Senior Property Tax Exemption Colorado Web A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified The three basic requirements are 1 the

Web A property tax exemption is available to senior citizens and the surviving spouses of seniors who previously qualified When the State of Colorado s budget allows 50 Web CLIMBER Oversight Board Meeting Colorado Secure Savings Board Meeting Property Tax Deferral Program 2 Tax Amounts are required to complete the property tax deferral

Senior Property Tax Exemption Colorado

Senior Property Tax Exemption Colorado

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/how-to-apply-for-senior-property-tax-exemption-in-california-prorfety.jpg?fit=1080%2C1349&ssl=1

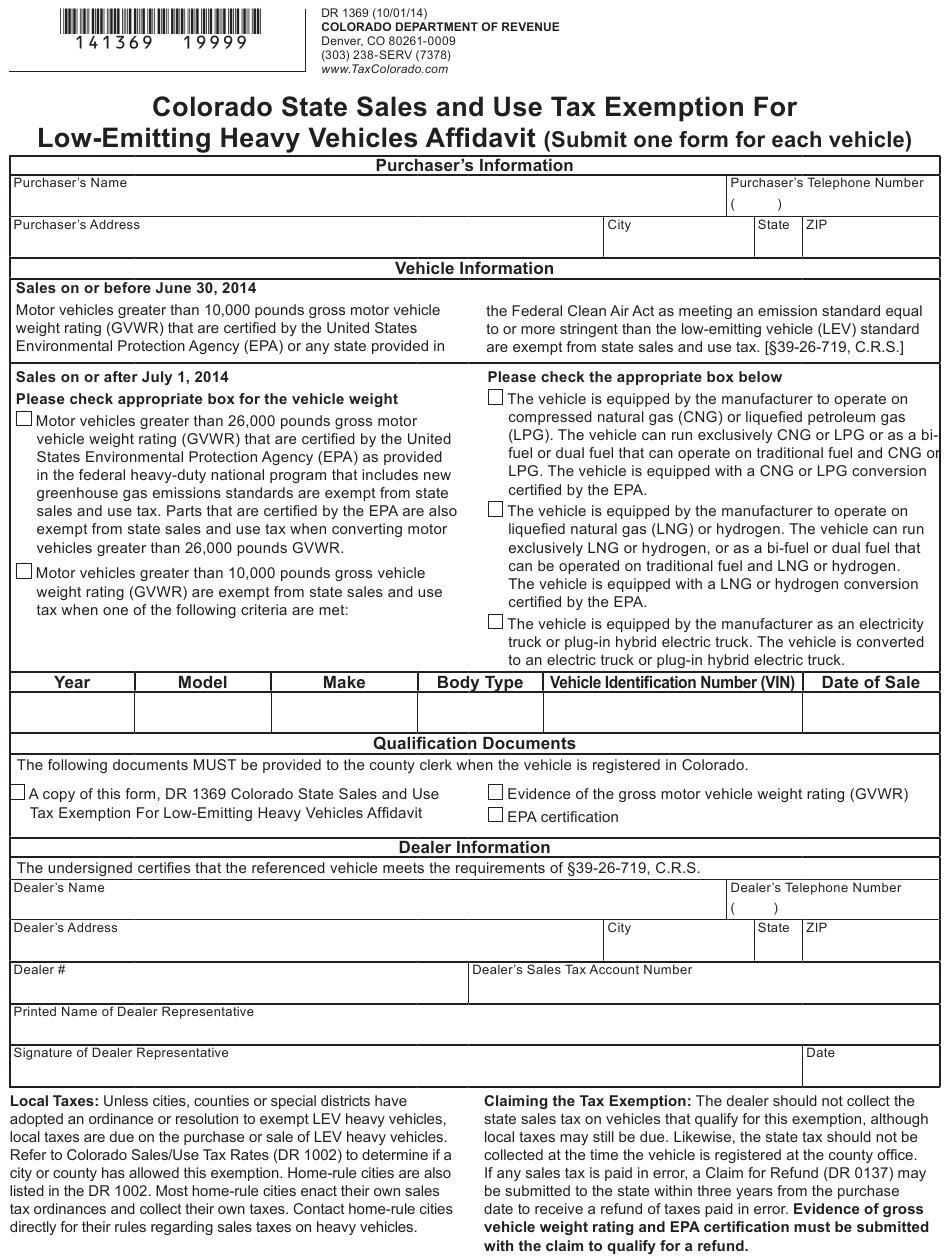

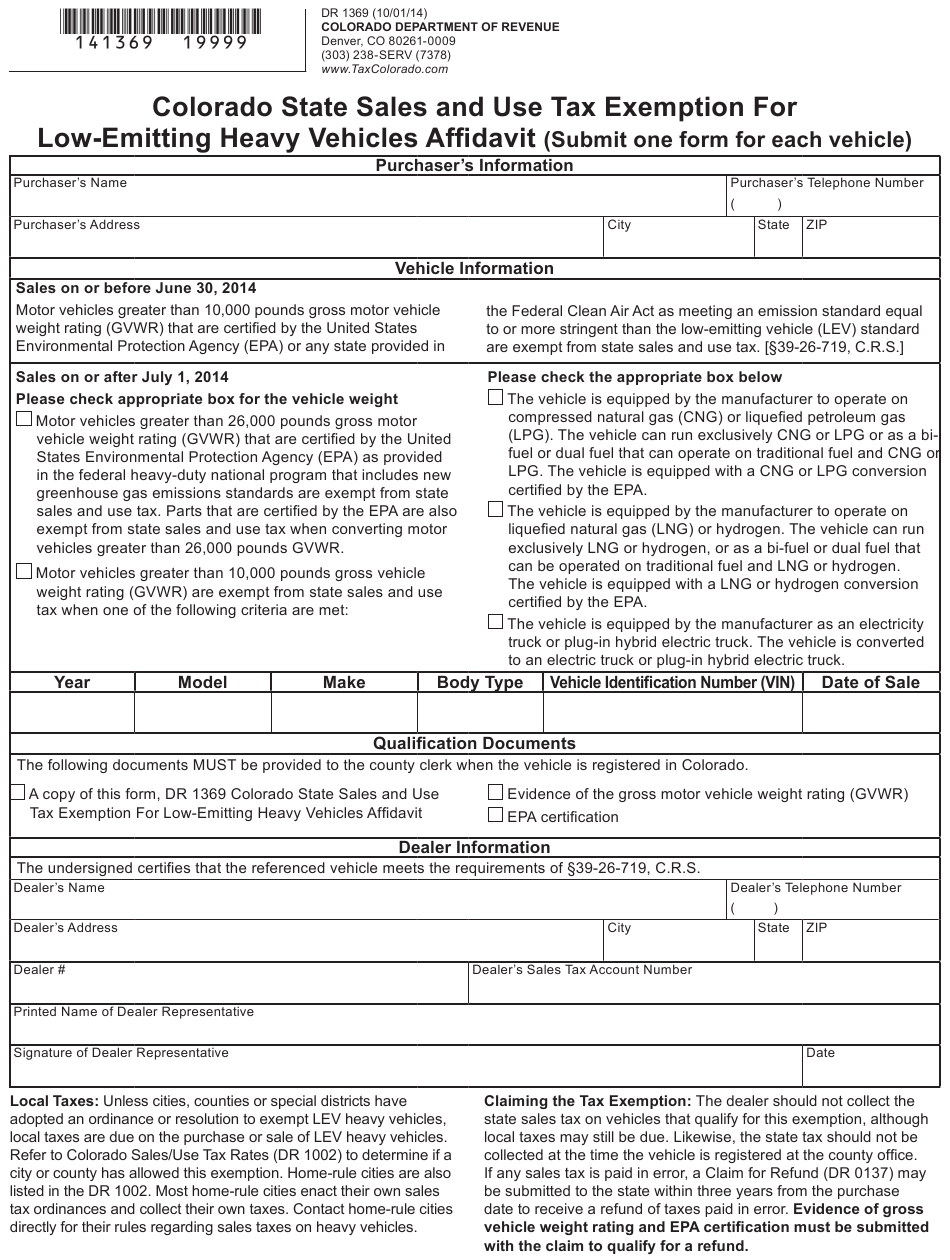

Colorado Sales And Use Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-dr1369-download-fillable-pdf-or-fill-online-colorado-state-sales.png

Colorado Department Revenue Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/73/581/73581659/large.png

Web Senior Citizens and Veterans with a Disability Exemption Property Tax Exemption for Senior Citizens in Colorado Property Tax Exemption for Disabled Veterans in Web 17 Nov 2023 nbsp 0183 32 For the property tax year commencing on January 1 2023 the bill specifies that a senior is deemed to be a 10 year owner occupier of a primary residence that the

