Standard Deduction In New Tax Regime 2023 Budget Web 9 Feb 2023 nbsp 0183 32 Budget 2023 extends standard deduction to the new income tax regime Budget 2023 extended standard deduction to the new income tax regime Salaried individuals pensioners and family pensioners can now avail of standard deductions even if they choose the new income tax regime Getty Images 2 7 What FM Nirmala

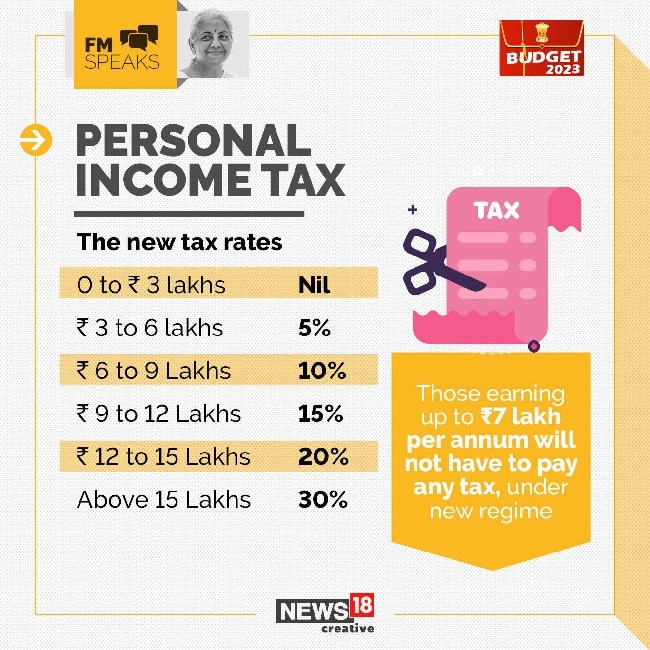

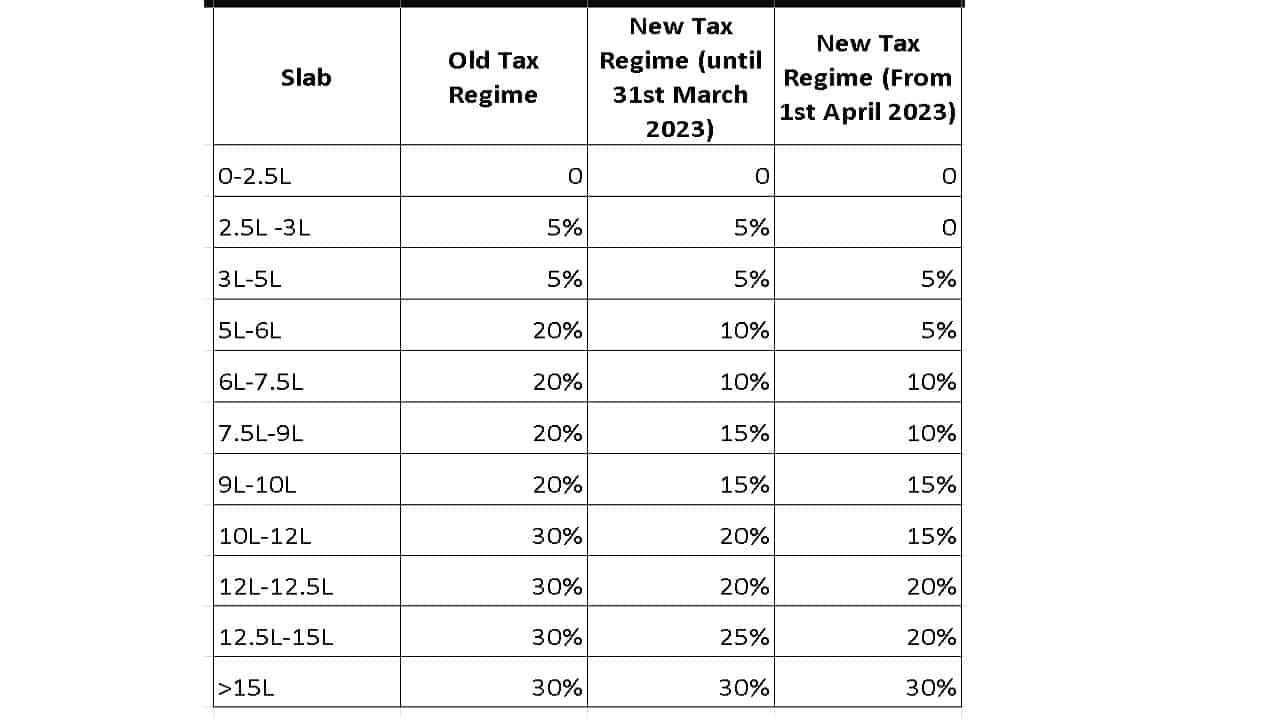

