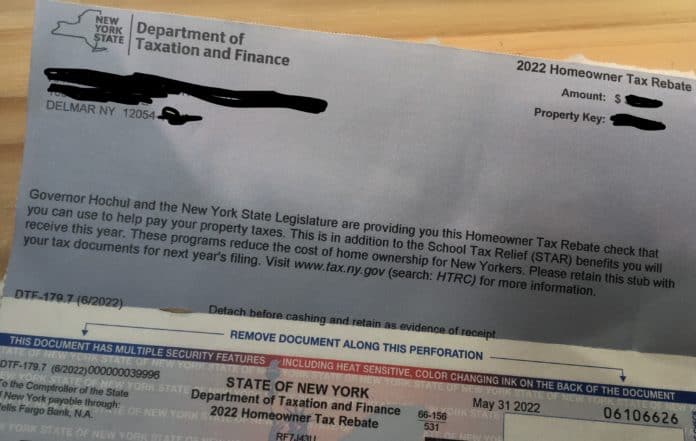

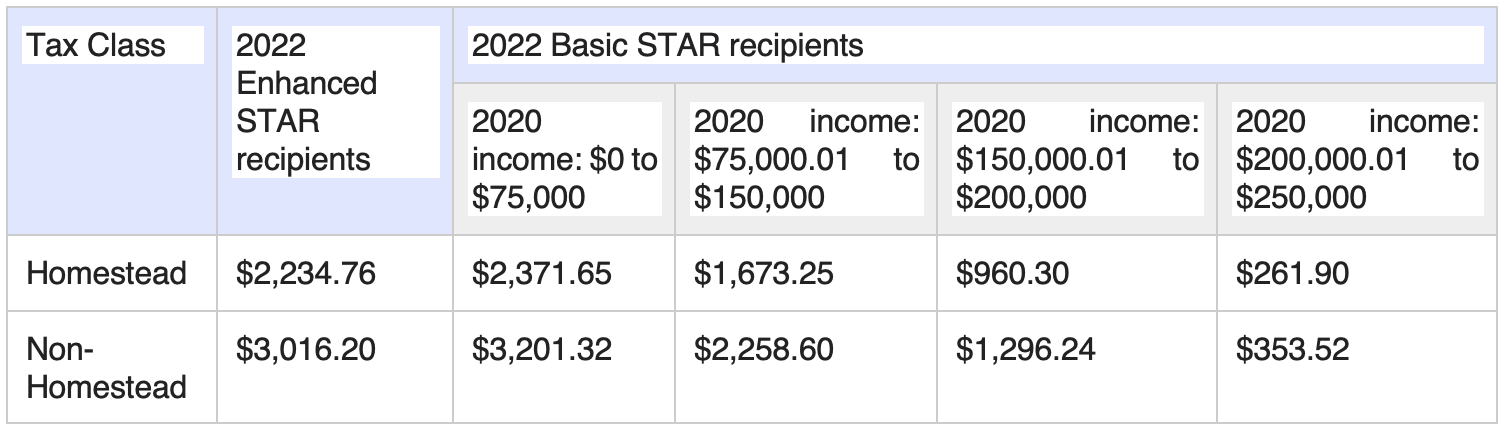

Nys Homeowner Tax Rebate Taxable Web 23 juin 2022 nbsp 0183 32 Eligibility for the Homeowner Tax Rebate Credit Qualified for a 2022 STAR credit or exemption Income less than or equal to 250 000 for the 2020 income tax year

Web 9 juin 2022 nbsp 0183 32 homeowner tax rebate credit HTRC If you itemize your deductions reduce your itemized deduction for real estate taxes paid by the total amount of any STAR credit Web We ve begun issuing homeowner tax rebate checks We recently began mailing nearly three million checks for the 2022 homeowner tax rebate credit HTRC to eligible New

Nys Homeowner Tax Rebate Taxable

Nys Homeowner Tax Rebate Taxable

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Nys-Property-Tax-Rebate-2023.jpg?resize=768%2C561&ssl=1

Nys Property Tax Rebate Checks 2023 Eligibility Application Process

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Nys-Property-Tax-Rebate-Checks-2023.jpg

Fun With Pre Paid Cards

https://townsquare.media/site/497/files/2022/06/attachment-RS28849_ThinkstockPhotos-623211702-scr.jpg

