Spouse Income Tax Benefit Verkko 22 marrask 2023 nbsp 0183 32 For tax year 2024 the amount is 14 000 7 000 for each The catch up contribution increases the amount to 16 000 8 000 for each In general

Verkko 14 elok 2021 nbsp 0183 32 The tax on your Social Security spousal benefits is in addition to any tax you owe on other income such as wages from Verkko 7 syysk 2023 nbsp 0183 32 You make 120 000 and your spouse makes 40 000 this year Your top tax bracket would be 22 because of how tax law places couples filing jointly See more details in the table below to see

Spouse Income Tax Benefit

Spouse Income Tax Benefit

https://life.futuregenerali.in/media/2zmp035j/tax-benefit-on-loans.jpg

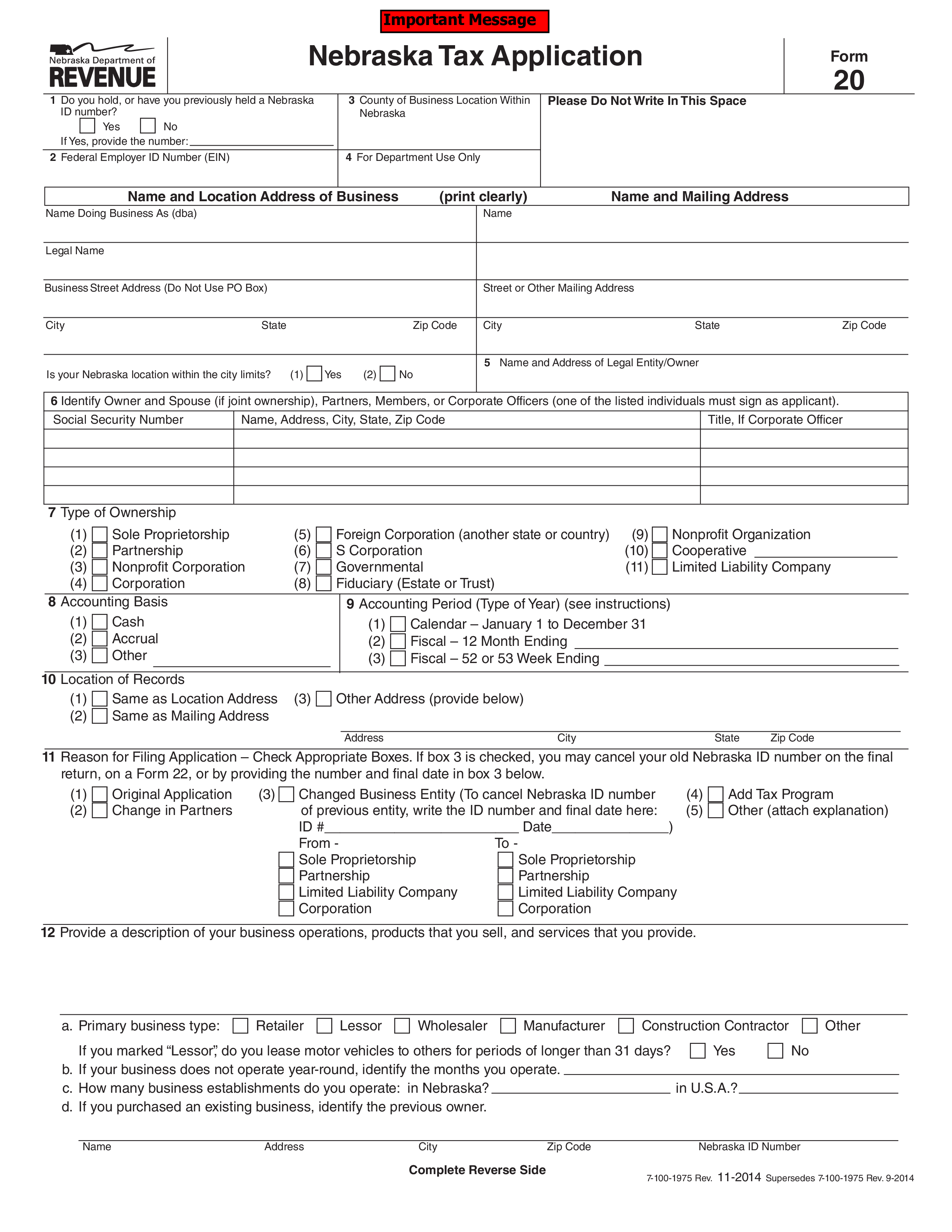

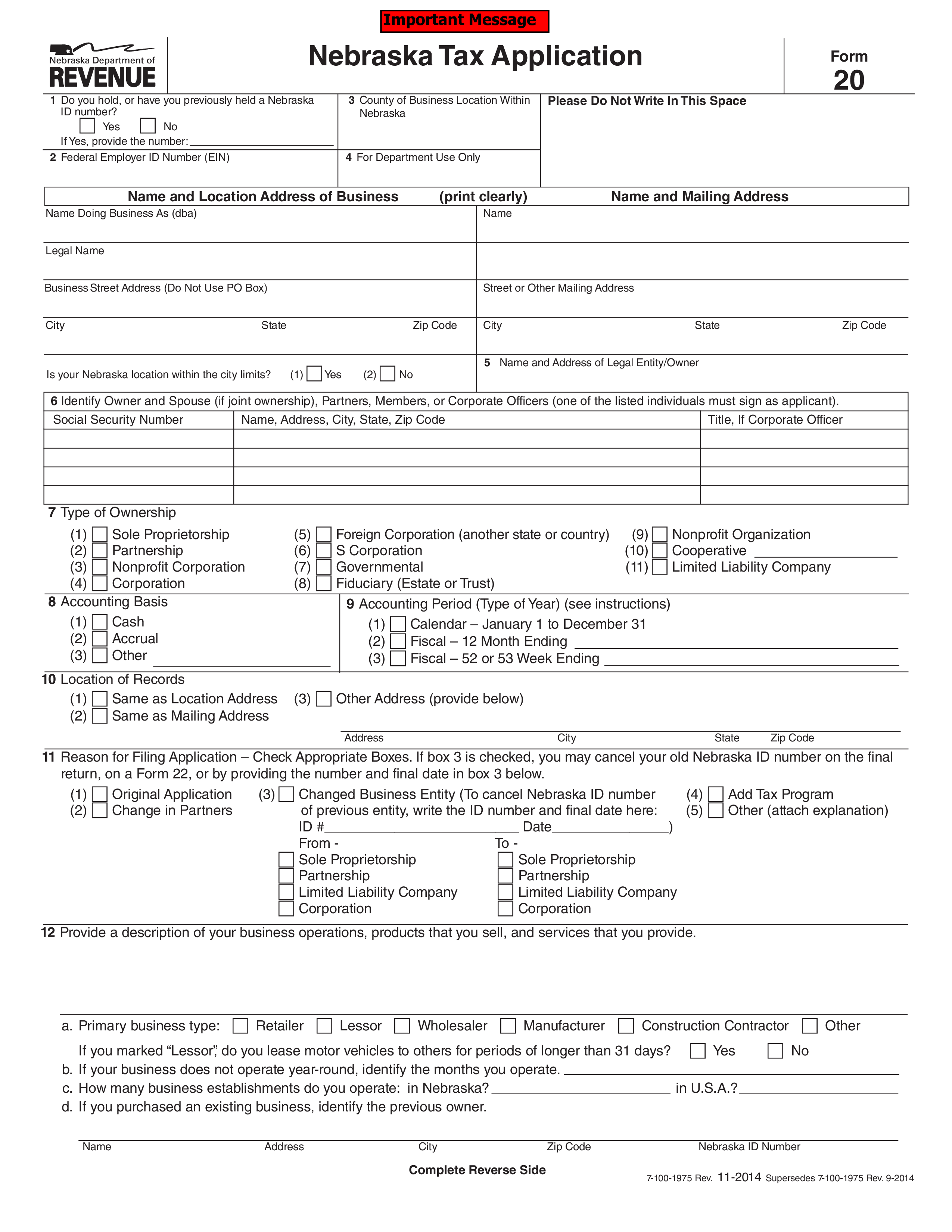

Kostenloses Income Tax Job Application Form

https://www.allbusinesstemplates.com/thumbs/9457204e-5366-4f57-8428-dbfe96dae55c_1.png

Irs Releases Form 1040 For 2020 Tax Year Free Download Nude Photo Gallery

https://www.taxgirl.com/wp-content/uploads/2021/01/Screen-Shot-2021-01-10-at-3.09.05-PM.png

