Solar Tax Credit Explained The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax credit would be 6 000 20 000 x 30 6 000

Solar Tax Credit Explained

Solar Tax Credit Explained

https://powur.solar-energy-quote.com/wp-content/uploads/2022/02/2022-Solar-Tax-Credit-Explained-scaled.jpg

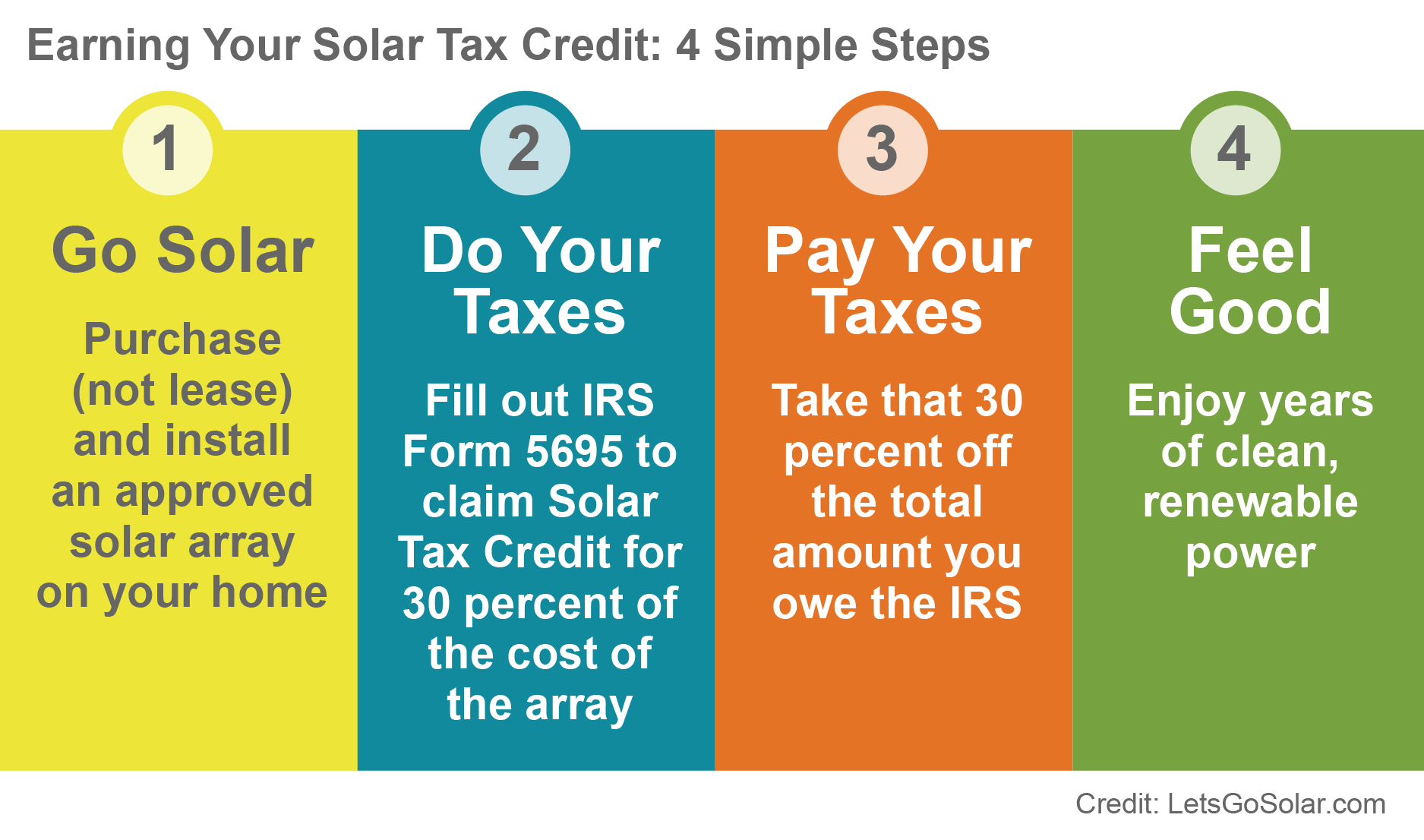

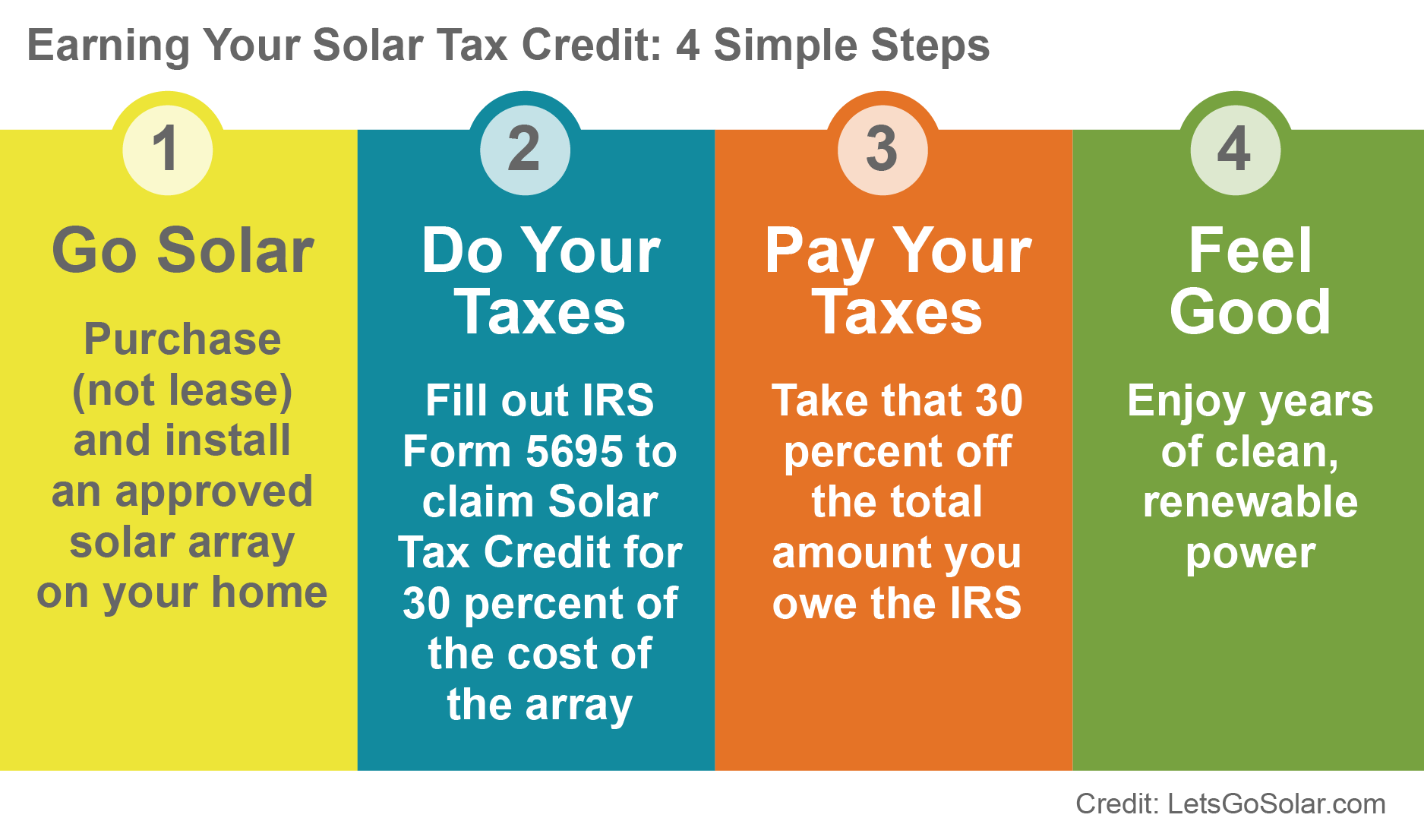

For Homeowners

https://gasolar.memberclicks.net/assets/images/Charts/chart900width_earningsolartaxcredit.png

Solar Tax Credit Explained For 2022

https://news.measuresolar.com/wp-content/uploads/2022/03/Large-Rectangle-2-1-1024x576.png

Key points The federal solar tax credit lowers your tax liability for qualifying solar system expenses The federal solar tax credit can be claimed anytime between 2022 through 2034 One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics also known as the Investment Tax Credit ITC This credit can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system

Get a significant tax credit on your solar installation with the Inflation Reduction Act Here s all you need to know about it If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On this page How it works Who qualifies Qualified expenses Qualified clean energy property How to claim the credit Related resources

Download Solar Tax Credit Explained

More picture related to Solar Tax Credit Explained

NJ Solar Tax Credit Explained

https://ecogenamerica.com/wp-content/uploads/New-Jersey-Tax-Credit-Complete-Guide.webp

The Solar Tax Credit Explained 2022 YouTube

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

Federal Solar Tax Credit 101 Everything You Need To Know ShopSolar

https://cdn.shopify.com/s/files/1/0034/8913/6751/files/SOLAR_TAX_CREDIT_EXPLAINED.png?v=1661618333

