Spousal Income Tax Credit If you reconciled with your spouse or common law partner and were living together on December 31 2023 you can claim an amount on line 30300 of your return and any allowable amounts on line 32600 of your return Only one spouse or common law partner can claim the amount on line 30300 for each other for the same year

The type of spousal support paid after a divorce can have varying tax implications Learn how to settle on the best tax solution for both parties Find if you qualify for the Earned Income Tax Credit EITC with or without qualifying children or relatives on your tax return Low to moderate income workers with qualifying children may be eligible to claim the Earned Income Tax Credit EITC if certain qualifying rules apply to them

Spousal Income Tax Credit

Spousal Income Tax Credit

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Earned Income Credit The Only Things You Need To Know Income

https://i.pinimg.com/originals/fa/72/ec/fa72ec5d477a4309bb49673a5f76f757.jpg

If you are married and you file your tax return using the filing status married filing separately you may be eligible for the Premium Tax Credit if you meet the criteria in section 1 36B 2 b 2 of the Income Tax Regulations which allows certain victims of domestic abuse and spousal abandonment to claim the Premium Tax Credit using the Married filing separately is a tax status that you can choose to file if you do not want to be responsible for any of your spouse s income or taxes If you re married and file a separate tax return you re only responsible for that

A tax credit is a benefit that lowers your taxes owed by the amount of the credit Tax credits can be nonrefundable refundable or partially refundable Complete Schedule S2 Provincial or Territorial Amounts Transferred from your Spouse or Common Law Partner to claim the corresponding provincial or territorial non refundable tax credit Enter the result on line 58640 of your provincial or territorial Form 428

Download Spousal Income Tax Credit

More picture related to Spousal Income Tax Credit

https://c.pxhere.com/photos/c2/d6/tax_return_control_tax_office_form_finance_money_income_tax_billing-1038566.jpg!d

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

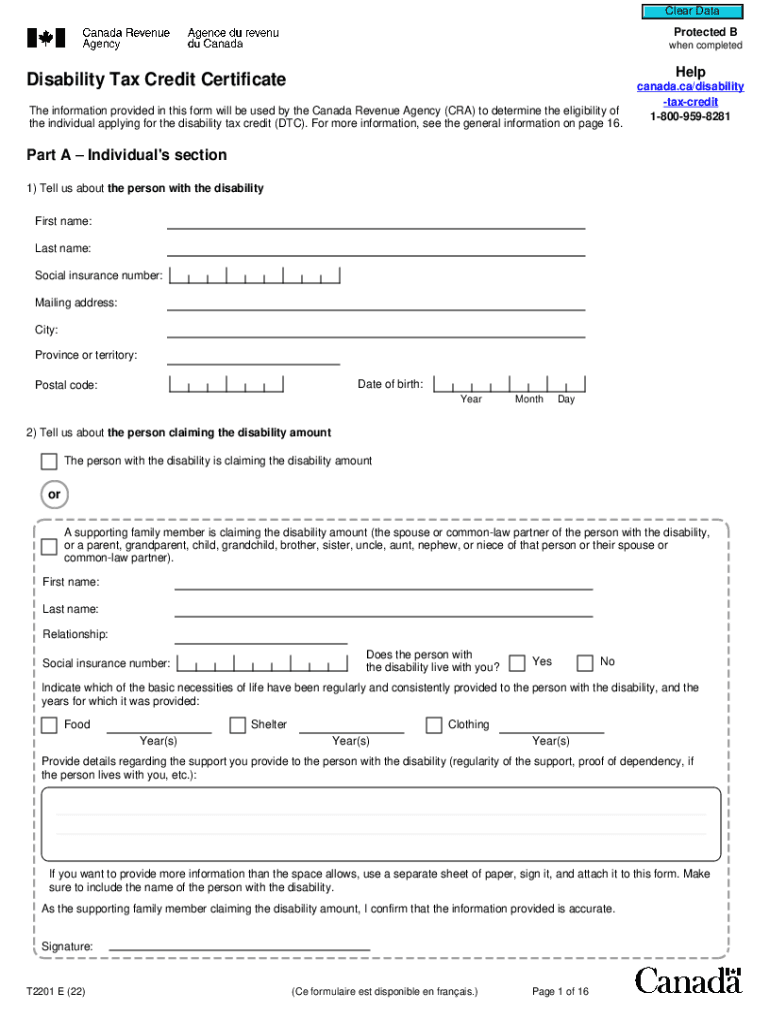

Cra Form T2201 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/612/211/612211030/large.png

Earned income tax credit Depending on your financial circumstances couples may also benefit or be penalized by the earned income tax credit EITC which is designed to help low to moderate income workers If you and your spouse or common law partner were separated for only part of the year due to a breakdown in your relationship you can still claim this tax credit as long as you do not claim any support amounts paid to your spouse

If you pay someone to provide care for your disabled spouse such as a nurse or aide you might be eligible for the tax credit for Child and Dependent Care Credit This is the same credit that working parents claim when they pay for child care Claiming Tax Credits and Deductions With a Spouse If one spouse is unemployed or has very low earnings the other spouse can claim a spousal tax credit See the tables of non refundable personal tax credits for the federal and provincial territorial amounts of the spousal tax credit

Income Tax Statistics 2023 Tax Brackets USA UK And More

https://www.enterpriseappstoday.com/wp-content/uploads/2022/10/Income-Tax-Statistics.jpg

How To Compute Income Tax On Salary Kanakkupillai

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/06/How-to-Compute-Income-Tax-on-Salary-with-Example.png

https://www.canada.ca/en/revenue-agency/services/...

