Sales Tax Exemption South Dakota Sales to the State of South Dakota and South Dakota public or municipal corporations are exempt from sales tax The governments from other states or the District of Columbia are exempt from sales tax if the law in that state provides

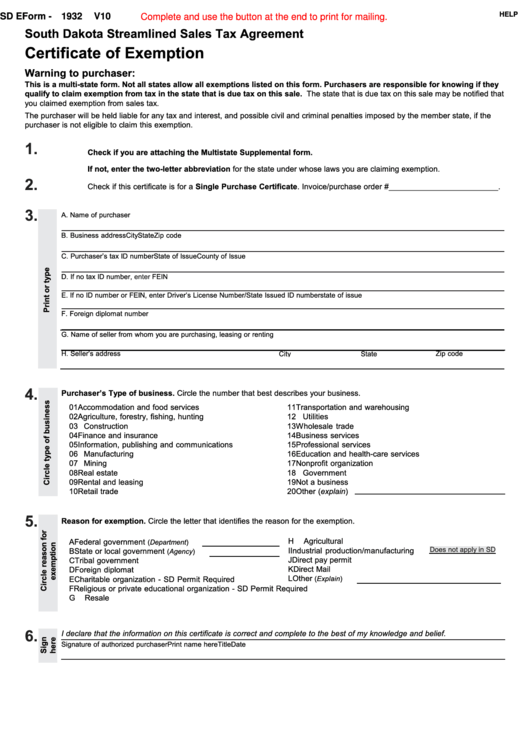

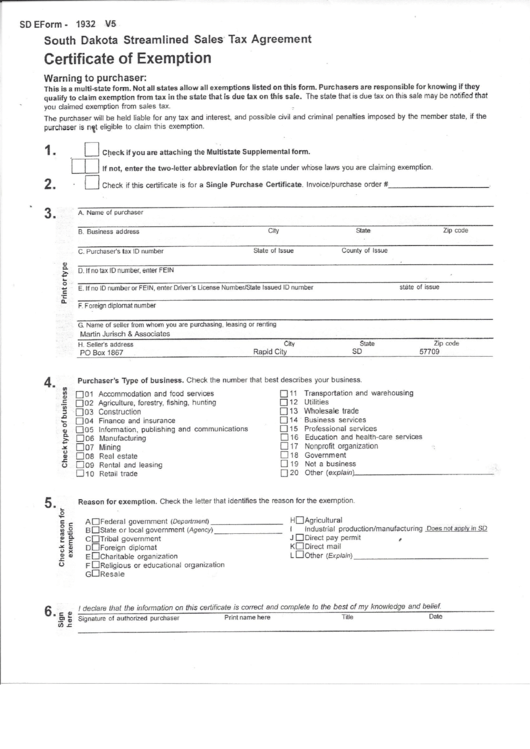

Remote sellers and marketplace providers who meet certain revenue thresholds must obtain a South Dakota sales tax license and pay applicable sales tax To see how this impacts a business visit the business section Sales Use Tax page This page explains how to make tax free purchases in South Dakota and lists two South Dakota sales tax exemption forms available for download

Sales Tax Exemption South Dakota

Sales Tax Exemption South Dakota

https://img.yumpu.com/45296656/1/500x640/south-dakota-tax-exemption-certificate-imprints-wholesale.jpg

How To Get A Certificate Of Exemption In South Dakota Step By Step

https://stepbystepbusiness.com/wp-content/uploads/2022/07/South-Dakota-Certificate-of-Exemption-1024x200.png