IR 2024 202 Aug 7 2024 WASHINGTON The Department of the Treasury and the Internal Revenue Service today issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023 The Inflation Reduction Act or IRA extended and expanded tax credits PDF that allow taxpayers to claim residential and Aug 8 2024 Americans claimed more than 8 billion in climate friendly tax credits under the Inflation Reduction Act last year according to new data released by the Treasury Department a

The Federal Solar Tax Credit officially called the Residential Clean Energy Credit allows eligible homeowners to deduct up to 30 of the cost of their solar energy system from their federal taxes for the year of installation and potentially beyond depending on their tax liability The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is available for homeowners that install solar from 2022 to 2032

The Federal Solar Tax Credit Explained

https://solarliberty.com/wp-content/uploads/2020/06/The-Federal-Solar-Tax-Credit-Explained-768x461.jpg

The Federal Solar Tax Credit Explained Sunshine Plus Solar

https://sunshineplussolar.com/wp-content/uploads/2020/05/The-Federal-Solar-Tax-Credit-Explained-2.png

https://www.energy.gov/eere/solar/homeowners-guide...

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

https://www.energysage.com/solar/solar-tax-credit-explained

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill

Federal Solar Tax Credit Explained YouTube

The Federal Solar Tax Credit Explained

Solar Federal Tax Credit Explained So Power

Solar Tax Credit Explained For 2022

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

Solar Federal Tax Credit Explained So Power

Solar Federal Tax Credit Explained So Power

Powerful Solar Federal Solar Tax Credit Explained

The 2020 Federal Solar Tax Credit Explained YouTube

Federal Tax Credit For Installing Solar Panels Tax Walls

Solar Tax Credit Explained - If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On this page How it works Who qualifies Qualified expenses Qualified clean energy property How to claim the credit Related resources