Refundable Income Tax Rebate Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 31 mai 2023 nbsp 0183 32 Refundable tax credits are called refundable because if you qualify for a refundable credit and the amount of the credit is larger than the tax you owe you will Web 17 ao 251 t 2022 nbsp 0183 32 If you did not receive one or more of your payments or the full amount due for example because the income on your taxes was too high and your lower income would have qualified you or because

Refundable Income Tax Rebate

Refundable Income Tax Rebate

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

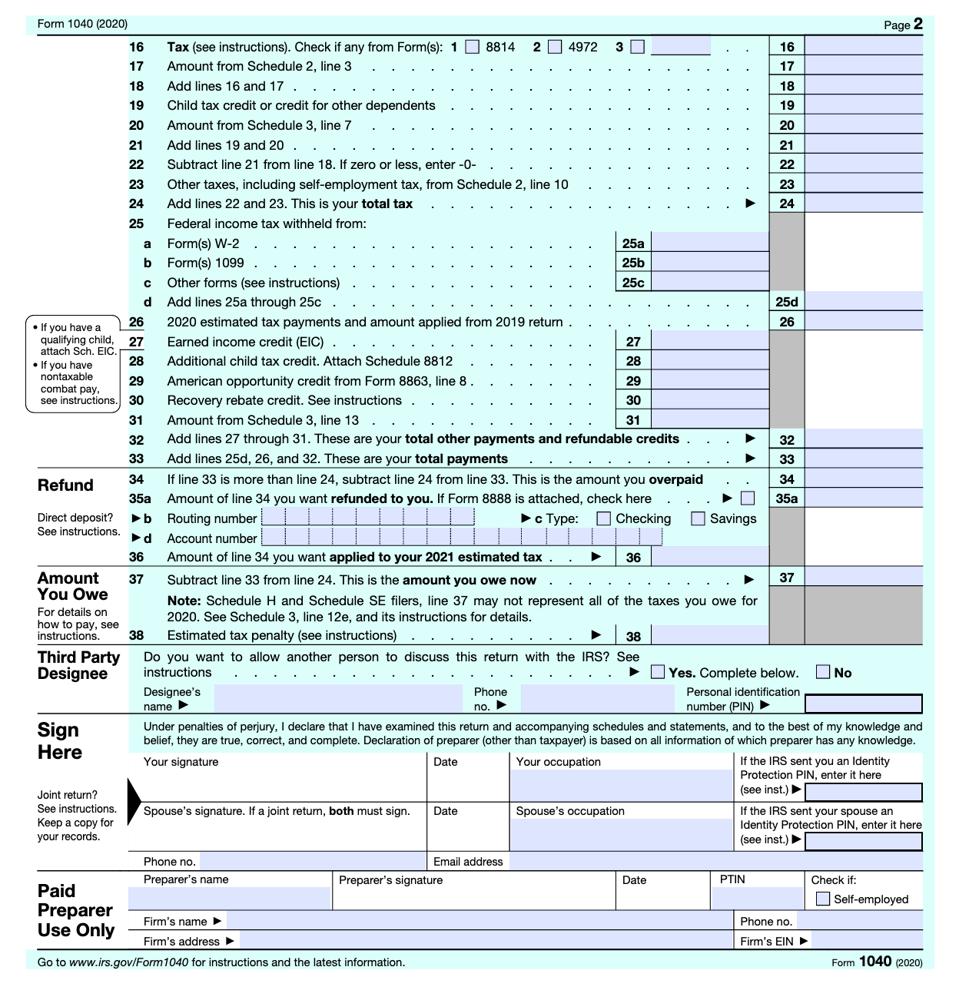

Form 1040 For 2020 P2

https://specials-images.forbesimg.com/imageserve/5fd3d26ac6323f845ed85872/960x0.jpg?fit=scale

