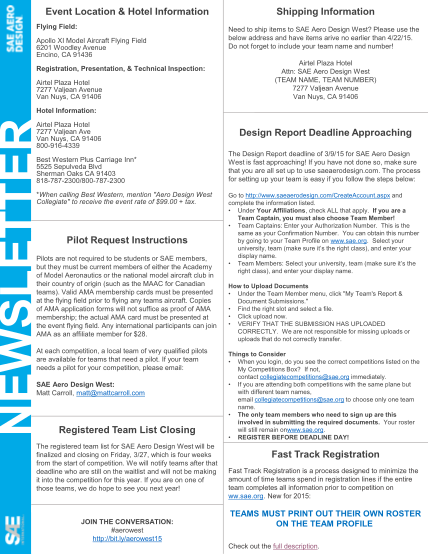

What Is Credit For Federal Tax On Fuels Verkko 19 lokak 2023 nbsp 0183 32 The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are untaxed

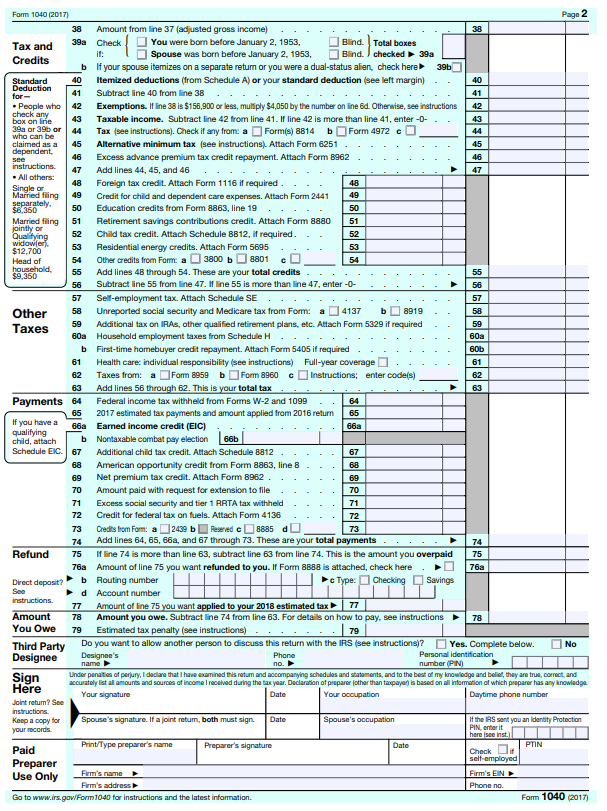

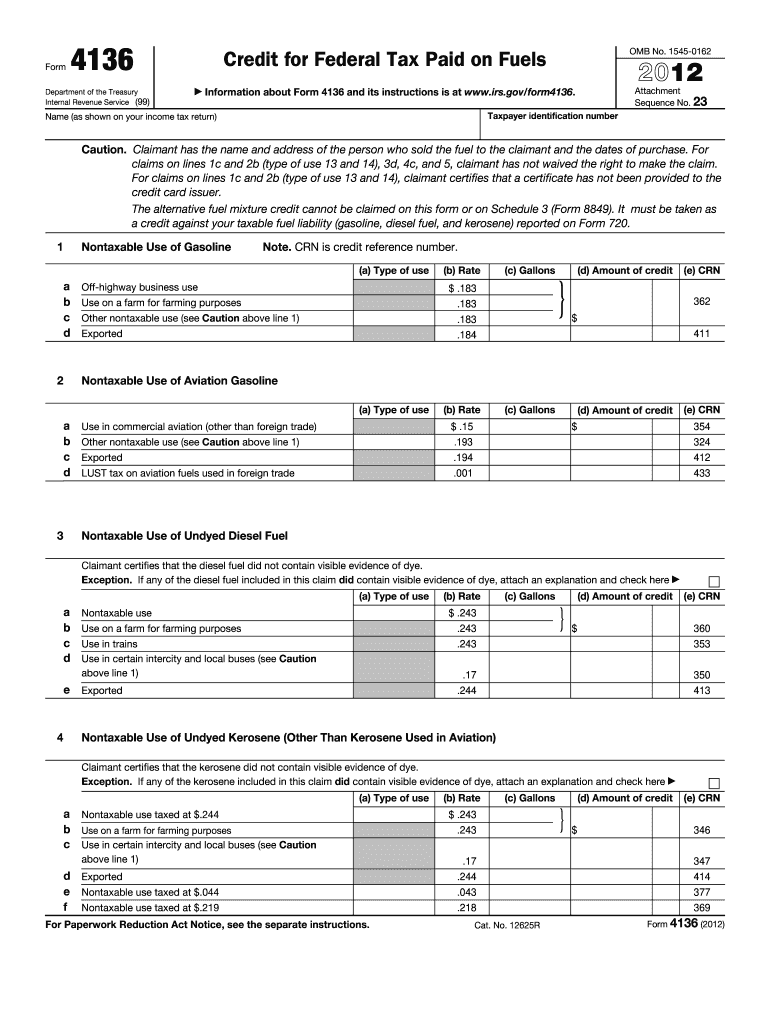

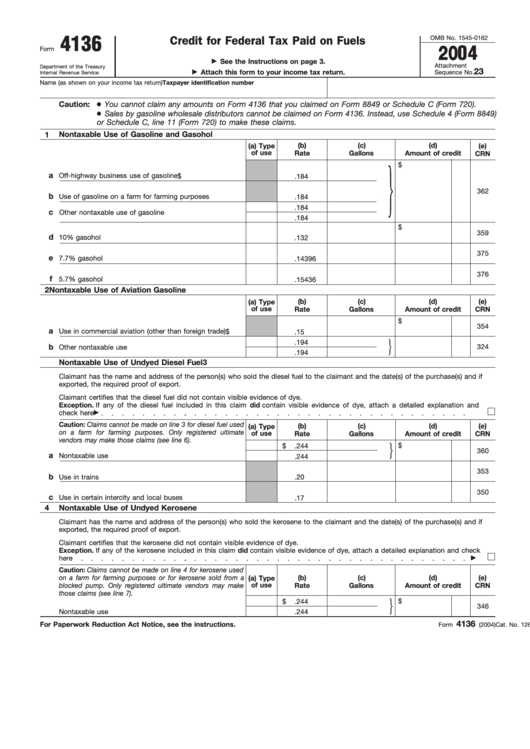

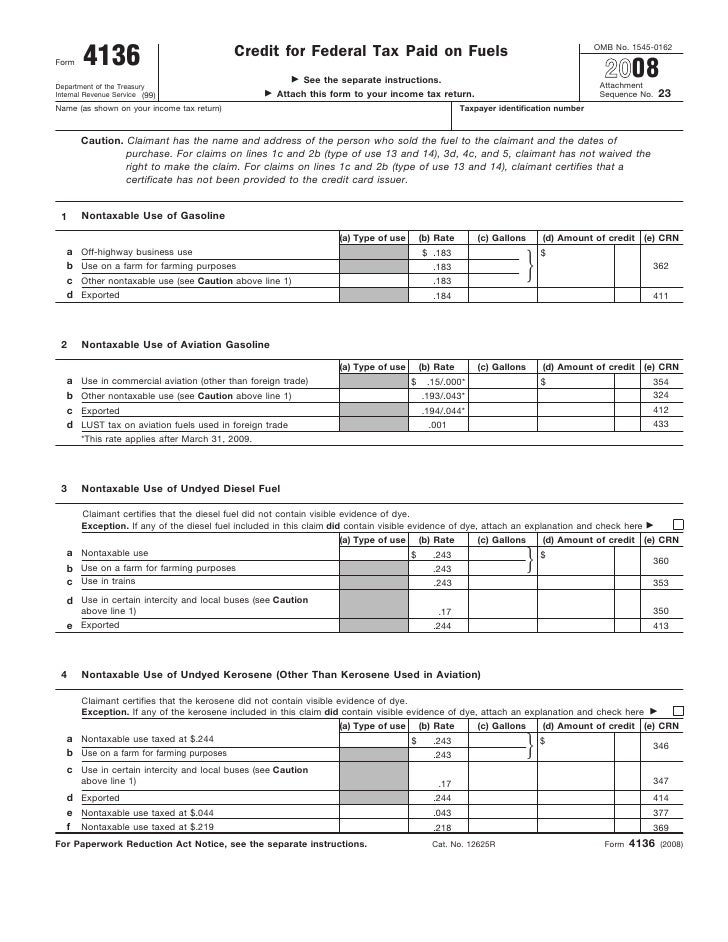

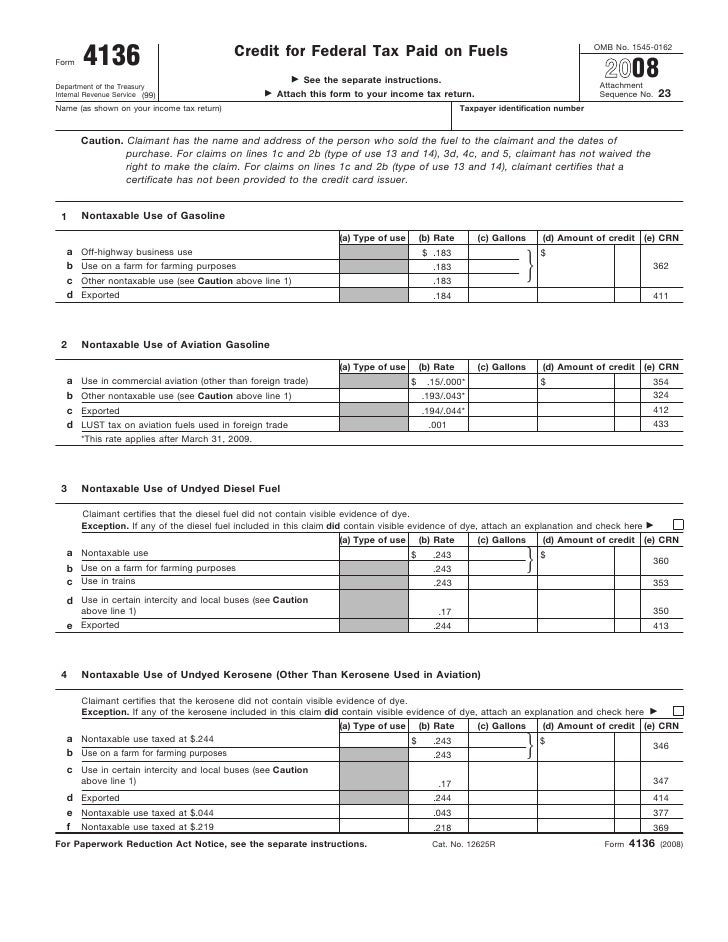

Verkko Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through December 31 2024 Alternative fuel credit Alternative fuel mixture credit Verkko Purpose of Form Use Form 4136 to claim the following The biodiesel or renewable diesel mixture credit credit of fuel tax year The alternative fuel A credit for certain nontaxable uses or sales during your income A credit for blending a diesel water

What Is Credit For Federal Tax On Fuels

What Is Credit For Federal Tax On Fuels

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEijO1qAMs_napos3v0ETHe96cx_283MPXVZQXocehgFGkIZ6xTYr0RfHfLiwzClgt1pNmbyCoGSW95DXvx_9PPk5WwQI6RomoDtBDcEFIVgflW04uIRTkMDrLhIZsWQ-upuVniwQQasrHnIe-nOvNw5SD0rXmfOFwsR1N0ob2tG3q6cavZuiSNBND-j/s762/ftc.jpg

Credit For Federal Tax On Fuels FederalProTalk

https://www.federalprotalk.com/wp-content/uploads/are-you-maximising-your-fuel-tax-credit-claim-nexia-a-nz.png

Fuel Tax Relief States Take Action TIP Excise Tax Recovery Services

https://tipexcise.com/wp-content/uploads/2022/05/pexels-engin-akyurt-11116152-scaled-e1651741469803.jpg

