Property Tax Exemption Colorado The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses For those who qualify 50 of the first 200 000

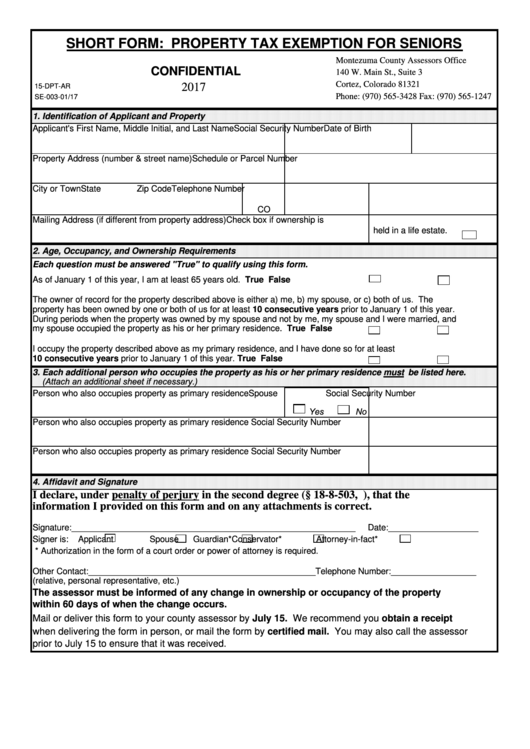

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified The three basic requirements are 1 the Application for Property Tax Exemption Late Filing Fee Waiver Request Remedies for Recipients of Notice of Forfeiture of Right to Claim Exemption Charitable Residential

Property Tax Exemption Colorado

Property Tax Exemption Colorado

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-short-form-property-tax-exemption-for-seniors-2017-3.png

