Pennsylvania Property Transfer Tax Exemptions Web Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted for improvements to property transferred by deed

Web 1867 and The Realty Transfer Tax Act 72 P S 167 167 3283 3292 unless otherwise noted Source The provisions of this Chapter 91 adopted May 10 1967 amended through Web 17 Feb 2023 nbsp 0183 32 In Pennsylvania there are a few different kinds of real estate transactions that are exempt from transfer taxes Certain sales made to or by government

Pennsylvania Property Transfer Tax Exemptions

Pennsylvania Property Transfer Tax Exemptions

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/form-rev-1220-pennsylvania-exemption-certificate-printable-pdf-download-1.png?w=950&ssl=1

Family Property Tax Transfer Exemptions Key Criteria

https://www.leowilkrealestate.com/wp-content/uploads/2020/02/Blog-Cover-Template.png

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Web Many conservation related property transactions are excluded from having to pay state and local realty transfer taxes in Pennsylvania Realty Transfer Tax Exclusions for Web 9 Dez 2022 nbsp 0183 32 The Pennsylvania Department of Revenue Department issued Realty Transfer Tax Bulletin 2022 01 on December 5 2022 The Bulletin addresses issues of tax payment and refund procedures for

Web A document that evidences the transfer of real estate pursuant to the statutory consolidation or merger of two or more corporations 15 Pa C S 167 1921 1932 or 15 Pa Web 15 Dez 2007 nbsp 0183 32 The Department of Revenue Department under authority contained in section 1107 C of the Tax Reform Code of 1971 TRC 72 P S 167 8107 C amends

Download Pennsylvania Property Transfer Tax Exemptions

More picture related to Pennsylvania Property Transfer Tax Exemptions

Pennsylvania Deed Transfer Tax 2022 Rates By County

https://cosmic-s3.imgix.net/51ba1a10-2547-11ed-b52d-a3f33977cd87-pa-transfer-taxes.png?auto=format

2023 Tax Exemption Form Pennsylvania ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/pa-exemption-certificate-fill-out-and-sign-printable-pdf-template-4.png