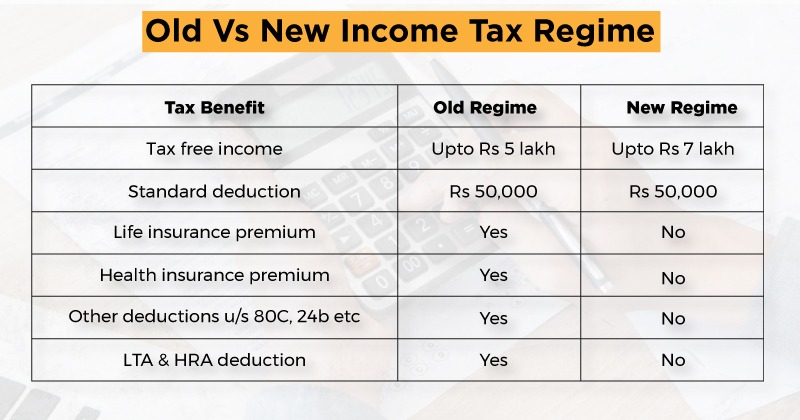

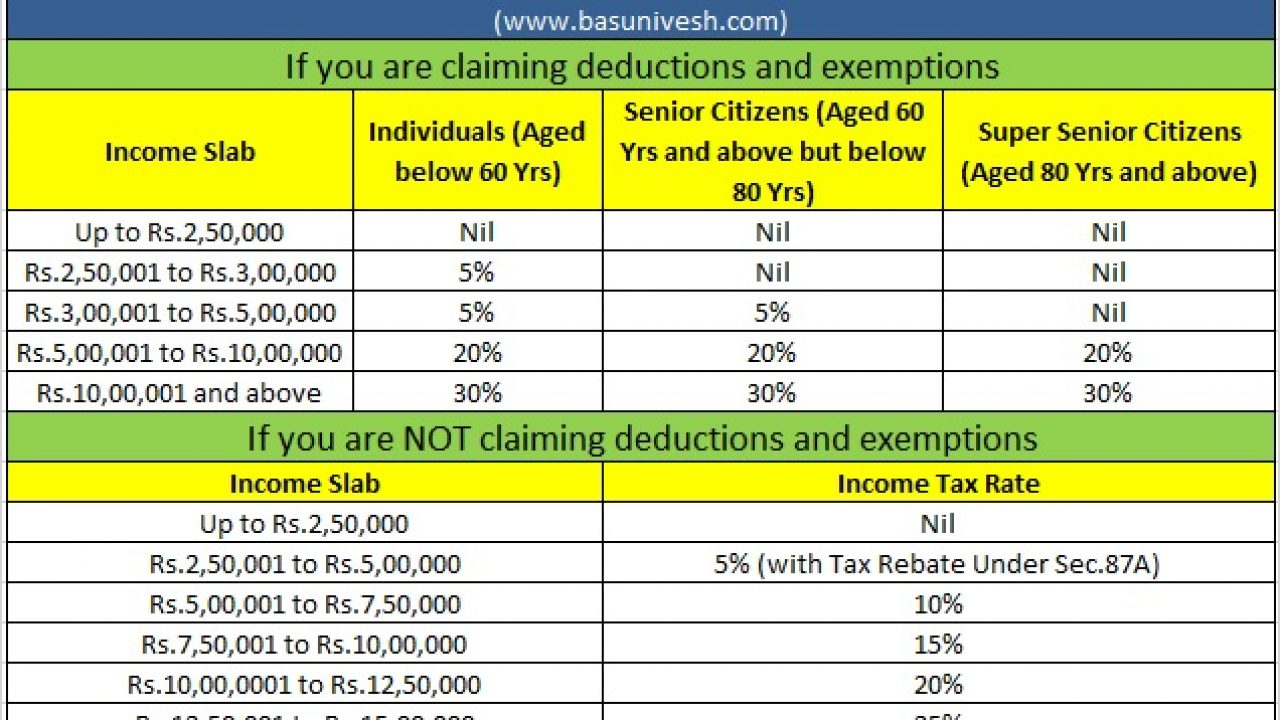

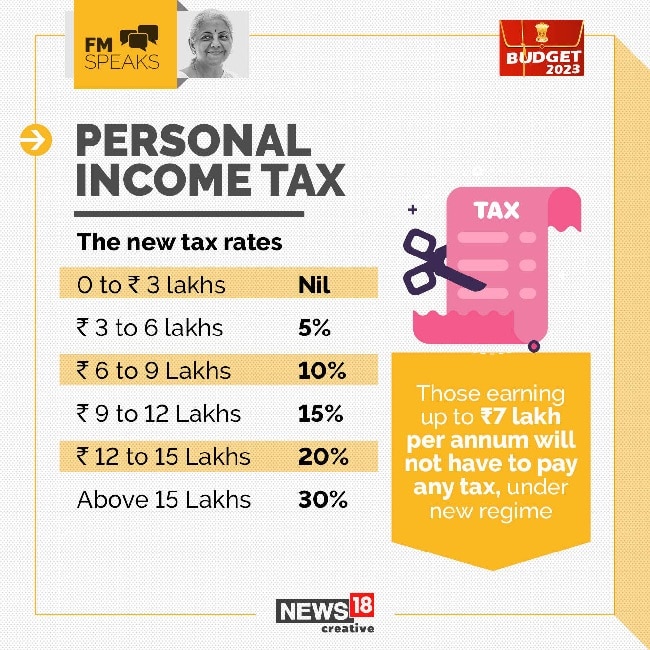

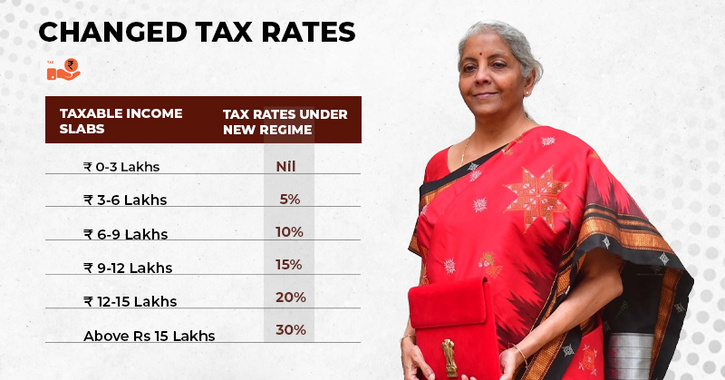

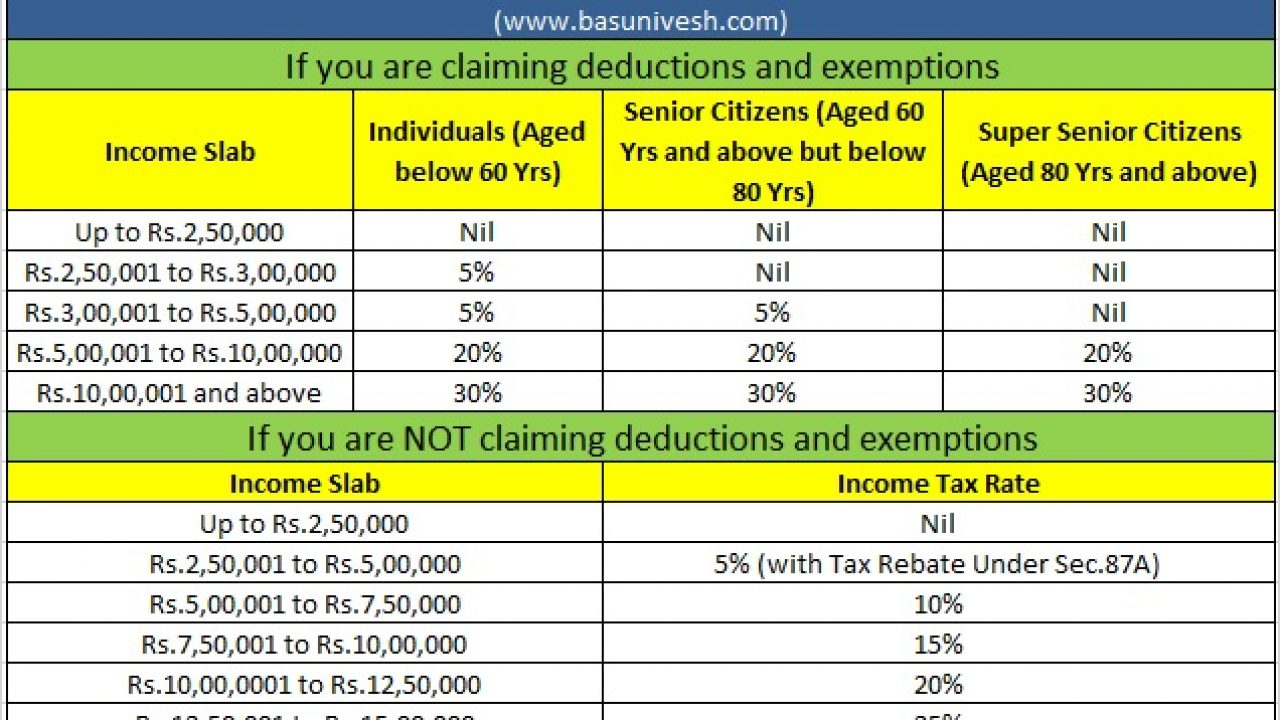

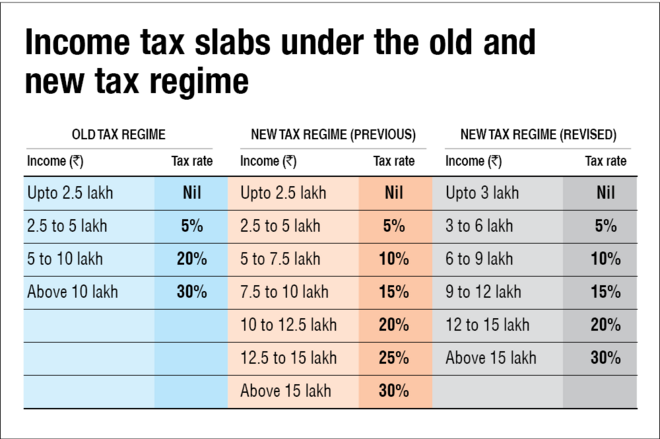

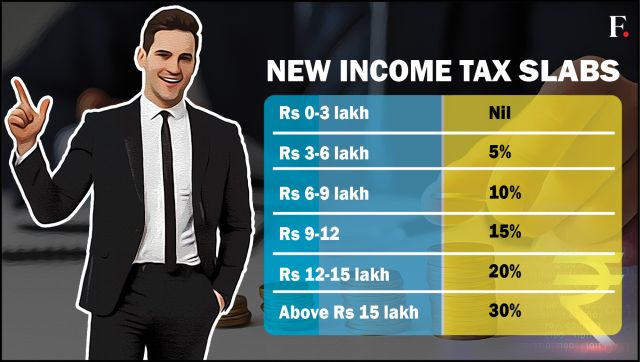

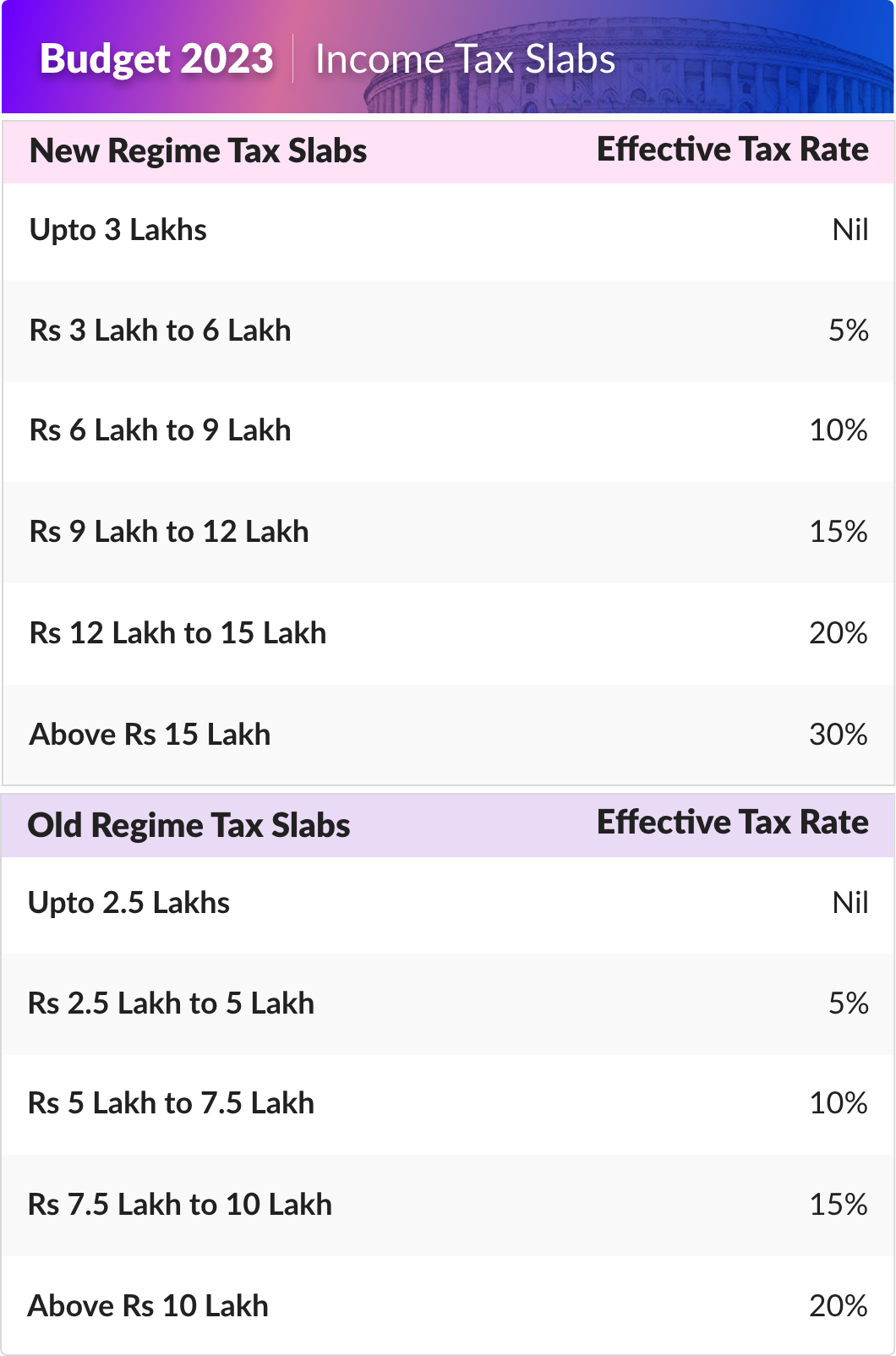

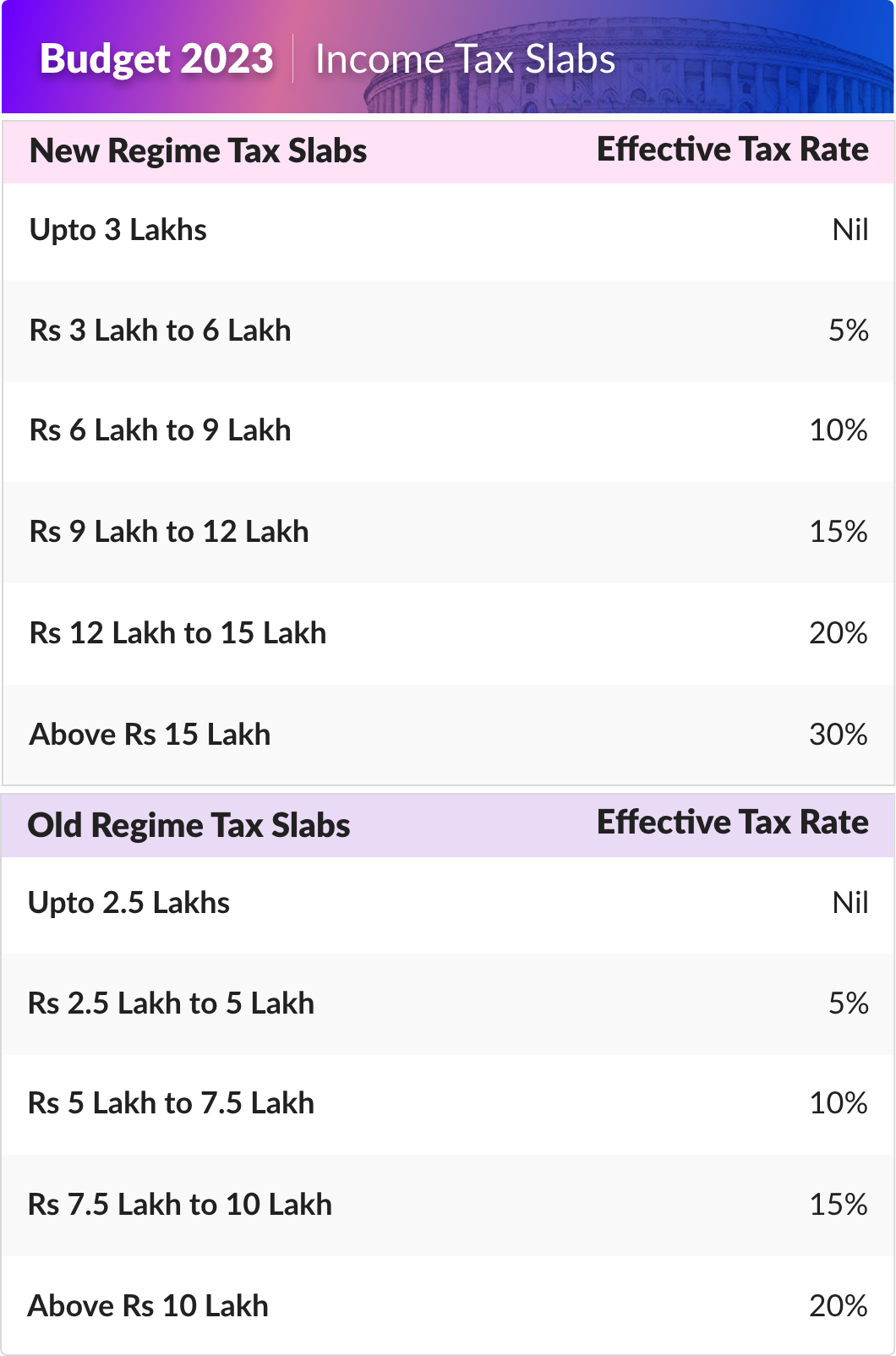

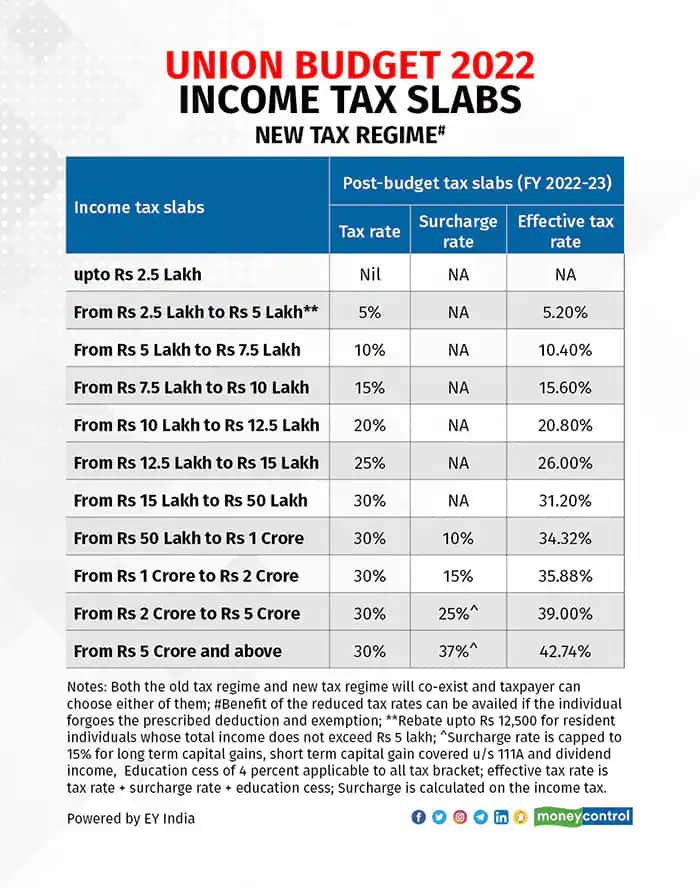

Web 1 Feb 2023 nbsp 0183 32 The Budget today proposed to extend the benefit