Growing Number Of State Sales Tax Jurisdictions Makes South Dakota V

https://files.taxfoundation.org/20180417094848/SalesTaxJurisdictions-Map.png

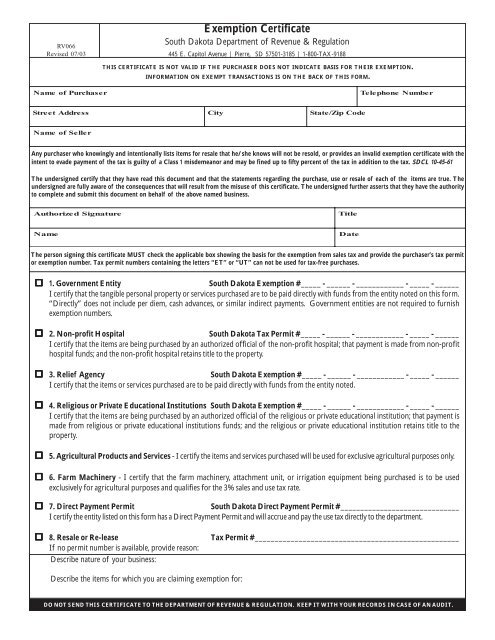

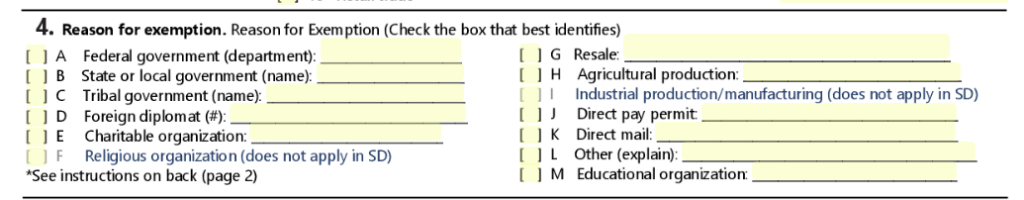

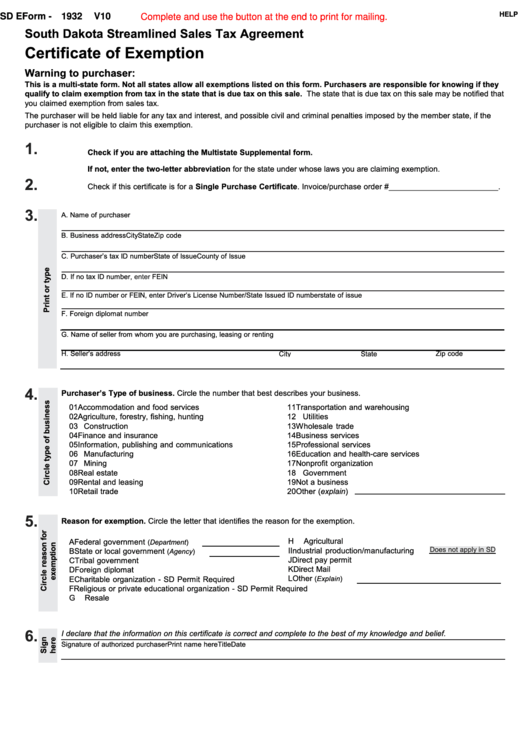

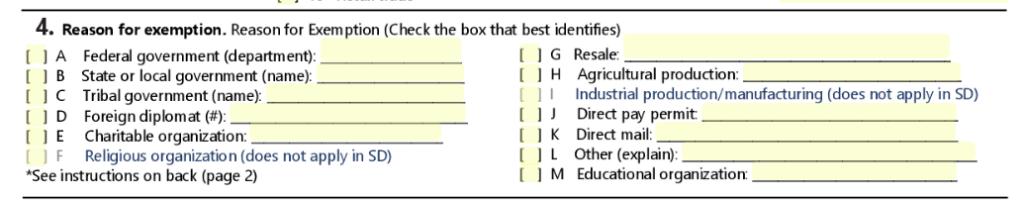

In South Dakota certain items may be exempt from the sales tax to all consumers not just tax exempt purchasers Several examples of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the South Dakota sales tax You can download a PDF of the South Dakota Streamlined Sales Tax Certificate of Exemption Form SST on this page

Yes there are certain entities exempt from paying sales tax on their purchases in South Dakota Here s a breakdown Government Agencies Federal state and local government agencies are generally exempt from paying sales tax on purchases made for official government business Some goods are exempt from sales tax under South Dakota law Examples include gasoline purchases made with food stamps and prescription drugs We recommend businesses review the laws and rules put forth by the South Dakota Department of Revenue to stay up to date on which goods are taxable and which are exempt and