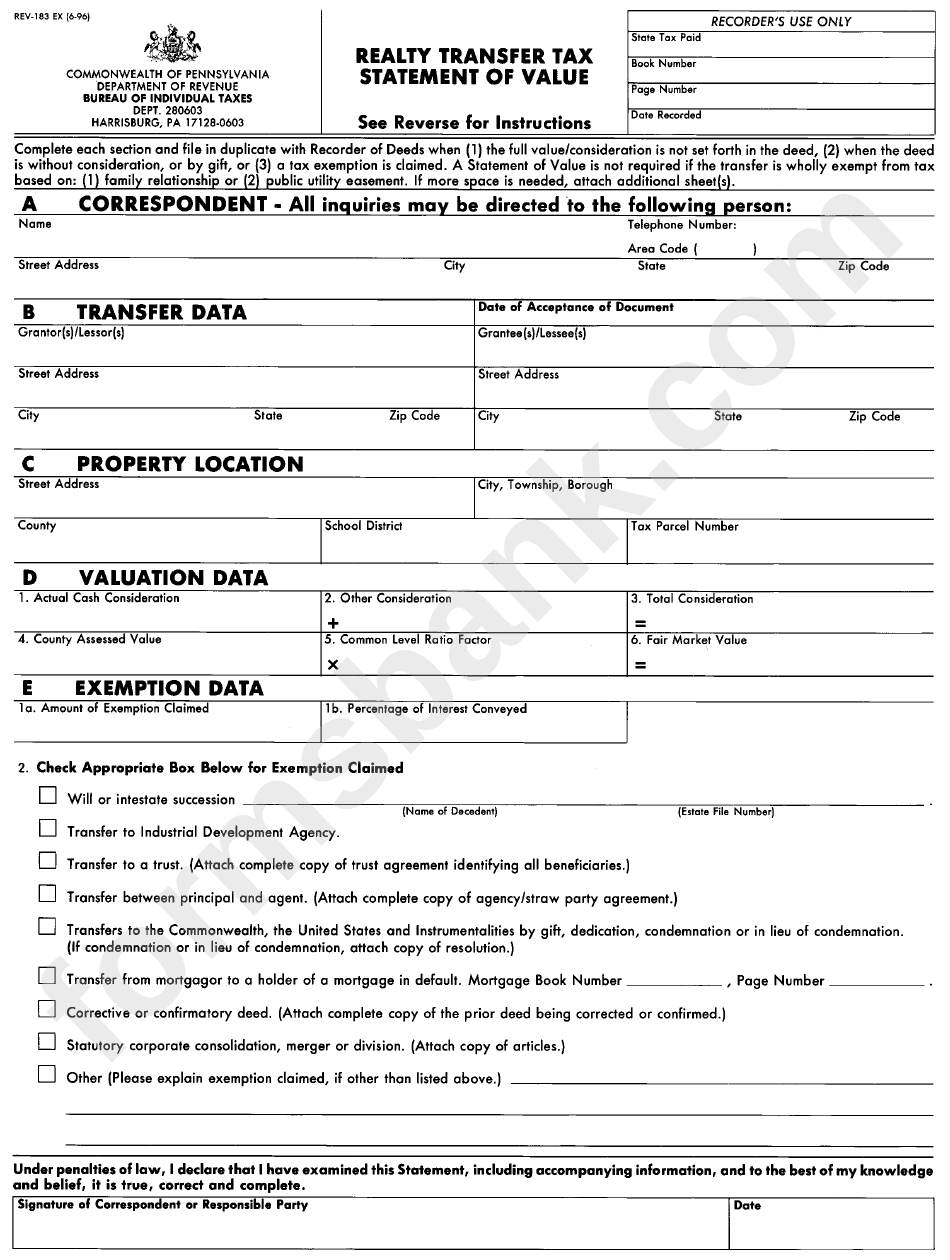

Fillable Realty Transfer Tax Statement Of Value Commonwealth Of

https://data.formsbank.com/pdf_docs_html/272/2723/272364/page_1_bg.png

Web 3 Feb 2003 nbsp 0183 32 See Title 61 PA Code Section 91 154 However a transfer of real estate from a family member to a family farm corporation or family farm partnership including a Web 11 Nov 2014 nbsp 0183 32 With respect to realty transfer tax Act 52 made three significant changes Pennsylvania imposes realty transfer tax not only on transfers of fee title to real estate but also upon transfers of 90 percent

Web 11 Apr 2023 nbsp 0183 32 Effective October 1 2018 the transfer tax for the city of Philadelphia is 3 278 with an additional state of Pennsylvania tax of 1 for a total of 4 278 This Web 1 Juli 2023 nbsp 0183 32 Some transactions are exempt from Transfer Tax Some examples would be conveyances between husband and wife parents and child grandparent and grandchild

What Do I Need To Know About Property Transfer Tax Silver Law

https://silverlaw.ca/wp-content/uploads/2016/08/iStock-917901028-1200x800.jpg

Where Are The Highest Property Tax Rates In Central Pa Pennlive

https://www.pennlive.com/resizer/hKgz5lh7BTlLhX1vsC1qs9nkbDs=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.pennlive.com/home/penn-media/width2048/img/news/photo/2016/02/11/share-2png-4b48efd2d4148190.png

https://www.revenue.pa.gov/TaxTypes/RTT

Web Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted for improvements to property transferred by deed

https://www.revenue.pa.gov/TaxTypes/RTT/Documents/reven…

Web 1867 and The Realty Transfer Tax Act 72 P S 167 167 3283 3292 unless otherwise noted Source The provisions of this Chapter 91 adopted May 10 1967 amended through

