Payroll Tax Deductions Georgia This publication contains information regarding withholding tax filing requirements based on the tax law as of January 1 2021 It includes applicable withholding tax tables basic

This publication contains information regarding withholding tax filing requirements based on the tax law as of January 1 2024 It includes applicable withholding tax tables basic Georgia payroll taxes for 2024 With six different tax brackets payroll in Georgia is especially progressive meaning the more your employees make the more

Payroll Tax Deductions Georgia

Payroll Tax Deductions Georgia

https://resourcingedge.com/wp-content/uploads/2021/12/2022_-Employers_Tax_Guide.png

What Mortgage Refinance Costs Can You Deduct From Your Taxes Lendgo

https://d1h86g9h1jpeic.cloudfront.net/2021/03/LG-taxes.jpg

Tax Deductions Armstrong Economics

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-2048x1536.jpg

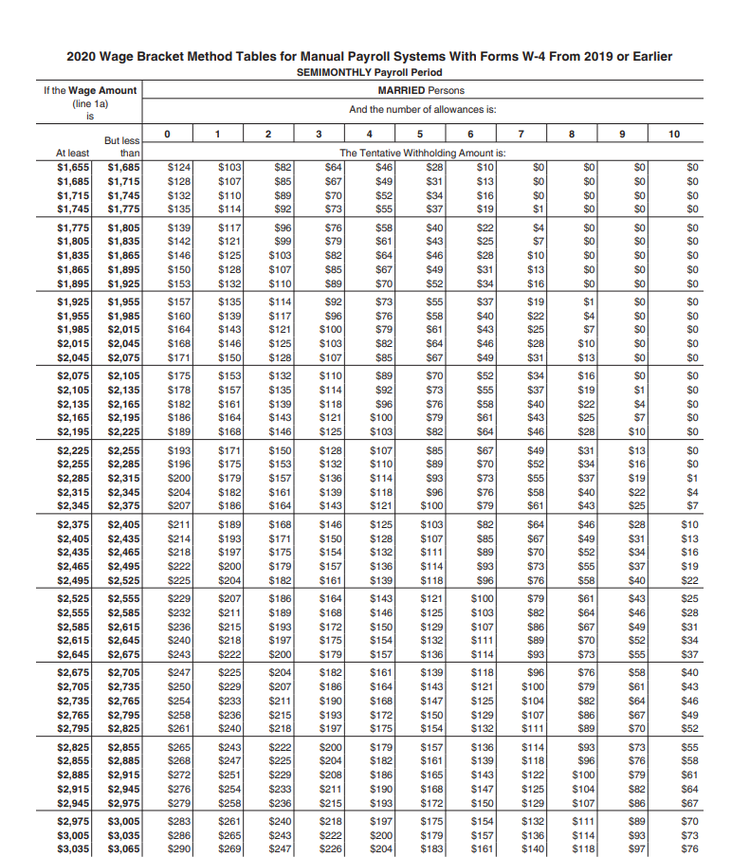

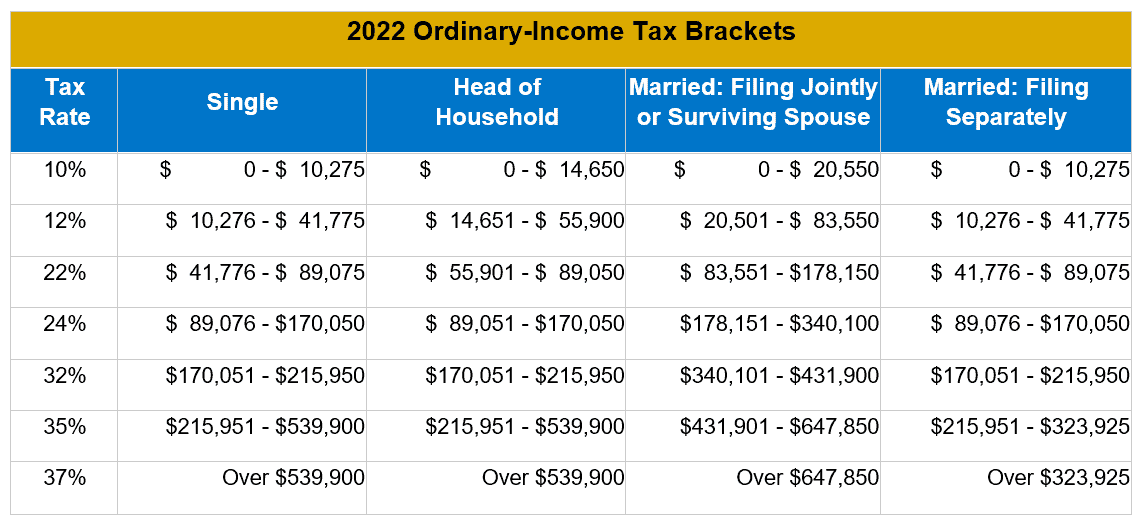

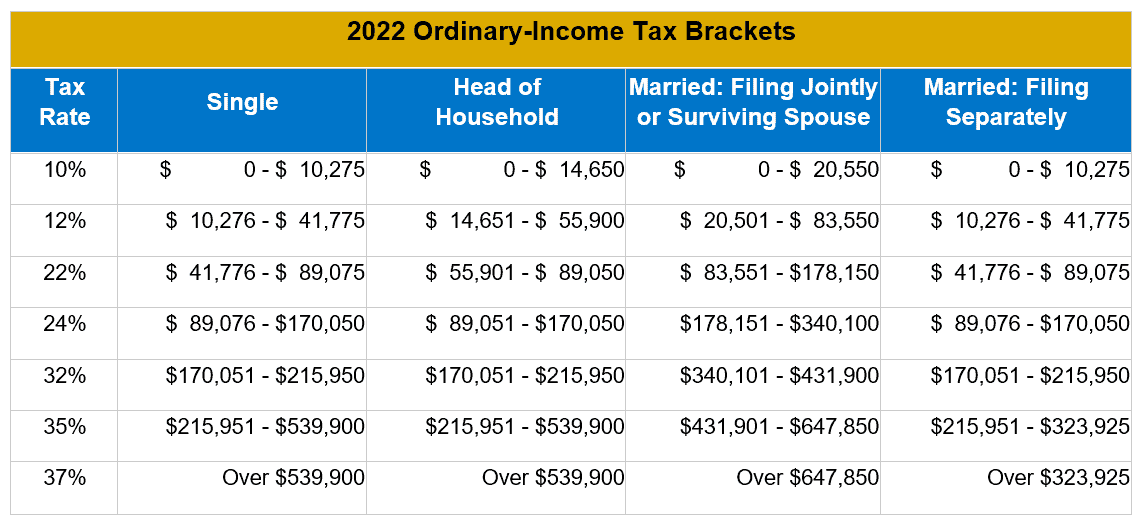

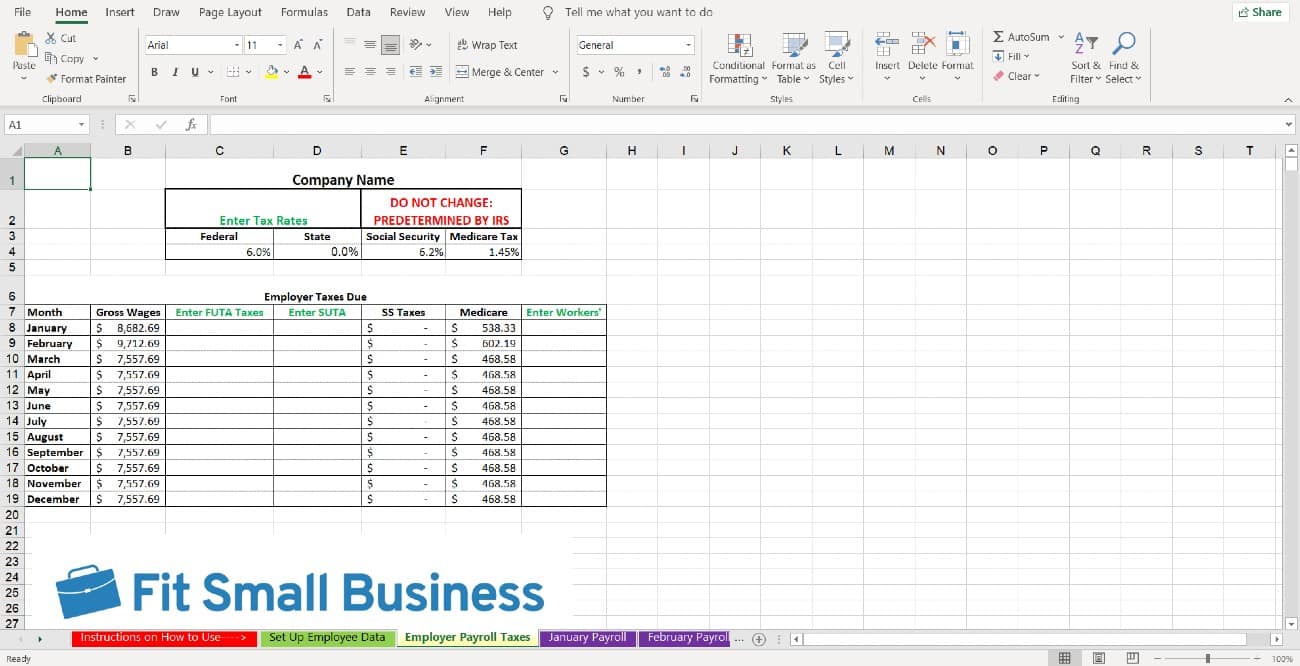

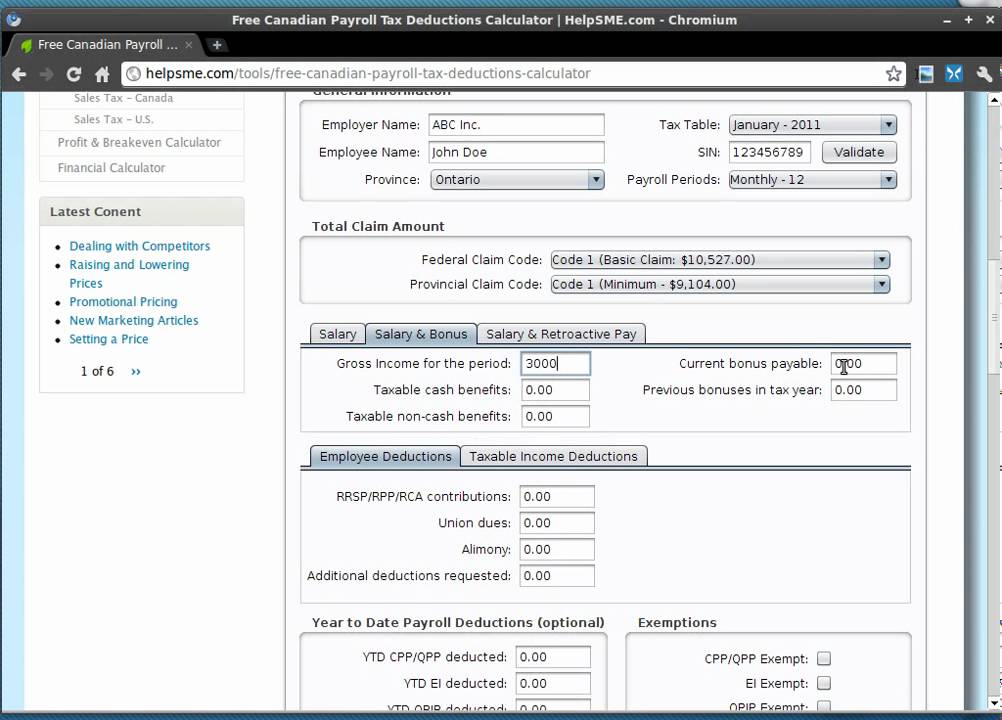

The next step in determining payroll taxes in Georgia is to calculate Federal income tax Federal taxes can range anywhere from 0 to 37 of taxable earnings so deduct Georgia Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax

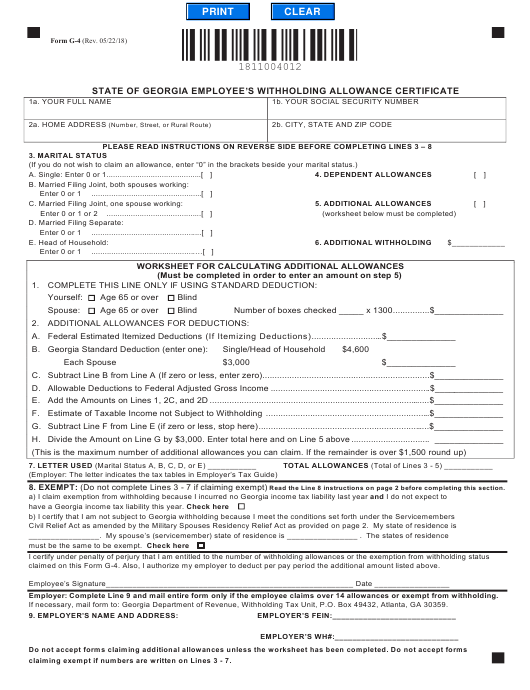

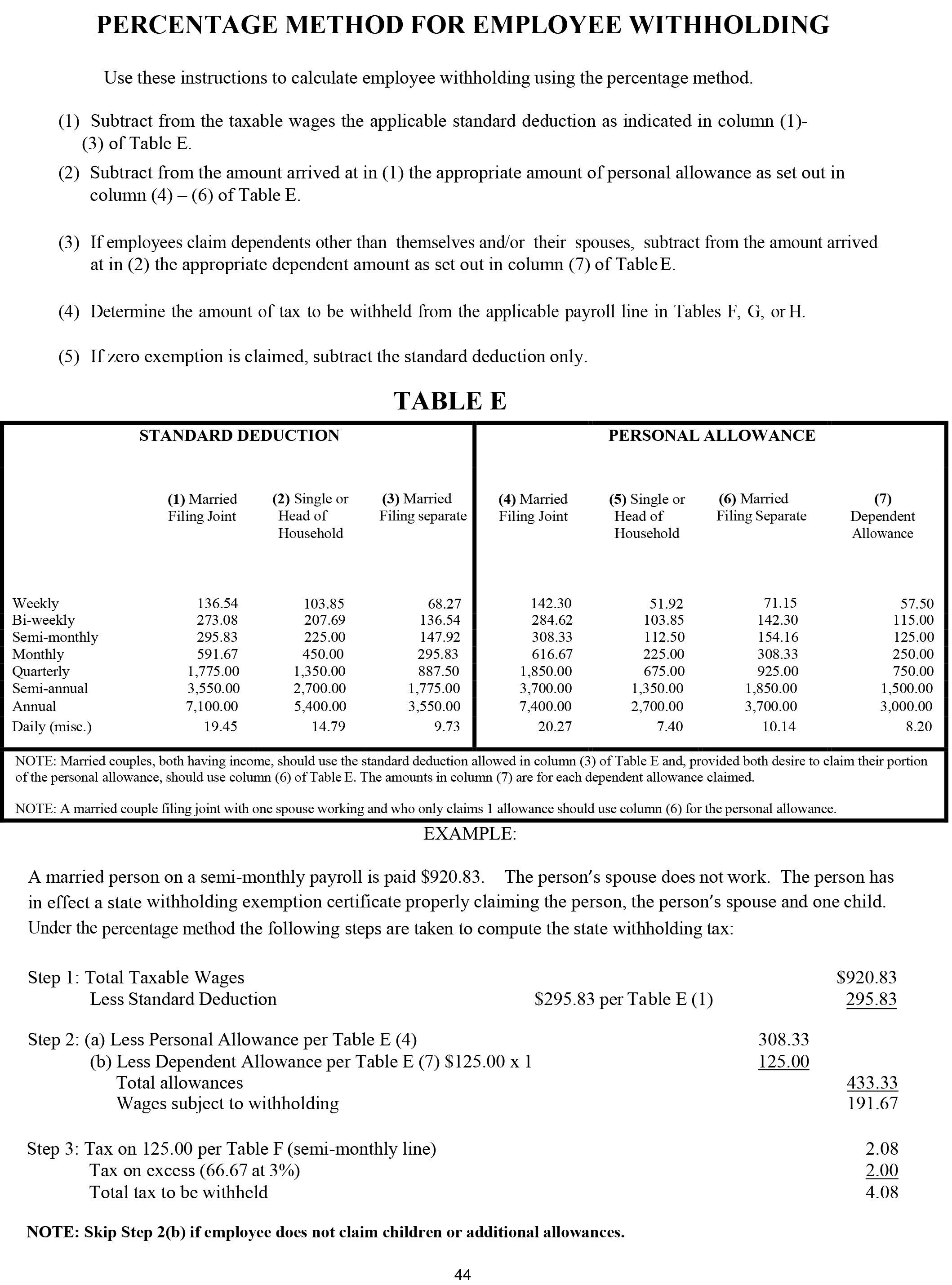

The annual standard deductions used in the guide s percentage method increased to 5 400 from 4 600 for single taxpayers and heads of household to Use the Georgia Paycheck Calculator to easily estimate your net income tax deductions and take home pay in Georgia The easy way to calculate your take home pay after tax

Download Payroll Tax Deductions Georgia

More picture related to Payroll Tax Deductions Georgia

Your 2017 Tax Preparation Checklist The Motley Fool

https://g.foolcdn.com/editorial/images/436027/tax-form_tax-deductions_gettyimages-515708887.jpg

Georgia State Employee Withholding Form 2023 Employeeform

https://www.employeeform.net/wp-content/uploads/2023/01/form-g-4-download-printable-pdf-state-of-georgia-employee-s.png

