Rebate On Home Loan In Old Tax Regime Verkko 4 helmik 2023 nbsp 0183 32 In addition to the deduction under Section 80C home loan borrowers can also claim a tax deduction on the interest component of their home loan repayment under Section 24 b of the Income Tax

Verkko Apr 27 2023 11 28 IST Source Pixabay Apart from the deduction of up to 1 5 lakh on principal payments and up to 2 lakh on interest payments an additional deduction Verkko Deductions for interest on home loans on self occupied or vacant properties Section 24b Deductions under Section 80C Exemptions for medical insurance premiums

Rebate On Home Loan In Old Tax Regime

Rebate On Home Loan In Old Tax Regime

http://instafiling.com/wp-content/uploads/2023/03/Topic-40-how-to-show-interest-on-home-loan-in-income-tax-return.png

Home Loan Tax Rebate

https://www.indiareviews.com/wp-content/uploads/2022/04/homeloan-tax-rebate-1.jpg

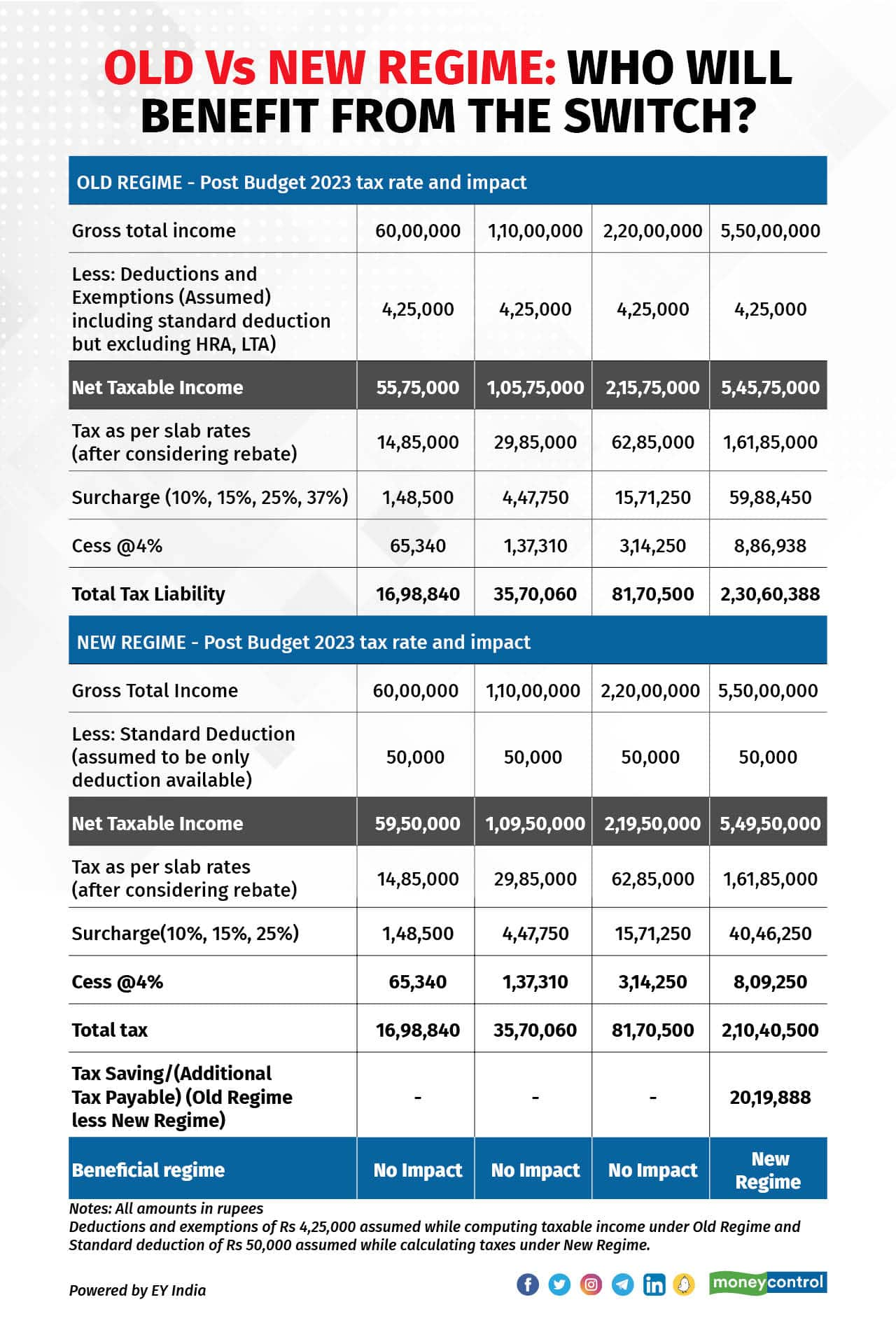

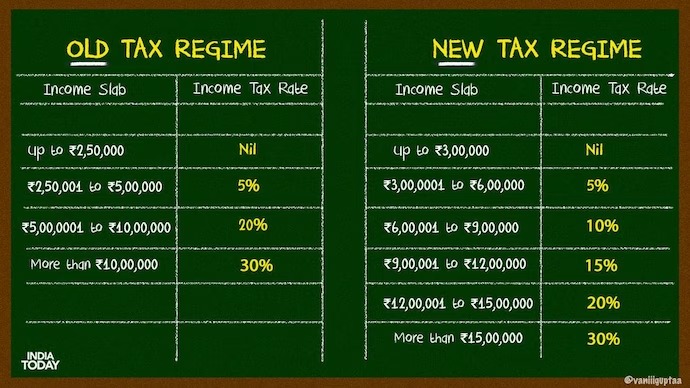

Do You Know When Old And New Tax Regimes Give The Same Tax Liability

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/break-even-point-for-old-and-new-tax-regime-.jpg?itok=h3-wLBy8

Verkko The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions Verkko 10 helmik 2023 nbsp 0183 32 You can benefit under the new tax regime but there are a few caveats Union Budget 2023 made the new tax regime attractive by reducing rates You have two options continue with the

Verkko 18 huhtik 2023 nbsp 0183 32 If you have a home loan you can claim both maximum principal and interest rate deductions you can save more taxes under the old tax regime Consider Verkko Super Rich Tax Cut Highest surcharge rate on the income above INR 5 crore to be reduced from 37 to 25 in the new tax regime Old Tax Regime Vs New Tax

