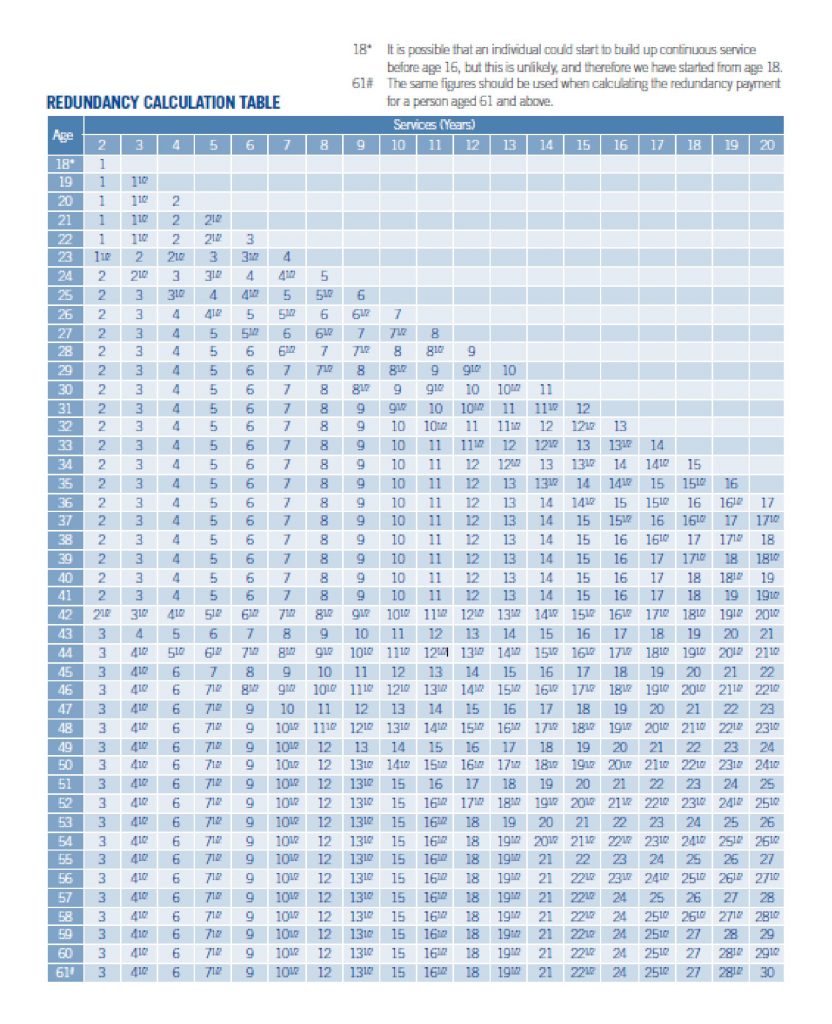

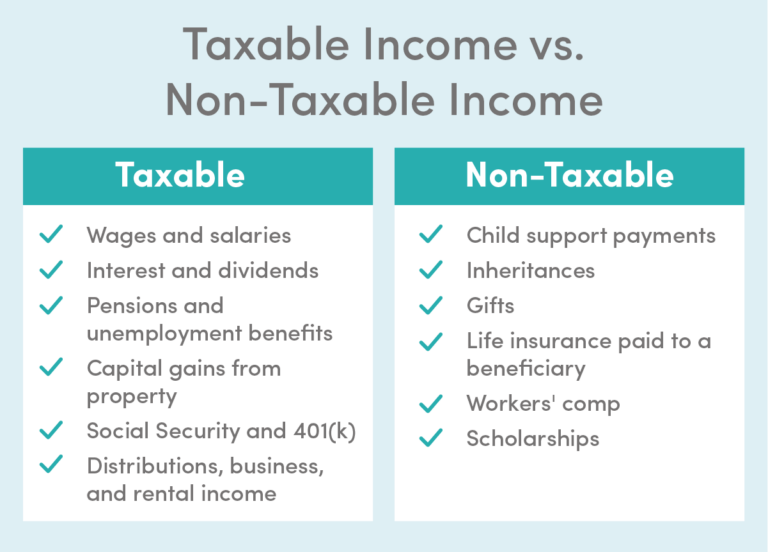

Redundancy Tax Benefits Verkko Your redundancy pay is tax free up to 163 30 000 But if your redundancy money includes holiday pay or pay in lieu of notice you ll have to pay tax on that part as you would on