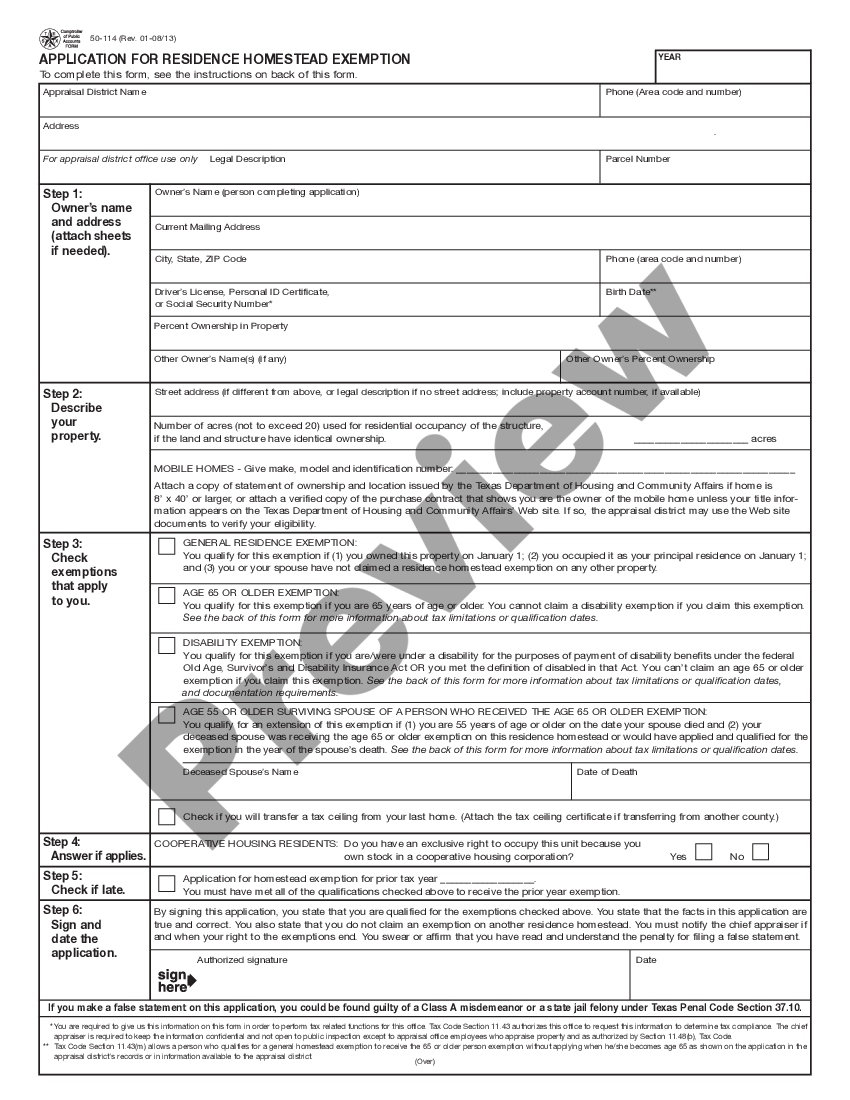

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

https://cdn.uslegal.com/uslegal-preview/TX/TX-HM-001/1.png

Sample Letter Exemption Doc Template PdfFiller

https://www.pdffiller.com/preview/497/332/497332572/large.png

The Colorado Senior Property Tax Exemption also known as the Homestead Exemption is a program to to permanently exempt seniors who have lived in their homes for at least The Colorado General Assembly has reinstated funding for the Senior Property Tax Exemption a k a Senior Homestead Exemption for tax year 2024 payable in 2025 The Deadline to apply for tax year 2024

Concerning the expansion of existing property tax exemptions for certain owner occupied primary residences for the 2023 property tax year For those who qualify 50 percent of the first 200 000 in actual value of the primary residence is exempted from property tax Once an exemption application is filed and

Download Property Tax Exemption Colorado

More picture related to Property Tax Exemption Colorado

Homestead Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/0/224/224079/large.png

