Senior Property Tax Exemption Douglas County Colorado Web The Senior Property Tax Homestead Exemption the Disabled Veterans and Gold Star Spouse exemptions allow 50 of the first 200 000 of actual value to be exempted which equates to between 600 and 1 000 Watch this video from the

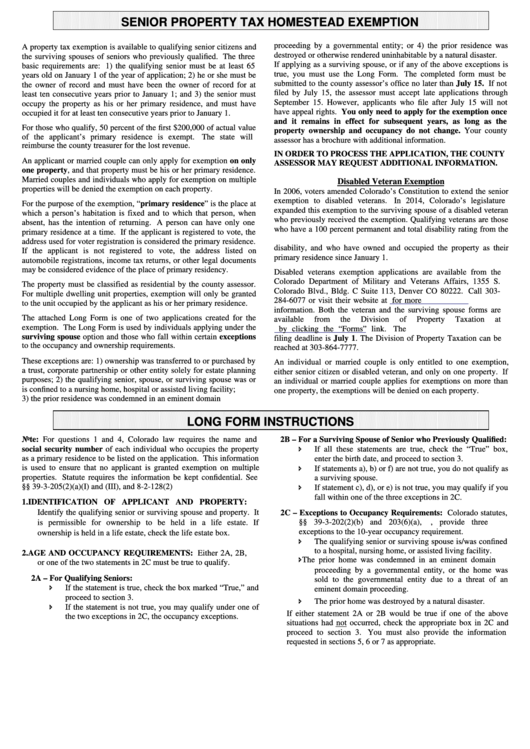

Web The senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens The state reimburses the local governments for the loss in revenue When the State of Colorado s budget allows 50 percent of the first 200 000 of actual value of the qualified applicant s primary residence is exempted Web An individual or married couple is only entitled to one exemption either senior citizen or disabled veteran and only on one property If an individual or married couple applies for exemptions on more than one property the exemptions will be denied on each property Note For questions 1 and 4 Colorado law requires the name and social

Senior Property Tax Exemption Douglas County Colorado

Senior Property Tax Exemption Douglas County Colorado

https://www.castlepinesconnection.com/wp-content/uploads/2023/06/28-senior-prop-tax-cmykflat.jpg