of standard deduction to the new tax regime Each salaried person with an income of Rs 15 5 lakh or more will thus stand to benefit by Rs 52 500 she said A rebate under section 87A has been enhanced under the new tax regime from current income level of Rs 5 lakh to Rs 7 lakh Thus Web Vor 6 Tagen nbsp 0183 32 Income tax slabs for FY2023 24 under the new tax regime are as follows Impact The changes in the income tax slabs under the new tax regime have made it more attractive as compared to the old tax regime The changes will be beneficial for those who are unable to make tax saving investments and expenditures in the old tax regime

Standard Deduction In New Tax Regime 2023 Budget

Standard Deduction In New Tax Regime 2023 Budget

https://images.cnbctv18.com/wp-content/uploads/2023/02/tax2.jpg

Budget 2023 Not Compelling Anyone To Shift From Old To New Tax Regime

https://images.firstpost.com/wp-content/uploads/2023/02/rsz_news_tax_rates.jpg

Revised New Tax Regime In Budget 2023 Comparison Table

https://freefincal.com/wp-content/uploads/2023/02/Revised-New-Tax-Regime-in-Budget-2023-Comparison-Table.jpg

Web 1 Feb 2023 nbsp 0183 32 Union Finance Minister Nirmala Sitharaman in her Budget 2023 announcement said that the standard deduction for salaried employees will now be a part of new tax slab Each salaried person with an income of Rs 15 5 lakh or more will stand to benefit by Rs 52 500 as standard deduction FM said Web Vor 2 Tagen nbsp 0183 32 New Tax regime until 31st March 2023 New Tax Regime From 1st April 2023 Income level for rebate eligibility 5 lakhs 5 lakhs 7 lakhs Standard Deduction 50 000 50 000 Effective Tax Free Salary income 5 5 lakhs 5 lakhs 7 5 lakhs Rebate u s 87A 12 500 12 500 25 000 HRA Exemption X X Leave

Web 2 Feb 2023 nbsp 0183 32 The following deduction shall be allowed under the new tax regime a Standard deduction to salaried taxpayer of Rs 50 000b Deduction from income in the nature of family pension 1 3rd of income or Rs 15 000 whichever is less c Amount paid or deposited in Agniveer Corpus Fund under newly proposed section 80CCH of the Act Web 1 Feb 2023 nbsp 0183 32 Income between Rs 3 lakh and Rs 6 lakh would be taxed at 5 Rs 6 lakh and Rs 9 lakh at 10 Rs 9 lakh and Rs 12 lakh at 15 Rs 12 lakh and Rs 15 lakh at 20 and income of Rs 15 lakh and above will be taxed at 30 I propose to extend the benefit of standard deduction to the new tax regime