Illinois Tax Exemption Form

https://i.pinimg.com/originals/7f/29/2c/7f292c4490b0b5a2bc05515ef3fb9ce0.jpg

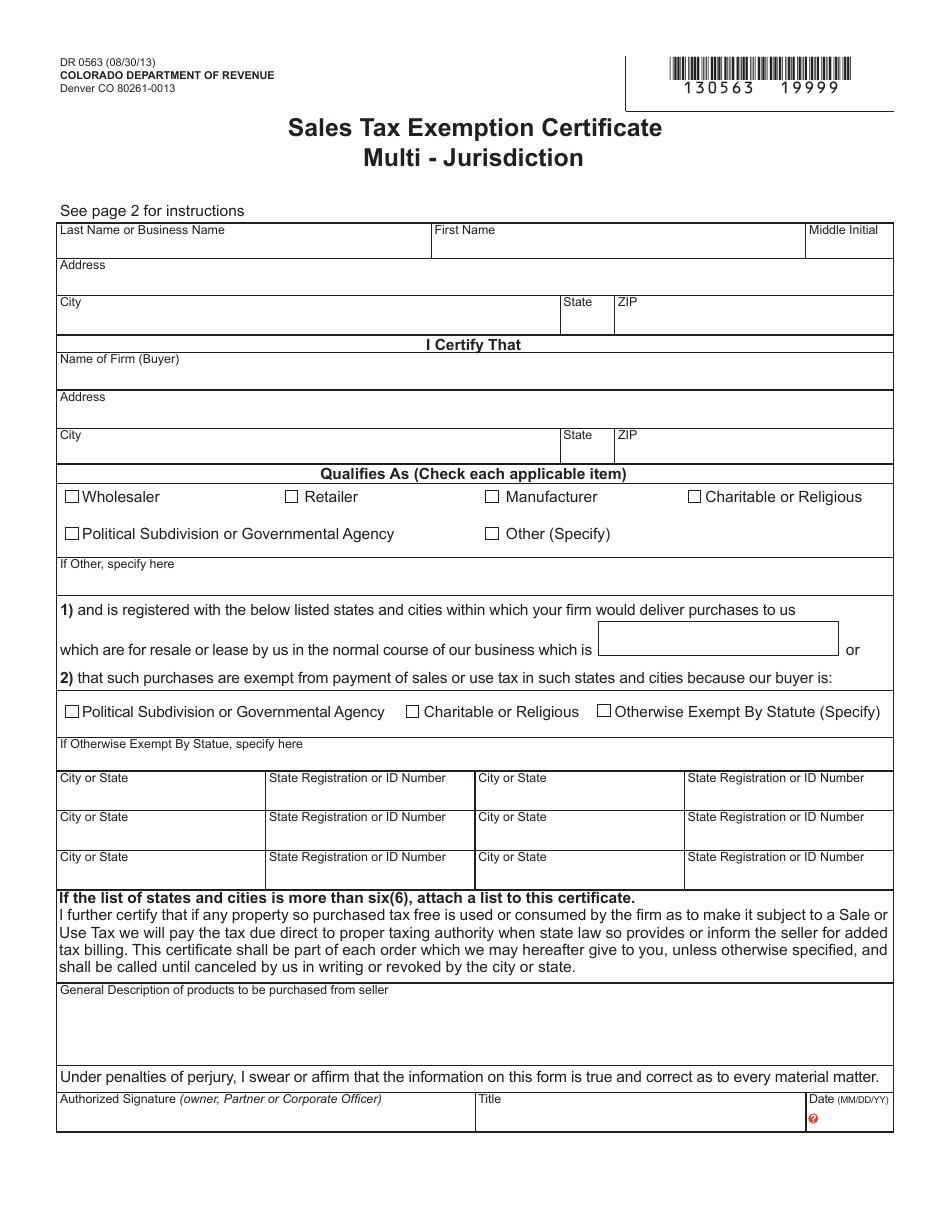

Form DR0563 Fill Out Sign Online And Download Fillable PDF Colorado

https://data.templateroller.com/pdf_docs_html/1734/17348/1734812/form-dr-0563-sales-tax-exemption-certificate-multi-jurisdiction-colorado_print_big.png

The Colorado Constitution establishes a property tax exemption for qualifying senior citizens surviving spouses of senior citizens who previously qualified and for Disabled The Colorado General Assembly has reinstated funding for the Senior Property Tax Exemption a k a Senior Homestead Exemption for tax year 2021 payable in 2022 The

Property Tax Exemptions for Senior Citizens in Colorado Click here for a brochure explaining eligibility requirements and filing deadlines for property tax exemptions for For the 2026 tax year the residential assessment rate for local governments would be set at 6 95 Homeowners would also receive a 10 exemption from

ALL COLORADO TOTALLY DISABLED VETS NEED THE DISABLED VETERAN PROPERTY

https://3.bp.blogspot.com/-4vaHfAzguK4/VulzYVK_SRI/AAAAAAAARcU/3ipspJy8UYQswkyr4J8WAyLT-hpRsSPfw/s1600/fix-it.jpg

Colorado Resale Certificate Dresses Images 2022

https://rossum.ai/use-cases/img/illust/documents/sales_tax_exemption_certificate.png

https://dpt.colorado.gov/property-tax-exemption...

The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses For those who qualify 50 of the first 200 000

https://agingstrategy.colorado.gov/sites...

A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified The three basic requirements are 1 the

2017 PAFPI Certificate of TAX Exemption Certificate Of

ALL COLORADO TOTALLY DISABLED VETS NEED THE DISABLED VETERAN PROPERTY

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Inequities In Colorado s Senior Homestead Property Tax Exemption

