Rebate On Income Tax For Ay 2022 23 A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount Individuals with net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A under the old tax regime i e tax liability will be NIL Important Points to note if you select the new tax regime

Rebate On Income Tax For Ay 2022 23

Rebate On Income Tax For Ay 2022 23

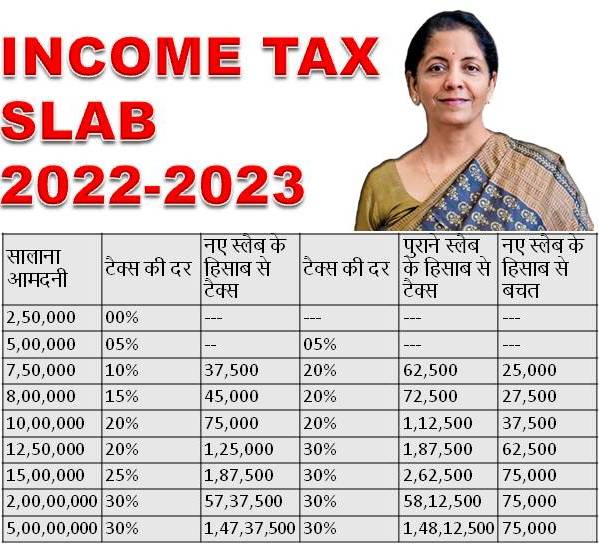

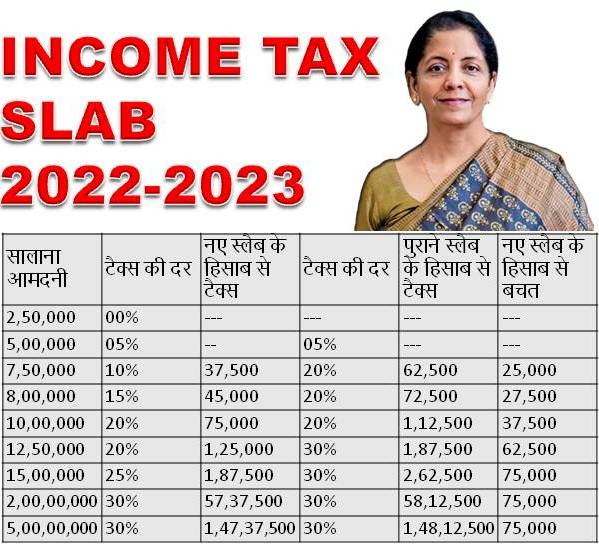

https://www.wecanspirit.com/wp-content/uploads/2022/02/Income-Tax-Slab-for-AY-2022-23.jpg

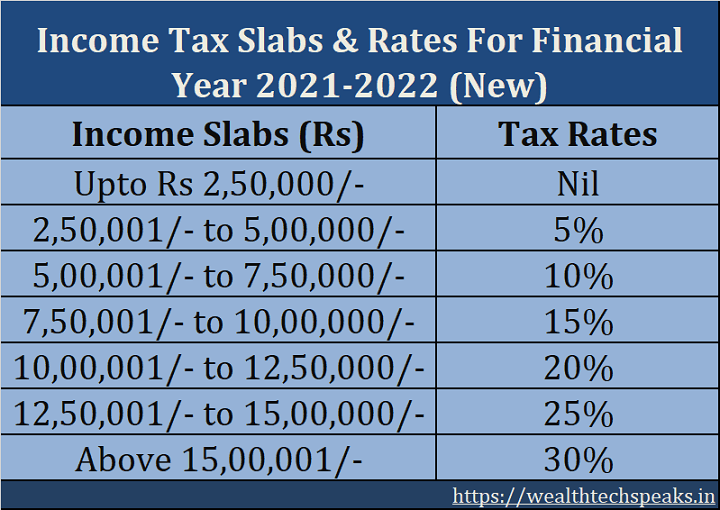

Income Tax Slab Rate For FY 2021 2022 AY 2022 23 Paytm Blog

https://paytm.com/blog/wp-content/uploads/2022/04/1_Income-Tax_Income-Tax-Slab-Rate-for-FY-2021-2022-and-AY-2022-23.png

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

You re eligible to claim the 87A rebate on your gross tax liability before cess and arrive at the net tax liability In case your total income is below 5 lakhs the maximum rebate under section 87A for the AY 2020 21 i e Rebate u s 87 A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less This Rebate is available in both tax regimes

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime The Income and Tax Calculator service enables both registered and unregistered e Filing users to calculate tax as per the provisions of Income Tax Act Income tax rules Notifications etc by providing inputs with respect to income s