Verkko 31 maalisk 2023 nbsp 0183 32 For the 2022 tax year the standard deduction for single taxpayers and married couples filing separately is 12 950 For heads of households the deduction is 19 400 while for married Verkko 30 tammik 2023 nbsp 0183 32 An individual or an HUF can claim two tax benefits in respect of home loan The first deduction is available in respect of home loan taken from specified

Verkko 2 kes 228 k 2022 nbsp 0183 32 Tax benefits of buying a home in the wife s name Experts explain that some of the obvious tax benefits of buying a home in the wife s name include an extra deduction of interest up to Rs 1 5 Verkko 9 helmik 2023 nbsp 0183 32 So in this scenario you can t deduct a penny of your 6 000 in medical bills because you filed jointly Now let s say you file separately Your AGI is say 55 000 and your spouse s AGI is

Download Spouse Income Tax Benefit

More picture related to Spouse Income Tax Benefit

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

Income Tax Return And Tax Benefit Claim Koppel Services

https://www.koppelservices.com/wp-content/uploads/2017/03/tax-benefit.jpg

How To Compute Income Tax On Salary Kanakkupillai

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/06/How-to-Compute-Income-Tax-on-Salary-with-Example.png

Verkko 5 hein 228 k 2023 nbsp 0183 32 Is Filing Taxes Separately When You re Married a Good Idea Which Is Better Filing Jointly or Separately When deciding how to file your federal income tax Verkko You can t claim spouses as dependents whether he or she maintains residency with you or not However you can claim an exemption for your spouse in certain

Verkko 20 marrask 2021 nbsp 0183 32 The surviving spouse also receives a one time death benefit of 255 regardless of their age They have two years to claim the benefit The amount of benefit gets complicated If neither spouse Verkko 31 jouluk 2022 nbsp 0183 32 If you reconciled with your spouse or common law partner and were living together on December 31 2022 you can claim an amount on line 30300 of your