Download Sales Tax Exemption South Dakota

More picture related to Sales Tax Exemption South Dakota

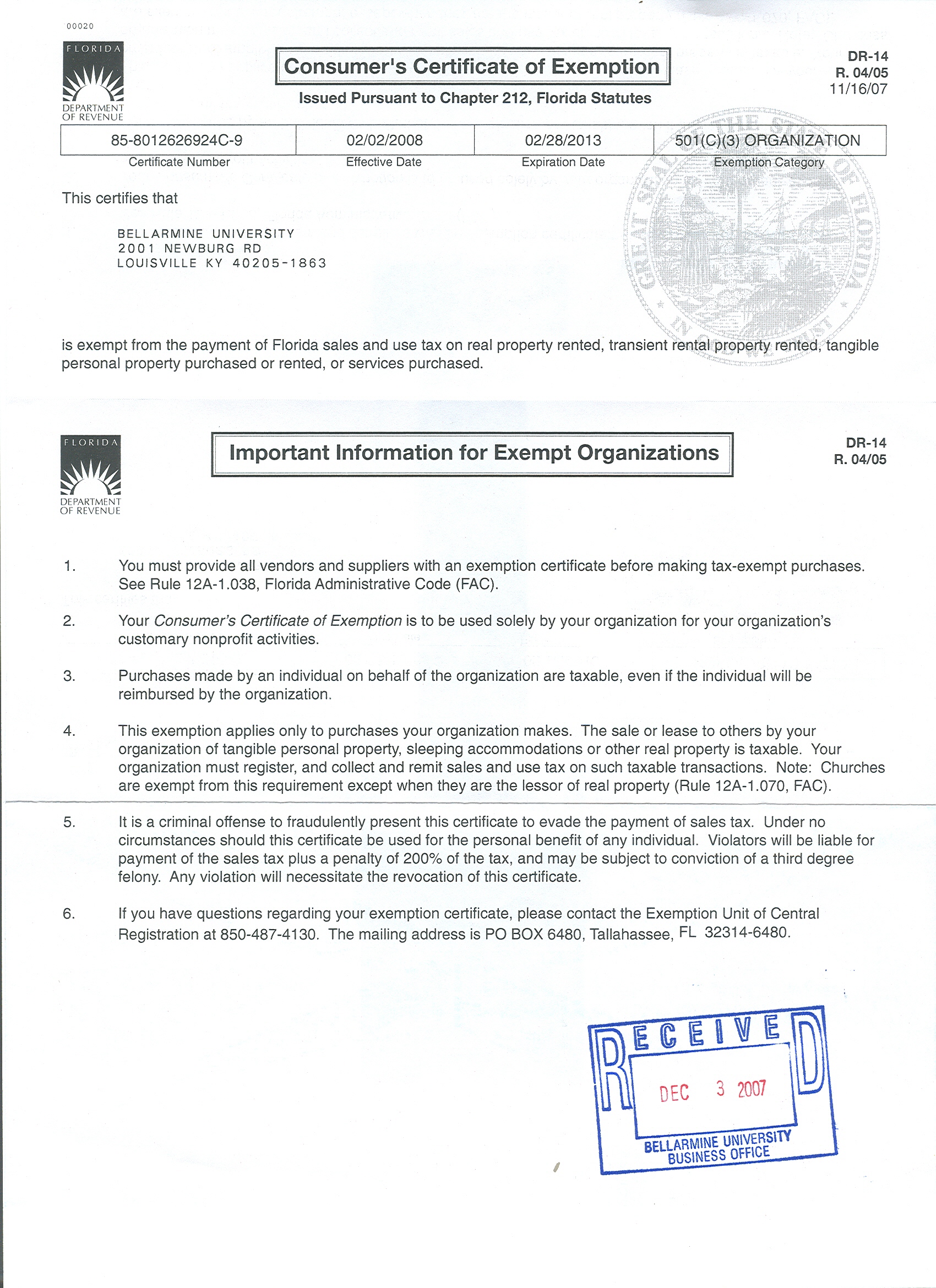

Printable Florida Sales Tax Exemption Certificates

http://www.salestaxhandbook.com/img/MTC_Thumbnail.jpg

Louisiana Hotel Tax Exempt Form 2020 Fill And Sign Printable Template

https://www.pdffiller.com/preview/11/44/11044398/large.png

Tax Exemptions

http://www.bellarmine.edu/images/Purchasing/FloridaCertificateofExemption.jpg

Use this form to claim exemption from sales tax on purchases of otherwise taxable items The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption We explain vital sales and use tax compliance obligations in South Dakota recent rate changes registration procedures tax return deadlines which goods and services are taxed or exempt record keeping recommendations available sales tax exemptions and more