Download Rebate On Home Loan In Old Tax Regime

More picture related to Rebate On Home Loan In Old Tax Regime

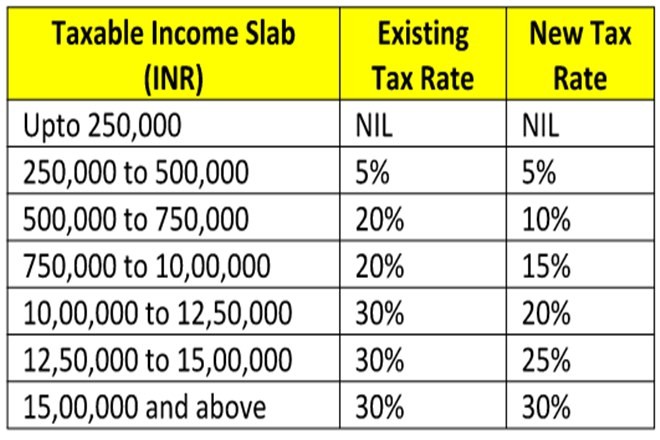

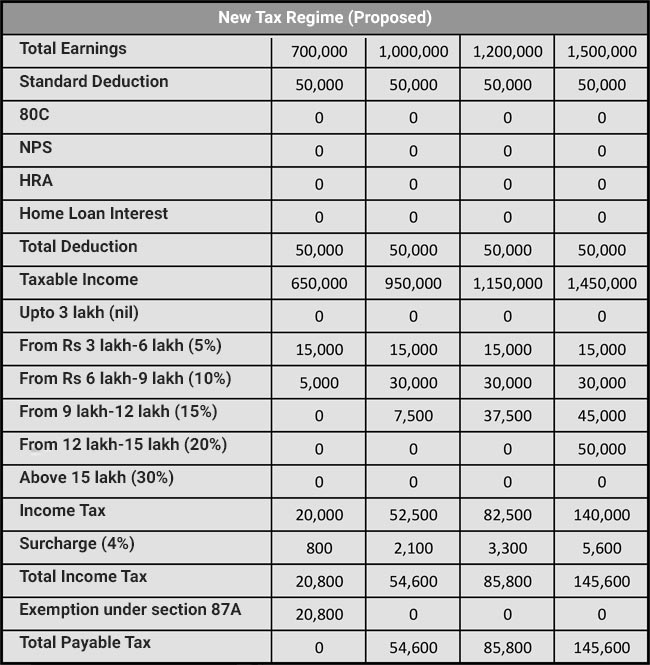

Calculate Your Projected Income Tax For FY 2020 21 In New Tax Regime

http://www.askbanking.com/wp-content/uploads/2020/04/income-tax-slabs.jpg

New Tax Regime Vs Old Tax Regime Which Is Better Yadn Vrogue co

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

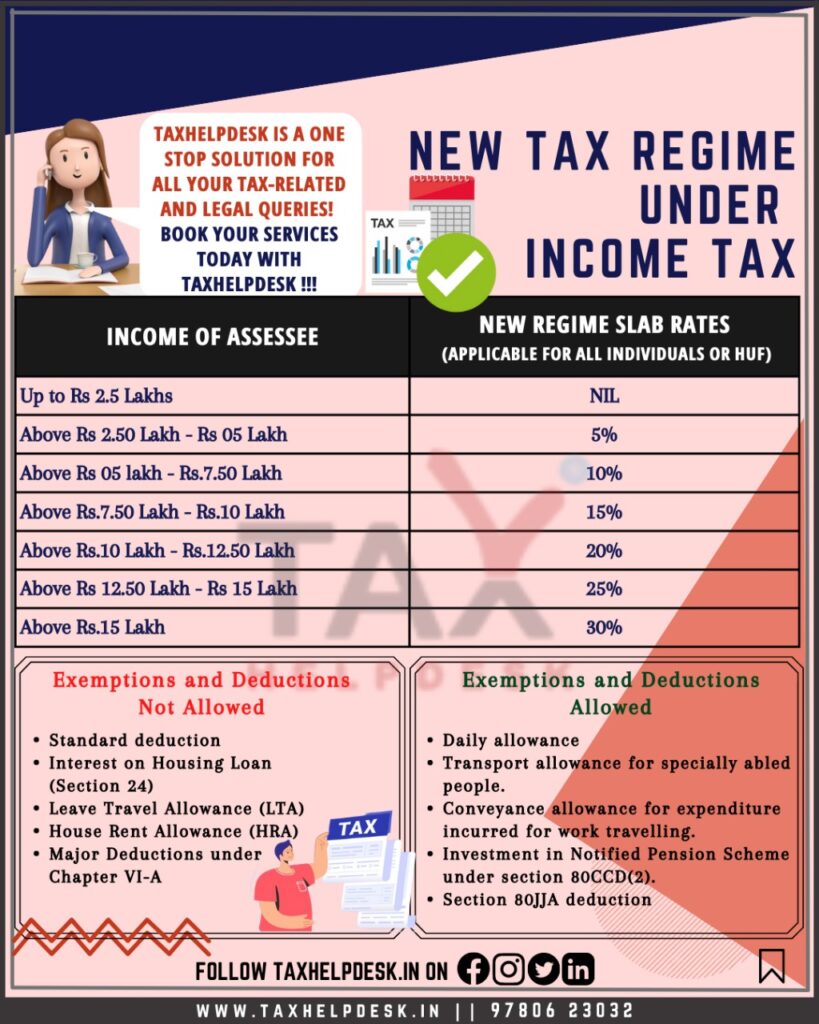

Income Tax Under New Regime Understand Everything

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/New-Regime-under-Income-Tax-819x1024.jpeg