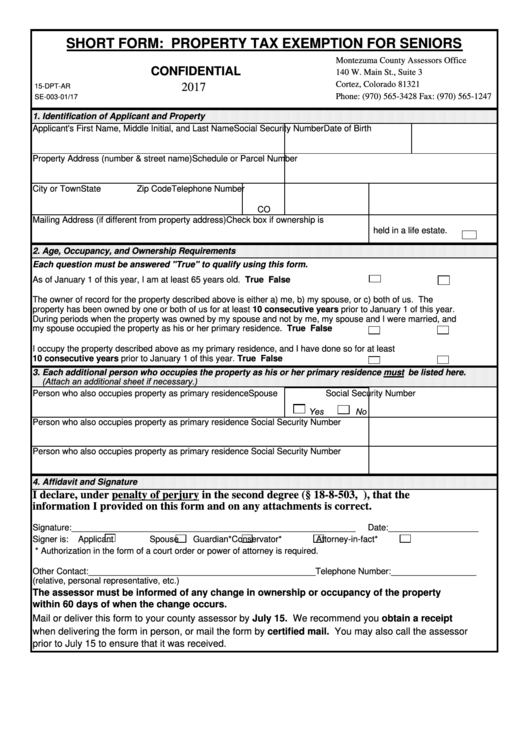

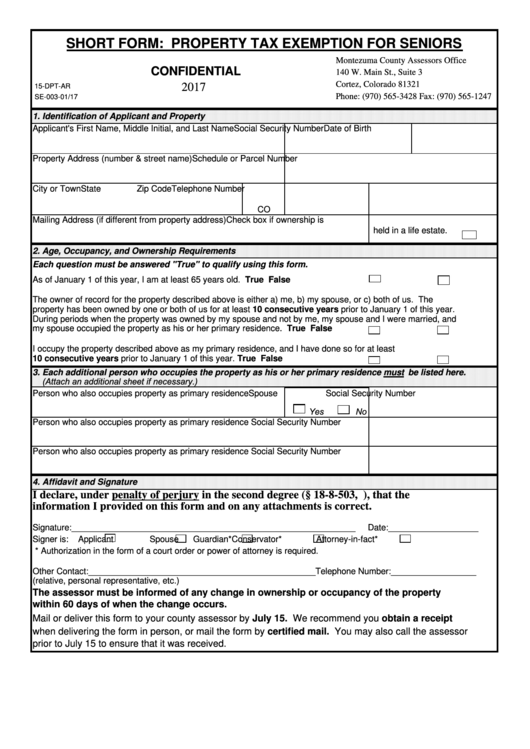

Fillable Short Form Property Tax Exemption For Seniors 2017

https://data.formsbank.com/pdf_docs_html/134/1344/134427/page_1_thumb_big.png

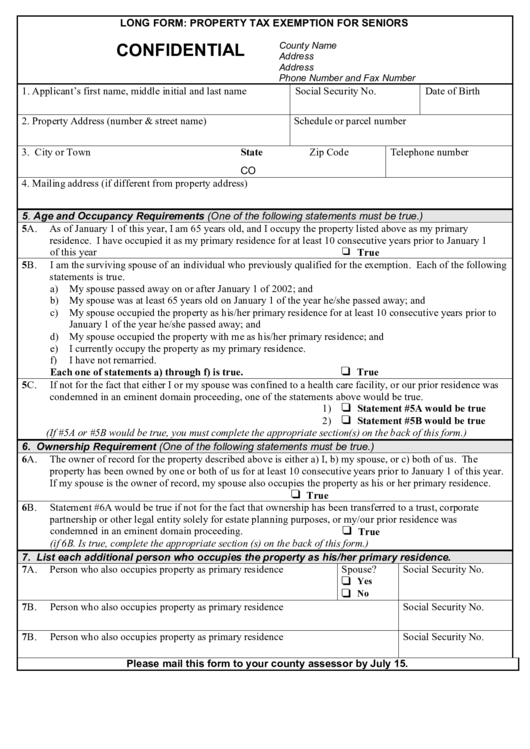

Long Form Property Tax Exemption For Seniors Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/6/69/6957/page_1_thumb_big.png

Web The Senior Property Tax Exemption for senior citizens was created for qualifying seniors and the surviving spouses of seniors who previously qualified As of January 1 st the taxpayer must be 65 years or older and must be the property owner of record and must have been so for at least 10 consecutive years as his or her primary residence Web On January 1 st 2023 the State of Colorado is expanding the deferral program to allow those who do not qualify for the senior or military personnel program to defer a portion of their real property taxes if they exceed the property tax growth cap of 4 averaged from the preceding two years

Web 30 Mai 2023 nbsp 0183 32 Your Douglas County Assessor s Office wants to help The Senior Property Tax Homestead Exemption the Disabled Veterans and Gold Star Spouse exemptions allow 50 of the first 200 000 of actual value to be exempted which equates to between 600 and 1 000 Web There are three basic requirements to qualify 1 The qualifying senior must be at least 65 years old on January 1 of the year in which he or she applies 2 The qualifying senior must be the property owner of record and must have been so for at least 10 consecutive years prior to January 1 and 3 The qualifying senior must occupy the property

Download Senior Property Tax Exemption Douglas County Colorado

More picture related to Senior Property Tax Exemption Douglas County Colorado

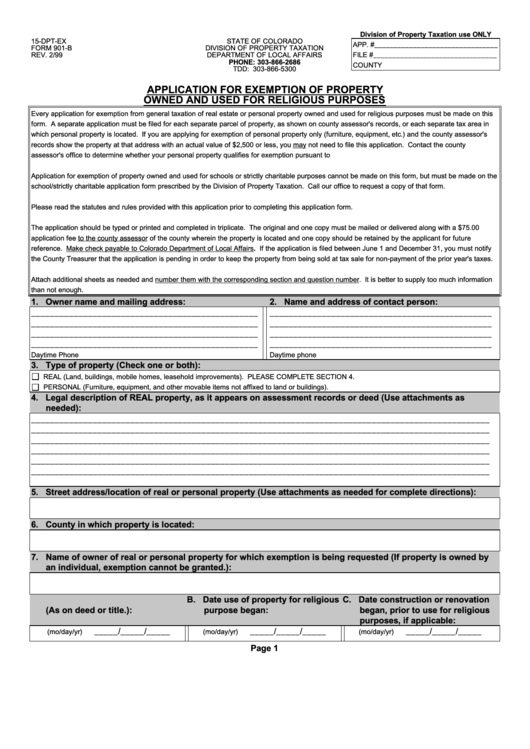

Colorado Property Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-901-b-application-for-exemption-of-property-owned-and-used-for.png