ALL COLORADO TOTALLY DISABLED VETS NEED THE DISABLED VETERAN PROPERTY

Exemption With Progression Irwin Law

Exemption With Progression Irwin Law

Harris County Homestead Exemption Form ExemptForm

Circuit Breaker Tax Exemption Archives California Property Tax

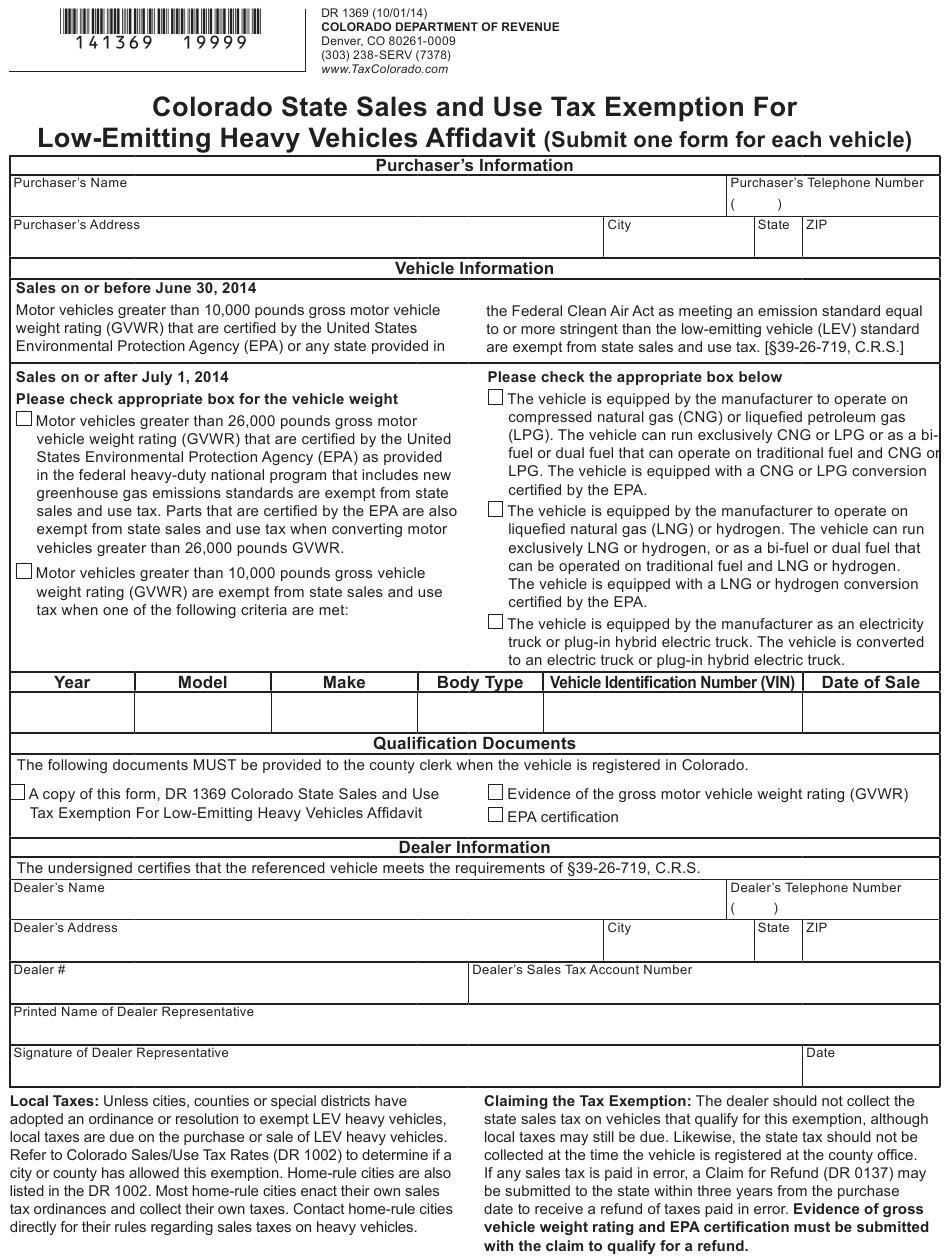

Colorado Sales And Use Tax Exemption Form ExemptForm

Property Tax Exemption Colorado - For those who qualify 50 percent of the first 200 000 in actual value of the primary residence is exempted from property tax Once an exemption application is filed and