Verkko 17 maalisk 2023 nbsp 0183 32 As a homeowner you can claim a deduction of up to Rs 2 lakh on your home loan interest if you or your family resides in the house property in case of Verkko 7 syysk 2020 nbsp 0183 32 A home loan is one of the easiest ways to get sizeable tax deductions All taxpayers are eligible for deductions up to Rs 1 5 lakh under Section 80C and up to Rs 2 lakh under Section 24B for

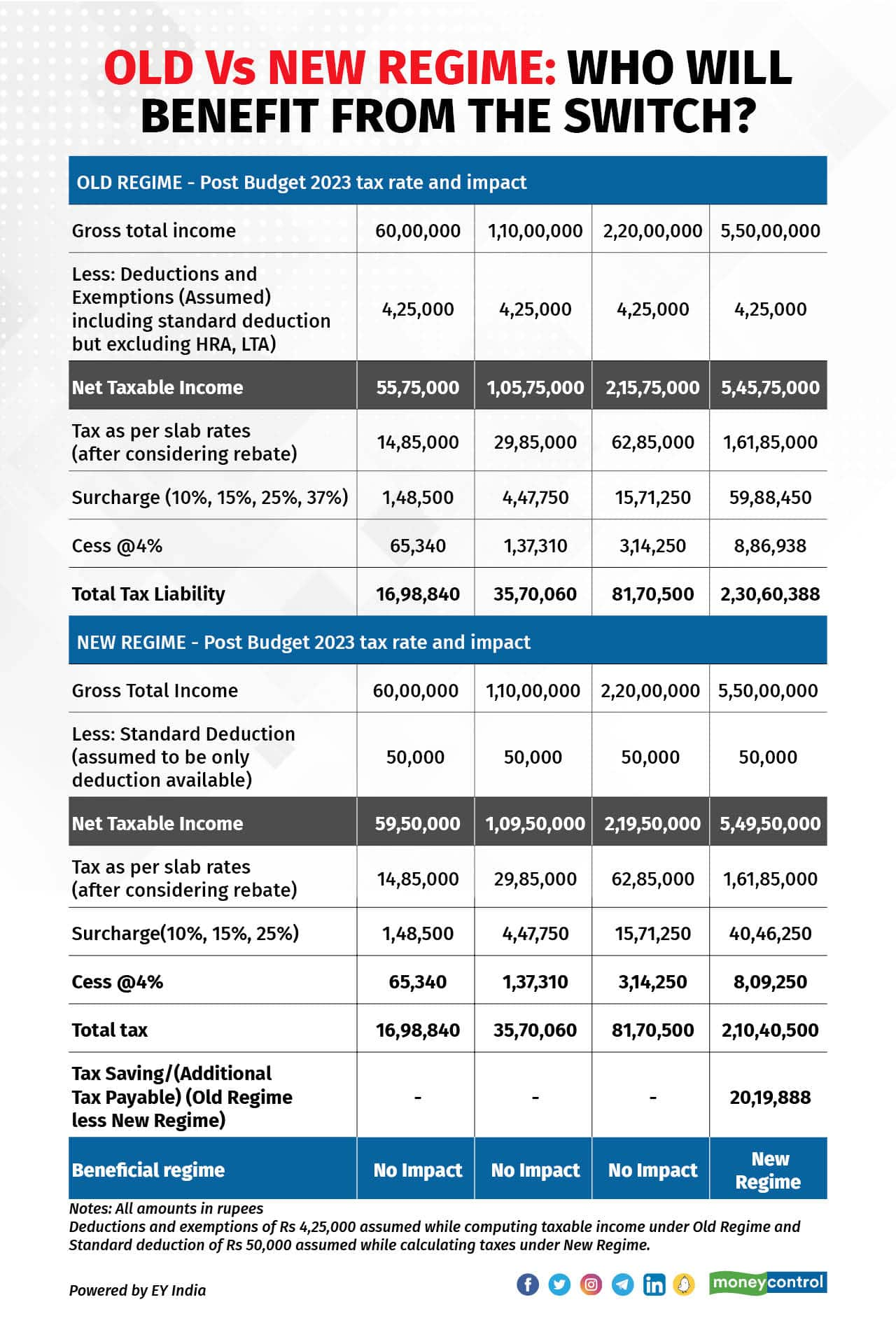

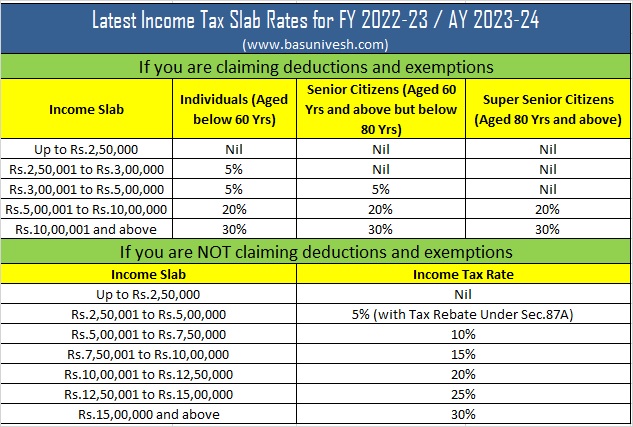