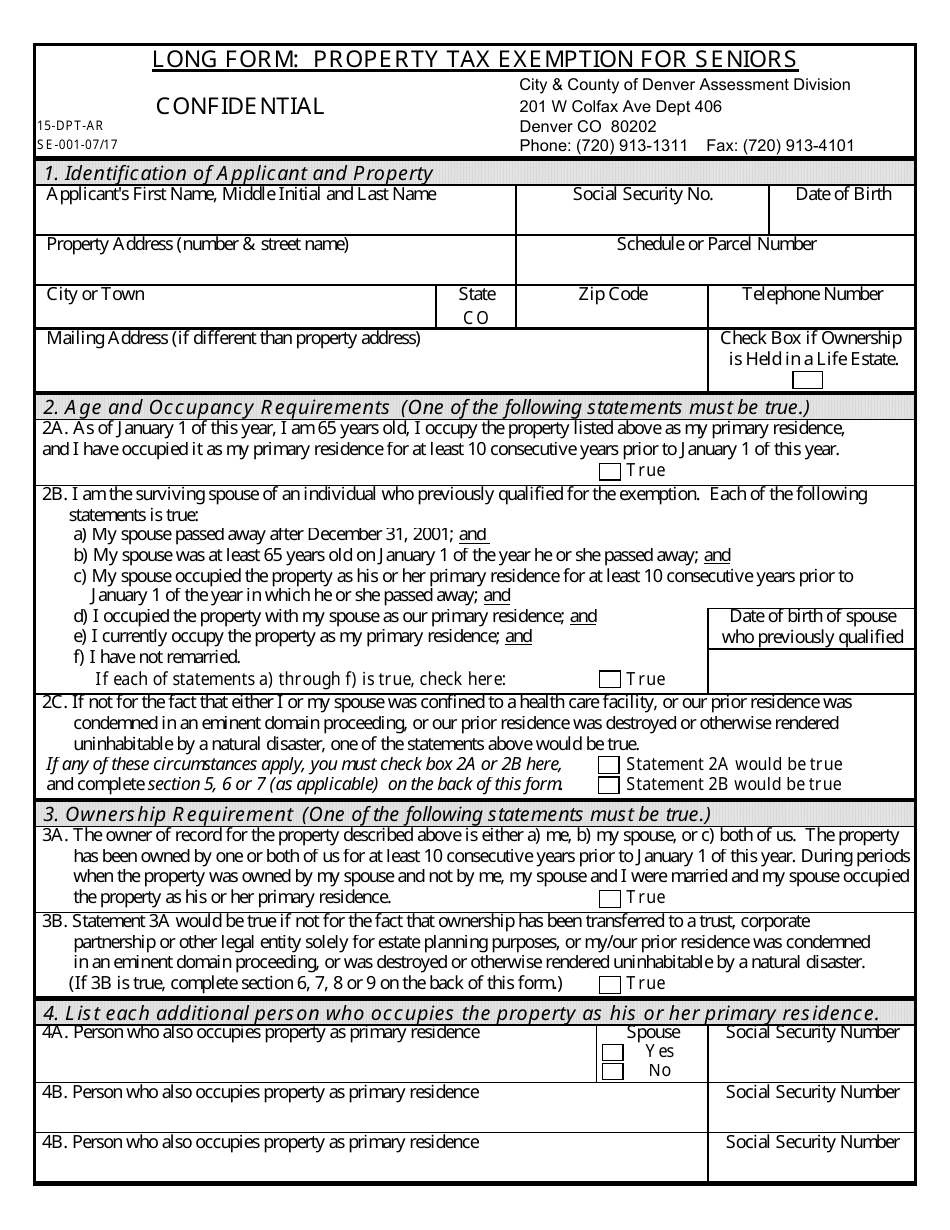

Form 15 DPT AR Fill Out Sign Online And Download Printable PDF

https://data.templateroller.com/pdf_docs_html/1729/17290/1729045/form-15-dpt-ar-long-form-property-tax-exemption-seniors-colorado_print_big.png

