What Does Solar Tax Credit Mean The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance By taking advantage of the solar tax credit it s possible to lower your tax bill effectively reducing the cost of your solar project Below we take a closer look at what the solar tax credit is how it works and how much you can potentially save

What Does Solar Tax Credit Mean

What Does Solar Tax Credit Mean

https://greenridgesolar.com/wp-content/uploads/2023/05/Does-Solar-Tax-Credit-Cover-Reroof-or-Roof-Repairs-1.webp

How Does The Federal Solar Tax Credit Work PB Roofing Co

https://pbroofingco.com/wp-content/uploads/2021/06/federal-solar-tax-credit.png

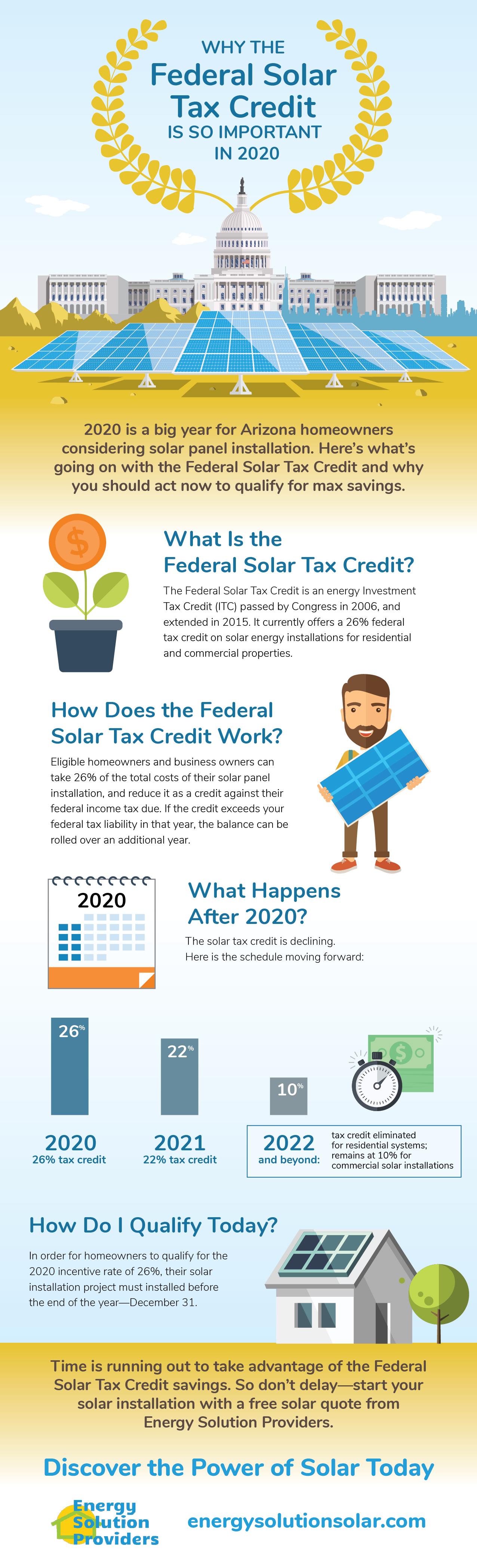

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax credit would be 6 000 20 000 x 30 6 000 The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is available for homeowners that install solar from 2022 to 2032

The solar tax credit lets homeowners subtract 30 of a solar purchase and installation off their federal taxes Here s how it works and who it works best for If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On this page How it works Who qualifies Qualified expenses Qualified clean energy property How to claim the credit Related resources

Download What Does Solar Tax Credit Mean

More picture related to What Does Solar Tax Credit Mean

What Does Solar Panel Efficiency Mean Dandelion Renewables

https://www.dandelionrenewables.com/wp-content/uploads/2020/09/Dandelion-renewables-blog-9-Sep.jpg

