Refund Of Income Tax Interest Verkko 2 syysk 2017 nbsp 0183 32 Interest is paid on refunds of tax withheld at source in accordance with section 11 4 of the Act on the Taxation of Nonresidents Income Non residents and

Verkko 24 toukok 2018 nbsp 0183 32 The taxpayer has to wait for some days after filing the income tax return to receive an income tax refund The assessee will receive interest on the Verkko 28 jouluk 2023 nbsp 0183 32 When the taxpayer is eligible to get a refund for paying extra taxes in the form of advance tax self assessment tax and TDS the interest on such an

Refund Of Income Tax Interest

Refund Of Income Tax Interest

https://img.etimg.com/thumb/msid-65355989,width-1070,height-580,imgsize-94405,overlay-etwealth/photo.jpg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

IRS To Send Tax Refund Interest Checks To Taxpayers Who Filed On Time

https://1622179098.rsc.cdn77.org/data/images/full/134273/tax-refund-interest.jpg

Verkko However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your income tax refund is eligible for interest Verkko 9 kes 228 k 2022 nbsp 0183 32 Basic provisions When the tax paid by the taxpayer could be in the form of advance tax or tax deducted collected at source or self assessment tax or payment of tax on regular assessment is

Verkko 4 toukok 2023 nbsp 0183 32 We stop paying interest on overpayments on the date we refund your overpayment and interest or offset it to an outstanding liability Exception We have Verkko 30 marrask 2022 nbsp 0183 32 Key Points If you re waiting for a tax refund it may be accruing interest and the rate jumps to 7 from 6 in January The IRS adds interest if it

Download Refund Of Income Tax Interest

More picture related to Refund Of Income Tax Interest

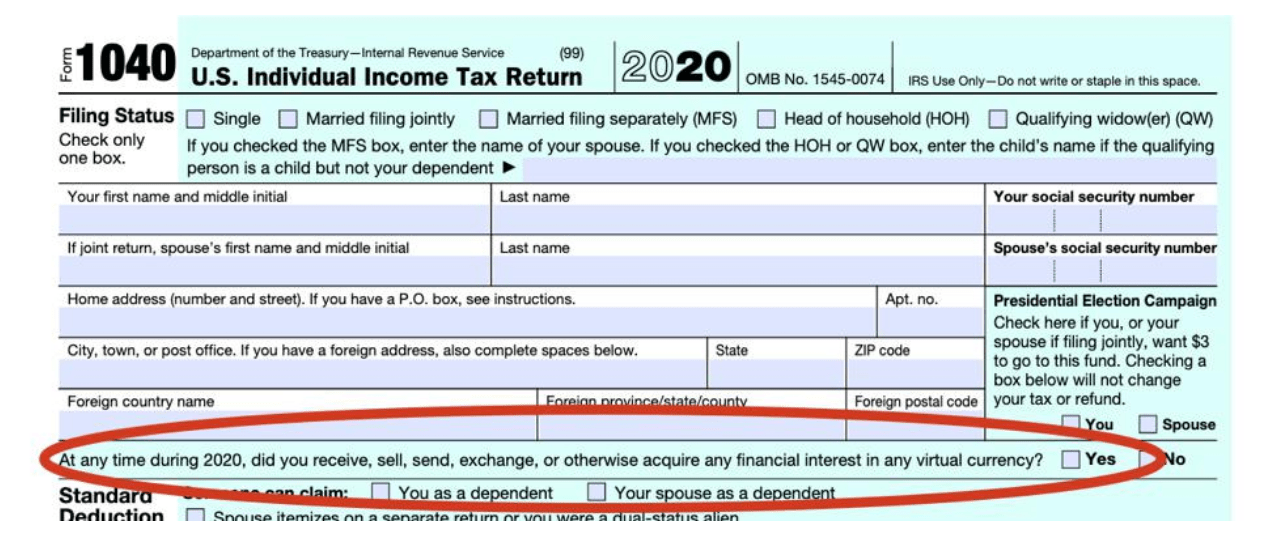

Irs Releases Form 1040 For 2020 Tax Year Free Download Nude Photo Gallery

https://www.taxgirl.com/wp-content/uploads/2021/01/Screen-Shot-2021-01-10-at-3.09.05-PM.png

Income Tax 20p Rate Will Form Part Of Review Guernsey Press

https://guernseypress.com/resizer/s4jAXy0imak1dcPMplbgeCoSUYM=/1200x0/cloudfront-us-east-1.images.arcpublishing.com/mna/ODNPXKST5ZGKTFV2BHWXRFB7VY.jpg

What Is The Tax Liability On The Income Of Partners Of LLP S

https://i.pinimg.com/originals/8f/cf/83/8fcf8316af47d1911442260b3f77e090.jpg

Verkko 16 kes 228 k 2023 nbsp 0183 32 When the CRA owes you a tax refund they must pay it to you by a specific deadline If you don t receive your tax refund by the deadline the CRA will pay you interest on the refund amount Tax Verkko 20 jouluk 2023 nbsp 0183 32 Income Tax Guidance Claim a refund of Income Tax deducted from savings and investments R40 English Cymraeg Apply for a repayment of tax on your

Verkko 24 kes 228 k 2023 nbsp 0183 32 If your income tax refund amount exceeds Rs 50 000 there may be a requirement to pay interest on the refund based on your tax liability It is crucial to Verkko 15 elok 2016 nbsp 0183 32 HMRC interest rates are set in legislation and are linked to the Bank of England base rate There are 2 rates late payment interest set at base rate plus

