Spouse Income Tax Return By including your spouse s income in your tax return we can work out if you re entitled to specific offsets rebates or reductions It also lets us know if you re liable for the

You have the option to either place the mandatory YEL MYEL contributions in your personal tax return or your spouse s return The amounts are equally deductible both ways And even if you still haven t introduced your partner to all your friends and family the ATO wants you to declare them and their income on your tax return Here s what you need to know Why does the ATO want to

Spouse Income Tax Return

Spouse Income Tax Return

https://www.taxgirl.com/wp-content/uploads/2021/01/Screen-Shot-2021-01-10-at-3.09.05-PM.png

Five Grown up Ways To Spend Your Tax Return

https://apexadvice.com.au/wp-content/uploads/sites/137/2023/09/202309-5-ways-to-spend-tax-return-copy.jpeg

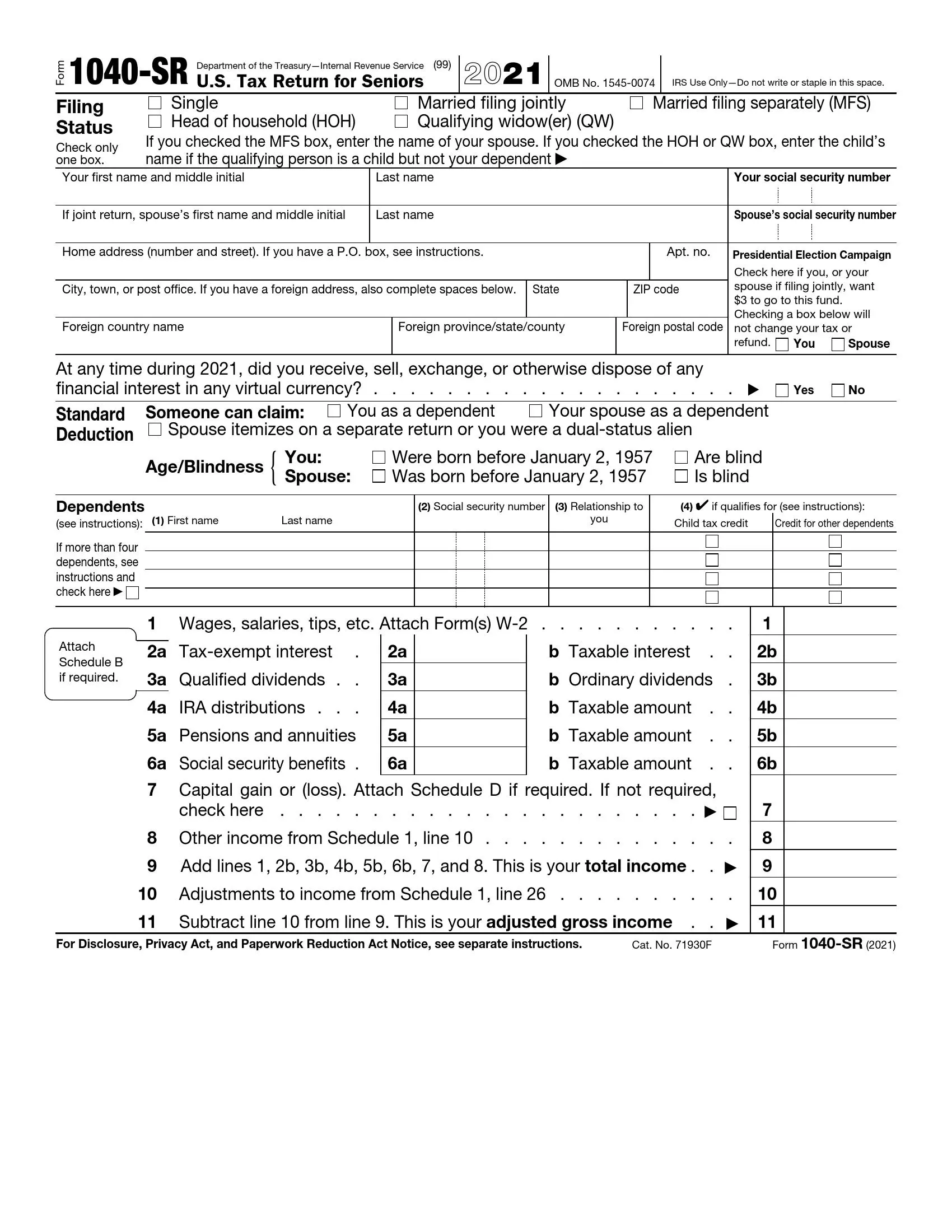

Printable IRS Form 1040 For Tax Year 2021 CPA Practice Advisor

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/01/Form_1040_2021.61dc944778e68.png

The ATO uses your spouse s income to work out whether you are entitled to a rebate for your private health insurance you are entitled to the seniors and pensioners tax offset You will need details of your spouse s income These can be obtained from your spouse your spouse s Tax return for individuals 2022 and Tax return for individuals