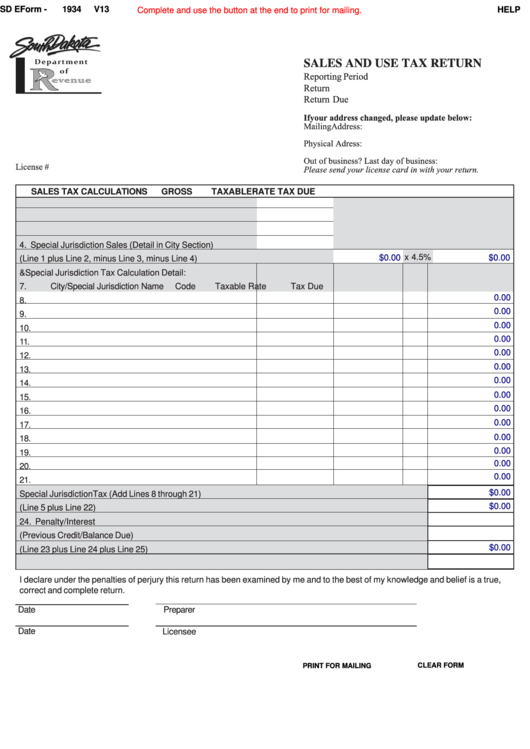

SDCL 10 45 10 exempts from sales tax the sale of products and services to the following governmental entities Government entities must provide an exemption certificate to the vendor or the vendor must keep documentation to show the purchase was paid from government funds 715 South Maple Watertown SD 57201 Yankton Office 1900 Summit Street Yankton SD 57078 4 July 2024 Sales and Use Tax Guide South Dakota Department of Revenue South Dakota does not have a corporate unitary or personal income tax however businesses may be subject to one or more of the following taxes

Sd Eform 1932 V10 South Dakota Streamlined Sales Tax Agreement

https://data.formsbank.com/pdf_docs_html/232/2321/232143/page_1_thumb_big.png

State And Local Public Finance Taxing Professional Services Beating

https://1.bp.blogspot.com/-FBZaqEQDH_o/UTeOM4UQVWI/AAAAAAAAAXI/-pdogFJD8xw/s1600/tax+map.png

https://dor.sd.gov/media/q0xpvden/exemption...

Sales to the State of South Dakota and South Dakota public or municipal corporations are exempt from sales tax The governments from other states or the District of Columbia are exempt from sales tax if the law in that state provides

https://dor.sd.gov/individuals/taxes/sales-use-tax

Remote sellers and marketplace providers who meet certain revenue thresholds must obtain a South Dakota sales tax license and pay applicable sales tax To see how this impacts a business visit the business section Sales Use Tax page

Printable South Dakota Sales Tax Exemption Certificates

Sd Eform 1932 V10 South Dakota Streamlined Sales Tax Agreement

A Complete Guide To Sales Tax Exemptions And Exemption Certificate

Free Printable Tax Exempt Product Form For Companies Printable Forms

Top 14 South Dakota Sales Tax Form Templates Free To Download In PDF Format

Irs Tax Exempt Charitable Organization Irs Tax Forms

Irs Tax Exempt Charitable Organization Irs Tax Forms

State Sales Tax Pa State Sales Tax License

Certificate Of Exemption South Dakota Streamlined Sales Tax Agreement

How To Get A Wisconsin Sales Tax Exemption Certificate Resale

Sales Tax Exemption South Dakota - A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the South Dakota sales tax You can download a PDF of the South Dakota Streamlined Sales Tax Certificate of Exemption Form SST on this page