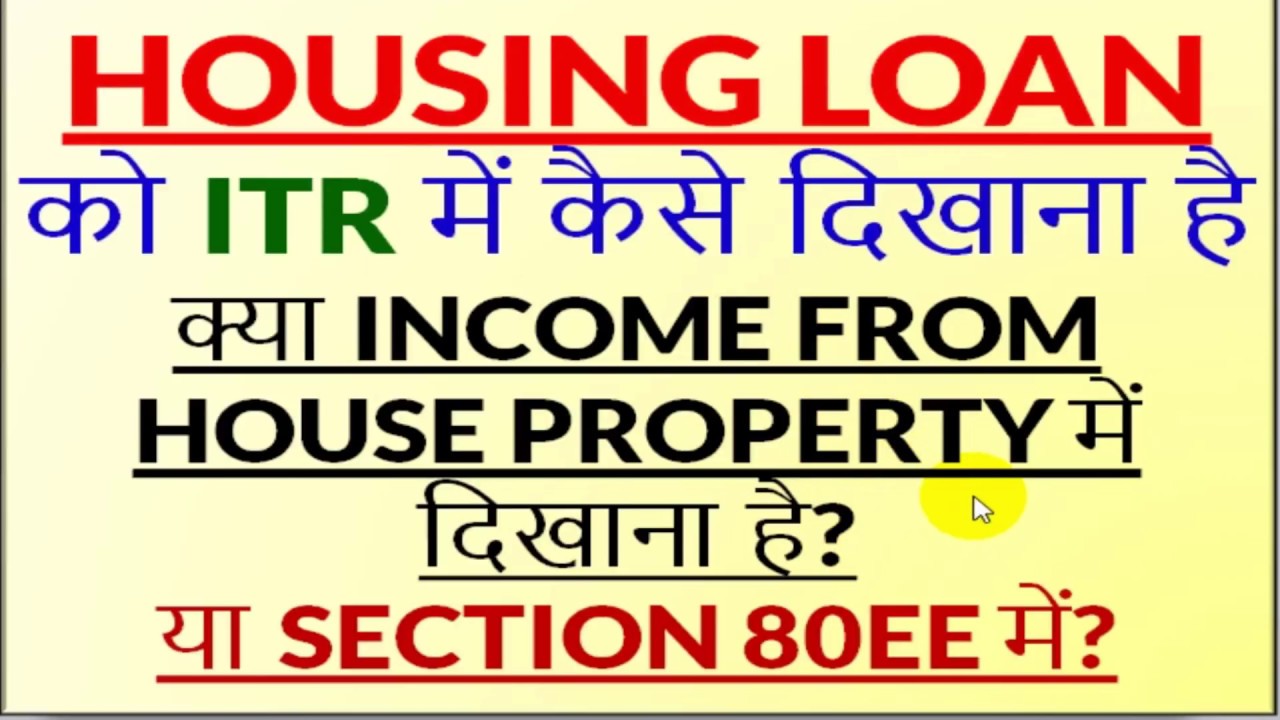

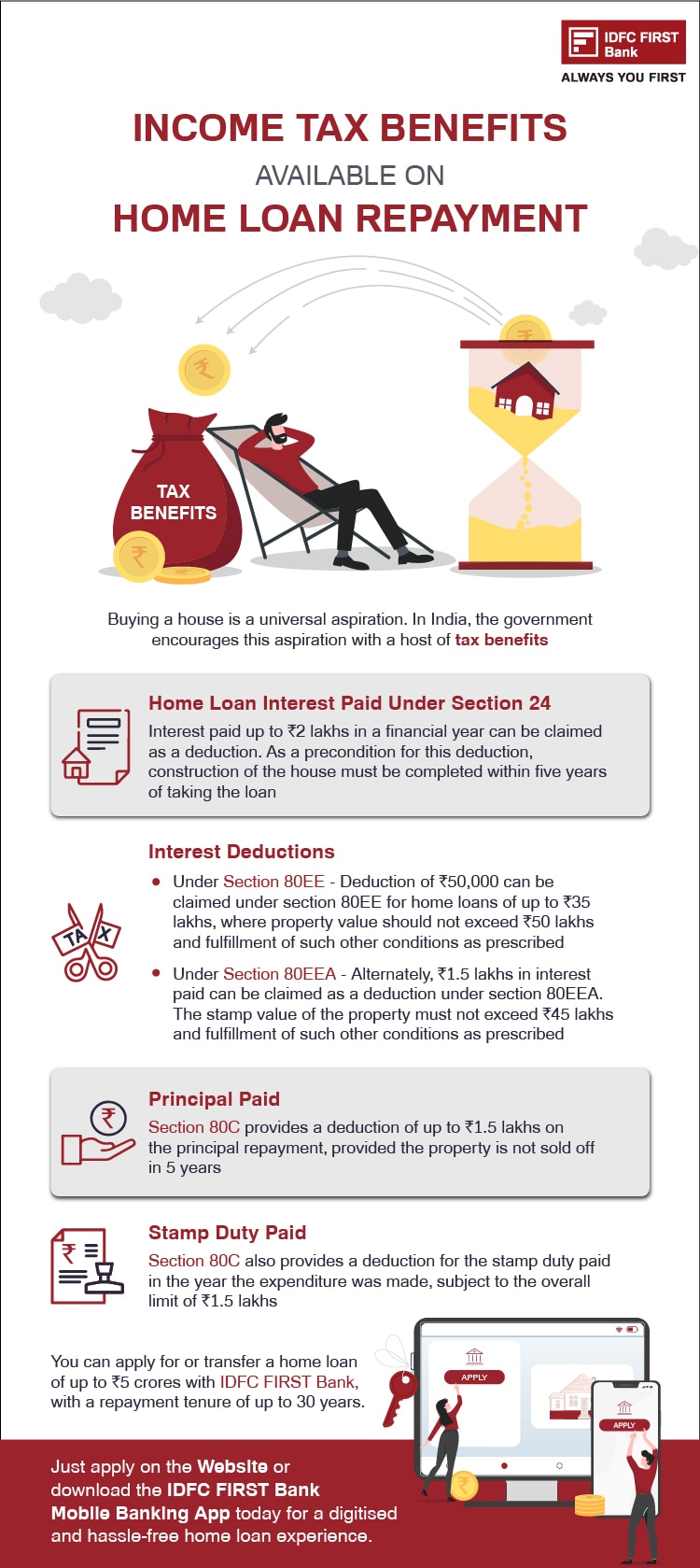

Rebate Of Income Tax On Housing Loan The government offers various tax rebates against home loan repayment On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA

An income tax rebate is allowed on both the principal and the interest throughout the repayment tenure of your home loan under the following sections In this guide we will discuss the terms and conditions to All home loan borrowers should be informed of all income tax refunds available on home loans since doing so can drastically lower their tax payments Every home loan borrower should be aware of the following income tax rebates on home loans

Rebate Of Income Tax On Housing Loan

Rebate Of Income Tax On Housing Loan

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Income Tax Dept Issued The Common Offline Utility For Form 3CA 3CD And

https://www.a2ztaxcorp.com/wp-content/uploads/2021/08/Income-tax-new-website.jpg

TAX Income Tax On Estates And Trust INCOME TAX ON ESTATES AND TRUSTS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/7364fb57dd83ad933e94a7b0f24defee/thumb_1200_1553.png

As per the new income tax rule starting April 2023 no new home loans sanctioned in FY23 24 will be eligible to claim the tax benefits under section 80 EEA Sections of the Income Tax Act for tax rebate on home loan Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

Income Tax Rebate on Home Loan Learn more about the Home Loan Tax Exemption the rebate you can claim on the Principal Interest paid and other benefits you can claim Under Section 24 of the Income Tax Act homeowners can avail of a deduction of up to Rs 2 lakh on the interest paid on their home loan provided that the owner or their family reside in the house property

Download Rebate Of Income Tax On Housing Loan

More picture related to Rebate Of Income Tax On Housing Loan

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Section 87A Income Tax Rebate

