Refund Of Income Tax Application for refund of Finnish withholding tax individual 6164e 6167e and 6166e If the payer withheld too much tax at source on income from a Finnish source on dividends wages or other type of income or if the payer withheld tax when it was not due use the forms below to ask for refund Send the form back to the address printed

Use this tool to check your refund Your refund status will appear around 24 hours after you e file a current year return 3 or 4 days after you e file a prior year return 4 weeks after you file a paper return E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103 0025 or 1800 419 0025

Refund Of Income Tax

Refund Of Income Tax

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

Income Tax Refund Reissue Refund Not Received IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2018/08/Income-Tax-Refund-Reissue.jpg

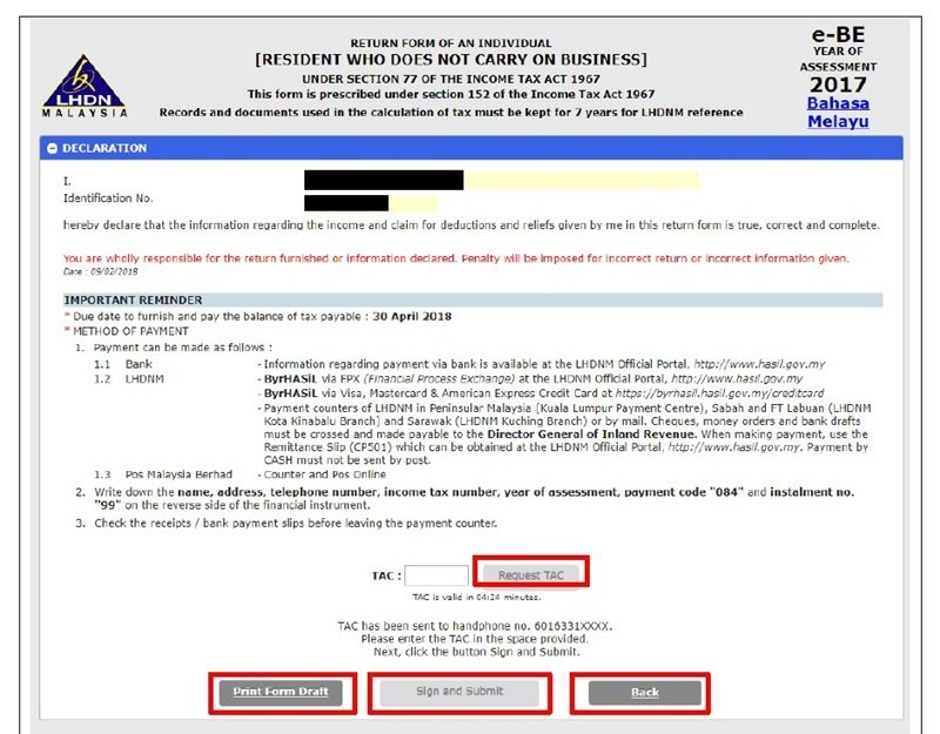

Income Tax Acknowledgement Download Renolo

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Ending-Income-Tax.png

Taxpayers can view status of refund 10 days after their refund has been sent by the Assessing Officer to the Refund Banker Other Refunds Status of paid refund being paid other than through Refund Banker can also be viewed at www tin nsdl by entering the PAN and Assessment Year Income tax returns for 2023 Overview of income in the e MTA Refund and additional payment of income tax Tax rates Tax return forms and instructions Tax incentives Calculation of basic exemption Housing loan interest Training expenses Gifts and donations Basic exemption at pensionable age Contributions to the supplementary

8 min read With the last few days to go for ITR filing many people are facing these bank validation errors Restricted Refund PAN Bank account IFSC linkage failed Validation in Progress not eligible for refund To resolve these validation errors on the income tax portal read on What is Restricted Refund On Income Tax Portal Overview Income tax refund means a refund amount that is initiated by the income tax department if the amount paid in taxes exceeds the actual amount due either by way of TDS or TCS or Advance Tax or Self Assessment Tax

Download Refund Of Income Tax

More picture related to Refund Of Income Tax

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

RECOVERY REFUND OF INCOME TAX LECTURE 15 Deduction Of Tax From

https://i.ytimg.com/vi/XlDP8hQ0DAk/maxresdefault.jpg

Early Access To Your Income Tax Refund Debt ca

https://www.debt.ca/wp-content/uploads/2023/02/Income-Tax-Refund.jpg

An official website of the United States Government Here s how you know Step 1 Visit the income tax portal and log in to your account Step 2 Click on e File choose Income Tax Returns and then select View Filed Returns Step 3 You can see the status of your current and past income tax returns Step 4 Click on View details and you ll see the status of your income tax refund like in the picture below