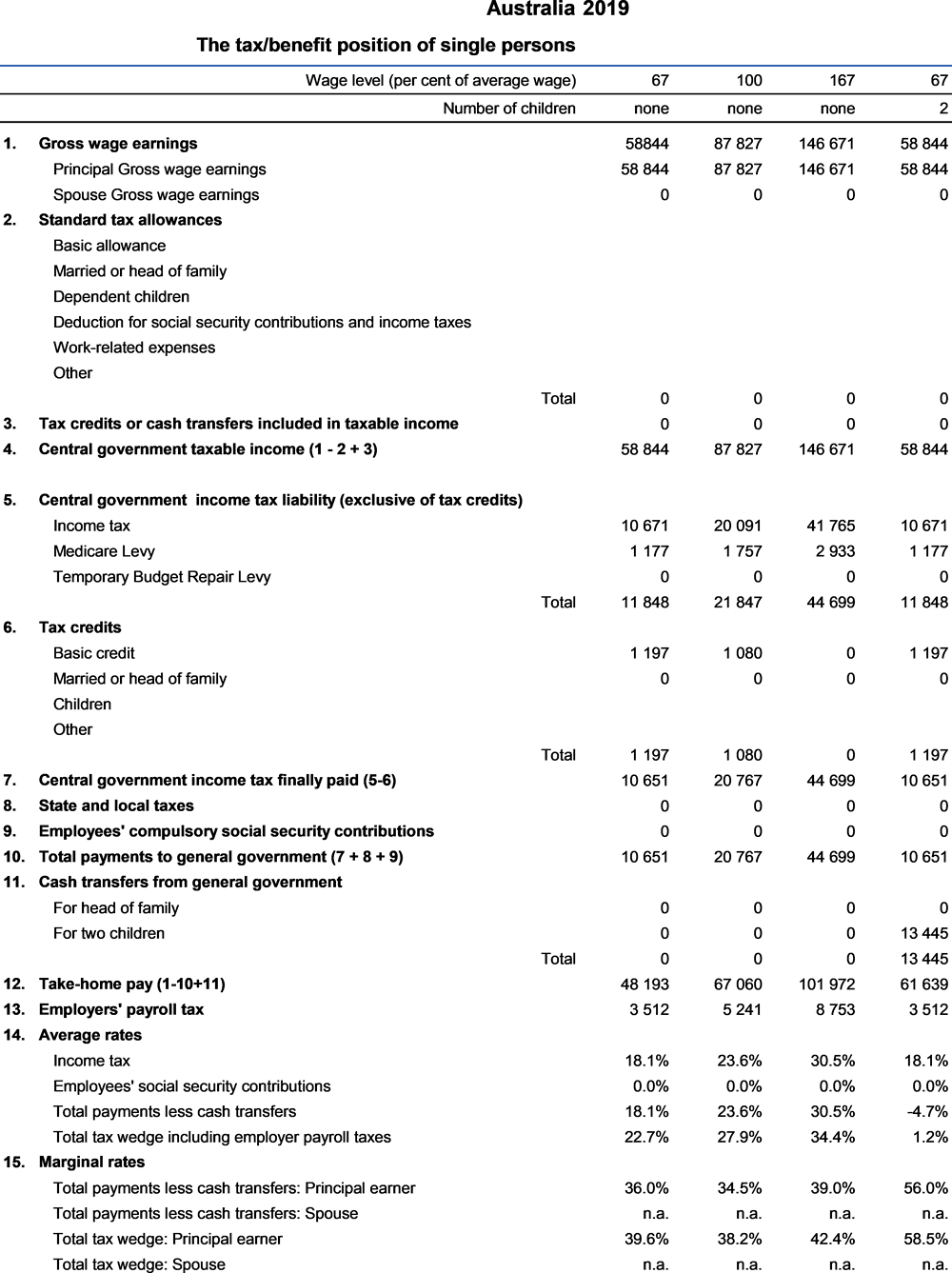

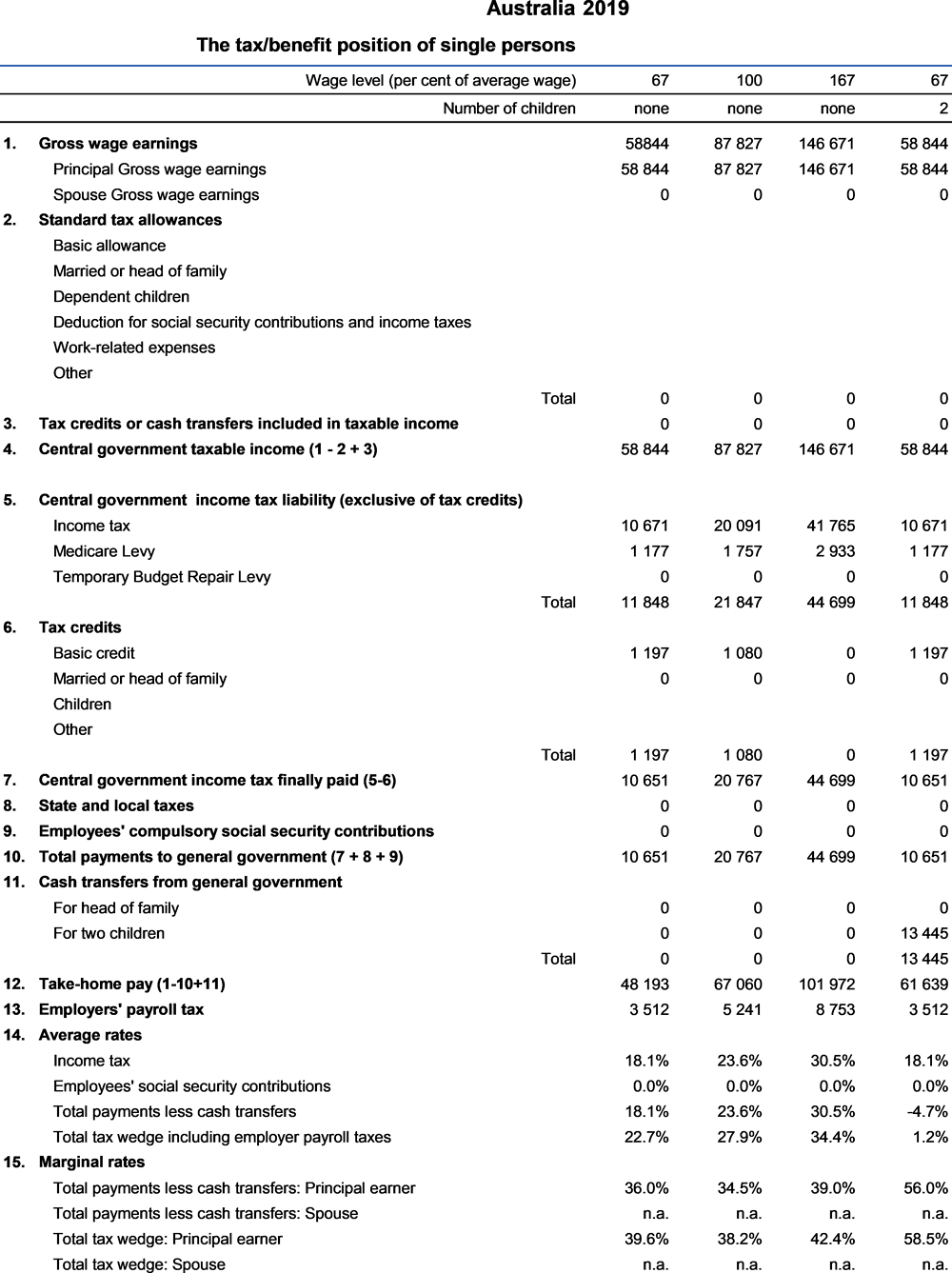

Australia Taxing Wages 2020 OECD ILibrary

https://www.oecd-ilibrary.org/sites/b8dedfd0-en/images/images/Australia19/media/image2.png

How To Split Your Tax Refund With Your Spouse YouTube

https://i.ytimg.com/vi/qnruQ2WPvAc/maxresdefault.jpg

https://www.investopedia.com/articles/retirement/06/marriedperks.asp

Verkko 22 marrask 2023 nbsp 0183 32 For tax year 2024 the amount is 14 000 7 000 for each The catch up contribution increases the amount to 16 000 8 000 for each In general

https://www.investopedia.com/ask/answers/08…

Verkko 14 elok 2021 nbsp 0183 32 The tax on your Social Security spousal benefits is in addition to any tax you owe on other income such as wages from

