taxes paid in 2022 are not subject to the federal limit and you can deduct foreign taxes

The new tax credit included in the state s 212 billion budget approved this week by the Legislature and Gov Andrew Cuomo will apply to eligible homeowners whose property tax bill Whether you have a 50 000 or 5 000 000 house you will owe property taxes in New York If your property was purchased mid year there is a chance your realtor will work it

Ny State Property Tax Deduction

Ny State Property Tax Deduction

https://www.tax.ny.gov/images/orpts/totaltaxeschart.gif

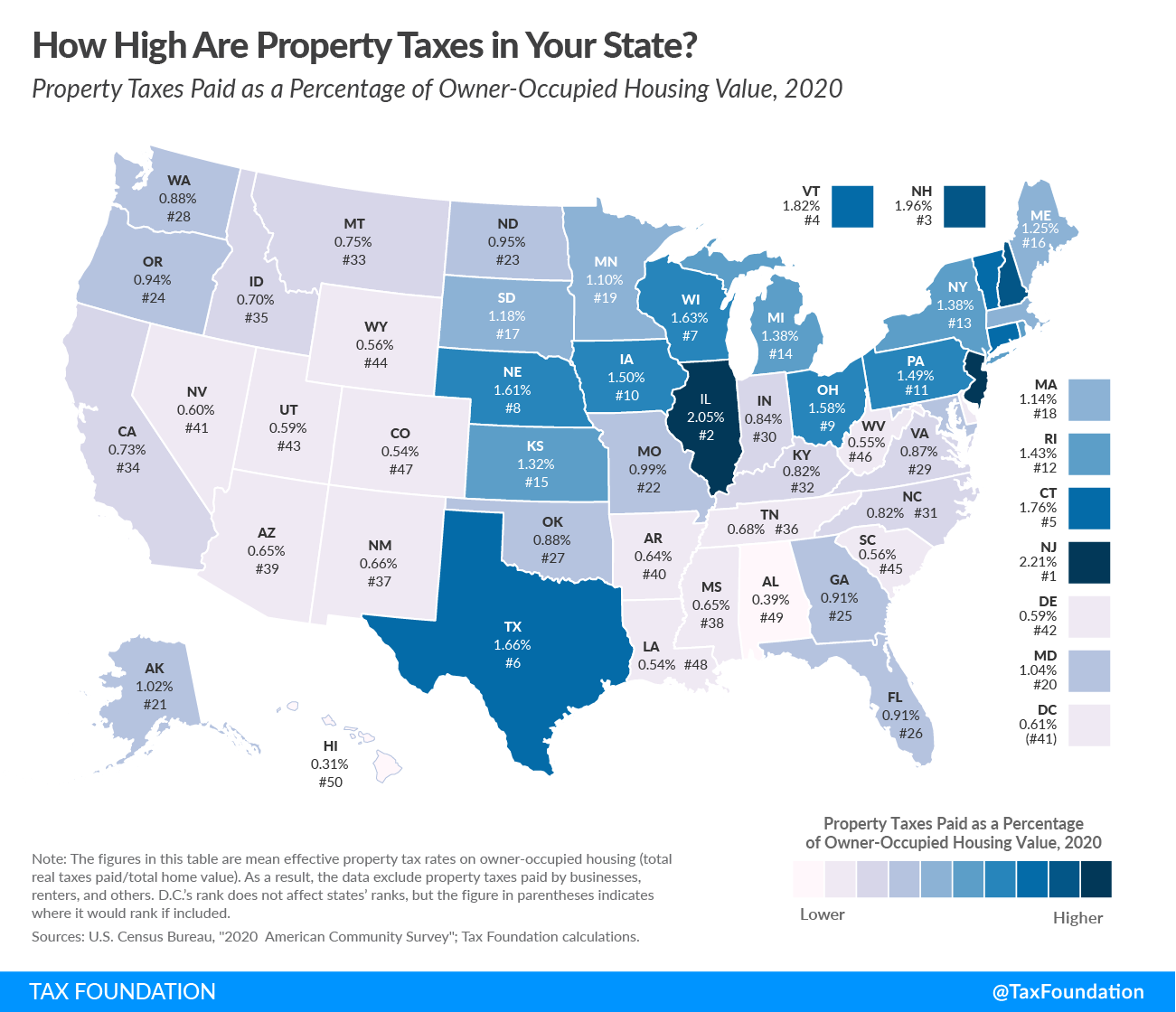

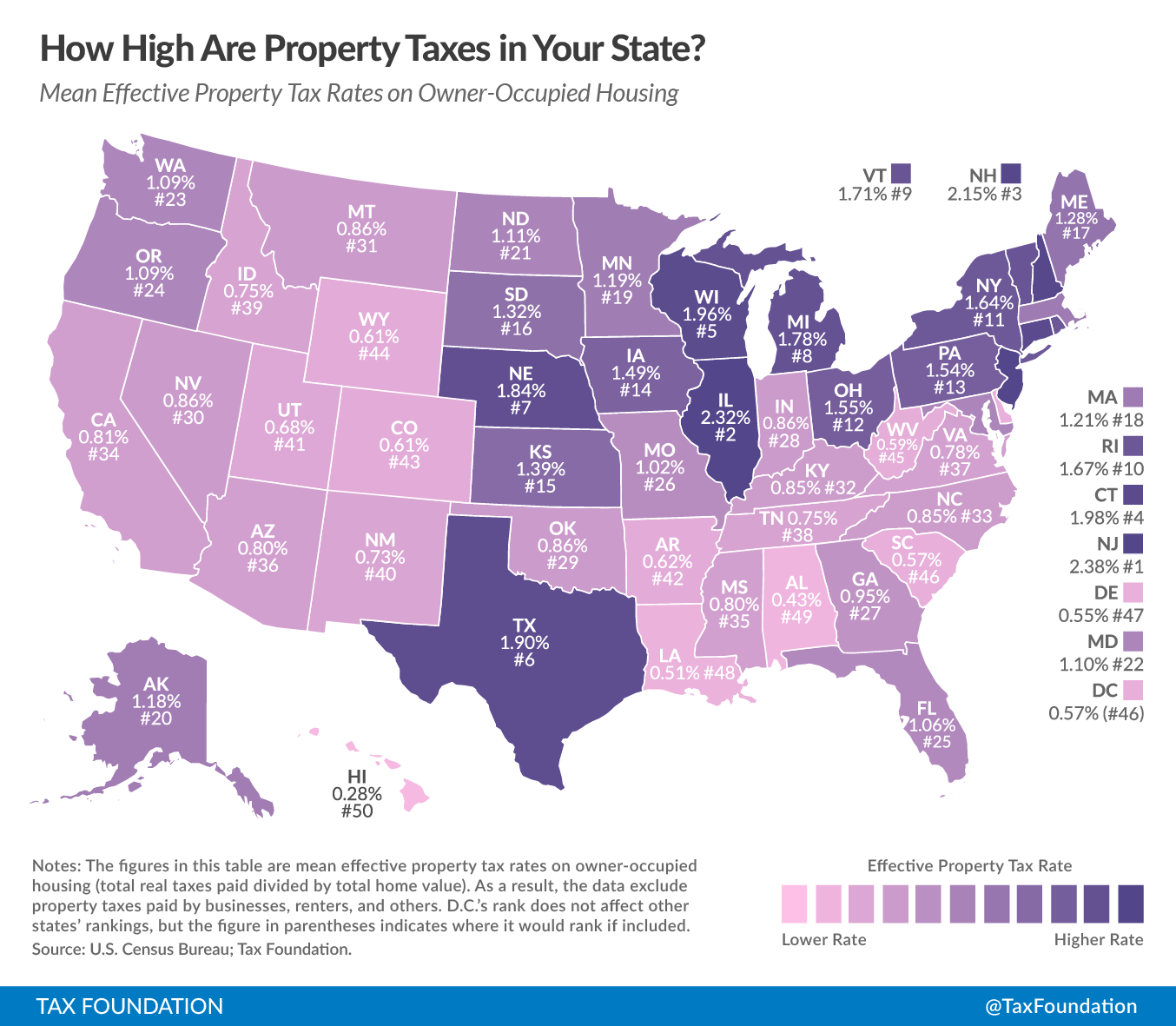

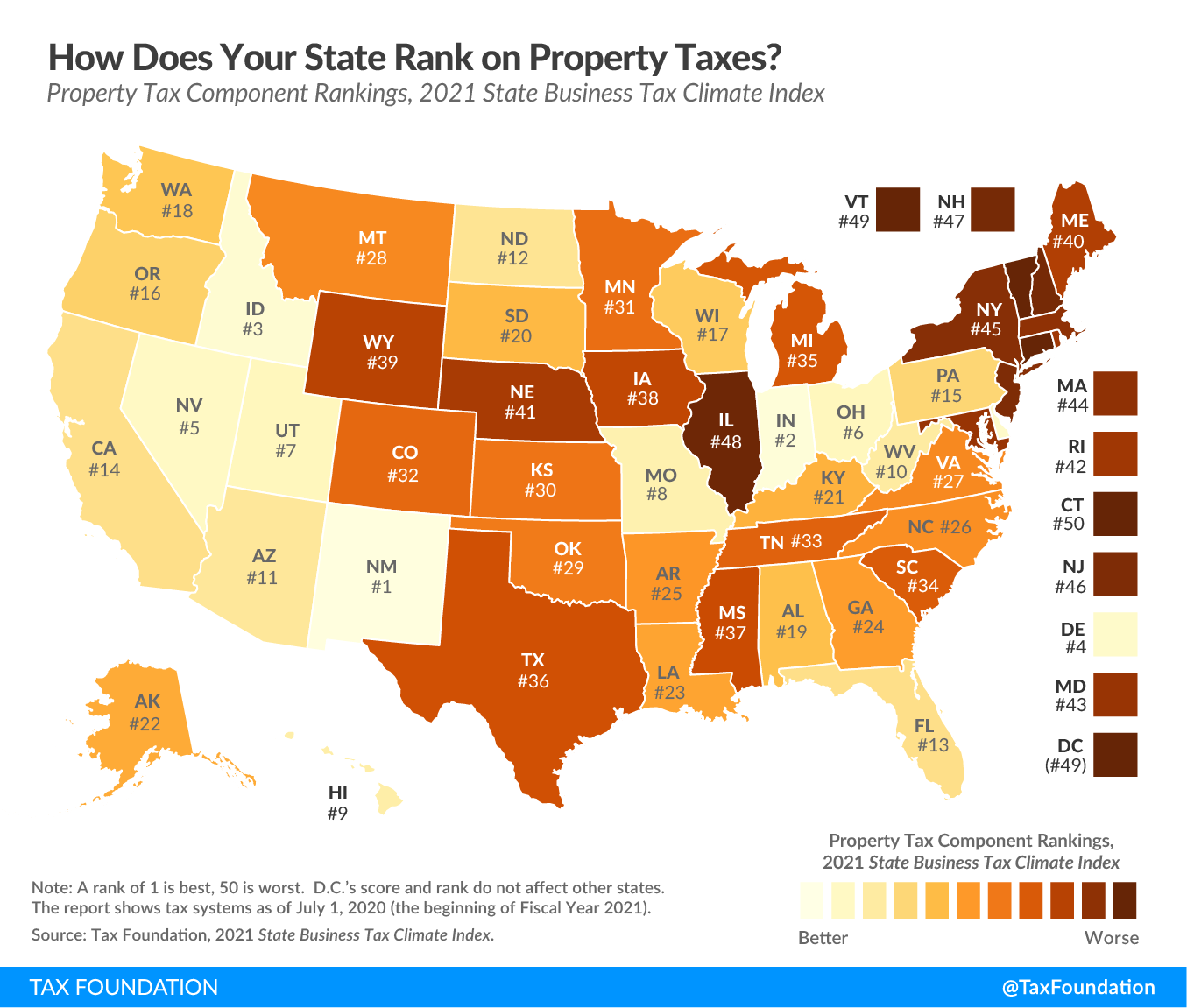

John Brown s Notes And Essays How High Are Property Taxes In Your

http://dailysignal.com/wp-content/uploads/property_taxes-01.png