https://taxguru.in/wp-content/uploads/2018/07/Tax-rebate.jpg

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce taxable income for income tax calculations under home loan tax benefit 80c section Can I claim tax benefits on the principal repaid on a housing loan Yes you can avail of tax benefits on the principal amount repaid on the home loan from total income under Section 80C What is the maximum amount I can avail of

Individuals who have taken a home loan for purchasing or constructing a residential property can claim tax deductions on the interest paid on the loan under Section 24 of the Income Tax Act Additionally principal repayments are Under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan amount repayment you may claim tax benefit on stamp duty and registration payment as well but only once

How To Fill Housing Loan Interest And Principal In Income Tax Return

https://i.ytimg.com/vi/0xIFd-jhyEU/maxresdefault.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

https://housing.com › news › home-loans-guide-claiming-tax-benefits

The government offers various tax rebates against home loan repayment On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA

https://housing.com › news › income-tax-rebate-on-home-loan

An income tax rebate is allowed on both the principal and the interest throughout the repayment tenure of your home loan under the following sections In this guide we will discuss the terms and conditions to

Income Tax Benefits On Housing Loan In India

How To Fill Housing Loan Interest And Principal In Income Tax Return

TAX Income Tax On Corporations INCOME TAX ON CORPORATIONS Under Sec

Income Tax Rebate Under Section 87A

How To Calculate Tax Rebate In Income Tax Of Bangladesh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Income TAX ON Estates AND Trusts INCOME TAX ON ESTATES AND TRUSTS

Rebate Of Income Tax On Housing Loan - Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b