If you reconciled with your spouse or common law partner and were living together on December 31 2023 you can claim an amount on line 30300 of your return and any allowable amounts on line 32600 of your return Only one spouse or common law partner can claim the amount on line 30300 for each other for the same year

https://www.investopedia.com/articles/tax/10/...

The type of spousal support paid after a divorce can have varying tax implications Learn how to settle on the best tax solution for both parties

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

Income Tax Statistics 2023 Tax Brackets USA UK And More

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

Earned Income Tax Credit EITC Are You Eligible Kiplinger

How To Determine The Most Tax Friendly States For Retirees

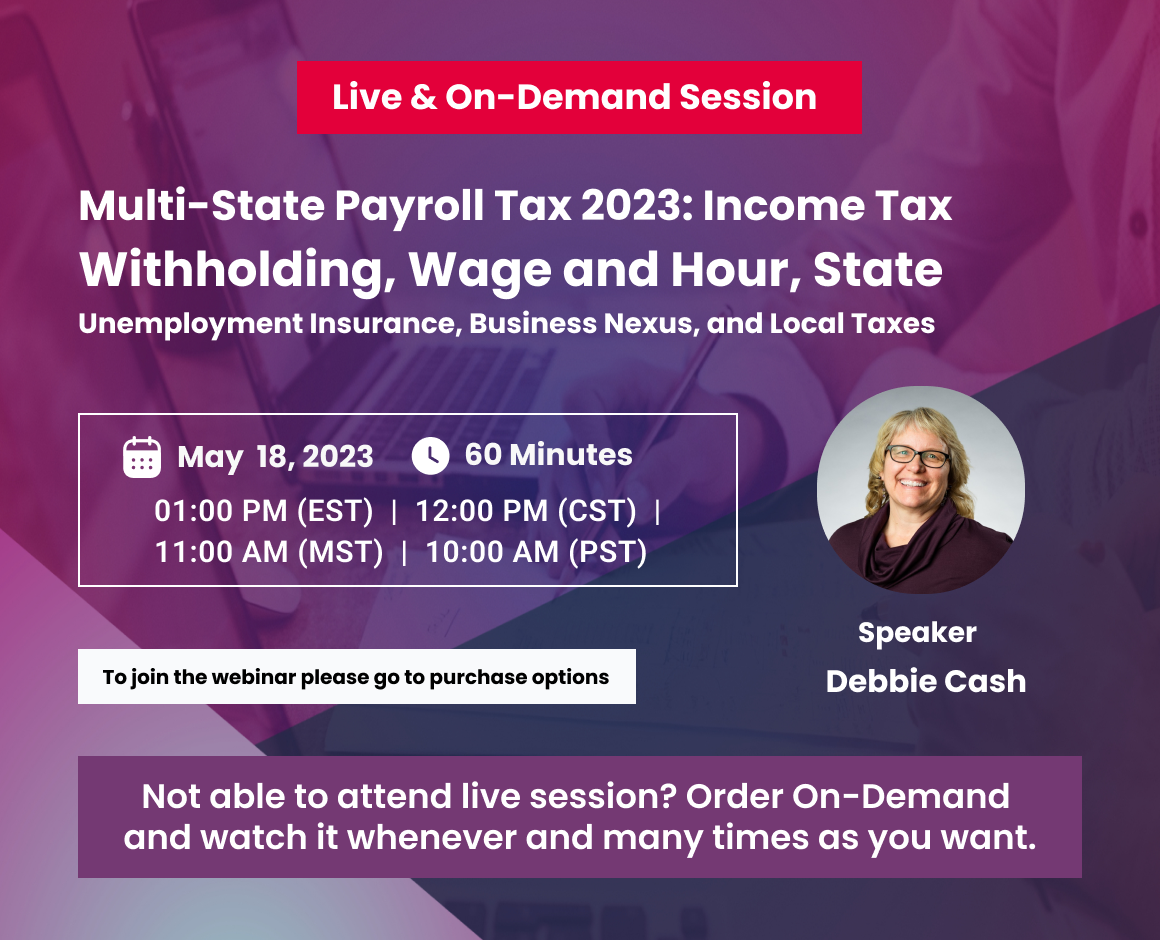

Multi State Payroll Tax 2023 Income Tax Withholding Wage And Hour

Multi State Payroll Tax 2023 Income Tax Withholding Wage And Hour

CNN News18 News Anchor Journalist Columnist Blogger Page363

State Income Tax

Common Income Tax Mistakes American Profile

Spousal Income Tax Credit - Married filing separately is a tax status that you can choose to file if you do not want to be responsible for any of your spouse s income or taxes If you re married and file a separate tax return you re only responsible for that