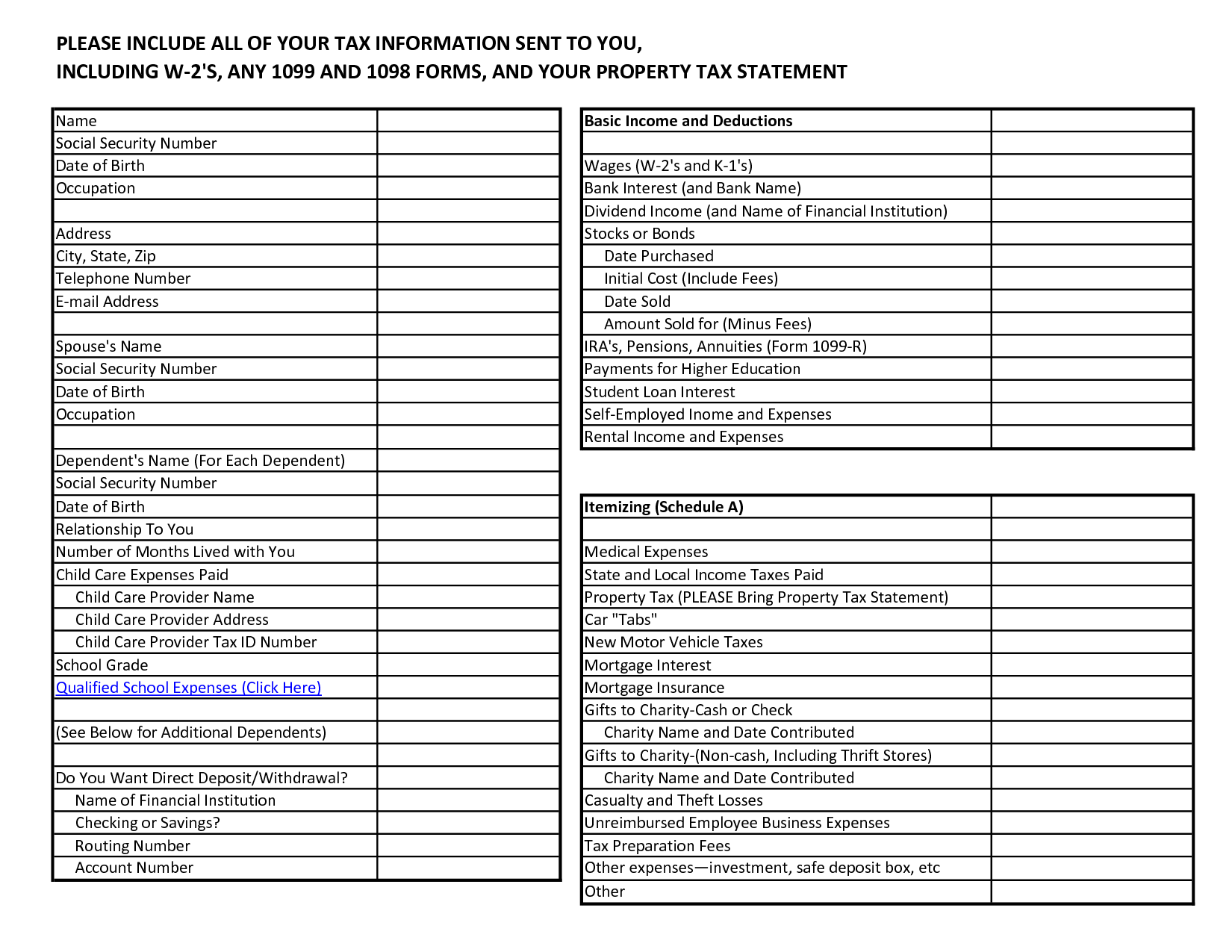

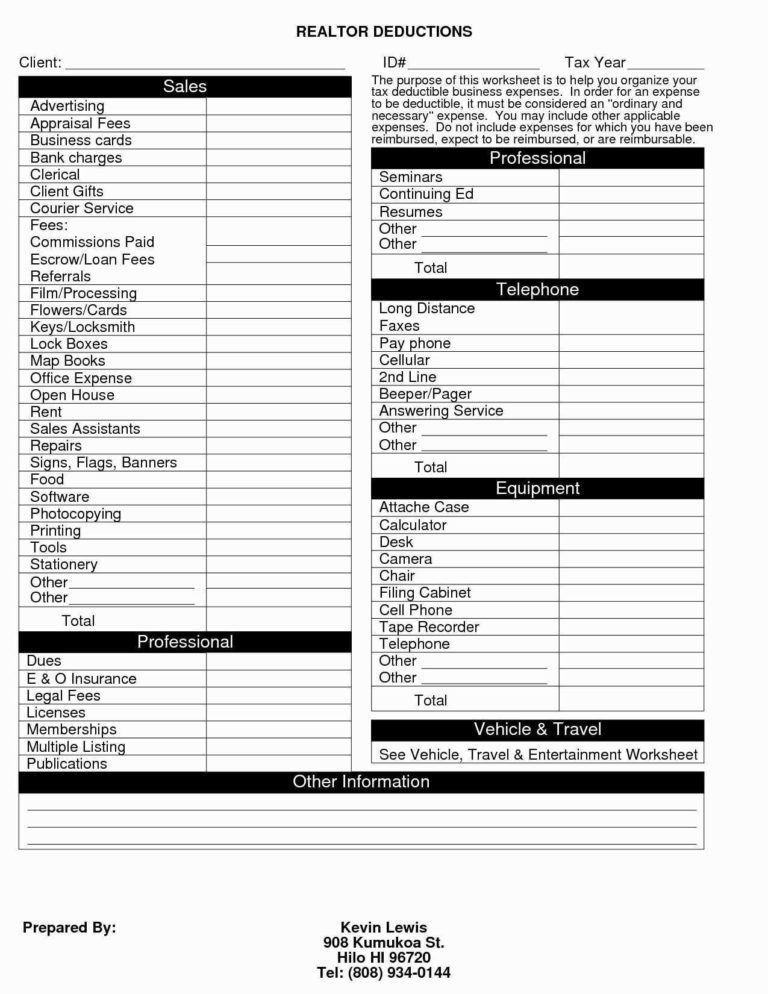

10 Home Based Business Tax Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/01/business-tax-deductions-worksheet_472298.png

The fiscal year 2023 property tax rebate is for homeowners whose New York City property is their primary residence and whose combined income is 250 000 or less Most The newly approved 212 billion state budget includes relief for qualifying homeowners in New York who pay among the highest tax levies in the country But not everyone will qualify for the relief as part of

If you own a home in New York you ll need to pay property taxes Learn how property tax exemptions tax rates and credits work in New York state The property tax deduction is great for homeowners Here s how it works in 2023 2024 and what you can do to save money