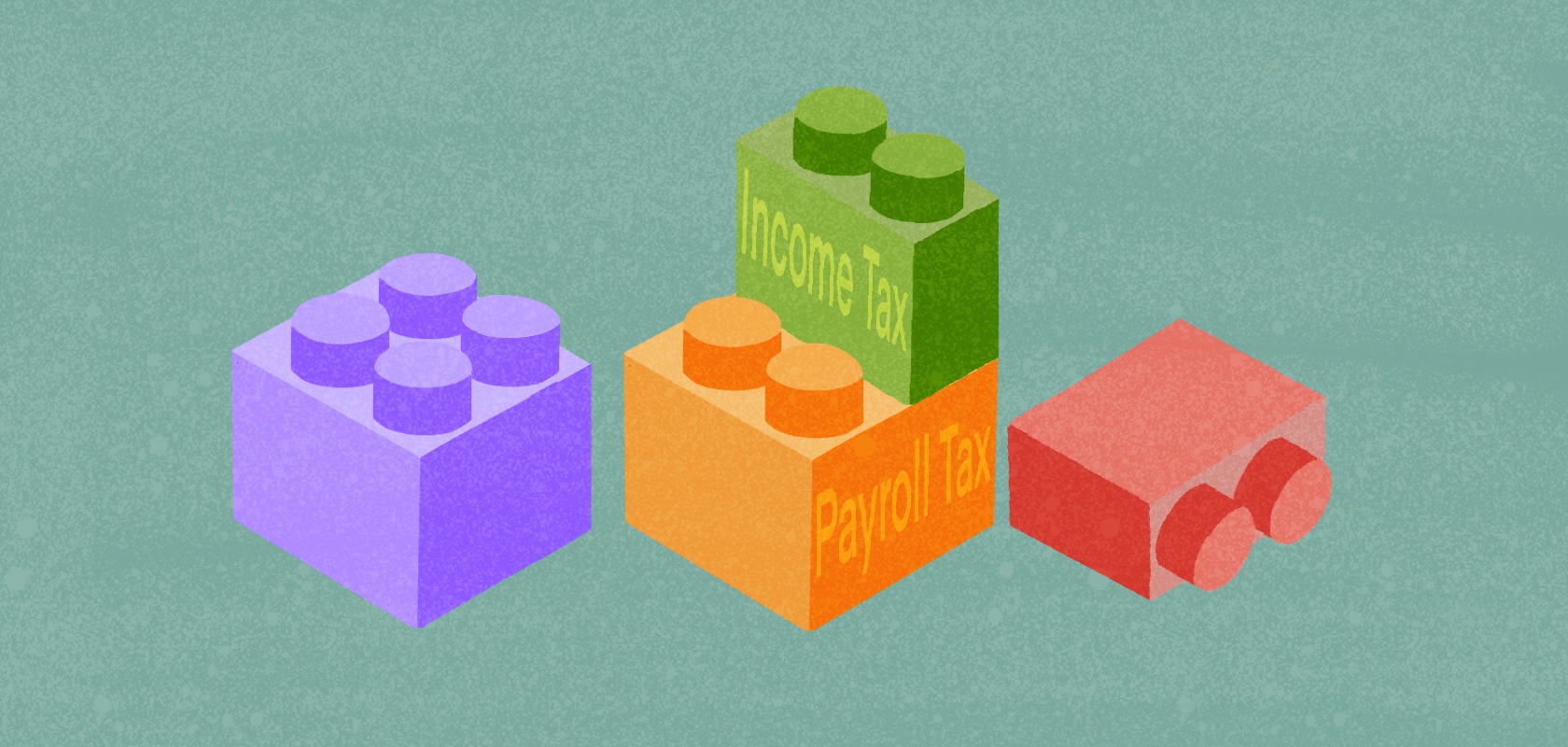

Payroll 101 America s Preferred Payroll

https://americaspreferredpayroll.com/wp-content/uploads/payroll-tax-deductions-federal-income-tax.jpg

Total payroll taxes 0 00 NaN Total pre tax deductions 0 00 NaN Total post tax deductions 0 00 NaN State income taxes are based on tax year Calculate your Georgia net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local W4 information into this free

Use ADP s Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other FICA and Employment Taxes The Federal Insurance Contributions Act FICA requires all employers to deduct federal taxes from every paycheck on their

Homeowner Tax Deductions Georgia United Credit Union

https://gucu.org/images/default-source/social-media---rectangle-images/blog-social-media/blog_lifeafterwork-v5---1200x6278d863f03-2f47-4984-bb28-9f5aa3250a2e.jpg?sfvrsn=8a328f1f_5

Tabelas Anuais De Irs 2023 Withholding Certificate 8288 Instructions

https://m.foolcdn.com/media/affiliates/images/PayrollTaxes-01-IRSWithholdingTable_7CWWk0h.width-750.png

https://dor.georgia.gov/document/document/2023...

This publication contains information regarding withholding tax filing requirements based on the tax law as of January 1 2021 It includes applicable withholding tax tables basic

https://dor.georgia.gov/document/document/2024...

This publication contains information regarding withholding tax filing requirements based on the tax law as of January 1 2024 It includes applicable withholding tax tables basic

5 Benefits Of Payroll Services Payroll Cpa Accounting Accounting

Homeowner Tax Deductions Georgia United Credit Union

Payroll Tax Vs Income Tax Wagepoint

Weekly Payroll Deduction Chart

Health Insurance Payroll Deduction Calculator RoslynRhian

2022 Cost of Living Adjustments Tax Planning CPA Atlanta GA

2022 Cost of Living Adjustments Tax Planning CPA Atlanta GA

Taxes On Paycheck In Georgia JaskaranJim

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

Easy Tax Payroll Calculator AidynnWeston

Payroll Tax Deductions Georgia - Use the Georgia Paycheck Calculator to easily estimate your net income tax deductions and take home pay in Georgia The easy way to calculate your take home pay after tax