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

Australia Taxing Wages 2020 OECD ILibrary

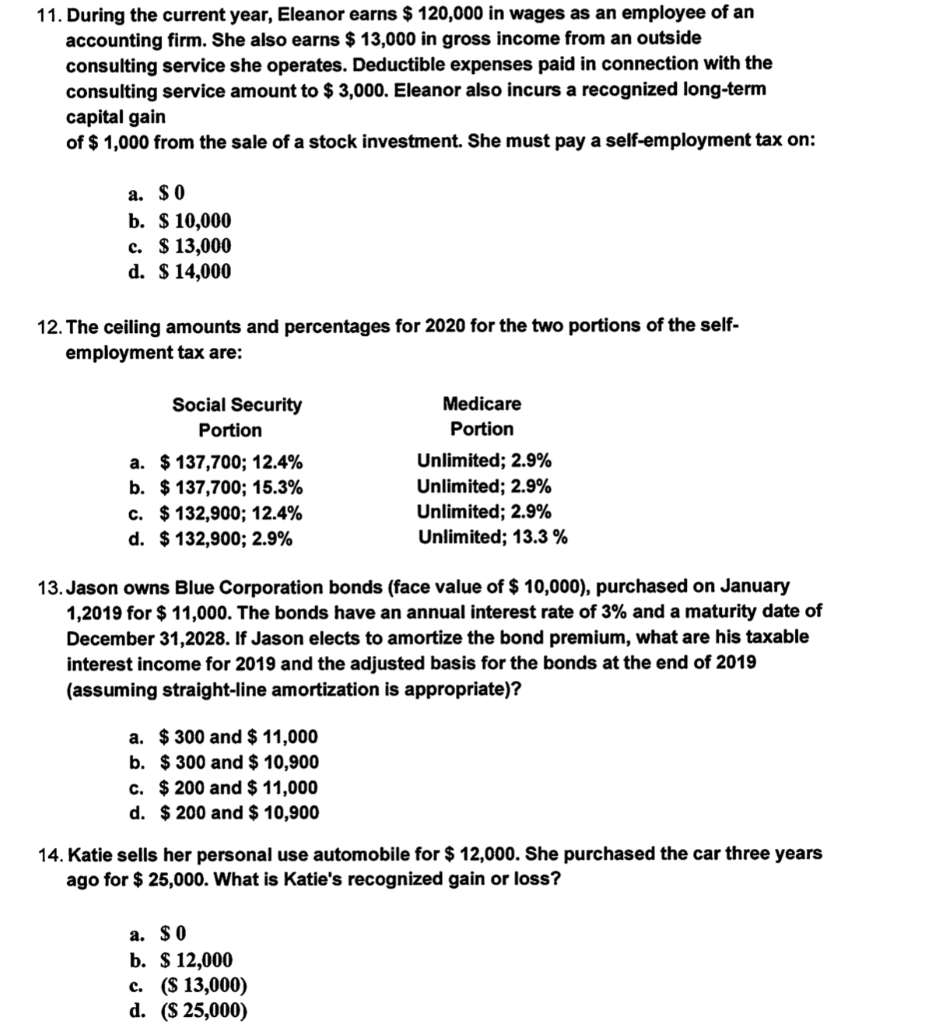

Solved 8 In 2020 George And Martha Are Married And File A Chegg

Tax Table Internal Revenue Code Sales Revenue Net Income Tax

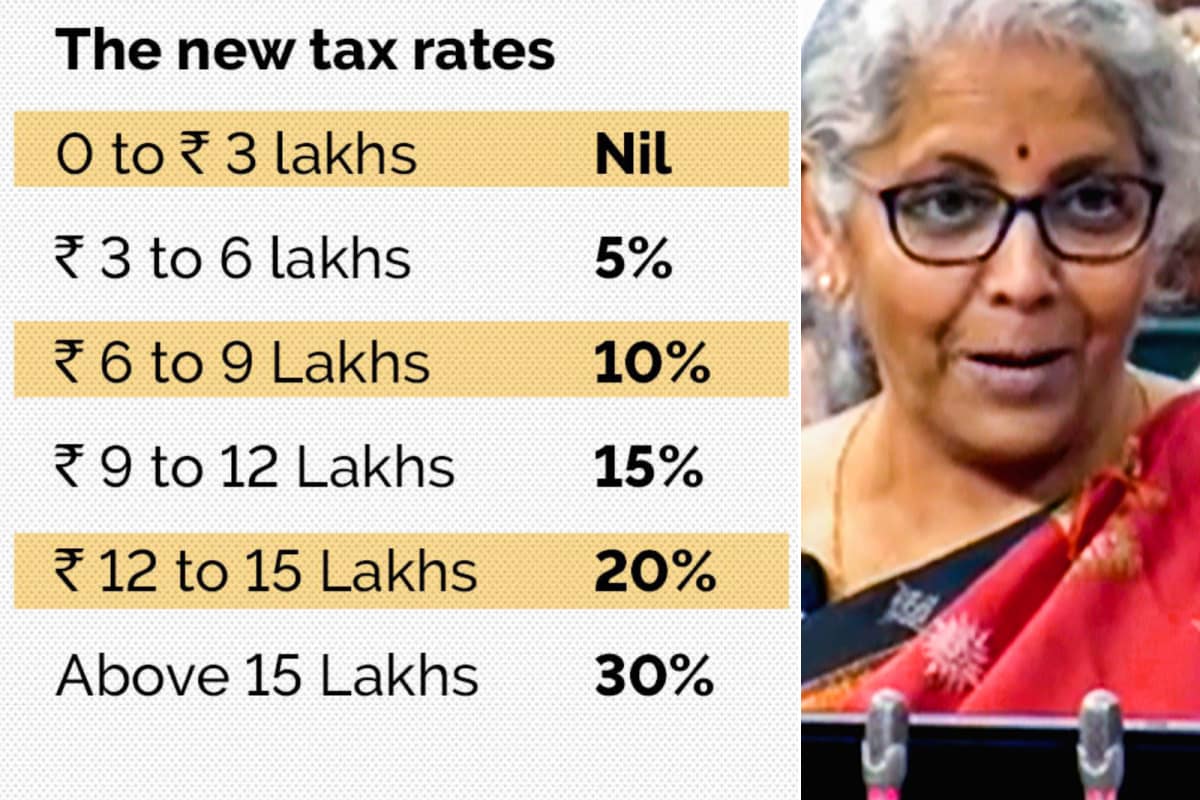

CNN News18 News Anchor Journalist Columnist Blogger Page363

Tax Reduction Company Inc

Tax Reduction Company Inc

Investment Secrets Revealed How To Get Highest Tax Benefit With Tax

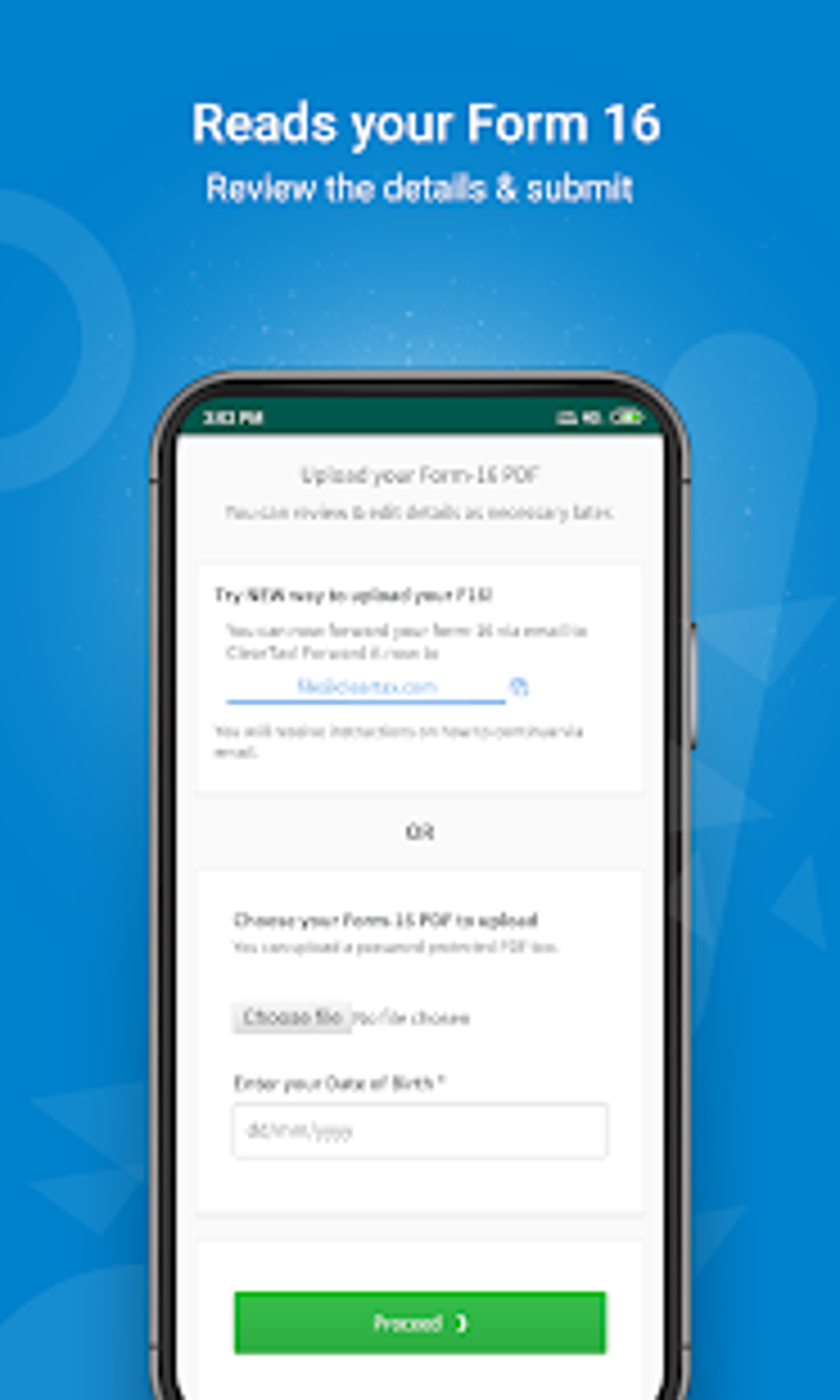

File FREE Income Tax Return ClearTax ITR E filing Android

Clubbing Of Income Of Spouse Child A Complete Guide FY 2024

Spouse Income Tax Benefit - Verkko 30 elok 2022 nbsp 0183 32 Hi Todd Yes If you earn more than the earnings test exempt amount then Social Security will need to withhold at least part of both your retirement benefits