Sc Fuel Tax Credit Form Use I 385 to claim a refundable Income Tax credit for the amount you paid during the tax year for the increase in motor fuel user fee or preventative maintenance costs The

Motor fuel income tax credit How to claim I 385 Make sure to use the form for the correct year Who is eligible South Carolina residents who purchased gas in South Carolina INSTRUCTIONS FOR I 385 MOTOR FUEL INCOME TAX CREDIT Rev 10 3 18 Purpose of Form I 385 Use form I 385 if you are a resident taxpayer claiming a

Sc Fuel Tax Credit Form

Sc Fuel Tax Credit Form

https://www.accountancygroup.com.au/wp-content/uploads/fuel-tax.jpg

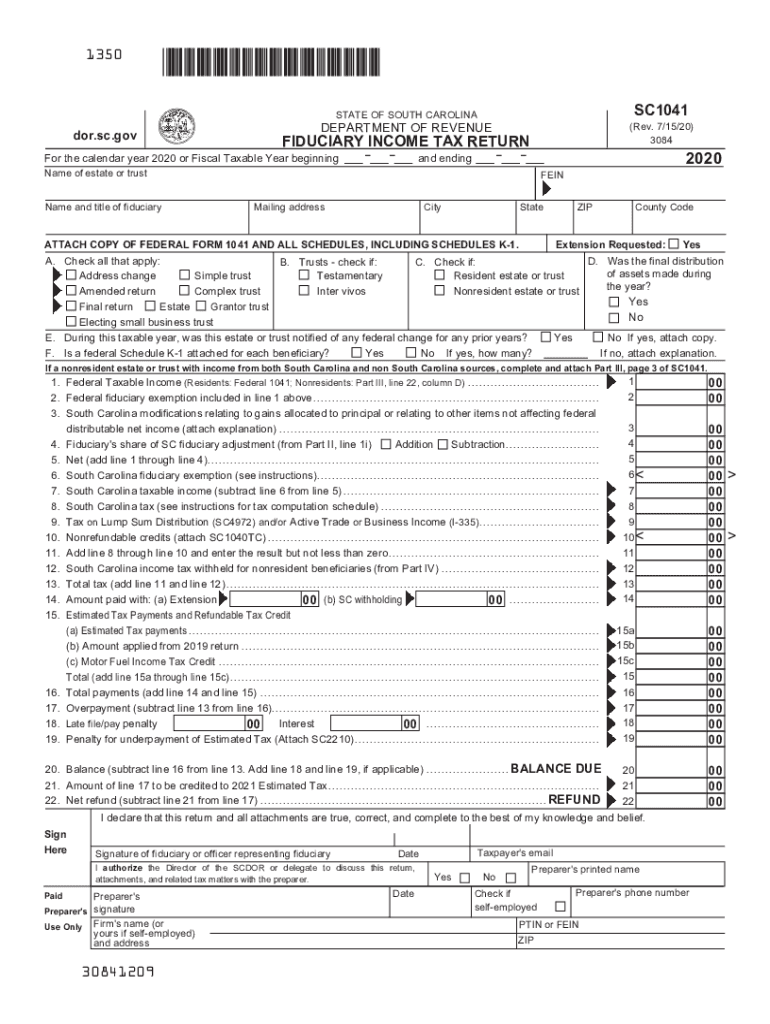