Fillable Long Form Property Tax Exemption For Seniors Printable Pdf

https://data.formsbank.com/pdf_docs_html/55/553/55317/page_1_thumb_big.png

Web A property tax exemption is available to senior citizens and the surviving spouses of seniors who previously qualified When the State of Colorado s budget allows 50 percent of the first 200 000 of actual value of the qualified applicant s primary residence is exempted The exemption is available to individuals who are 65 years of age or Web SHORT FORM PROPERTY TAX EXEMPTION FOR SENIORS CONFIDENTIAL 15 DPT AR SE 003 01 20 Douglas County 301 Wilcox St Castle Rock CO 80104 Assessors douglas co us 1 Identification of Applicant and Property Applicant s First Name Middle Initial and Last Name Social Security Number Date of Birth

Web 17 Nov 2023 nbsp 0183 32 Bill Summary For the property tax year commencing on January 1 2023 the bill specifies that a senior is deemed to be a 10 year owner occupier of a primary residence that the senior has owned and occupied for less than 10 years and therefore qualifies for the senior property tax exemption for the residence if The senior would Web Dates of ownership of condemned property from to 6C Dates property was occupied as primary residence 6D Approximate date of condemnation from to 6E Since the condemnation of my prior residence I have not owned and occupied any property as my primary residence other than the property for which I am applying for exemption

Senior Property Tax Exemption Deadline Approaching

https://www.castlepinesconnection.com/wp-content/uploads/2021/06/31-senior-prop-tax-copy-1.jpg

This Senior Property Tax Exemption Has Saved Colorado s Older

https://www.kennedy4co.com/wp-content/uploads/2021/06/SENIOR-TAX-EXEMPT-KS-06012021041-1140x532.jpg

https://www.douglas.co.us/assessor/residential-exemptions

Web The Senior Property Tax Homestead Exemption the Disabled Veterans and Gold Star Spouse exemptions allow 50 of the first 200 000 of actual value to be exempted which equates to between 600 and 1 000 Watch this video from the

https://dpt.colorado.gov/property-tax-exemption-for-senior-citizens-in...

Web The senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens The state reimburses the local governments for the loss in revenue When the State of Colorado s budget allows 50 percent of the first 200 000 of actual value of the qualified applicant s primary residence is exempted