Download Rebate On Income Tax For Ay 2022 23

More picture related to Rebate On Income Tax For Ay 2022 23

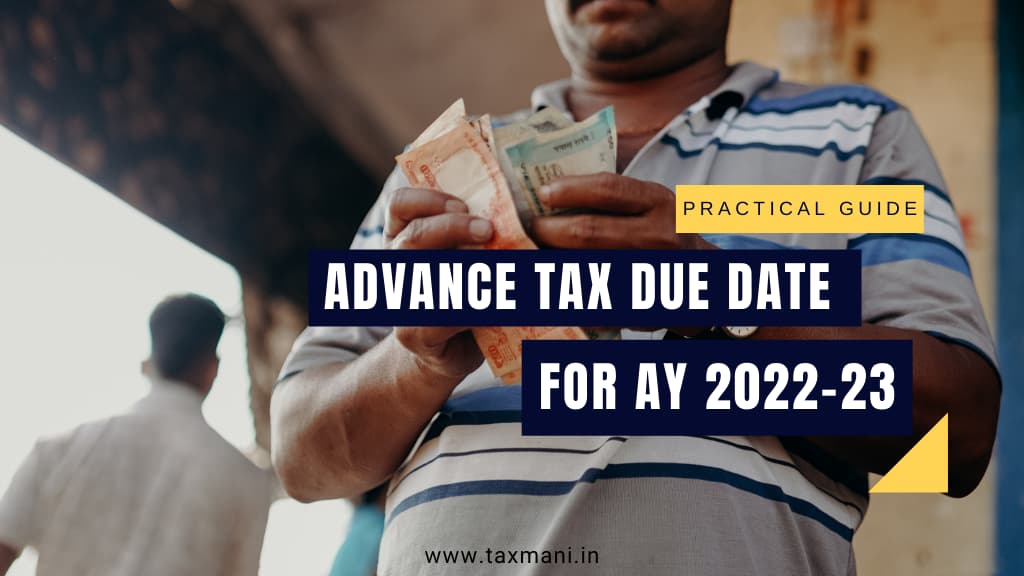

Advance Tax Due Date For FY 2022 23 AY 2023 24

https://www.taxmani.in/wp-content/uploads/2022/02/advance-tax-due-date-ay-2022-23.jpg

INCOME TAX RETURN E FILING AY 2022 23 FY 2021 22 LATEST VERSON 2 0

https://i.ytimg.com/vi/cAuUm6bIJ4k/maxresdefault.jpg

Income Tax Slab Rate 2022 23 Slab Rate For AY 2023 24 FY 2022 23

https://i.ytimg.com/vi/7RCj5lyMAjc/maxresdefault.jpg

a For Assessment Year 2023 24 a resident individual whose net income does not exceed Rs 5 00 000 can avail rebate under section 87A It is deductible from income tax before calculating education cess The amount of How to claim an income tax refund after the due date An income tax refund can be claimed only when you file ITR However if you skip the due date for filing ITR you can file

Section 115BAC the new tax regime system came into force from FY 2020 21 AY 2021 22 The new tax regime introduced concessional tax rates with reduced deductions The new income tax regime which will be effective from FY 2023 24 AY 2024 25 has changed the rebate amount under Section 87A Under this regime if you are a resident individual