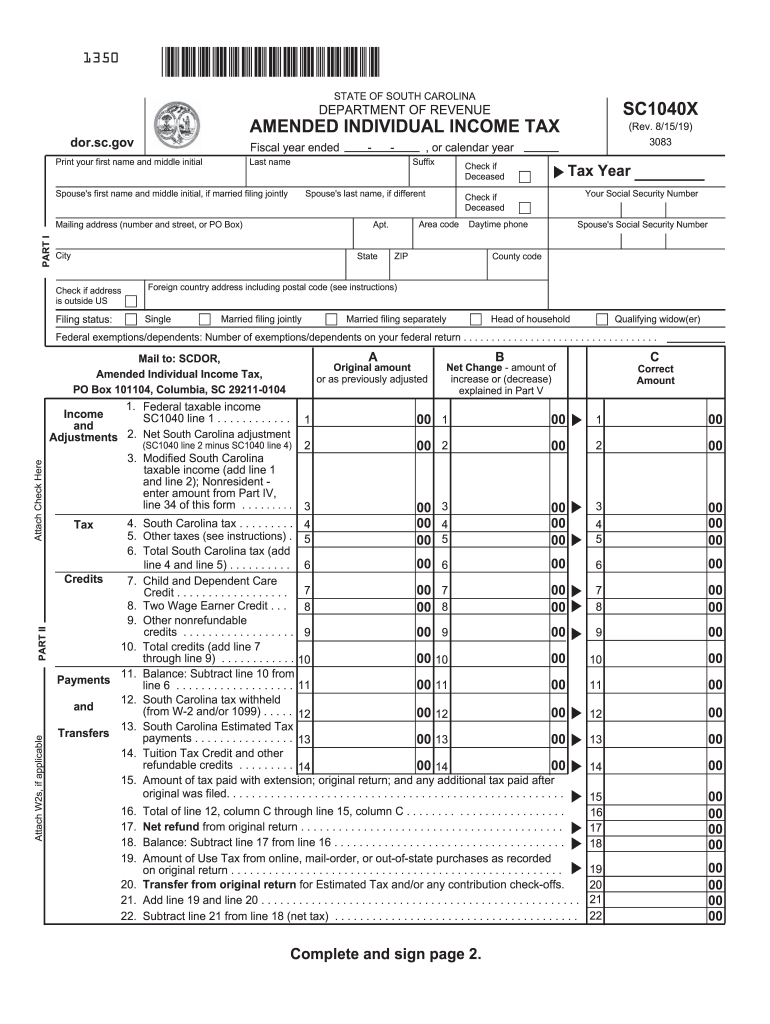

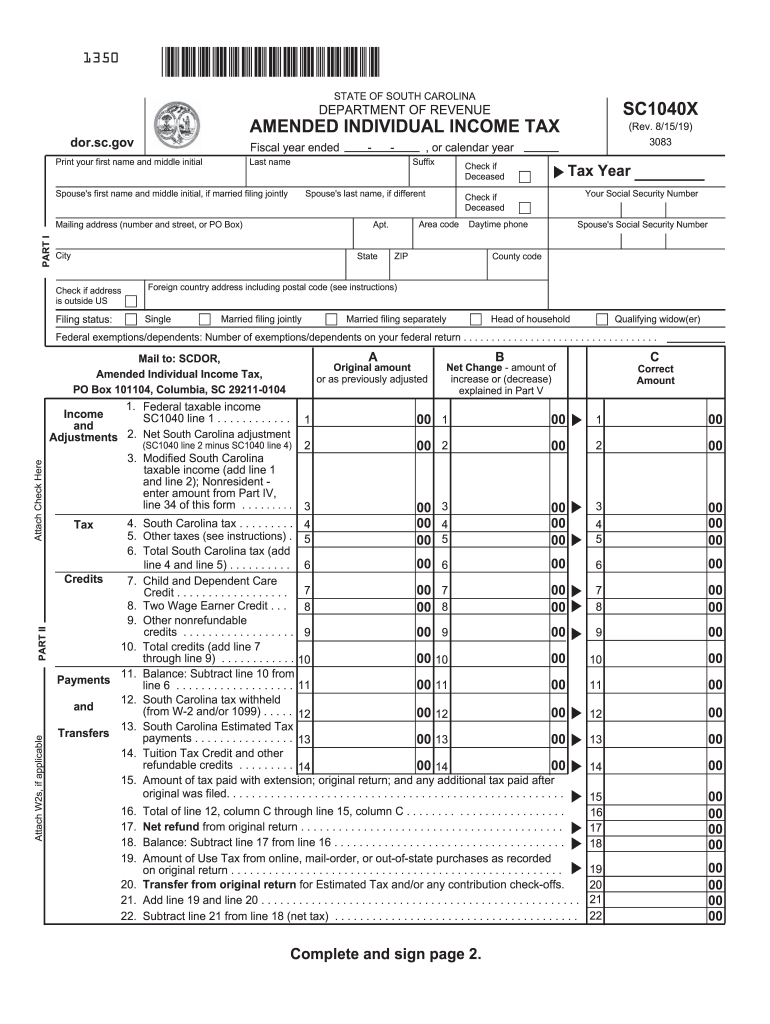

SC DoR SC1041 2020 2022 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/552/450/552450635/large.png

Fuel Tax Credit Are You Getting The Your FTC Tax Benefits

https://www.fleetistics.com/wp-content/uploads/2022/07/man-filling-gasoline-fuel-expecting-fuel-tax-credit.jpg

Forms Filing Requirements Lists Charts Refunds Exemptions eServices FAQ South Carolina Department of RevenueMotor Fuel PO Box 125 Columbia SC 29214 0845 Forms Filing Requirements Lists Charts Refunds Exemptions eServices FAQ South Carolina Department of RevenueMotor Fuel PO Box 125 Columbia SC 29214 0845