Download Standard Deduction In New Tax Regime 2023 Budget

More picture related to Standard Deduction In New Tax Regime 2023 Budget

Old Vs New Tax Regime Which One To Pick

https://im.indiatimes.in/content/2023/Feb/Old-Vs-New-Tax-Regime-Which-One-To-Pick-After-Budget-2023_63db747264d86.jpg

New Tax Regime Exemption And Deduction 2023 List After Budget 2023

https://i.ytimg.com/vi/hGWvrWSxX0E/maxresdefault.jpg

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

Web Improved rebate modified tax structure slabs reduced surcharges higher exemption on leave encashment for retirees in private sector and extension of standard deduction in the New Tax Regime were announced by the Finance Minister Nirmala Sitharaman during Parliament s Budget Session on 1 February 2023 Web 6 Feb 2023 nbsp 0183 32 Introduction of standard deduction in New Personal Tax Regime quot NPTR quot changes in the basic exemption limit changes in the income tax slab rates reduction of the peak marginal tax rate increase in gross receipts limits for presumptive income for professionals etc are all strong positives and a hit with the public

Web Vor 2 Tagen nbsp 0183 32 Salary income The standard deduction of 50 000 which was only available under the old regime has now been extended to the new tax regime as well This along with the rebate makes 7 5 lakhs as Web 1 Feb 2023 nbsp 0183 32 14 The new income tax regime will now become the default option but people will still have the option to go for old income tax regime 15 Section 16 of the Income Tax Act 1961 Standard deduction As per the provisions of section 16 ia there is a standard deduction of Rs 50000 the amount of the salary whichever is less has

Pay Deduction Calculator 2021 Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/standard-deduction-for-salary-ay-2021-22-standard.jpg

Do You Know When Old And New Tax Regimes Give The Same Tax Liability

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/break-even-point-for-old-and-new-tax-regime-.jpg?itok=h3-wLBy8

https://economictimes.indiatimes.com/wealth/tax/new-income-tax-slabs...

Web 9 Feb 2023 nbsp 0183 32 Budget 2023 extends standard deduction to the new income tax regime Budget 2023 extended standard deduction to the new income tax regime Salaried individuals pensioners and family pensioners can now avail of standard deductions even if they choose the new income tax regime Getty Images 2 7 What FM Nirmala

https://economictimes.indiatimes.com/news/economy/policy/standard...

Web 1 Feb 2023 nbsp 0183 32 The Budget today proposed to extend the benefit of standard deduction to the new tax regime Each salaried person with an income of Rs 15 5 lakh or more will thus stand to benefit by Rs 52 500 she said A rebate under section 87A has been enhanced under the new tax regime from current income level of Rs 5 lakh to Rs 7 lakh Thus

10 FAQs About The New Income Tax Regime s Changes Effective From FY 2023 24

Pay Deduction Calculator 2021 Tax Withholding Estimator 2021

Old Or New Which Tax Regime Is Better After Budget 2023 24 Value

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

Union Budget 2023 2024 What Are The New Income Tax Slabs And How Much

Budget 2023 New Income Tax Slabs How To Calculate Your Tax Hindustan

Budget 2023 New Income Tax Slabs How To Calculate Your Tax Hindustan

Budget 2023 New Income Tax Regime Standard Deduction Check Amount

Income Tax New Regime These Are The Deductions You Can Still Claim

Budget 2023 What Could The FM Do To Make The New Regime Attractive To

Standard Deduction In New Tax Regime 2023 Budget - Web Vor 2 Tagen nbsp 0183 32 New Tax regime until 31st March 2023 New Tax Regime From 1st April 2023 Income level for rebate eligibility 5 lakhs 5 lakhs 7 lakhs Standard Deduction 50 000 50 000 Effective Tax Free Salary income 5 5 lakhs 5 lakhs 7 5 lakhs Rebate u s 87A 12 500 12 500 25 000 HRA Exemption X X Leave