Verkko 27 jouluk 2023 nbsp 0183 32 While the new tax regime has lower income tax slab rates it does not have the option to claim all the exemptions allowances as well as deductions On the Verkko 18 jouluk 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under

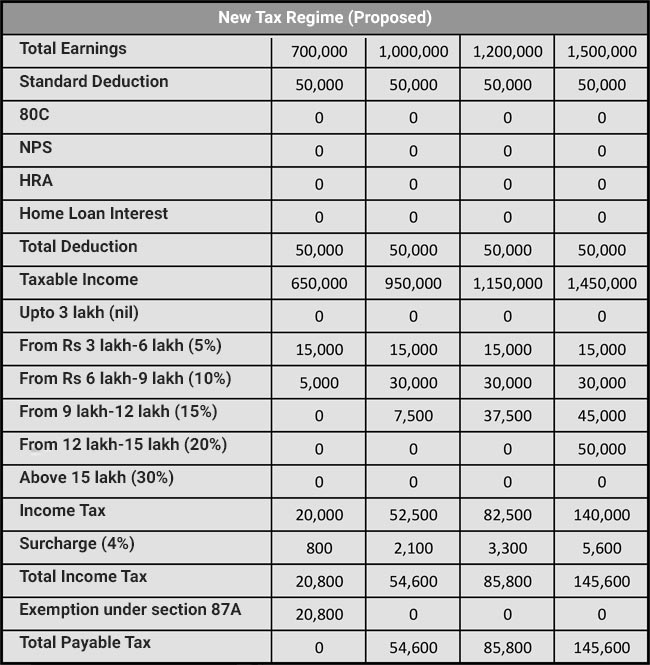

Old Tax Regime And New Tax Regime Explained In 3 Scenarios Forum

https://c.ndtvimg.com/2023-02/hfvfqj2o_income-tax-slab_625x300_02_February_23.jpg