Download Ny State Property Tax Deduction

More picture related to Ny State Property Tax Deduction

Maryland State Income Tax Deductions

https://i.pinimg.com/originals/d1/cc/34/d1cc3440c2d9554d9b23652b32649ea1.jpg

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5.png

Property Taxes By State County Median Property Tax Bills

https://taxfoundation.org/wp-content/uploads/2022/09/Property-taxes-by-state-compare-state-property-tax-rankings.png

Key Takeaways If you itemize your deductions you can deduct the property taxes you pay on your main residence and any other real estate you own The total amount of deductible state and local State and Local Property Taxes You ve probably heard about this well known deduction property taxes The maximum amount of property taxes you can deduct from

These webinars provide a general overview of the Property Tax Cap for Local Governments and School Districts Presenters will discuss the Property Tax Cap Though all property is assessed not all of it is taxable See a list of common property tax exemptions in New York State

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

Lowest Property Tax by State Property Tax Estate Tax State Tax

https://i.pinimg.com/originals/31/5d/12/315d121c14c65a6adce36e7afcc72bb6.png

https://www.tax.ny.gov/pit/file/itemized-deductions-2022.htm

For New York purposes Form IT 196 lines 5 6 and 7 your state and local taxes paid in 2022 are not subject to the federal limit and you can deduct foreign taxes

https://www.lohud.com/story/news/202…

The new tax credit included in the state s 212 billion budget approved this week by the Legislature and Gov Andrew Cuomo will apply to eligible homeowners whose property tax bill

How 2017 Property Tax Deductions Work NJMoneyHelp

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Best Worst State Property Tax Codes Tax Foundation

Property Tax Deduction

Rethinking Texas Taxes Final Report Of The Select Committee On Tax

GOP Tax Reform The Property Tax Deduction Won t Be Scrapped CBS News

GOP Tax Reform The Property Tax Deduction Won t Be Scrapped CBS News

Upstate NY Has Some Of The Highest Property Tax Rates In The Nation

Rental Property Tax Deductions Worksheet

Self Employment Tax Deduction Worksheet

Ny State Property Tax Deduction - The property tax deduction is great for homeowners Here s how it works in 2023 2024 and what you can do to save money