Web 31 Jan 2023 nbsp 0183 32 For property tax years commencing on or after January 1 2028 the bill increases the maximum amount of actual value of the owner occupied residence of a Web 2 Mai 2023 nbsp 0183 32 DENVER TODAY the Colorado State Treasurer reminded homeowners of the Property Tax Deferral Programs Colorado s Property Tax Deferral Programs have

Download Senior Property Tax Exemption Colorado

More picture related to Senior Property Tax Exemption Colorado

Shoreline Area News Property Tax Exemption For Seniors

https://2.bp.blogspot.com/-3e6xG-dglpg/XCUQA-cyb7I/AAAAAAAB6Iw/tcc3qNCu91ga_eDv6DWSzt03YbKQHsYMwCLcBGAs/s640/Senior%2Bproperty%2Btax.jpg

Colorado Forum On The Senior Property Tax Homestead Exemption By

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1873855322680834&get_thumbnail=1

Personal Real Estate Exemptions Chart FY 2020 Cohasset MA

http://cohassetma.org/ImageRepository/Document?documentID=1864

Web File Application Form Senior Property Tax Exemption pdf 305 4 KB History of Property Tax Exemption JBC Memo pdf 104 6 KB Potential Changes JBC Memo pdf 288 38 KB Web The senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens The state reimburses the local governments for the loss in

Web 17 Nov 2023 nbsp 0183 32 For the 2023 property tax year the bill increases the maximum amount of actual value of the owner occupied residence of a qualifying senior veteran with a Web For those who qualify 50 percent of the first 200 000 in actual value of their primary residence is exempted for a maximum exemption amount of 100 000 in actual value

Denver Sales Tax Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/request-for-exemption-from-denver-sales-use-and-or-business.png

Action Alert Protect Colorado s Senior Homestead Exemption Fund

https://dev.disabilitylawco.org/sites/default/files/styles/original/public/news-thumbnails/senior homestead alert web.jpg?itok=IY-mAiJb

https://agingstrategy.colorado.gov/sites/agingstrategy/files...

Web A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified The three basic requirements are 1 the

https://dpt.colorado.gov/rebates-exemptions-and-deferrals

Web A property tax exemption is available to senior citizens and the surviving spouses of seniors who previously qualified When the State of Colorado s budget allows 50

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/KGBSXVUIPZELVAJ3G54E7JAYQM.jpg)