Verkko 14 kes 228 k 2023 nbsp 0183 32 Any payments that meet the conditions of a genuine redundancy are tax free up to a limit depending on your years of service with your employer The tax Verkko 6 huhtik 2023 nbsp 0183 32 There are some special tax rules that apply to redundancy payments payments or benefits made in connection with the termination of employment for example an ex gratia payment to

Redundancy Tax Benefits

Redundancy Tax Benefits

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

Opportunity Knocks IRS Clarifies Tax Benefits To Investing In Low

https://www.apriem.com/wp-content/uploads/2017/05/BenjaminLau040.jpg

An Employee s Guide To Redundancy Neate Pugh

https://www.neateandpugh.com/wp-content/uploads/2022/03/redundancy-individual-1024x1024.png

Verkko 12 huhtik 2023 nbsp 0183 32 You ll receive your redundancy pay as a lump sum and up to 163 30 000 is generally tax free so you wouldn t owe any income tax or National Insurance contributions NICs It s mandatory for Verkko 30th September 2021 06 26 PDT By Kevin Peachey Personal finance reporter Getty Images As the government s furlough scheme ends some employers may decide

Verkko 30 syysk 2021 nbsp 0183 32 What is changing after furlough How many people could lose their jobs Can your employer make you redundant on the spot No The amount of notice Verkko 30 jouluk 2020 nbsp 0183 32 Experts say it can be tax efficient to have a redundancy payout paid into a pension scheme instead of handed over as cash Up to 163 30 000 of a payment

Download Redundancy Tax Benefits

More picture related to Redundancy Tax Benefits

Termination Pay Redundancy CooperAitken Chartered Accountants

http://www.cooperaitken.co.nz/wp-content/webpc-passthru.php?src=https://www.cooperaitken.co.nz/wp-content/uploads/2020/08/Redundancy.png&nocache=1

F rmula De Los Ingresos Gravables Aprenda M s FinancePal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

A Lucrative Tax Break For Manufacturers The Domestic Production

https://blog.concannonmiller.com/hubfs/mfg emblem-TAX BENEFITS copy.png#keepProtocol

Verkko 9 kes 228 k 2021 nbsp 0183 32 Full tax exemption is given for gratuities received for the following reasons Due to ill health based on IRB s discretion On or after reaching age 55 or Verkko 7 lokak 2020 nbsp 0183 32 The taxable part of the redundancy package will obviously boost earnings and the potential for a large pension contribution The 163 30 000 tax free part

Verkko any redundancy pay you re owed or you ve been told when you ll get it any pay in lieu if you re not working your full notice any holiday pay you re entitled to any Verkko 1 jouluk 2023 nbsp 0183 32 One easy way to pay less tax on severance pay is to contribute the money to a tax deferred account such as an individual retirement account IRA The

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

How To Calculate Your Statutory Redundancy Pay Business Tips YouTube

https://i.ytimg.com/vi/YVQNoJvJlu4/maxresdefault.jpg

https://www.moneyhelper.org.uk/en/work/losing-your-job/claiming-your...

Verkko Your redundancy pay is tax free up to 163 30 000 But if your redundancy money includes holiday pay or pay in lieu of notice you ll have to pay tax on that part as you would on

https://www.ato.gov.au/.../leaving-your-job/redundancy-payments

Verkko 14 kes 228 k 2023 nbsp 0183 32 Any payments that meet the conditions of a genuine redundancy are tax free up to a limit depending on your years of service with your employer The tax

Redundancy Payment What To Do With It

Tax Accounting Services Lee s Tax Service

Redundancy Advice For Employers DavidsonMorris

Tax On Redundancy Payments Davis Grant

Tax Series Part 1 Tax Benefits Of LLCs How To Use A LLC To Save

Tax On Redundancy Payments TaxAssist Accountants

Tax On Redundancy Payments TaxAssist Accountants

What Tax Do I Pay On Redundancy Payments Accounting Firms

Top 5 Tax Benefits In Real Estate Investing In 2023 Investing Real

The Trials And Tribulations Of Surviving Redundancy

Redundancy Tax Benefits - Verkko 30 syysk 2021 nbsp 0183 32 What is changing after furlough How many people could lose their jobs Can your employer make you redundant on the spot No The amount of notice