We pre fill your tax return with your spouse s other details from your 2022 23 tax return if you had a spouse on 30 June 2023 Check spouse details and update if necessary Do you need to declare spouse income in your tax return Visit ITP for all the answers on filing your taxes correctly

Download Spouse Income Tax Return

More picture related to Spouse Income Tax Return

Latest ITR Forms Archives Certicom

https://i0.wp.com/certicom.in/wp-content/uploads/2022/06/Understanding-updated-and-revised-income-tax-returns.jpg?fit=1920%2C1080&ssl=1

4 Smart Investments Using Your Tax Return

https://blog.usccreditunion.org/hubfs/tax-return-money.jpg

Nice Audit Report Of Reliance 2019 International Accounting Standard 10

https://i.pinimg.com/originals/44/17/ae/4417ae287a47614a557a5bcd993701d3.png

You won t need to send us formal advice that you ve separated from your husband if you declare that information on your tax return However you ll still need to let us know if you In Australia there is one tax return per person there is no such thing as a joint tax return or couples tax return However if you have a spouse or de facto partner you must include some of their tax information on your return and

Within your Income Tax Return you must make a legal declaration whether you had a spouse during the year where you answer yes to this question then the Australian Taxation Office ATO require a number of If you reconciled with your spouse or common law partner and were living together on December 31 2023 you can claim an amount on line 30300 of your return and any

