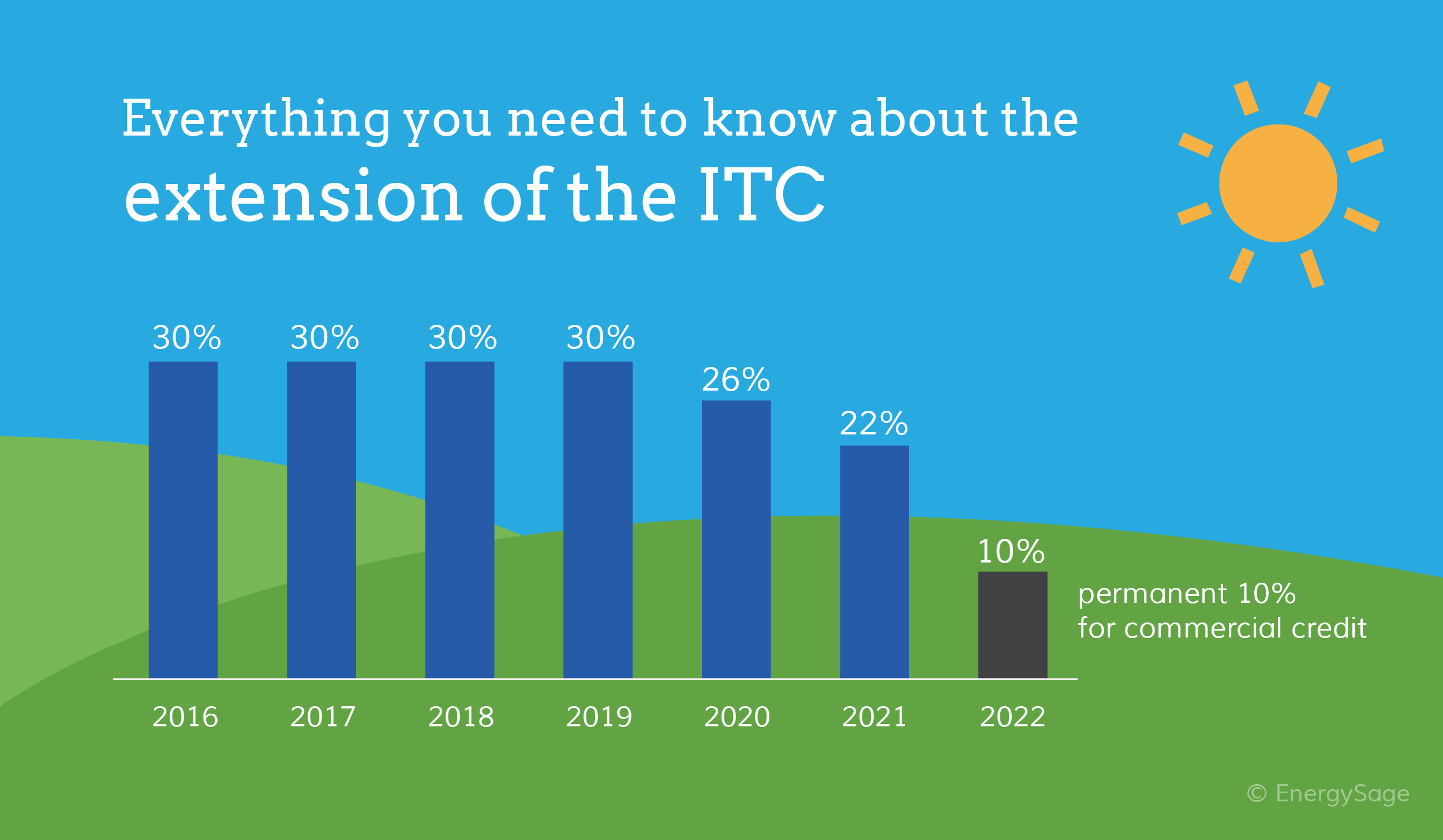

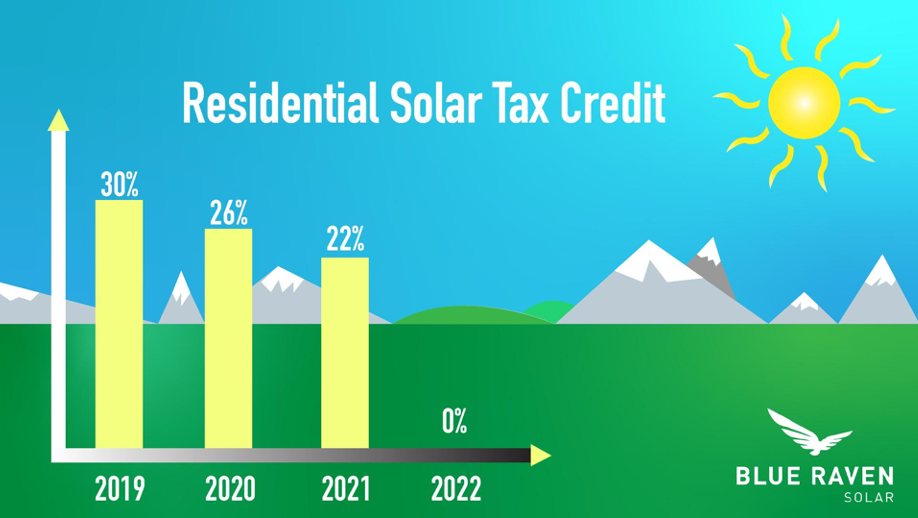

Solar Tax Credits And Rebates For Homeowners Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Web 7 ao 251 t 2023 nbsp 0183 32 Adding one to your home is a significant investment on average solar panels cost about 16 000 But home solar power systems can save you a significant amount Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

Solar Tax Credits And Rebates For Homeowners

Solar Tax Credits And Rebates For Homeowners

https://www.solarpowerrocks.com/wp-content/uploads/2018/12/MD-tax-credits-ring.png