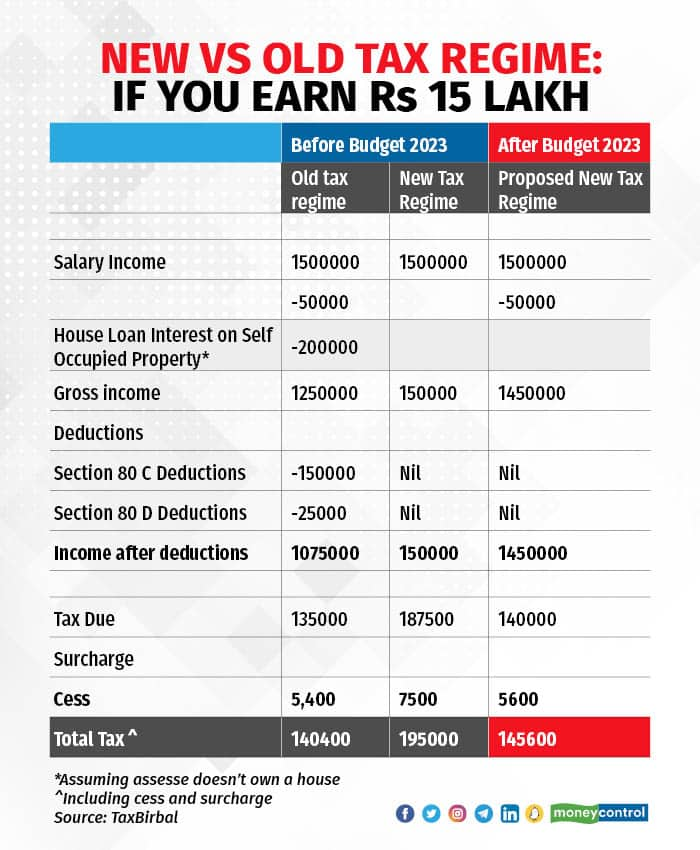

Old Or New Which Tax Regime Should You Use For An Income Of Rs 15 Lakh

https://images.moneycontrol.com/static-mcnews/2023/02/15-lakh-New-vs-Old-.jpg

https://www.personalfn.com/dwl/Tax-Planning…

Verkko 4 helmik 2023 nbsp 0183 32 In addition to the deduction under Section 80C home loan borrowers can also claim a tax deduction on the interest component of their home loan repayment under Section 24 b of the Income Tax

https://www.businessinsider.in/personal-finance/news/how-much-tax...

Verkko Apr 27 2023 11 28 IST Source Pixabay Apart from the deduction of up to 1 5 lakh on principal payments and up to 2 lakh on interest payments an additional deduction