Explore options for getting your federal tax refund how to check your refund status how to adjust next year s refund and how to resolve refund problems Updated on Jan 12th 2022 4 min read This article will help you understand Taxability of Interest on Income Tax Refund When a taxpayer has paid an excessive tax than what he is liable to pay the assessee is eligible to claim excess tax paid as a refund

If You Have Not Yet Received An Income Tax Refund Check Your Refund

https://1.bp.blogspot.com/-rHWVY-ErZt0/X0ORRIZIibI/AAAAAAAABz4/wbvB_FyYDJcCxTcCPpd6qEU7tyuUEmRMgCNcBGAsYHQ/s1600/image1598172898_1598184093.png

Being Called Beautiful Quotes

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/statutory-income-income-tax.png

https://www.vero.fi/en/About-us/contact-us/forms/...

Application for refund of Finnish withholding tax individual 6164e 6167e and 6166e If the payer withheld too much tax at source on income from a Finnish source on dividends wages or other type of income or if the payer withheld tax when it was not due use the forms below to ask for refund Send the form back to the address printed

https://www.irs.gov/wheres-my-refund

Use this tool to check your refund Your refund status will appear around 24 hours after you e file a current year return 3 or 4 days after you e file a prior year return 4 weeks after you file a paper return

How To Check Your Income Tax Refund Status In Few Easy Steps YouTube

If You Have Not Yet Received An Income Tax Refund Check Your Refund

Step To Check Income Tax Refund Status Reasons For Delay Chandan

Income Tax Refund Income Tax Department Reimbursed Rs 45 89 Crore

ITR Refund Status How To Check Income Tax Refund Status The Economic

Journal Entry For Income Tax GeeksforGeeks

Journal Entry For Income Tax GeeksforGeeks

Everything You Know About Getting A Tax Refund Is Wrong AOL Finance

How Your Tax Refund Can Improve Your Credit

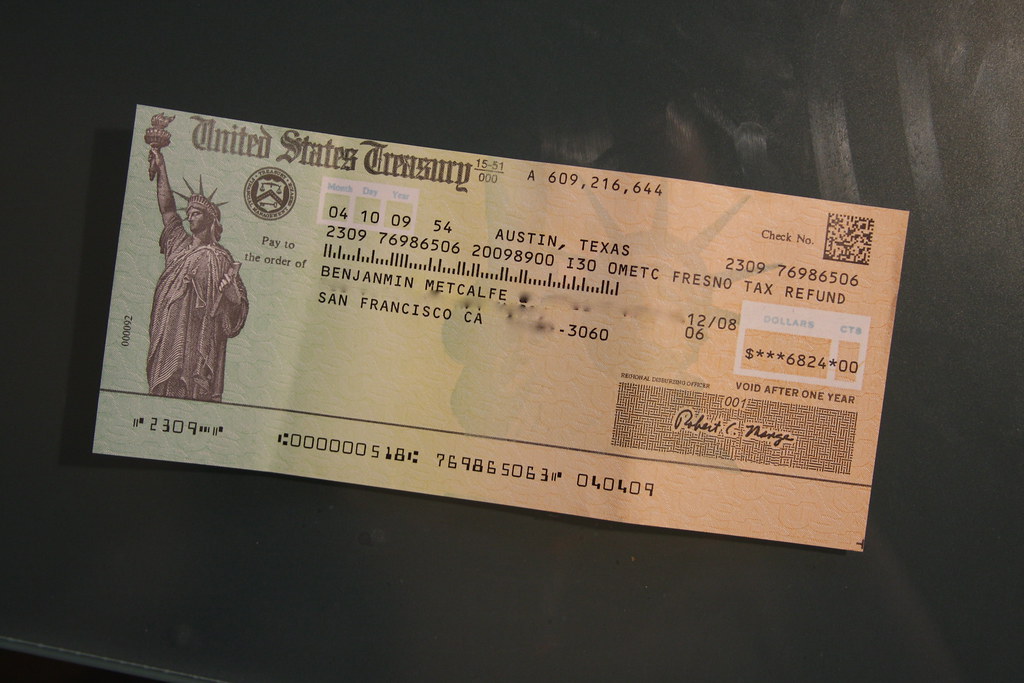

Tax Refund Check Wow The US Treasury Opened Up It s Vice Flickr

Refund Of Income Tax - Please reach out to IRAS to claim them Modes of Tax refunds You can receive faster tax refunds within 7 days from the date the credit arises if you are paying your taxes via GIRO or have signed up for PayNow NRIC FIN UEN Expand all