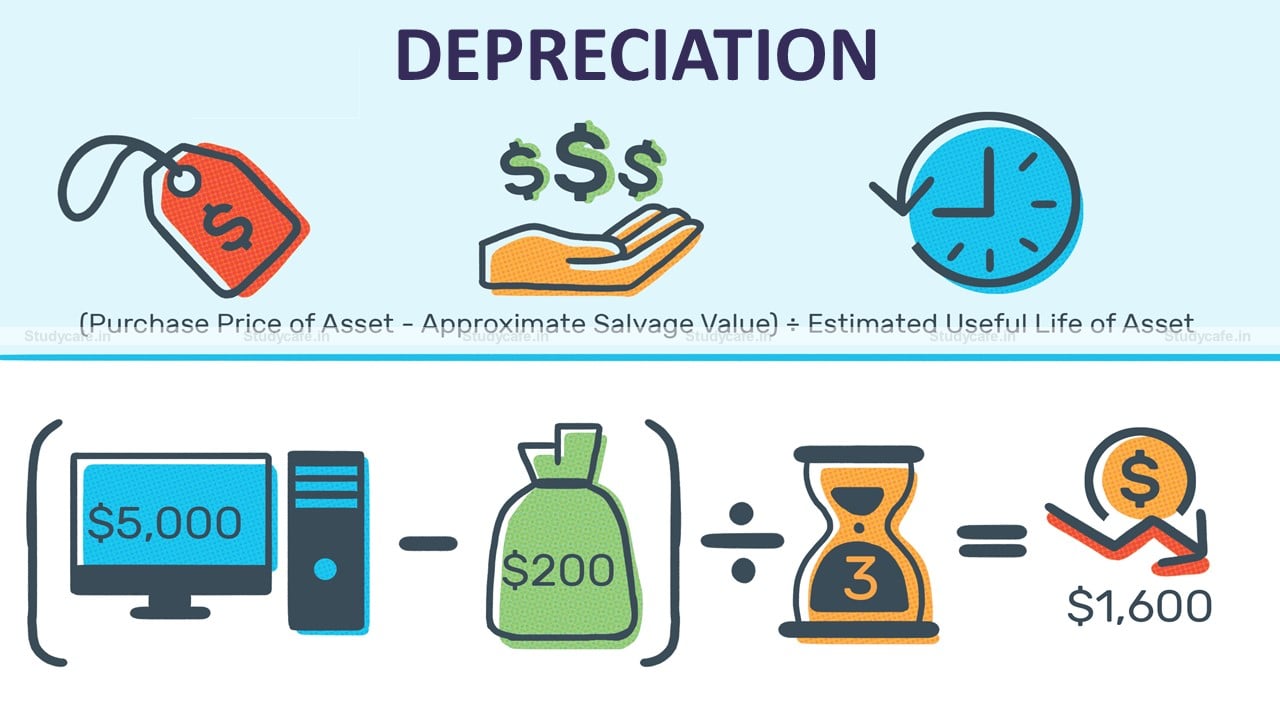

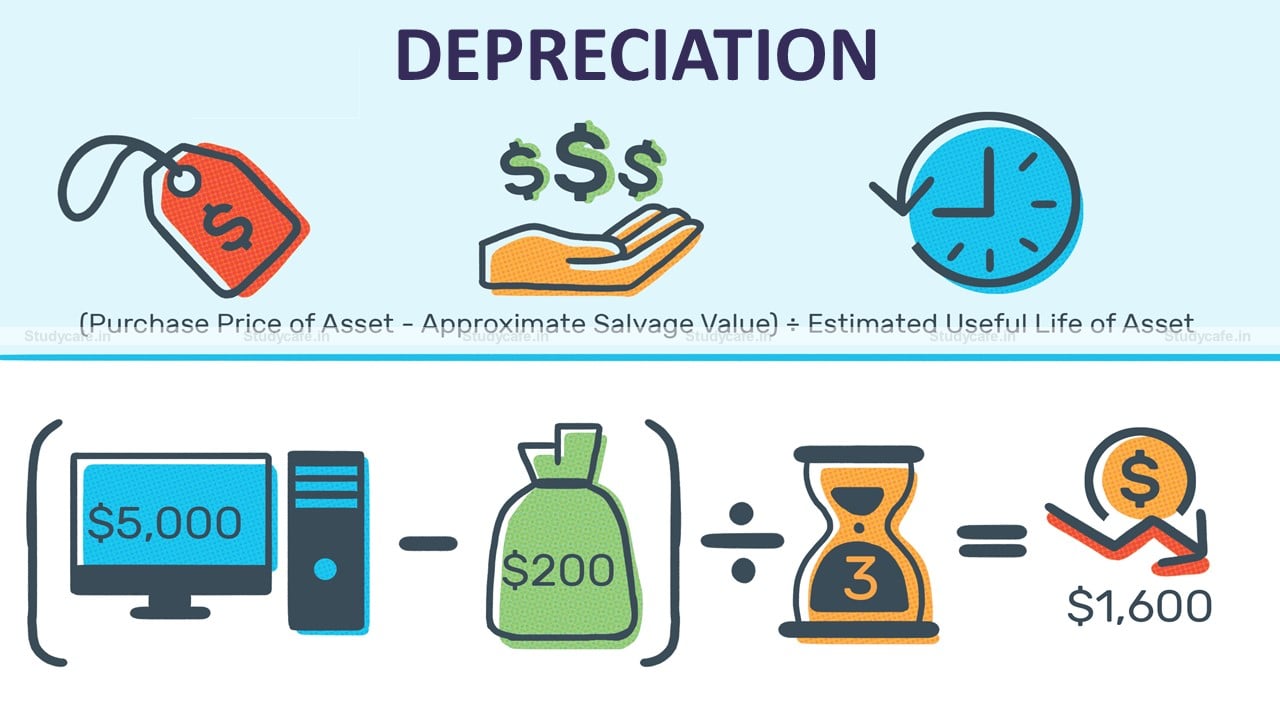

Rates Of Depreciation For Income Tax For AY 2022 23

https://studycafe.in/wp-content/uploads/2021/05/Depreciation.jpg

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax

https://i.ytimg.com/vi/Ib9IdrMgw84/maxresdefault.jpg

https://taxconcept.net › income-tax

A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if

https://tax2win.in › guide

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

Rates Of Depreciation For Income Tax For AY 2022 23

Income Tax Return Know Why Taxpayers Shouldn t File ITR For FY 2021 22

Revised Income Tax Audit Limit For AY 2022 23 New Tax Route

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

Income Tax Slabs For Senior Citizens FY 2022 23 AY 2023 24

Income Tax Rates For Fy 2021 22 Ay 2022 23 Fy 2022 23 Ay 2023 Mobile

New Income Tax Slabs Fy 2023 24 Ay 2024 25 2022 23 Rates For

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

Rebate On Income Tax For Ay 2022 23 - Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime