Spousal Income Tax Return Verkko 2 lokak 2022 nbsp 0183 32 Charlene Rhinehart Fact checked by Ryan Eichler The substantial divorce rate in America 50 of marriages end in divorce has engineered the creation of various types of spousal

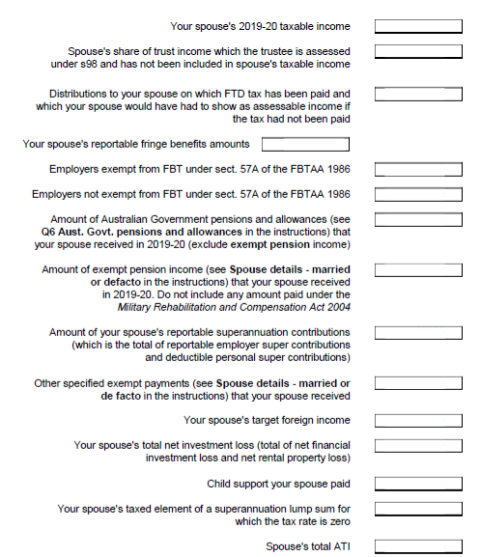

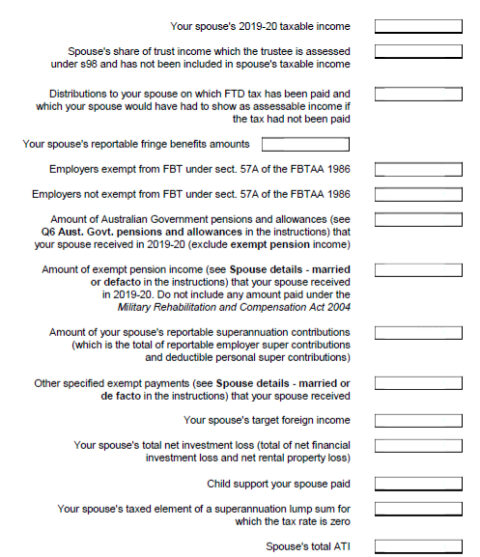

Verkko 25 toukok 2022 nbsp 0183 32 You will need details of your spouse s income These can be obtained from your spouse your spouse s Tax return for individuals 2022 and Tax return for Verkko 27 marrask 2023 nbsp 0183 32 Income splitting is a method of bringing a married couple s tax bracket down by transferring a portion of the higher earning spouse s income to the

Spousal Income Tax Return

Spousal Income Tax Return

https://refunded.com.au/wp-content/uploads/2021/06/Spouse-taxable-income-480x557.jpg

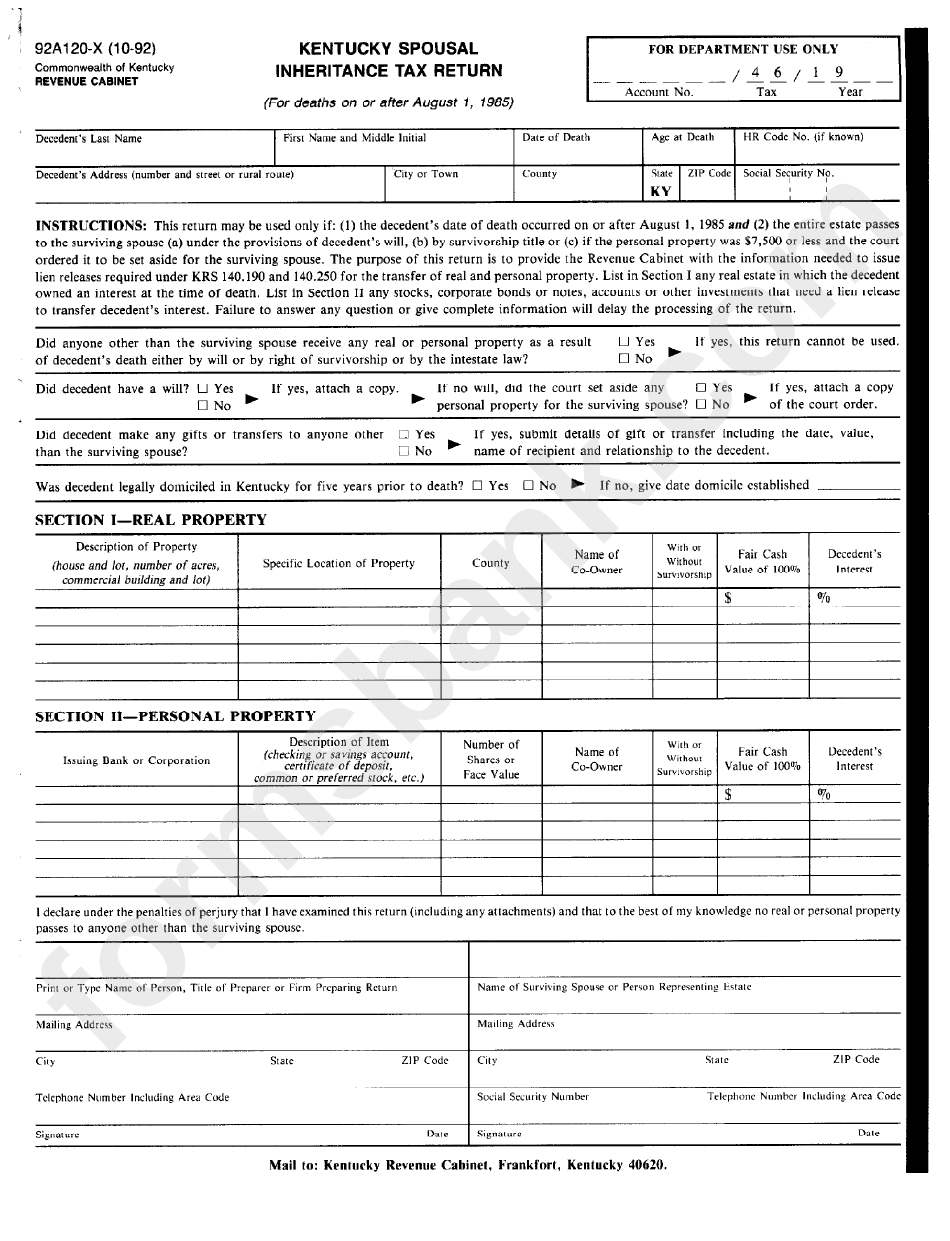

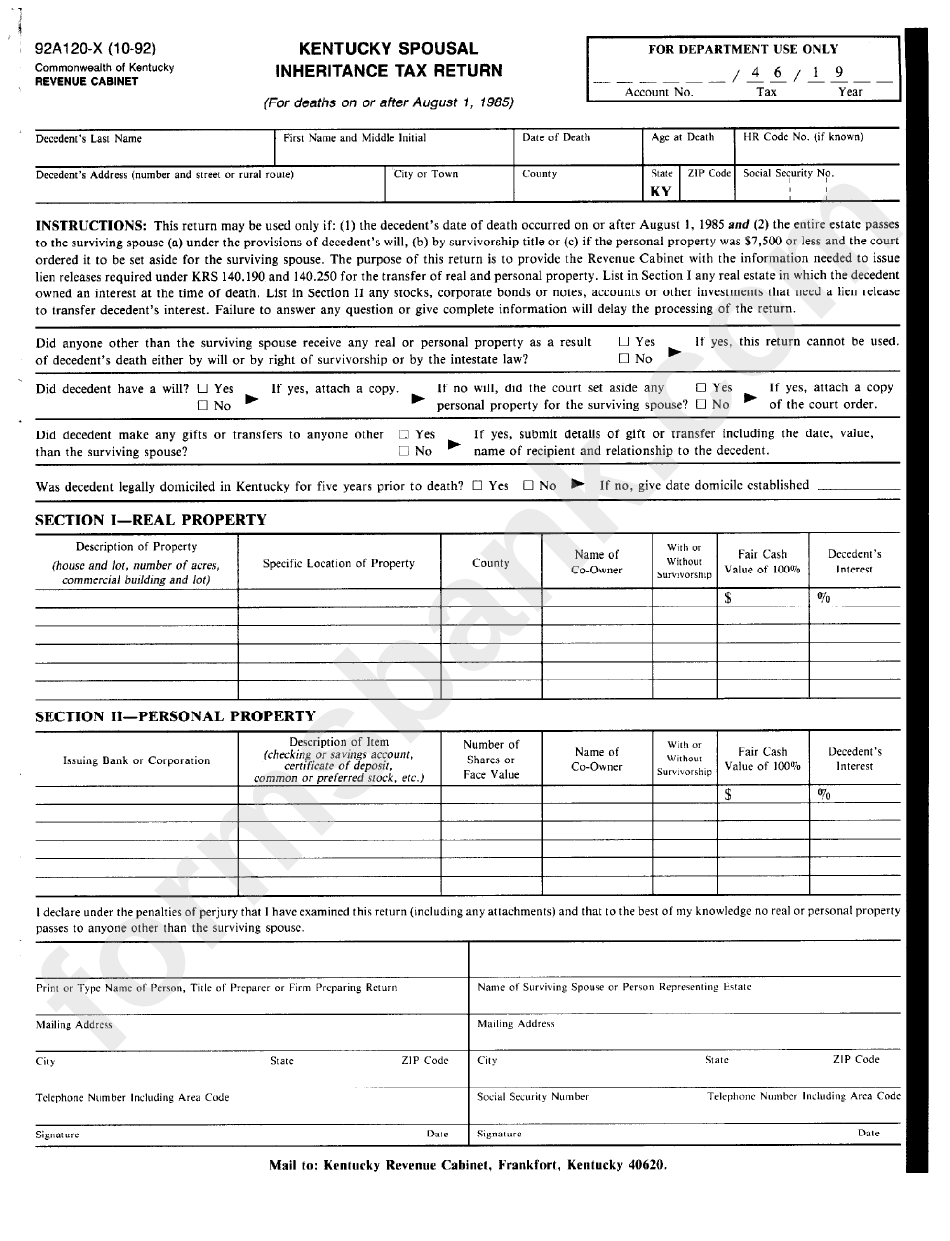

Fillable Form 92a120 X Kentucky Spousal Inheritance Tax Return

https://data.formsbank.com/pdf_docs_html/305/3059/305962/page_1_bg.png

:max_bytes(150000):strip_icc()/when-should-you-file-a-seperate-return-from-your-spouse-3193041-final-f72815b10bef416db12eebc301043dc3.png)

Is The Married Filing Separately Tax Status Right For You

https://www.thebalancemoney.com/thmb/_zm82VK70JJlY9nOmmgKyRC5bMc=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/when-should-you-file-a-seperate-return-from-your-spouse-3193041-final-f72815b10bef416db12eebc301043dc3.png

Verkko Enter on page 1 of your return the following information about your spouse or common law partner if applicable your spouse or common law partner s social insurance Verkko 31 jouluk 2022 nbsp 0183 32 an amount on line 30300 of your return for your spouse or common law partner If you reconciled with your spouse or common law partner and were living

Verkko 14 elok 2021 nbsp 0183 32 If your combined taxable income is less than 32 000 you won t have to pay taxes on your spousal benefits If your income is between 32 000 and 44 000 you would have to pay taxes on up to Verkko 1 marrask 2023 nbsp 0183 32 Under the spousal IRA rules for 2023 a couple where only one spouse works can contribute up to 13 000 per year or 15 000 if both are 50 or older If both spouses are 50 or older that cap rises

Download Spousal Income Tax Return

More picture related to Spousal Income Tax Return

Fillable Form 92a120 X Kentucky Spousal Inheritance Tax Return

https://data.formsbank.com/pdf_docs_html/305/3059/305962/page_1_thumb_big.png

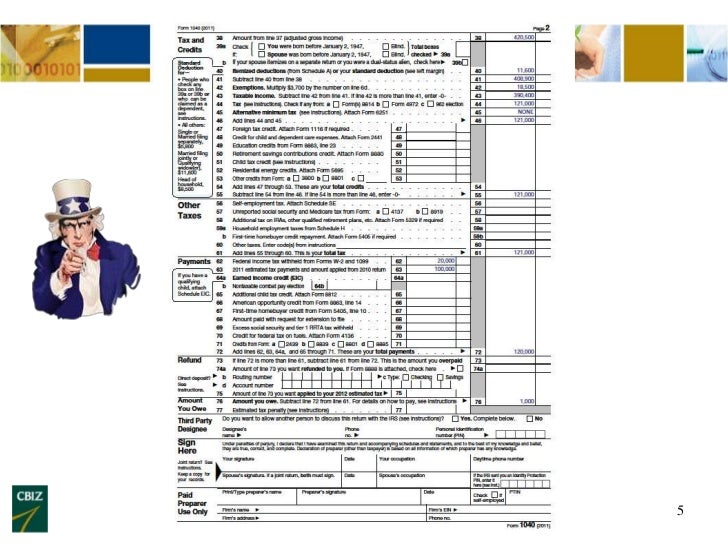

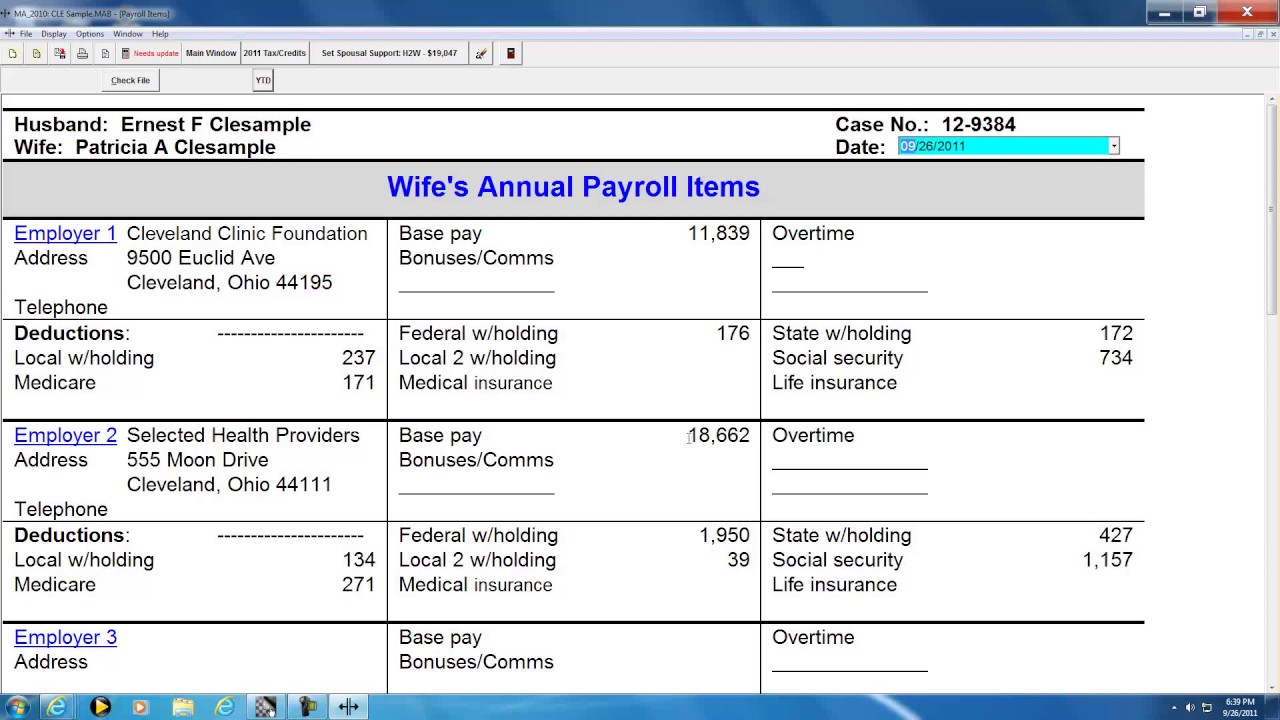

How To Read A Tax Return Cash Flow To Determine Spousal Maintenance

https://image.slidesharecdn.com/howtoreadataxreturn-120918165725-phpapp02/95/how-to-read-a-tax-return-cash-flow-to-determine-spousal-maintenance-child-support-12-728.jpg?cb=1349198424

How To Read A Tax Return Cash Flow To Determine Spousal Maintenance

https://image.slidesharecdn.com/howtoreadataxreturn-120918165725-phpapp02/95/how-to-read-a-tax-return-cash-flow-to-determine-spousal-maintenance-child-support-8-728.jpg?cb=1349198424

Verkko 12 jouluk 2023 nbsp 0183 32 A spousal IRA allows a working spouse to fund an IRA for a non working spouse effectively doubling their retirement savings for the year Otherwise Verkko 9 marrask 2023 nbsp 0183 32 There are two types of tax relief for spouses Injured spouse relief lets you reclaim money taken from your tax refund to cover your spouse s debts

Verkko 5 hein 228 k 2021 nbsp 0183 32 ABC Everyday By Meg Watson You may have to declare your partner s income even if you re not married Pexels Mikhail Nilov It s tax time You know what that means it s time to Verkko 24 tammik 2023 nbsp 0183 32 Spouse or common law partner amount Amount for an eligible dependant Canada caregiver amount for spouse or common law partner or eligible

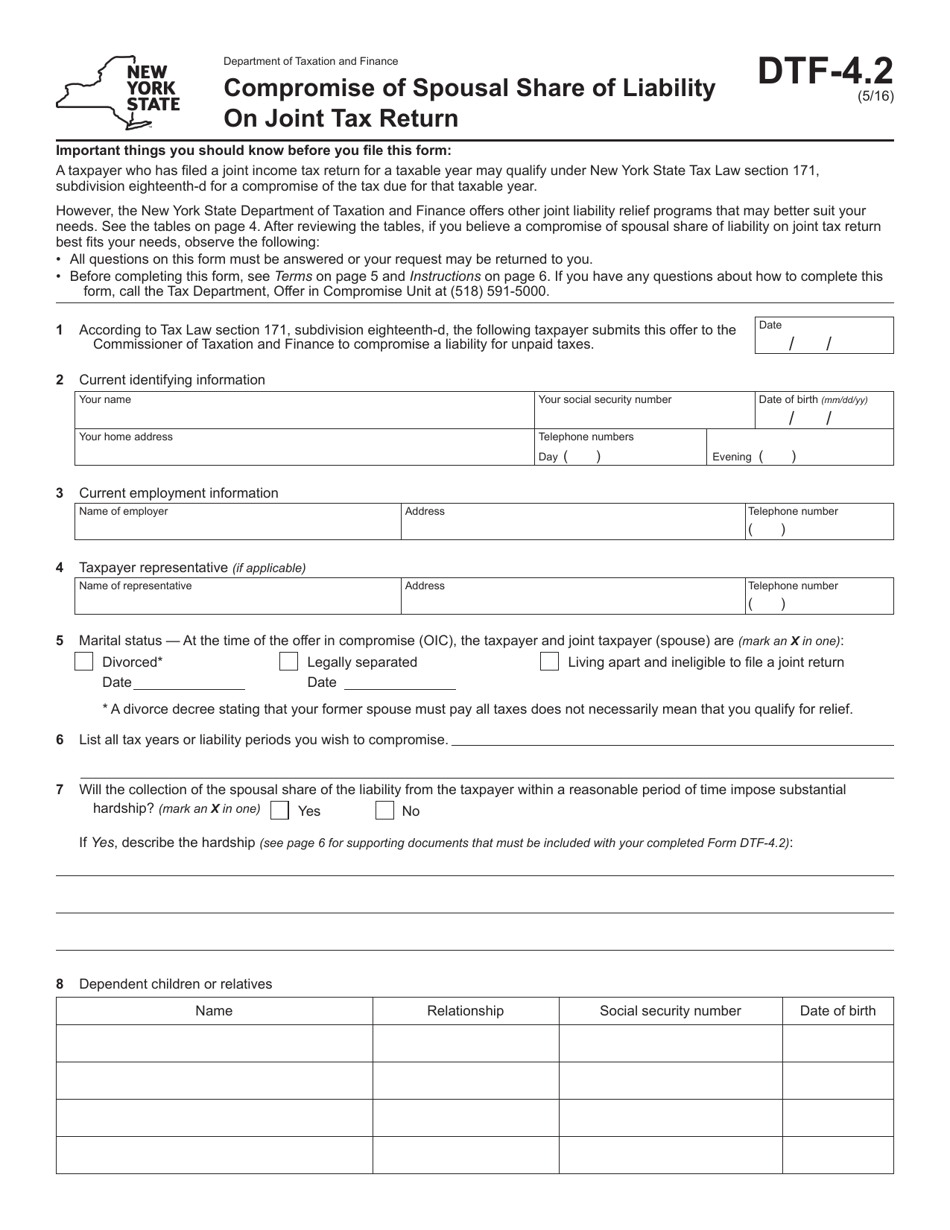

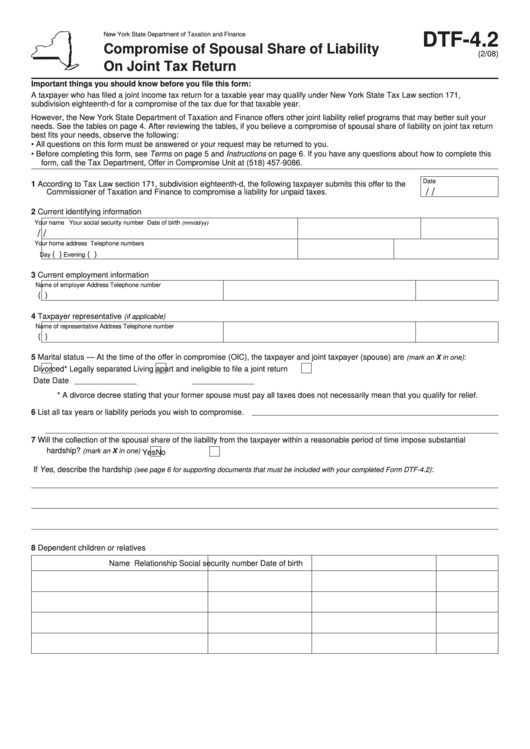

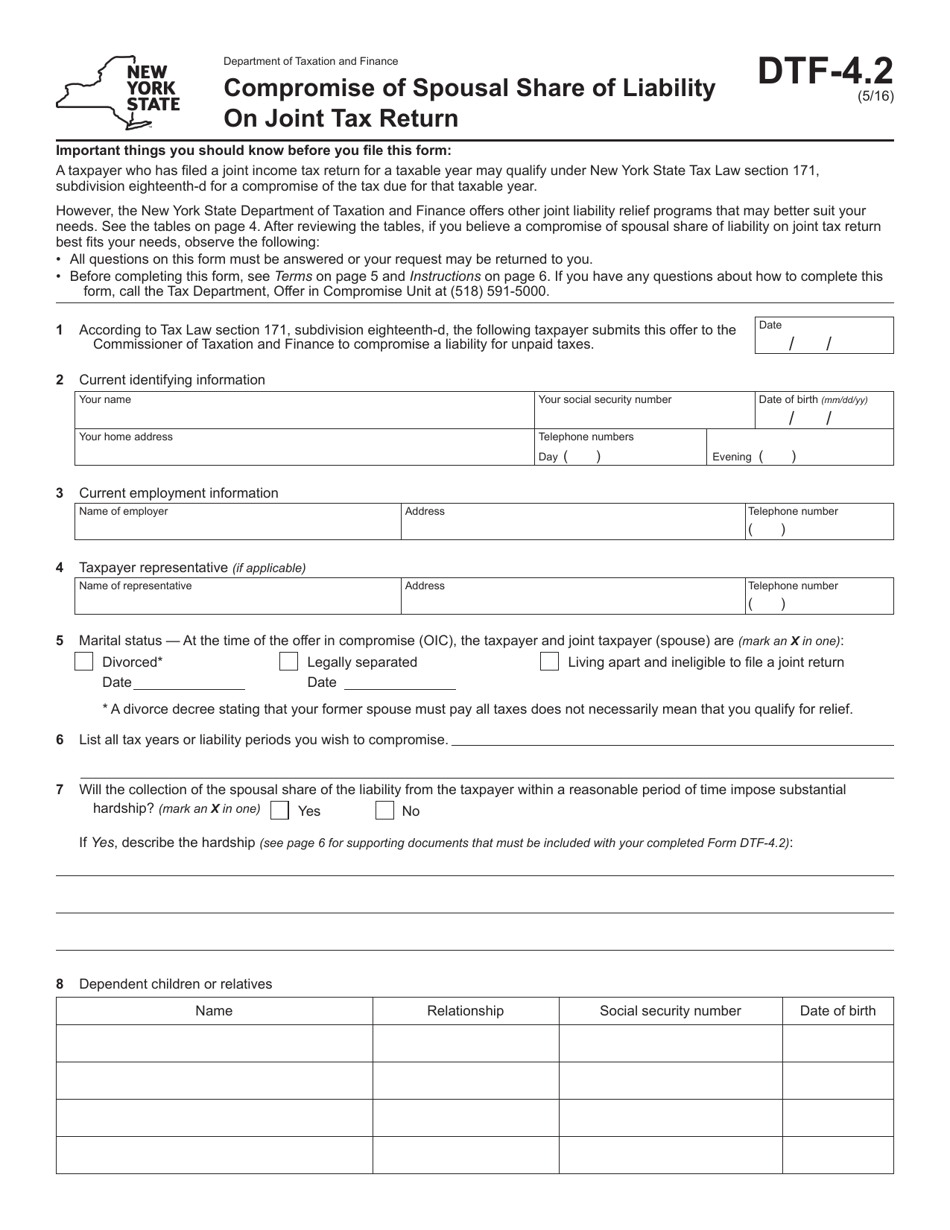

Form DTF 4 2 Download Printable PDF Or Fill Online Compromise Of

https://data.templateroller.com/pdf_docs_html/1879/18796/1879696/form-dtf-4-2-compromise-of-spousal-share-of-liability-on-joint-tax-return-new-york_print_big.png

How To Read A Tax Return Cash Flow To Determine Spousal Maintenance

https://image.slidesharecdn.com/howtoreadataxreturn-120918165725-phpapp02/95/how-to-read-a-tax-return-cash-flow-to-determine-spousal-maintenance-child-support-5-728.jpg?cb=1349198424

https://www.investopedia.com/articles/tax/10/…

Verkko 2 lokak 2022 nbsp 0183 32 Charlene Rhinehart Fact checked by Ryan Eichler The substantial divorce rate in America 50 of marriages end in divorce has engineered the creation of various types of spousal

https://www.ato.gov.au/Individuals/Tax-return/2022/Tax-return/Spouse...

Verkko 25 toukok 2022 nbsp 0183 32 You will need details of your spouse s income These can be obtained from your spouse your spouse s Tax return for individuals 2022 and Tax return for

Form Dtf 4 2 Compromise Of Spousal Share Of Liability On Joint Tax

Form DTF 4 2 Download Printable PDF Or Fill Online Compromise Of

Ohio Spousal Support Calculator Chapter 4 Income Inflation Protection

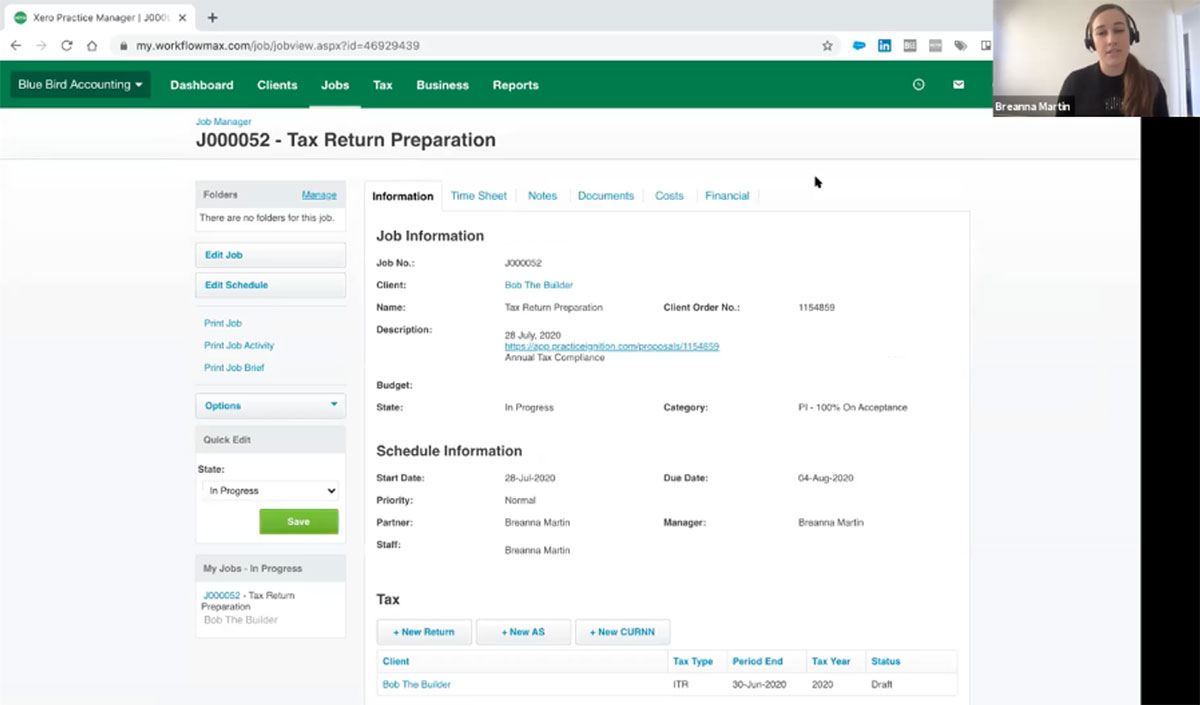

The Modern Income Tax Return Process FYI

Tax Hacks Fall In Love With These Income Splitting Tips For You And

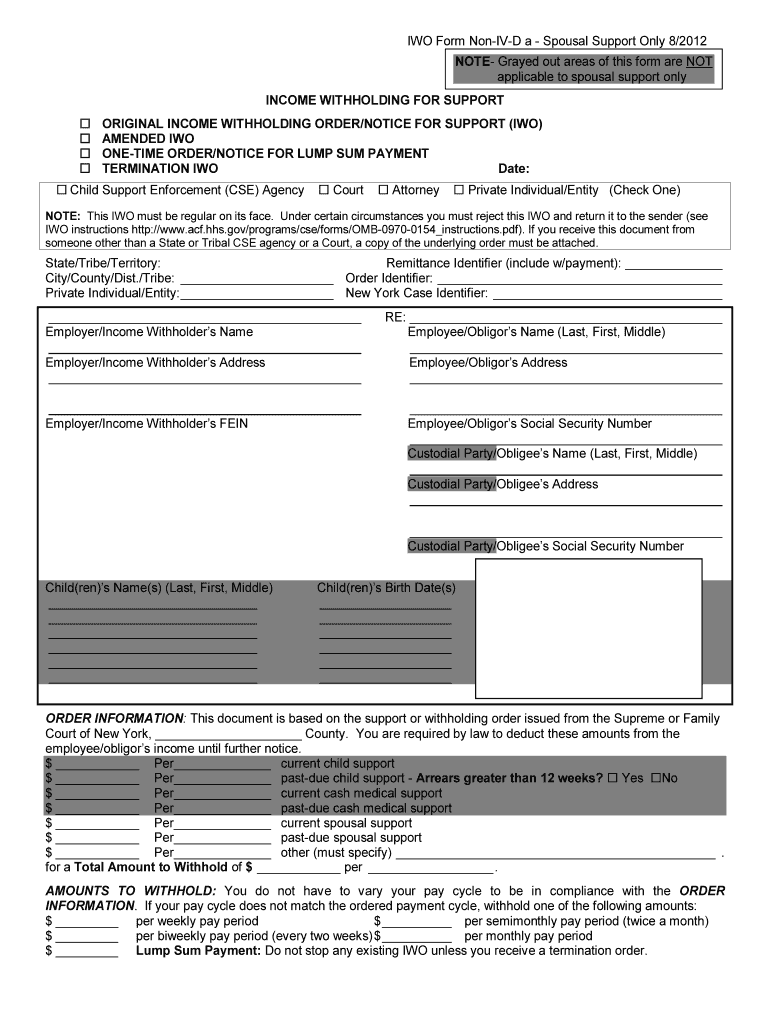

Withholding Spousal Form Fill Online Printable Fillable Blank

Withholding Spousal Form Fill Online Printable Fillable Blank

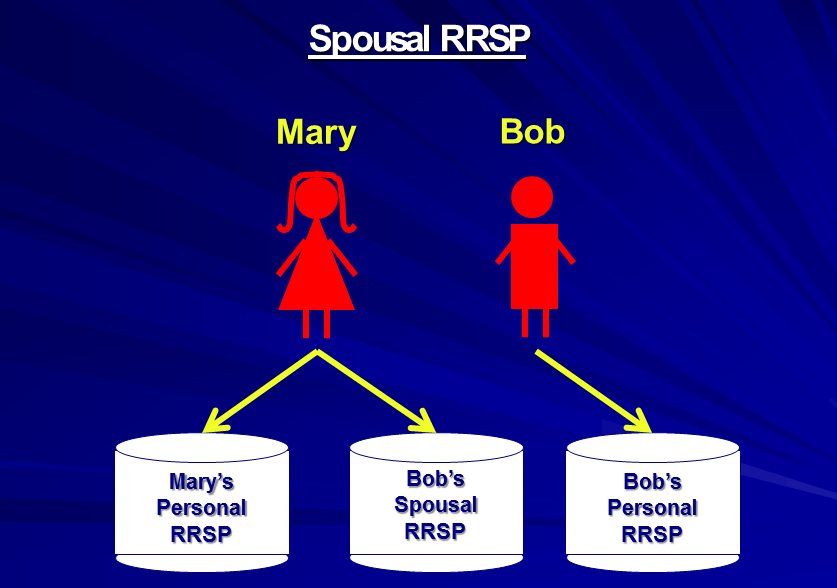

The Proper Use Of Spousal RRSPs Retire Happy

Spousal Roth IRA Double Your Tax Advantaged Savings

Social Security Spousal Benefits What You Need To Know Retirement

Spousal Income Tax Return - Verkko A spousal individual retirement account or arrangement IRA is just a regular IRA the distinction being that its limits and deductibility looks at the household income rather