King County Launches Plan To Help Low income Seniors Others With

Denver Sales Tax Exemption Form ExemptForm

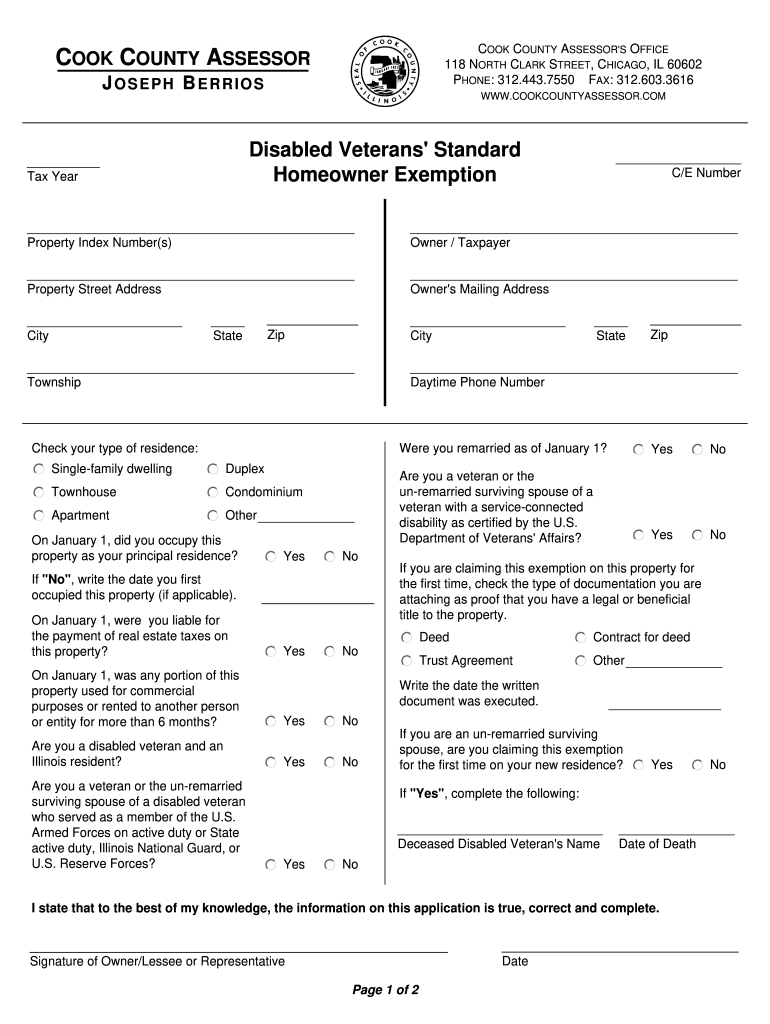

Senior Citizen Exemption Application Form Cook County ExemptForm

Link To Info Re Sr Citizen s Tax Homestead Exemptions Freezes In Will

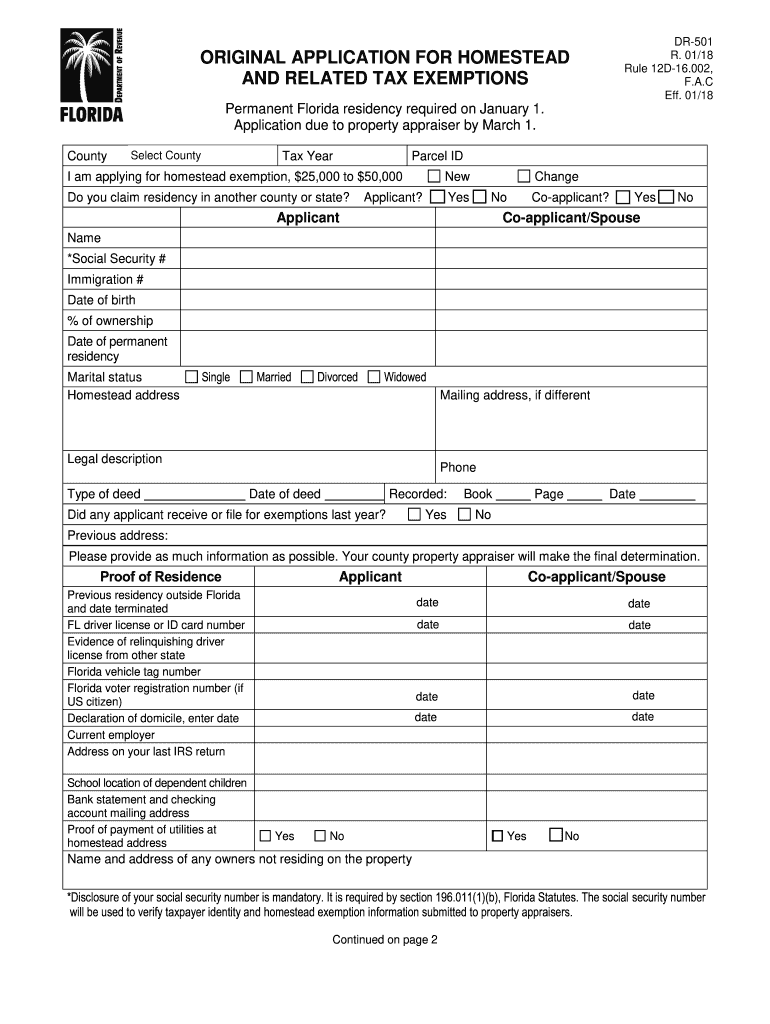

501 Homestead 2018 2024 Form Fill Out And Sign Printable PDF Template

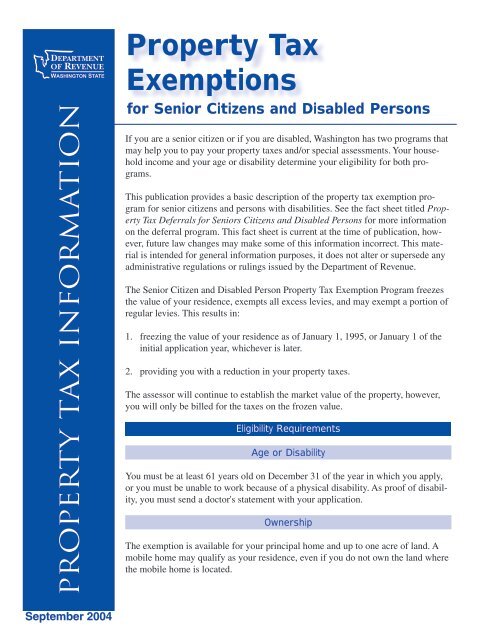

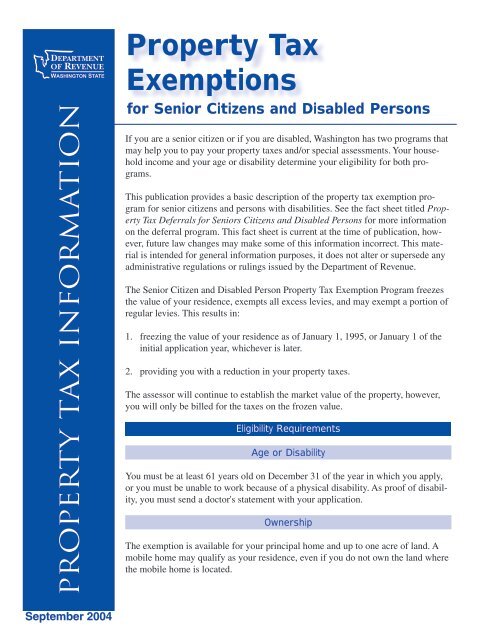

Property Tax Exemptions For Senior Citizens And Mason County

Property Tax Exemptions For Senior Citizens And Mason County

2020 Colorado Senior Property Tax Exemption Funded

ALL COLORADO TOTALLY DISABLED VETS NEED THE DISABLED VETERAN PROPERTY

Jefferson County Property Tax Exemption Form ExemptForm

Senior Property Tax Exemption Colorado - Web 31 Jan 2023 nbsp 0183 32 For property tax years commencing on or after January 1 2028 the bill increases the maximum amount of actual value of the owner occupied residence of a