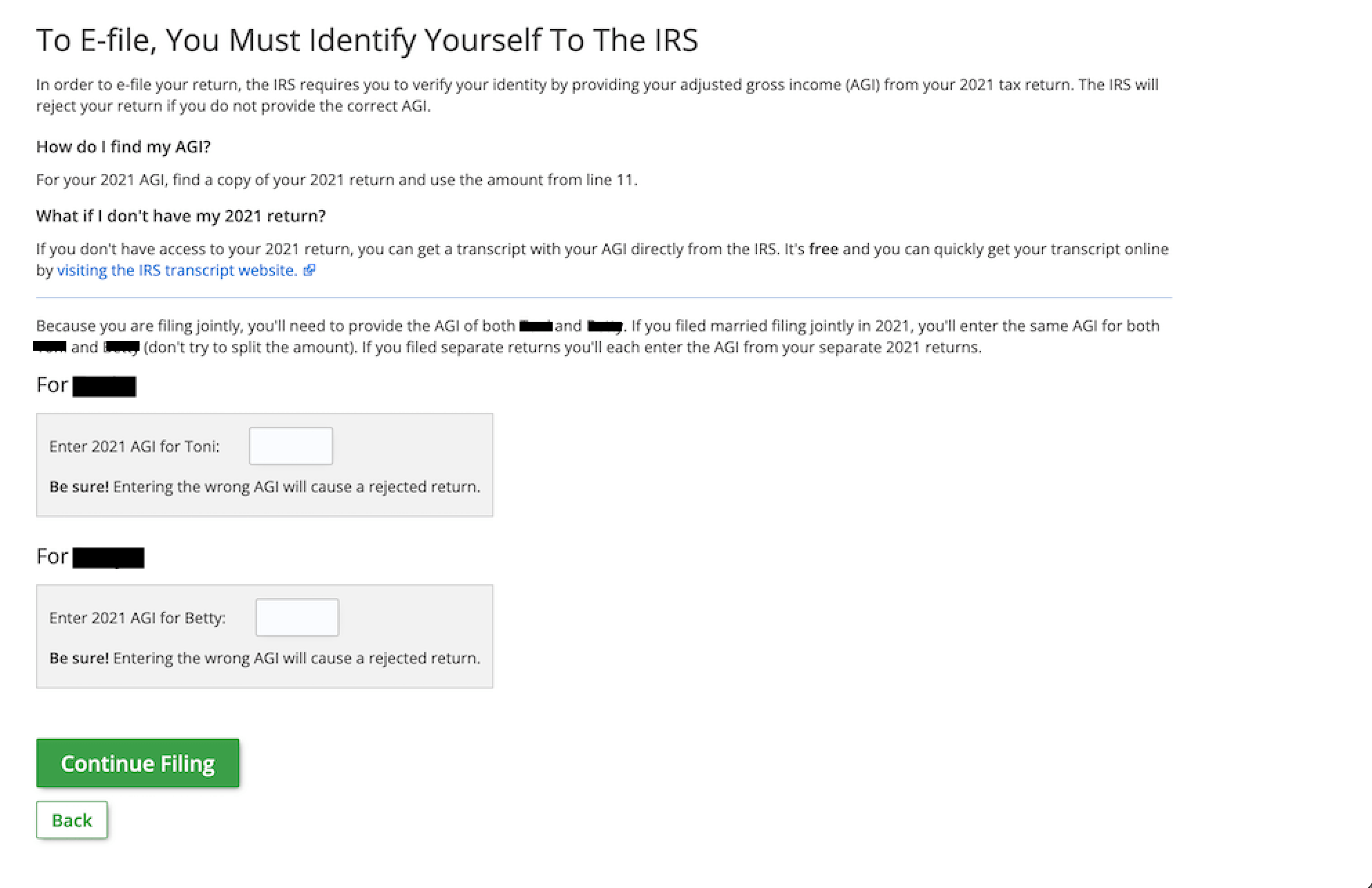

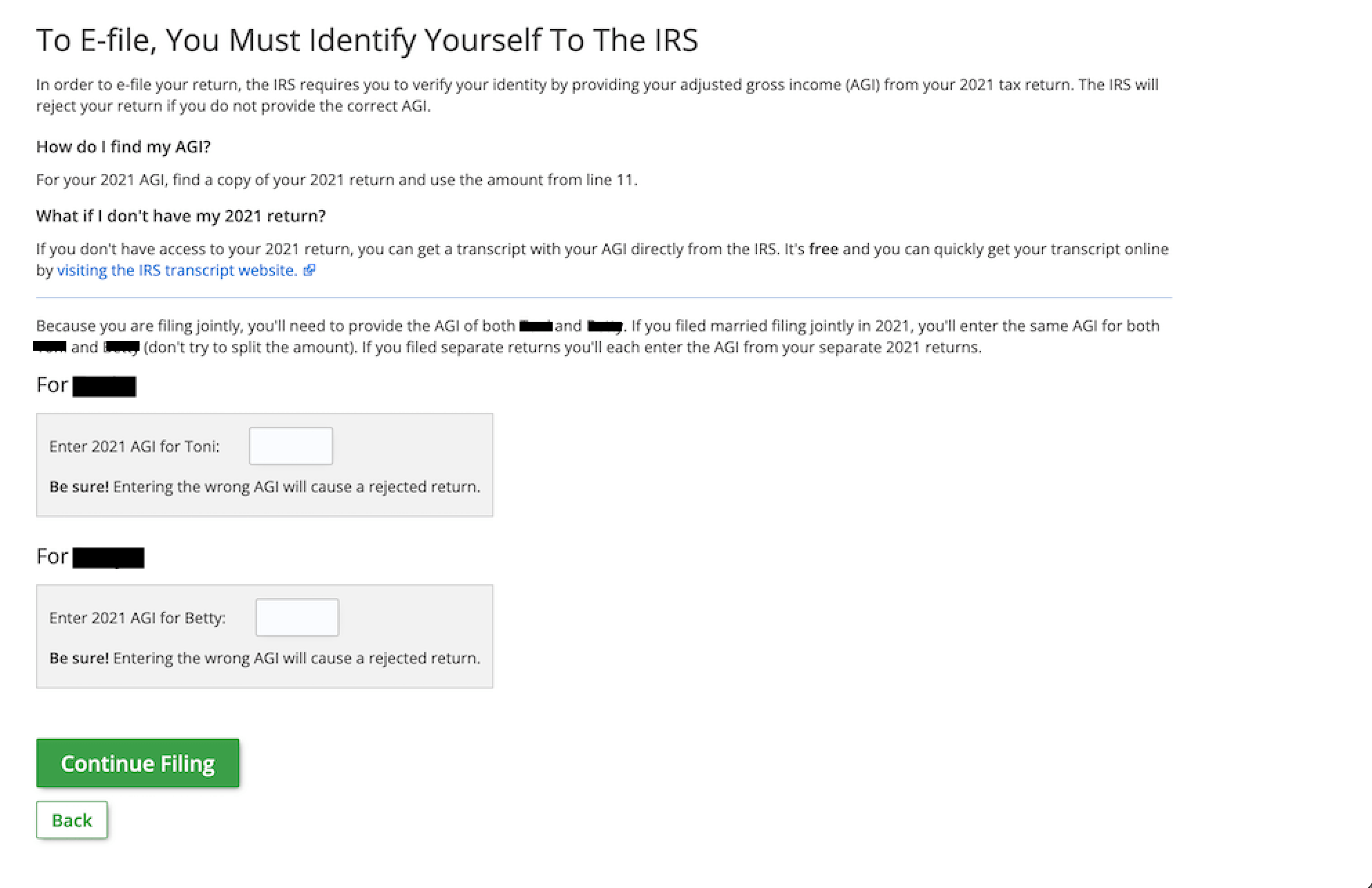

Top 7 Adjusted Gross Income Line On 1040 2022

https://www.efile.com/image/enter-prior-year-agi.png

Withholding Tax Return

https://zatca.gov.sa/ar/eServices/PublishingImages/incom tax submission.png

https://community.ato.gov.au/s/article/a079s0000009GmvAAE

By including your spouse s income in your tax return we can work out if you re entitled to specific offsets rebates or reductions It also lets us know if you re liable for the

https://www.vero.fi/en/individuals/tax-cards-and...

You have the option to either place the mandatory YEL MYEL contributions in your personal tax return or your spouse s return The amounts are equally deductible both ways

Wage And Income Transcript From The Irs INCOMEARTA

Top 7 Adjusted Gross Income Line On 1040 2022

1040 Sr Tax Form 2023 Printable Forms Free Online

1040 Tax Table Married Filing Jointly Elcho Table

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

Income Tax Filing Spouse s Income Tax After Clubbing Spouse s Income

Form 1040 V Payment Voucher Meru Accounting

Where Could Interest And Tax Rates Be Headed Mercer Advisors

Spouse Income Tax Return - The ATO uses your spouse s income to work out whether you are entitled to a rebate for your private health insurance you are entitled to the seniors and pensioners tax offset