ITR Refund Status How To Check Income Tax Refund Status The Economic

https://img.etimg.com/photo/msid-86750817/tax-refund-1.jpg

Journal Entry For Income Tax GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/uploads/20220513152536/IncomeTaxSol.PNG

https://www.vero.fi/en/detailed-guidance/guidance/48518/interest-to …

Verkko 2 syysk 2017 nbsp 0183 32 Interest is paid on refunds of tax withheld at source in accordance with section 11 4 of the Act on the Taxation of Nonresidents Income Non residents and

https://cleartax.in/s/interest-on-income-tax-refund

Verkko 24 toukok 2018 nbsp 0183 32 The taxpayer has to wait for some days after filing the income tax return to receive an income tax refund The assessee will receive interest on the

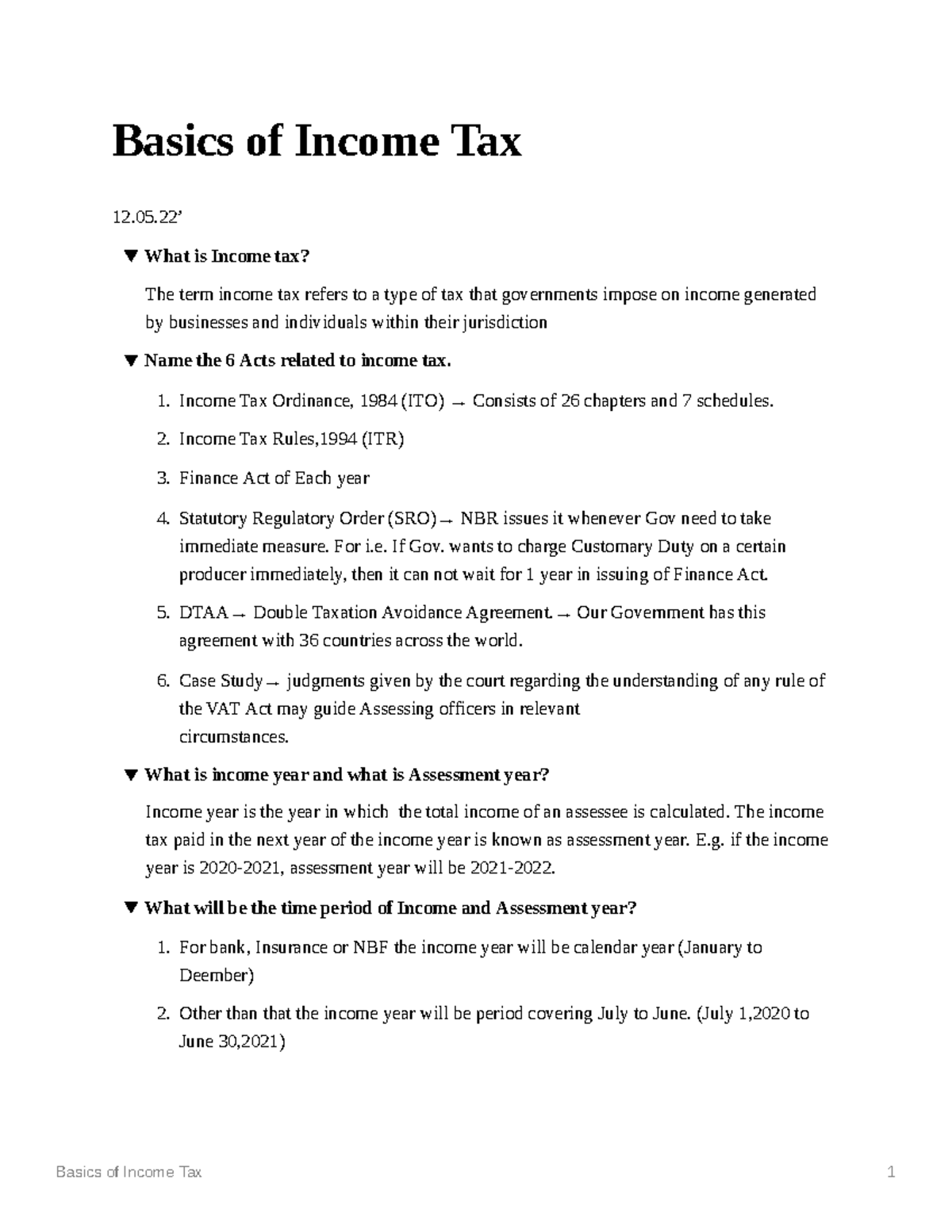

Basics Of Income Tax Basics Of Income Tax 12 What Is Income Tax The

ITR Refund Status How To Check Income Tax Refund Status The Economic

If You Have Not Yet Received An Income Tax Refund Check Your Refund

NY Sends Tiny Checks To Pay Interest On Last Year s Tax Refund

IDR 2020 Interest Rates Standard Deductions And Income Tax Brackets

Average Tax Refund In Every U S State Vivid Maps

Average Tax Refund In Every U S State Vivid Maps

RECOVERY REFUND OF INCOME TAX LECTURE 15 Deduction Of Tax From

Tax Refund Tax Refund Journal Entry

What Does Code 570 And 971 Mean On My IRS Tax Transcript And Will It

Refund Of Income Tax Interest - Verkko However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your income tax refund is eligible for interest