What Is A Homestead Exemption And How Does It Work LendingTree

What Do I Need To Know About Property Transfer Tax Silver Law

What Are Transfer Taxes

New Change To Pennsylvania Inheritance Tax Law Takes Effect

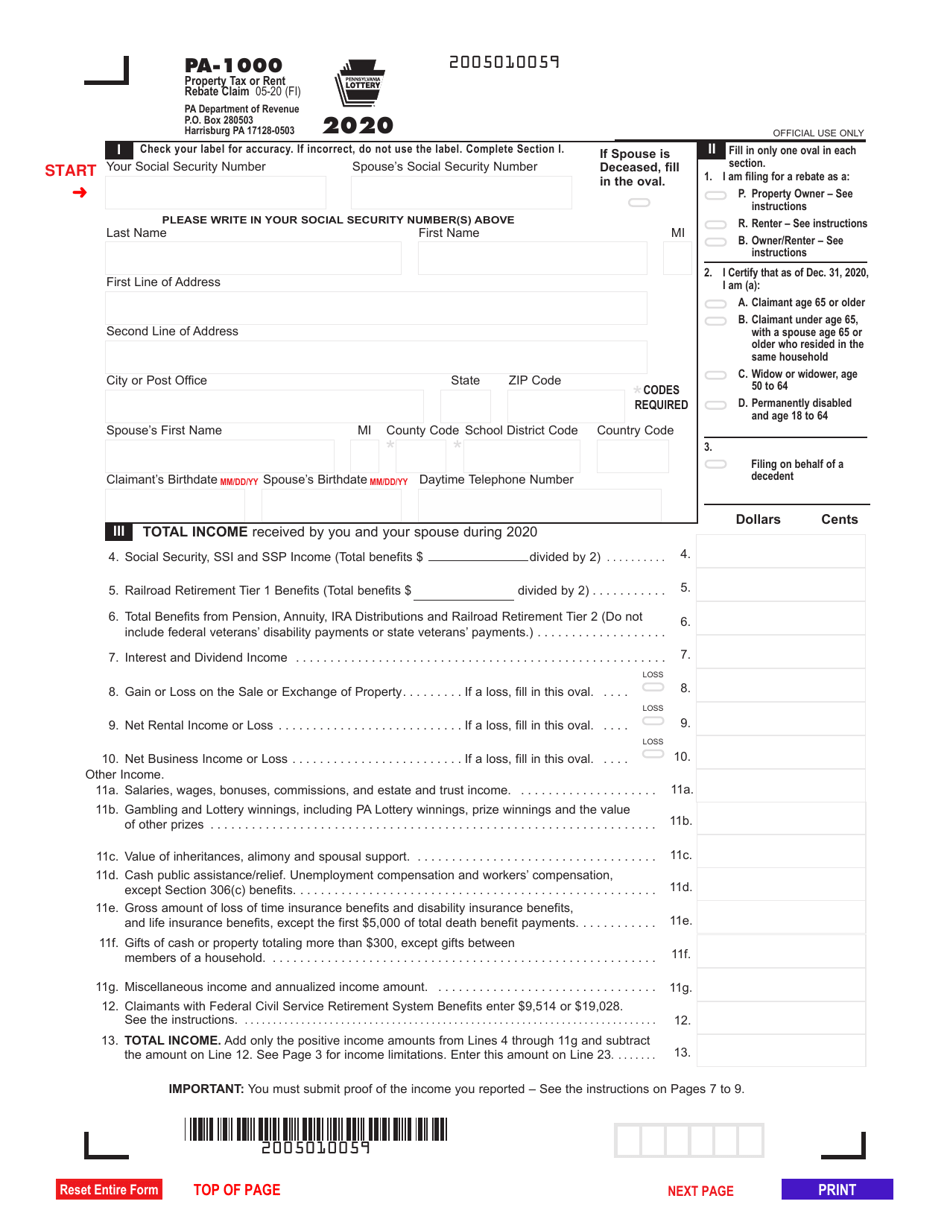

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Property Tax Exemptions Do You Qualify

Can You Take A Home Loan And Also Claim LTCG Tax Exemption

Mismanaged Idle SSS Assets Justifies Tax Exemption Says BMP The

Pennsylvania Property Transfer Tax Exemptions - Web A document that evidences the transfer of real estate pursuant to the statutory consolidation or merger of two or more corporations 15 Pa C S 167 1921 1932 or 15 Pa