Web We ve mailed nearly two million homeowner tax rebate credit checks to eligible New York homeowners and many more are on their way Web 10 f 233 vr 2023 nbsp 0183 32 The tax rebate is a reduction in property tax which is not income The only way it would be taxable on your federal return is if you itemized your deductions and

Web 9 sept 2023 nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have Web 17 ao 251 t 2022 nbsp 0183 32 Homeowner tax rebate credit registration Homeowner tax rebate credit registration If you received a letter Form RP 5303 requesting that you register for the

Download Nys Homeowner Tax Rebate Taxable

More picture related to Nys Homeowner Tax Rebate Taxable

NYS Homeowner Tax Credit Talks Lyons Main Street

https://static.wixstatic.com/media/0e0fa1_815d22e1cacf4551823c50c8085bfdde~mv2.jpg/v1/fill/w_1545,h_1530,al_c,q_90/0e0fa1_815d22e1cacf4551823c50c8085bfdde~mv2.jpg

About 2 5 Million New Yorkers Are Eligible To Receive A Check

https://cnycentral.com/resources/media2/16x9/full/1900/center/80/bb776db9-9697-43c3-882f-8577bedc9e89-tax_rebate.PNG

NY Tax Rebate 2023 Everything You Need To Know Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/04/Nys-Tax-Rebate-2023.jpg

Web 9 avr 2022 nbsp 0183 32 Accelerates a 1 2 Billion Dollar Middle Class Tax Cut and Provides a Homeowner Tax Rebate Credit for Almost 2 5 Million New Yorkers Provides Up to 250 Web 1 mai 2023 nbsp 0183 32 May 1 2023 by tamble Nys Property Tax Rebate Checks 2023 If you re a homeowner in New York State you may be eligible for a property tax rebate check in 2023 This program is designed to provide

Web 14 mars 2023 nbsp 0183 32 For homeowners within New York City If you are a New York City homeowner see New York City t o find the amount of your HTRC check For Web 5 juil 2023 nbsp 0183 32 If you re looking for information about the 2022 homeowner tax rebate credit see homeowner tax rebate credit The property tax relief credit directly reduced your

Homeowner Tax Rebate 2023 Who s Eligible And How To Claim It Tax

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/2023-Homeowner-Tax-Rebate.jpg?resize=990%2C787&ssl=1

Money In Your Pocket Who Qualifies For Tax Cut Property Tax Rebate In

https://cbs6albany.com/resources/media2/16x9/full/1900/center/80/75ea137d-d90b-4e6c-9179-5003af955c7f-thumb_196074.png

https://www.localsyr.com/news/your-stories/your-stories-qa-will-i-be...

Web 23 juin 2022 nbsp 0183 32 Eligibility for the Homeowner Tax Rebate Credit Qualified for a 2022 STAR credit or exemption Income less than or equal to 250 000 for the 2020 income tax year

https://www.tax.ny.gov/pit/property/report_property_tax_credits.htm

Web 9 juin 2022 nbsp 0183 32 homeowner tax rebate credit HTRC If you itemize your deductions reduce your itemized deduction for real estate taxes paid by the total amount of any STAR credit