Texas Solar Power For Your House Rebates Tax Credits Savings

https://i.pinimg.com/originals/14/05/ef/1405ef205102ec2392f7c34907bb980e.png

2018 Guide To West Virginia Home Solar Incentives Rebates And Tax

https://i.pinimg.com/originals/2a/b8/14/2ab814871ec51f6c0c811affc8287602.png

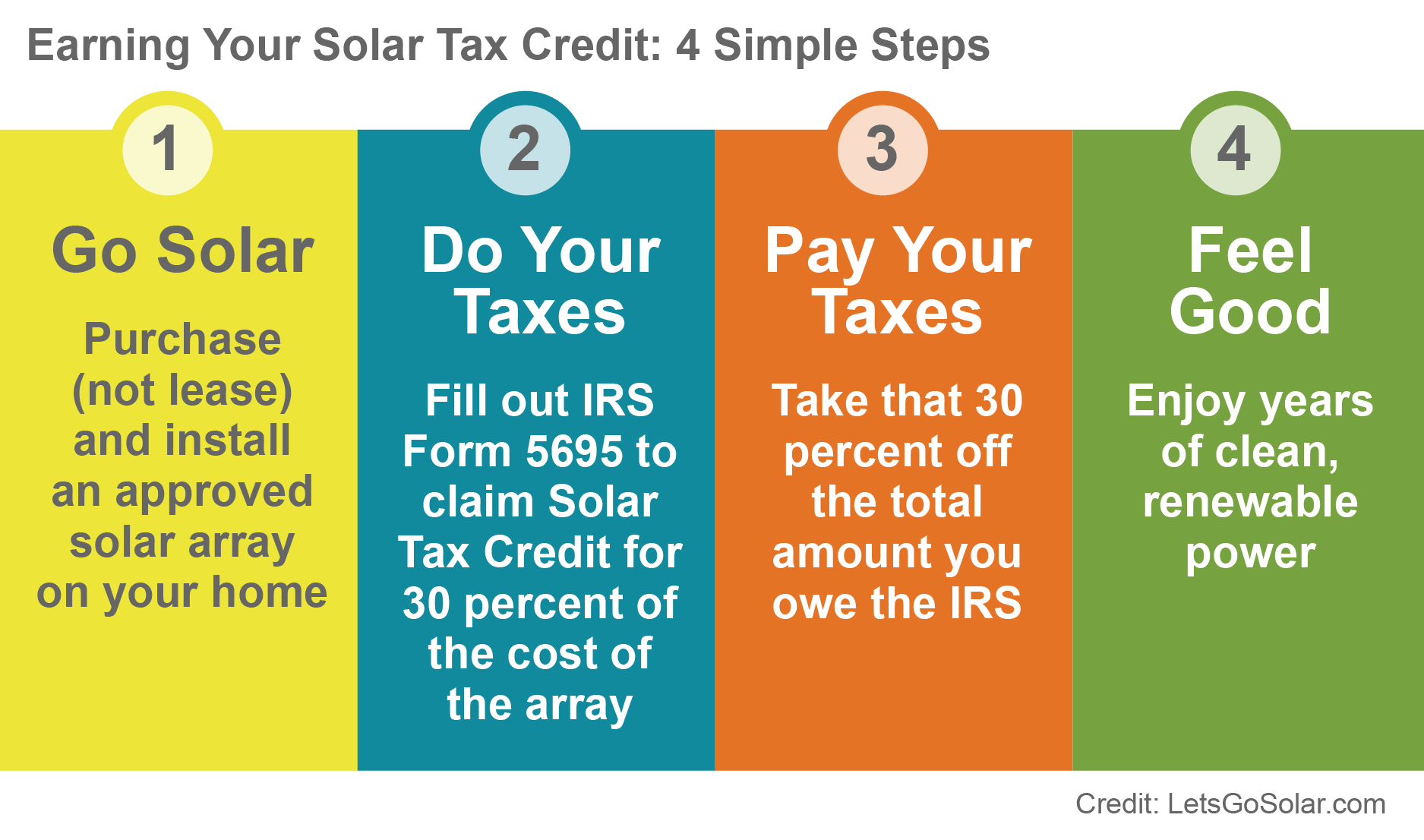

Web The federal solar tax credit also known as the solar investment tax credit ITC incentivizes homeowners to purchase a solar power system by reducing the amount Web Mike De Socio Sept 11 2023 3 22 a m PT 5 min read Federal tax credits can help you cover the cost of insulation saving you money on energy and keeping your home more

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other Web For 2022 the tax code remains focused on providing incentives for homeowners to make the move to renewable energy sources such as the IRS solar tax credit Note Tax credits for home improvements that

Download Solar Tax Credits And Rebates For Homeowners

More picture related to Solar Tax Credits And Rebates For Homeowners

2019 Guide To Nebraska Home Solar Incentives Rebates And Tax Credits

https://i.pinimg.com/originals/54/fc/fd/54fcfd6747e33c2000c020e7dfd2525d.png

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

https://greenridgesolar.com/wp-content/uploads/2019/01/tax-credit-change-.jpg

2019 New York Home Solar Incentives Rebates And Tax Credits

https://www.solarpowerrocks.com/wp-content/uploads/2018/12/NY-tax-credits-ring.png

Web 30 d 233 c 2022 nbsp 0183 32 In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 percent income tax credit for clean Web 5 ao 251 t 2022 nbsp 0183 32 The climate bill a surprise agreement between Senators Joe Manchin and Chuck Schumer that also has the support of Senator Kyrsten Sinema would restore a