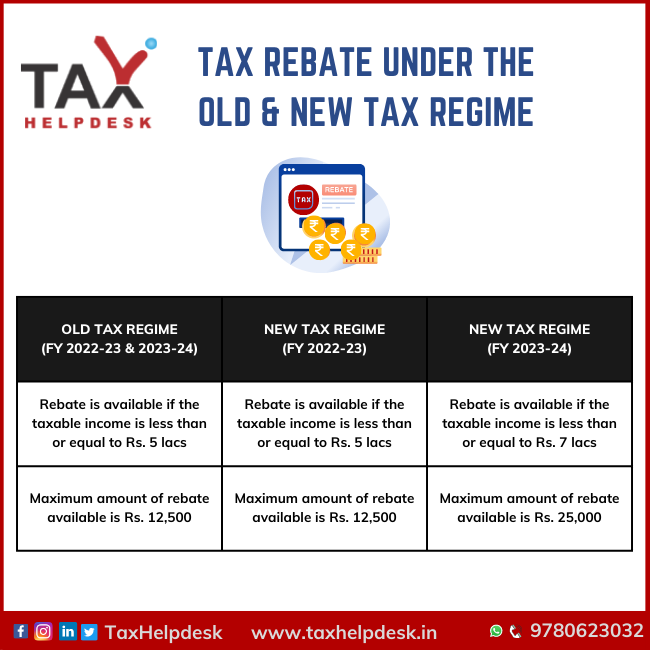

Tax Rebate Under The Old New Tax Regime

Old Tax Regime And New Tax Regime Explained In 3 Scenarios Forum

Housing Loan Tax Benefit Provident Housing

Rebate Limit New Income Slabs Standard Deduction Understanding What

Shift Between Old And New Tax Regime Cant Come Back To Old Tax Regime

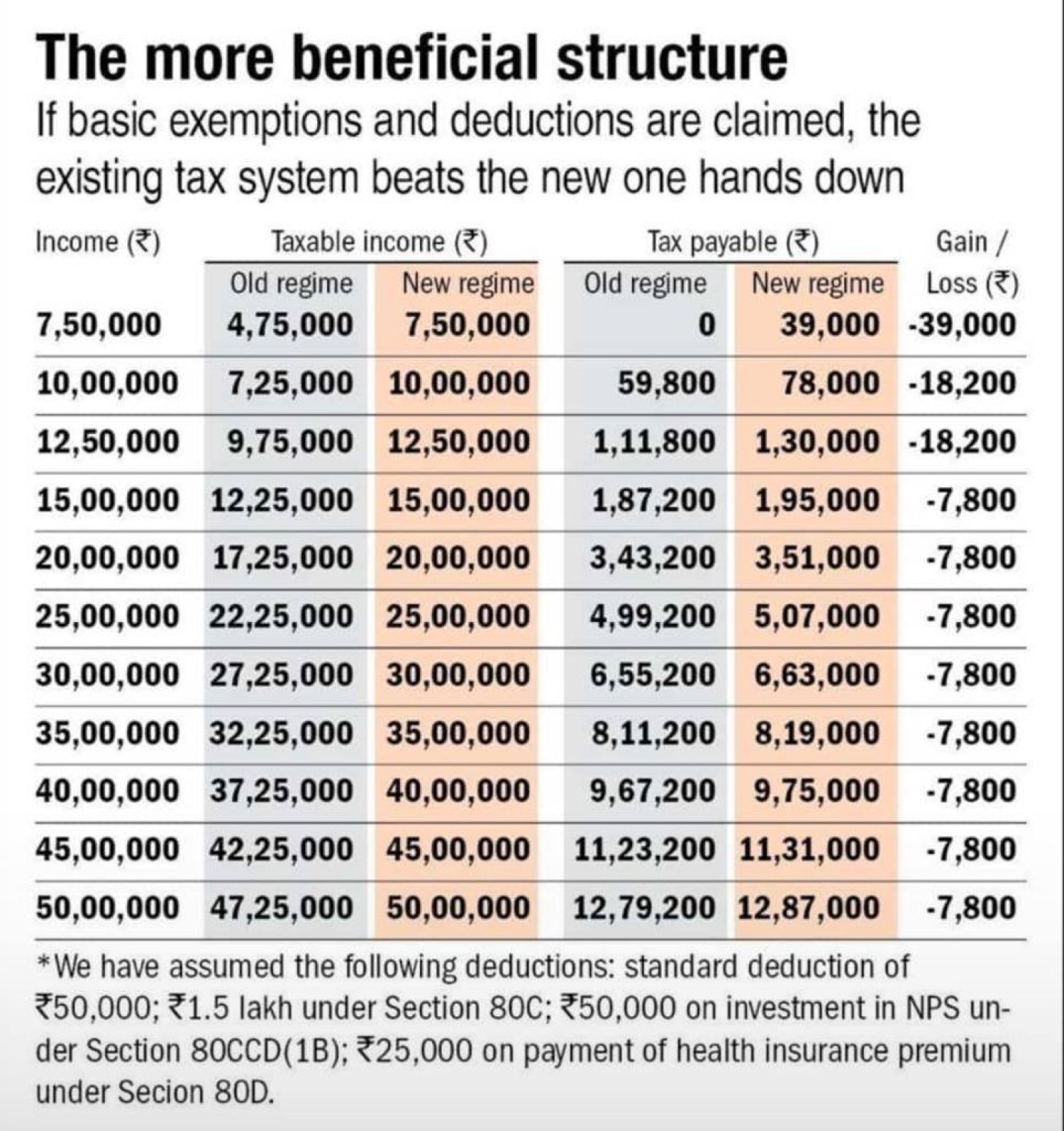

Budget 2023 Old Vs New Tax Regimes Who Should Make The Switch