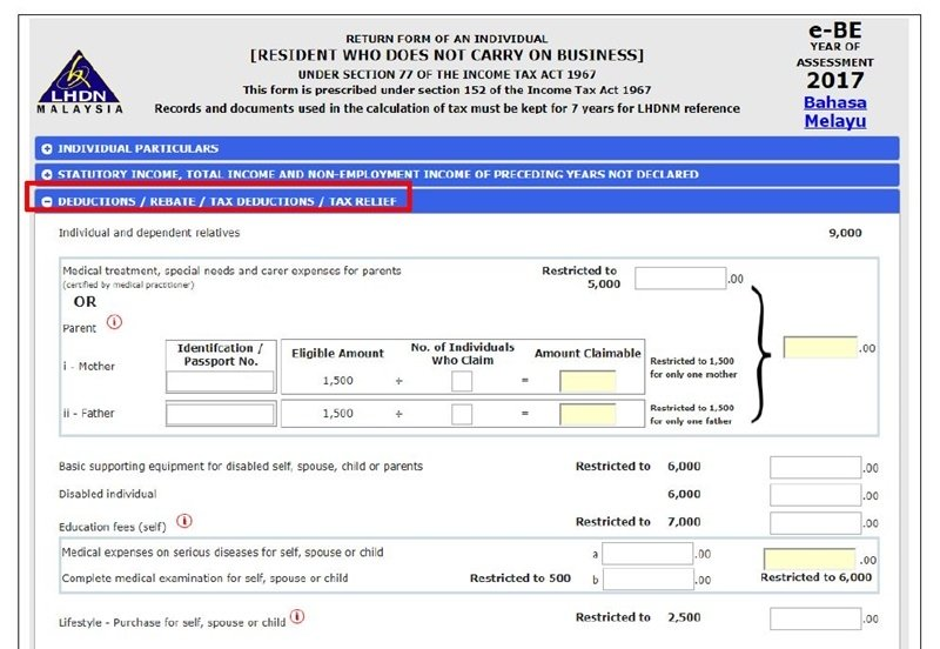

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web 7 janv 2022 nbsp 0183 32 For every 1 000 of income that exceeded the limit the CTC was reduced by 5 The 2021 CTC has a two part phase out The new income limits are 150 000 for Web 10 d 233 c 2021 nbsp 0183 32 If you didn t get the full first and second Economic Impact Payment you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return

Web 13 janv 2022 nbsp 0183 32 A1 You must file a 2021 tax return to claim a 2021 Recovery Rebate Credit even if you usually don t file a tax return See the 2021 Recovery Rebate Credit FAQs Web 10 janv 2021 nbsp 0183 32 For tax year 2020 the return you ll file in 2021 a new line has been added to the Form 1040 1040 SR for a Recovery Rebate Credit This is where taxpayers will indicate if they received stimulus

Download Refundable Income Tax Rebate

More picture related to Refundable Income Tax Rebate

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

https://www.eztaxreturn.com/blog/wp-content/uploads/2022/08/Screenshot-2022-08-29-at-17-11-37-2022-State-of-Illinois-Tax-Rebates.png

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

Web 27 f 233 vr 2023 nbsp 0183 32 The taxpayer is eligible for refundable tax credits which can reduce the amount of taxes owed below 0 In other words if the credit is larger than your tax bill you will receive a refund Web 15 janv 2021 nbsp 0183 32 Recovery Rebate Credit and other benefits IRS Free File is all taxpayers need to claim the Recovery Rebate Credit and other tax benefits such as the Earned

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

P55 Tax Rebate Form Business Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-h...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://turbotax.intuit.com/tax-tips/tax-deductions-and-credits/5...

Web 31 mai 2023 nbsp 0183 32 Refundable tax credits are called refundable because if you qualify for a refundable credit and the amount of the credit is larger than the tax you owe you will

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Georgia Income Tax Rebate 2023 Printable Rebate Form

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Rebate Astonishingceiyrs

Tax Rebate For Individual It Is The Refund Which An Individual Can

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Refundable Income Tax Rebate - Web 13 janv 2022 nbsp 0183 32 A1 You must file a 2021 tax return to claim a 2021 Recovery Rebate Credit even if you usually don t file a tax return See the 2021 Recovery Rebate Credit FAQs