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul

Homeowner Tax Rebate 2023 Who s Eligible And How To Claim It Tax

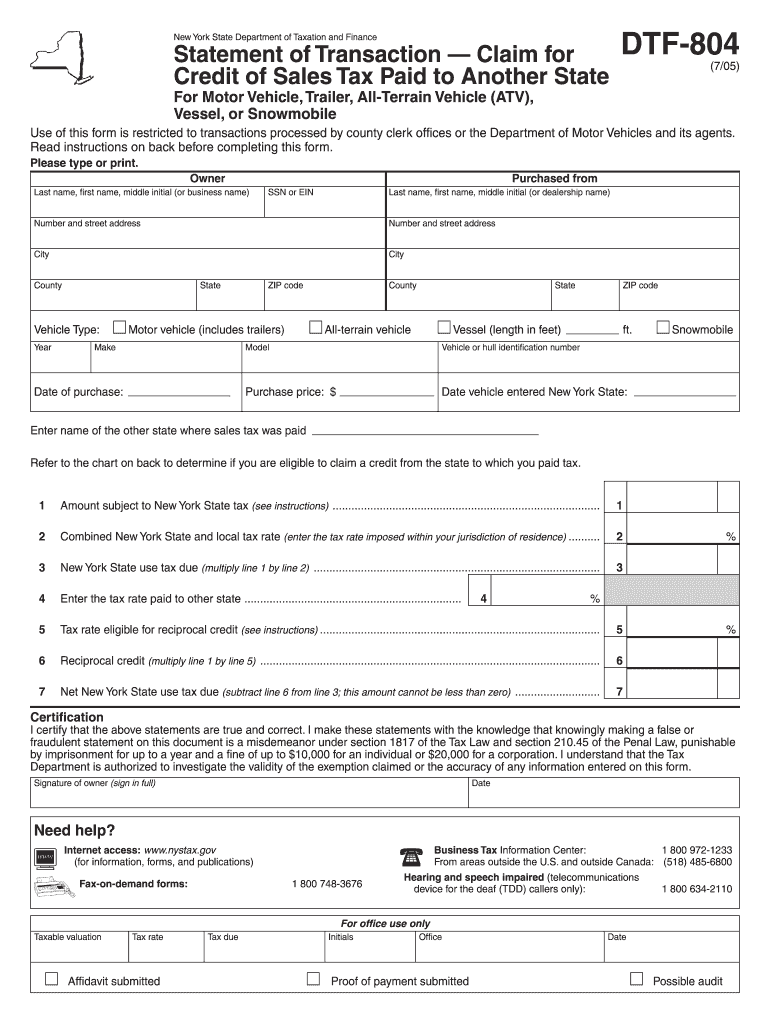

2020 Form NY DTF CT 3 S Fill Online Printable Fillable Blank PdfFiller

Nys Dmv Dtf 804 2005 Form Fill Out Sign Online DocHub

Nys Property Tax Rebate Check 2023 PropertyRebate

Ny Homeowner Tax Rebate 2023 Tax Rebate

Ny Homeowner Tax Rebate 2023 Tax Rebate

From Town Assessor State Sending Letter On New Homeowner Tax rebate

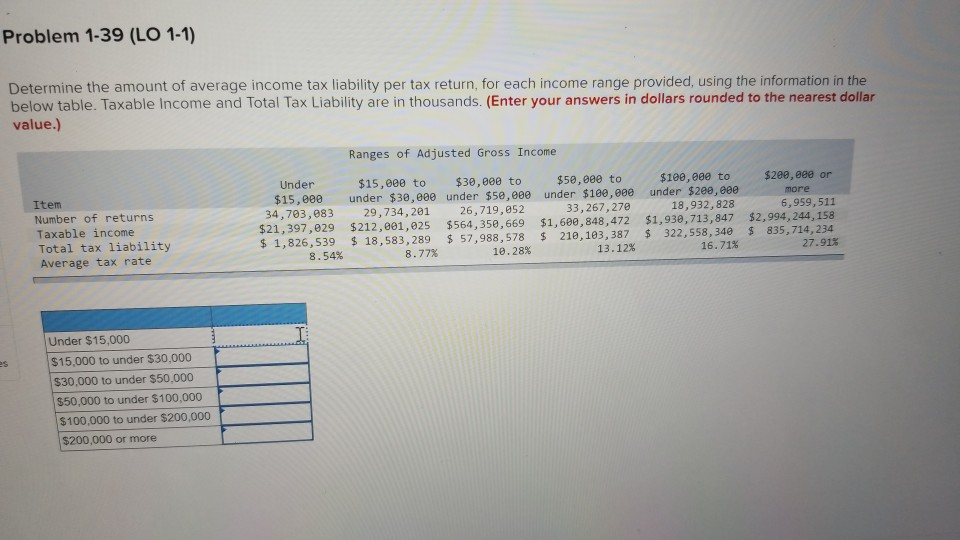

Solved Problem 1 39 LO 1 1 Determine The Amount Of Average Chegg

Nys Charges Tax On Car Rebates 2023 Carrebate

Nys Homeowner Tax Rebate Taxable - Web 17 ao 251 t 2022 nbsp 0183 32 Homeowner tax rebate credit registration Homeowner tax rebate credit registration If you received a letter Form RP 5303 requesting that you register for the