Verkko Generally for information on fuel credits against income tax see the instructions for Form 4136 Credit for Federal Tax Paid on Fuels Form 6478 Biofuel Producer Credit and Form 8864 Biodiesel Renewable Diesel or Sustainable Aviation Fuels Credit Verkko Credit for Federal Tax Paid on Fuels Go to www irs gov Form4136 for instructions and the latest information OMB No 1545 0162 2022 Attachment Sequence No 23 Name as shown on your income tax return Taxpayer identification number Caution

Verkko for Form 4136 Credit for Federal Tax Paid on Fuels Form 6478 Biofuel Producer Credit and Form 8864 Biodiesel Renew able Diesel or Sustainable Aviation Fuels Credit Sustainable aviation fuel credit The Act created a sustainable aviation fuel Verkko The alternative fuel credit A credit for certain nontaxable uses or sales of fuel during your income tax year A credit for blending a diesel water fuel emulsion A credit for exporting dyed fuels or gasoline blendstocks Substainable aviation fuel SAF credit

Download What Is Credit For Federal Tax On Fuels

More picture related to What Is Credit For Federal Tax On Fuels

Credit For Federal Tax On Fuels FederalProTalk

https://www.federalprotalk.com/wp-content/uploads/fuel-tax-credit-ps-support.png

What Is Credit For Prior Learning Credits2Careers

https://www.credits2careers.org/sites/all/modules/mycompass/modules/c2c/images/C2C_exams.png

Solved Required Information The Following Information Chegg

https://media.cheggcdn.com/media/f89/f89d1731-8b54-4b2a-a8de-b15671b29f62/phprxnqwa.png

Verkko A claim for credit is made on the taxpayer s income tax return and should be accompanied by Form 4136 Credit for Federal Tax Paid on Fuels which is used to compute the credit The credit may be claimed within three years after the due date Verkko 6 lokak 2022 nbsp 0183 32 Section 6426 e allows a blender of an alternative fuel mixture to claim a 0 50 per gallon credit against its excise tax liability under Section 4081 This credit may not exceed a person s excise tax liability under Section 4081 for the calendar

Verkko If you are an individual or business that purchases fuel for one of these reasons you can claim a credit on your tax return for the tax paid Listed below are the nontaxable uses for fuel Code 01 Farm Fuel used on a farm for farming purposes Verkko 13 jouluk 2010 nbsp 0183 32 This credit can be claimed on Form 4136 Credit for Federal Tax Paid on Fuels filed with the annual federal income tax return Certain taxpayers may be entitled to claim a periodic refund for the federal excise tax on fuels by filing Form

78 Importance Of Presentation Skills Ppt Page 4 Free To Edit

https://cdn.cocodoc.com/cocodoc-form/png/77503437--PowerPoint-Presentation-Instructions-for-Form-4136-Credit-for-Federal-Tax-Paid-on-Fuels-sae--x-01.png

Credit For Federal Tax Paid On Fuels IRS Gov Fill Out And Sign

https://www.signnow.com/preview/6/954/6954663/large.png

https://turbotax.intuit.com/tax-tips/small-busin…

Verkko 19 lokak 2023 nbsp 0183 32 The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses of fuels are untaxed

https://www.irs.gov/.../small-businesses-self-employed/fuel-tax-credits

Verkko Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through December 31 2024 Alternative fuel credit Alternative fuel mixture credit

FAFSA Tutorial

78 Importance Of Presentation Skills Ppt Page 4 Free To Edit

Income Tax Forms Income Tax Forms Federal

Fillable Form 4136 Printable Forms Free Online

Form 4136 Credit For Federal Tax Paid On Fuel

Form 4136 Credit For Federal Tax Paid On Fuel

Form 4136 Credit For Federal Tax Paid On Fuel

Bank Of England Base Rate Prediction 2023

FAFSA Tutorial

What Is Form 4136 Credit For Federal Tax Paid On Fuels TurboTax Tax

What Is Credit For Federal Tax On Fuels - Verkko To see which fuel credits are still available go to IRS Instructions for Form 4136 Credit for Federal Tax Paid on Fuels Go to IRS Publication 510 Excise Taxes Including Fuel Tax Credits and Refunds for definitions and information on nontaxable uses Note