Budget 2023 Old Vs New Tax Regimes Who Should Make The Switch

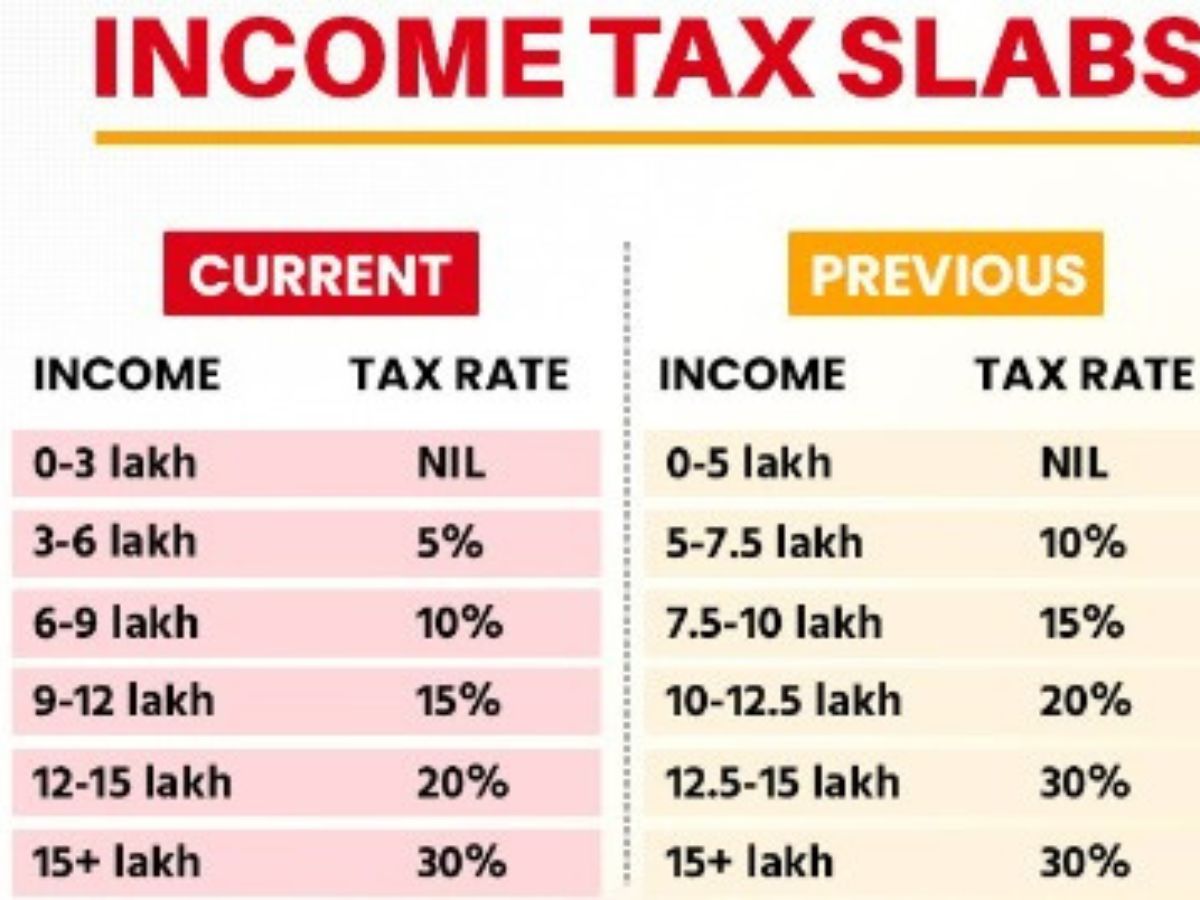

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

Lifeline Investment

Spuerkeess The Home Loan In Three Main Steps

Rebate On Home Loan In Old Tax Regime - Verkko 10 helmik 2023 nbsp 0183 32 You can benefit under the new tax regime but there are a few caveats Union Budget 2023 made the new tax regime attractive by reducing rates You have two options continue with the