Each taxpayer can claim the credit for a maximum of two vehicles The form includes fields to provide vehicle information details of preventative maintenance costs South Carolina taxpayers can claim a credit to help offset the increase in the Motor Fuel User Fee The credit equals the lesser of the vehicle maintenance fees paid

Download Sc Fuel Tax Credit Form

More picture related to Sc Fuel Tax Credit Form

Helpful SC Fuel Tax Links MFLC

https://www.mflicensecenter.com/content/images/state-jurisdiction-SC.jpg

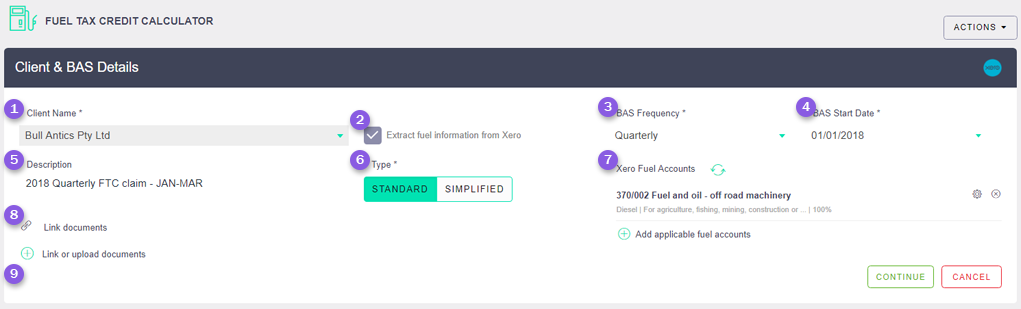

Fuel Tax Credit Calculation

https://i2.wp.com/atotaxrates.info/wp-content/uploads/2013/06/ftc-1aug2017.jpg

Common Cents SC Fuel Tax Is Funding Improvements Scfor

https://www.scfor.org/wp-content/uploads/2019/06/Copy-of-Copy-of-Untitled.png

When filing income tax returns claim the credit on the Motor Fuel Income Tax Credit I 385 form available at dor sc gov forms and included in many online filing products Continue saving receipts from With SC Gas Tax Credit App you can Automatically produce the information to file the Motor Fuel Income Credit Form I385 Easily document and track fuel purchases and

Download Printable Form I 385 In Pdf The Latest Version Applicable For 2024 Fill Out The Motor Fuel Income Tax Credit South The credit is calculated on South Carolina Form I 385 Motor Fuel Income Tax Credit This form must be included with the taxpayer s income tax return 3 What

Restoring The Fuel Tax Credit Survey

https://surveymonkey-assets.s3.amazonaws.com/survey/401326471/26ab5588-e395-468e-a44b-ea045dddcd0d.png

Helpful SC Fuel Tax Links MFLC

https://www.mflicensecenter.com/content/images/state-resources-SC.jpg

https://dor.sc.gov/forms-site/Forms/I385_2021.pdf

Use I 385 to claim a refundable Income Tax credit for the amount you paid during the tax year for the increase in motor fuel user fee or preventative maintenance costs The

https://dor.sc.gov/about/forms

Motor fuel income tax credit How to claim I 385 Make sure to use the form for the correct year Who is eligible South Carolina residents who purchased gas in South Carolina

SC s Fuel Tax Increases Two Cents Scfor

Restoring The Fuel Tax Credit Survey

Fillable Online Form N 163 Rev 2020 Fuel Tax Credit For Commercial

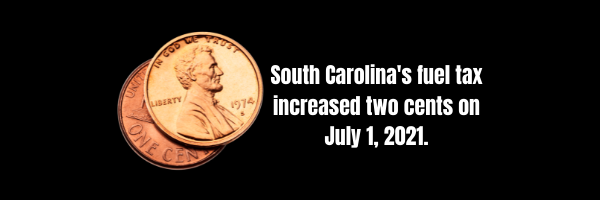

Fillable Form 4136 Printable Forms Free Online

Fuel Tax Credit UPDATED JUNE 2022

Short Form Fillable Federal Tax Forms Printable Forms Free Online

Short Form Fillable Federal Tax Forms Printable Forms Free Online

Don t Forget Claim Your NY State Clean Fuel Tax Credit Burt s Reliable

Common Cents SC Fuel Tax Is Funding Improvements Scfor

Fuel Tax Credit Calculator AccountKit Support Center

Sc Fuel Tax Credit Form - Each taxpayer can claim the credit for a maximum of two vehicles The form includes fields to provide vehicle information details of preventative maintenance costs