How Does The Solar Tax Credit Work How To Claim Solar Tax Credit

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi5DdCe3Z6HTjWCbd7zb8WOW7Gh1xRVarVdbvj2AaEcpaIMKvg60ivX4mAPdo78yeko3ZdPp04ubBsk1Imc68JJYVBu9UtaVGjRsTfsmdfPuvIWN60xXD0AZshB-FOebYzeAMEtk7LZJpkB8lxJGLvirouLssrzVAxALEsz4bovK-CAwZ8BxZpgKhIxcg/s897/How Does the Solar Tax Credit Work & How to Claim Solar Tax Credit.jpg

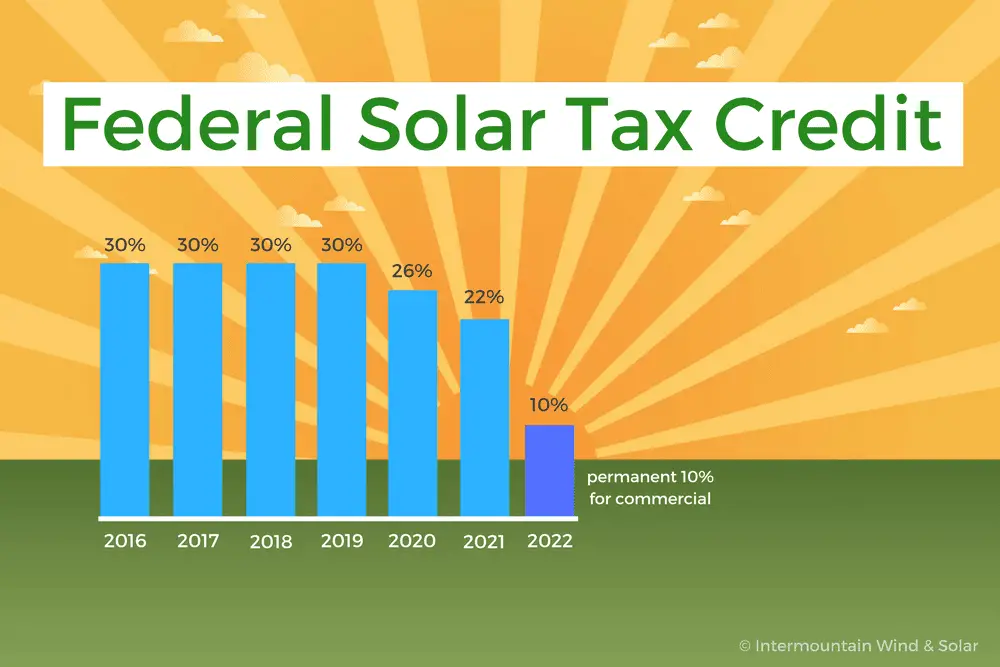

When Does Solar Tax Credit End SolarProGuide 2022

https://www.solarproguide.com/wp-content/uploads/when-does-the-federal-solar-tax-credit-expire.png

What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and labor costs

The 2023 solar tax credit applicable for taxes filed in 2024 provides financial incentives to make solar installations more accessible and affordable for homeowners The Federal Solar Tax Credit officially called the Residential Clean Energy Credit allows eligible homeowners to deduct up to 30 of the cost of their solar energy system from their federal taxes for the year of installation and potentially beyond depending on their tax liability

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

https://supreme.solar/wp-content/uploads/2022/07/solar-tax-credit.jpg

How Does The Solar Tax Credit Work SolarPower Guide Article

https://solarpower.guide/solar-energy-insights/images/solar-tax-credit.jpg

https://www.energysage.com/solar/solar-tax-credit-explained

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill

https://www.energy.gov/eere/solar/homeowners-guide...

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Things To Know About Solar Installation Tax Credit

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

How Does The Federal Solar Tax Credit Work Freedom Solar

How Does Solar Tax Credit Work CreditProTalk

What Does The New Tax Credit For Ireland s Games Industry Actually Mean

What Does Solar Friendly Mean Interlock Metal Roofing

What Does Solar Friendly Mean Interlock Metal Roofing

How Does The Federal Solar Tax Credit Work

How Does Solar Tax Credit Work CreditProTalk

The ITC Solar Tax Credit And Your New Home Cotswold Homes

What Does Solar Tax Credit Mean - The solar tax credit lets homeowners subtract 30 of a solar purchase and installation off their federal taxes Here s how it works and who it works best for