Seniors Can Apply For The Colorado Senior Property Tax Exemption

Senior Property Tax Exemption Deadline Approaching

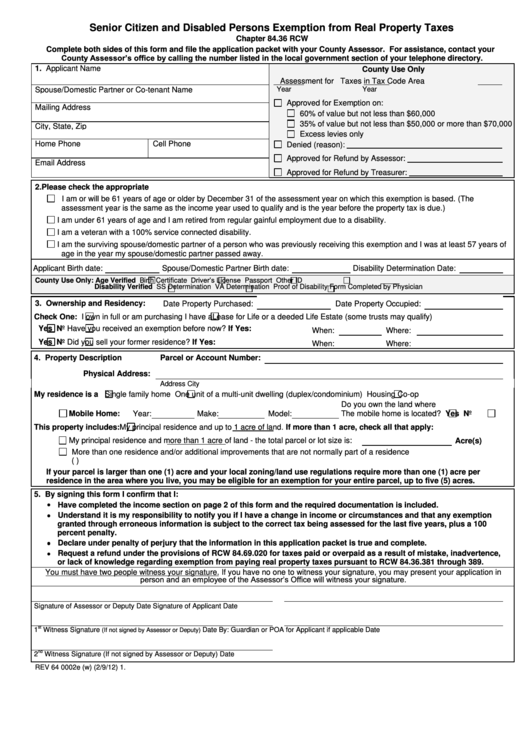

Fillable Form Rev 64 0002e Senior Citizen And Disabled Persons

Colorado Forum On The Senior Property Tax Homestead Exemption By

Colorado Homestead Property Tax Exemption There s An Equity Issue

Action Alert Protect Colorado s Senior Homestead Exemption Fund

Action Alert Protect Colorado s Senior Homestead Exemption Fund

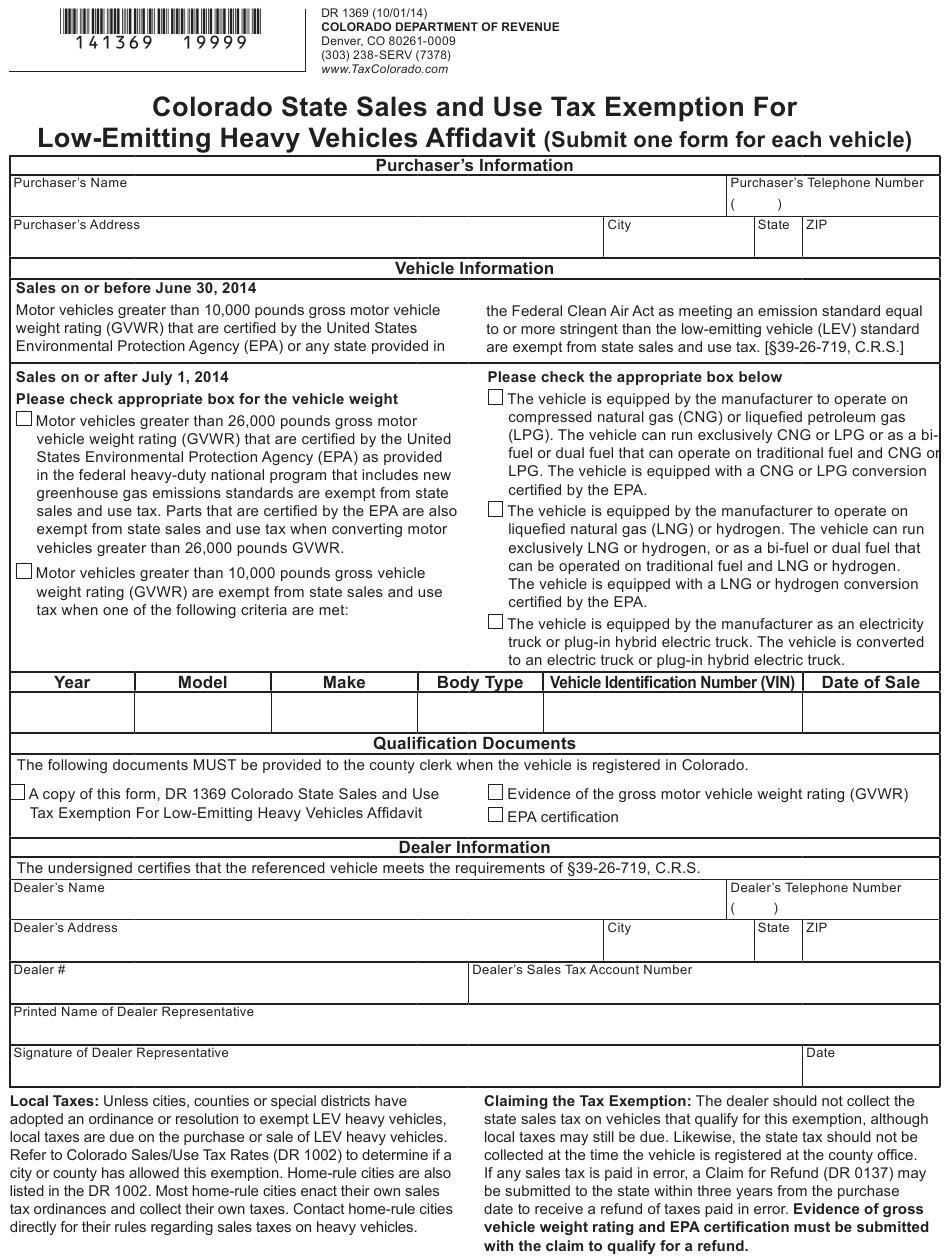

Colorado Sales And Use Tax Exemption Form ExemptForm

Protecting The Senior Homestead Property Tax Exemption

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton

Senior Property Tax Exemption Douglas County Colorado - Web There are three basic requirements to qualify 1 The qualifying senior must be at least 65 years old on January 1 of the year in which he or she applies 2 The qualifying senior must be the property owner of record and must have been so for at least 10 consecutive years prior to January 1 and 3 The qualifying senior must occupy the property