Star Tax Rebate New York Web 26 Dez 2023 nbsp 0183 32 You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either

Web 30 Okt 2023 nbsp 0183 32 You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either Web 18 Mai 2021 nbsp 0183 32 The STAR credit program open to any eligible homeowner whose income is 500 000 or less provides you with a check in the mail from the New York State Tax Department to apply to your school taxes If you currently receive your STAR benefit as a reduction on your school tax bill the STAR exemption you may receive a greater

Star Tax Rebate New York

Star Tax Rebate New York

https://cdn.newsday.com/ace/c:NTBhYzAzOTktOTBkNi00:OGU5ZjNh/landscape/1280

New York Weighs A Gas Tax Holiday A Popular Bad Idea The New York

https://static01.nyt.com/images/2022/03/30/nyregion/30ny-gastax/merlin_204671793_9d487063-9d27-456f-83ff-f398e9a954b2-superJumbo.jpg?quality=75&auto=webp

New York Weighs A Gas Tax Holiday A Popular Bad Idea The New York

https://static01.nyt.com/images/2022/03/30/nyregion/30ny-gastax/30ny-gastax-videoSixteenByNineJumbo1600.jpg

Web 26 Dez 2023 nbsp 0183 32 Income eligibility for the 2024 STAR credit is based on federal or state income tax return information from the 2022 tax year Income for STAR purposes Income means federal adjusted gross income minus the taxable amount of total distributions from IRAs individual retirement accounts and individual retirement annuities Web 8 Sept 2023 nbsp 0183 32 Make under 500 000 or under per household for the STAR credit and 250 000 or under for the STAR exemption Seniors are eligible for Enhanced STAR if they are 65 or older Own and occupy a

Web 30 Okt 2023 nbsp 0183 32 You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either Web 1 How it Works STAR helps lower the property taxes for eligible homeowners who live in New York State If you apply and are eligible you ll get a STAR credit check by mail every year to use towards your property taxes There are two types of STAR benefits depending on your household income

Download Star Tax Rebate New York

More picture related to Star Tax Rebate New York

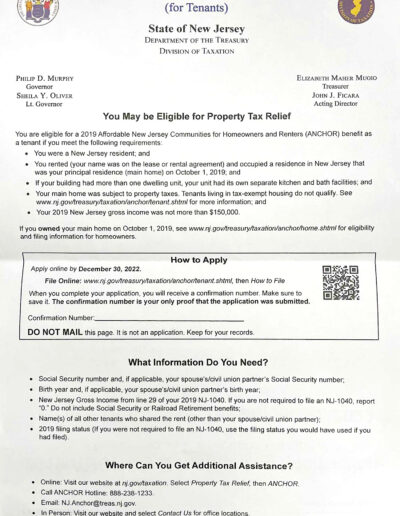

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

New York State Begins Mailing Out Homeowner Tax Rebate Credit Checks

https://media.wgrz.com/assets/WGRZ/images/1045202f-604f-4386-8a31-35efff450899/1045202f-604f-4386-8a31-35efff450899_1920x1080.jpg

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

Web 8 Sept 2022 nbsp 0183 32 The STAR benefit program provides eligible homeowners with a break on their property taxes through an up front savings that comes directly off their tax bill the STAR exemption or a Web 9 Apr 2022 nbsp 0183 32 Under this program basic School Tax Relief STAR exemption and credit beneficiaries with incomes below 250 000 and Enhanced STAR recipients are eligible for the property tax rebate where the benefit is a percentage of

Web 18 Sept 2023 nbsp 0183 32 Do I need to register STAR exemption Q I own my single family home and have resided in it for more than a decade but I never applied for the Basic STAR exemption Am I eligible for the Basic STAR exemption now or do I have to register for the STAR credit with the Tax Department Web To be eligible for Basic STAR your income must be 250 000 or less You currently receive Basic STAR and would like to apply for Enhanced STAR You may be eligible for Enhanced STAR if you will be 65 or older in the calendar year in which you apply

Tax Rebate New Bag Of 2 9 Billion For Refunds Date And Who Is

https://phantom-marca.unidadeditorial.es/ad52a6d9611f7ac6c51c3f1b9d235934/resize/1200/f/jpg/assets/multimedia/imagenes/2022/09/18/16635146467097.jpg

The Star Tax Rebate For Domestic Travel Among Incentives Proposed To

https://global-uploads.webflow.com/5e15da6978f3a3f265178139/63b7955762c88f46410d1a6c_amirudin-shari-com-Star-TaxTravel.jpg

https://www.tax.ny.gov/pit/property/star

Web 26 Dez 2023 nbsp 0183 32 You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either

https://www.tax.ny.gov/pit/property/star/star-check-delivery-schedule.htm

Web 30 Okt 2023 nbsp 0183 32 You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either

I Missed The Homestead Rebate Deadline What Now Nj PropertyRebate

Tax Rebate New Bag Of 2 9 Billion For Refunds Date And Who Is

NY STAR Tax Program YouTube

Kentucky Tax Rebate 2023 Tax Rebate

Senator Andrew Zwicker Apply For Your Rebate New Jersey

Second New Jersey Anchor Tax Rebate Announced All You Need To Know

Second New Jersey Anchor Tax Rebate Announced All You Need To Know

Tax Relief Being Mailed To Eligible New Yorkers

When Will NY Homeowners Get New STAR Rebate Checks Syracuse

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You

Star Tax Rebate New York - Web 30 Okt 2023 nbsp 0183 32 You may be thinking of the homeowner tax rebate credit HTRC checks that we issued in 2022 HTRC was a one year program for 2022 only you will not receive an HTRC check for 2023 or other years The STAR program is separate from HTRC and STAR benefits are granted in the form of either