Web 29 ao 251 t 2022 nbsp 0183 32 The rebates are available to households earning less than 150 of the area s median income If your household income falls Below 80 of the area median Web 9 ao 251 t 2023 nbsp 0183 32 The federal solar tax credit is a clean energy credit that you can claim on your federal returns This tax credit is not valued at a set dollar amount rather it s a

Solar Tax Credits By State SolarDailyDigest

https://www.solardailydigest.com/wp-content/uploads/credit-file-solar-tax-credits-by-state.jpeg

Minnesota Solar Power For Your House Rebates Tax Credits Savings

https://i.pinimg.com/originals/f0/5a/d4/f05ad428174c29968441de8b94bc2bab.png

https://www.energy.gov/sites/default/files/2023-03/Homeow…

Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state

Web 7 ao 251 t 2023 nbsp 0183 32 Adding one to your home is a significant investment on average solar panels cost about 16 000 But home solar power systems can save you a significant amount

Solar Tax Credit Everything A Homeowner Needs To Know Credible

Solar Tax Credits By State SolarDailyDigest

Solar Tax Credit Chart Energy Sage Sol Luna Solar

Texas Solar Power For Your House Rebates Tax Credits Savings

For Homeowners

Solar Tax Credits Rebates Missouri Arkansas

Solar Tax Credits Rebates Missouri Arkansas

Oregon Solar Power For Your House Rebates Tax Credits Savings Tax

2020 Guide To Louisiana Home Solar Incentives Rebates And Tax Credits

Solar Tax Credits 2020 Blue Raven Solar

Solar Tax Credits And Rebates For Homeowners - Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other