State Gas Reimbursement Rate 17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5

WASHINGTON The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for The following lists the Privately Owned Vehicle POV reimbursement rates for automobiles motorcycles and airplanes

State Gas Reimbursement Rate

State Gas Reimbursement Rate

https://www.workyard.com/wp-content/uploads/2023/02/Mileage-Reimbursement-Form-Template.jpg

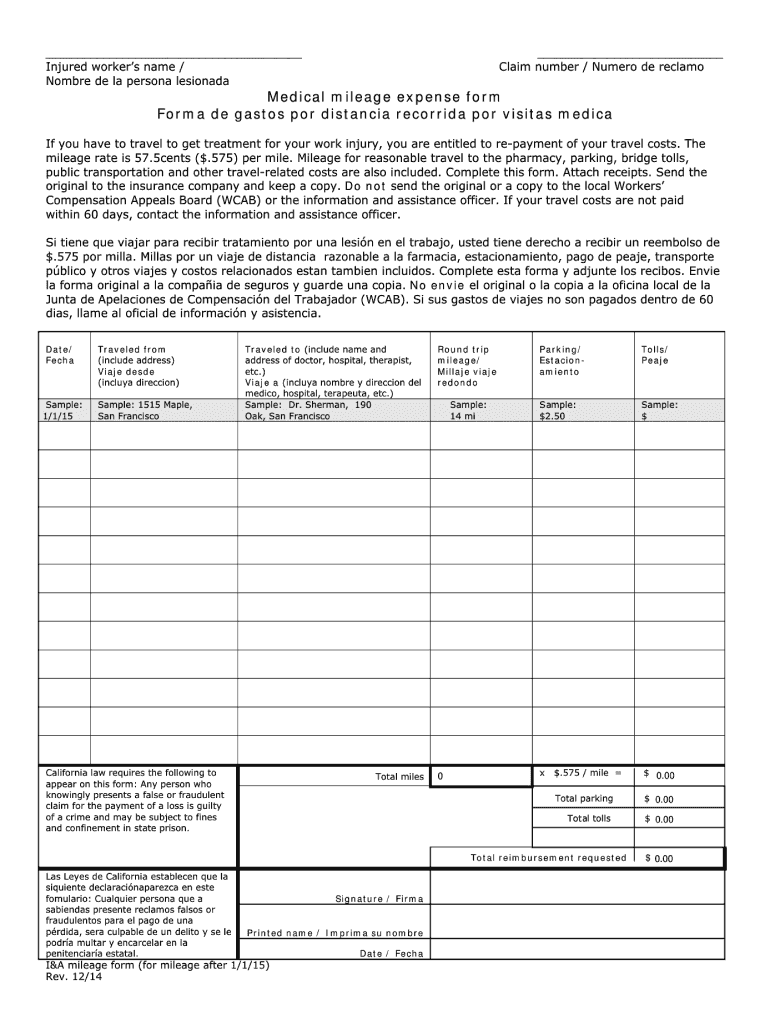

2024 Irs Medical Mileage Reimbursement Rate Faith Jasmine

https://images.sampletemplates.com/wp-content/uploads/2016/11/25163519/Workers-Compensation-Mileage-Reimbursement-Form.jpg

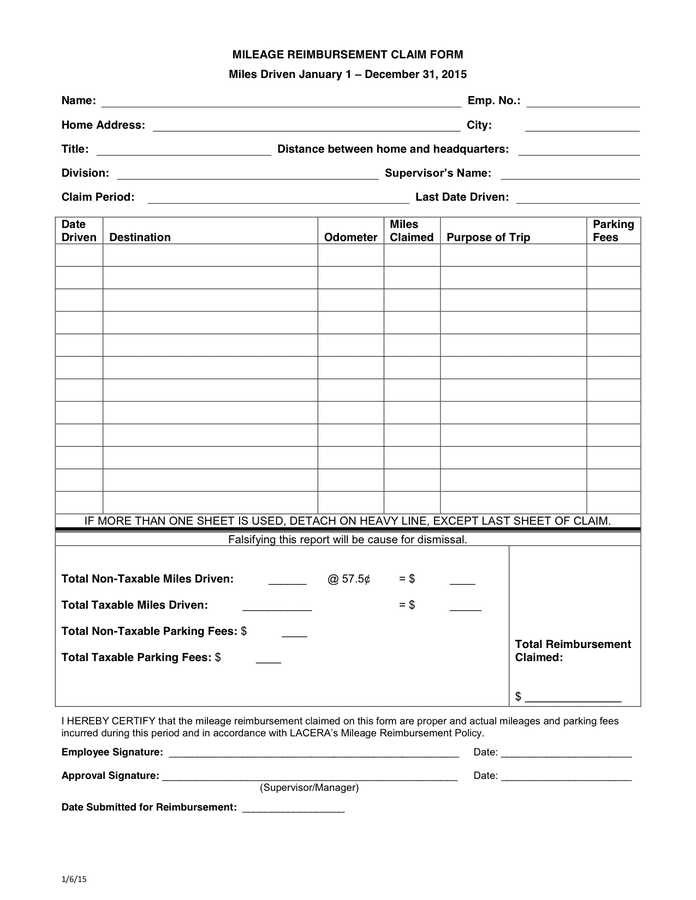

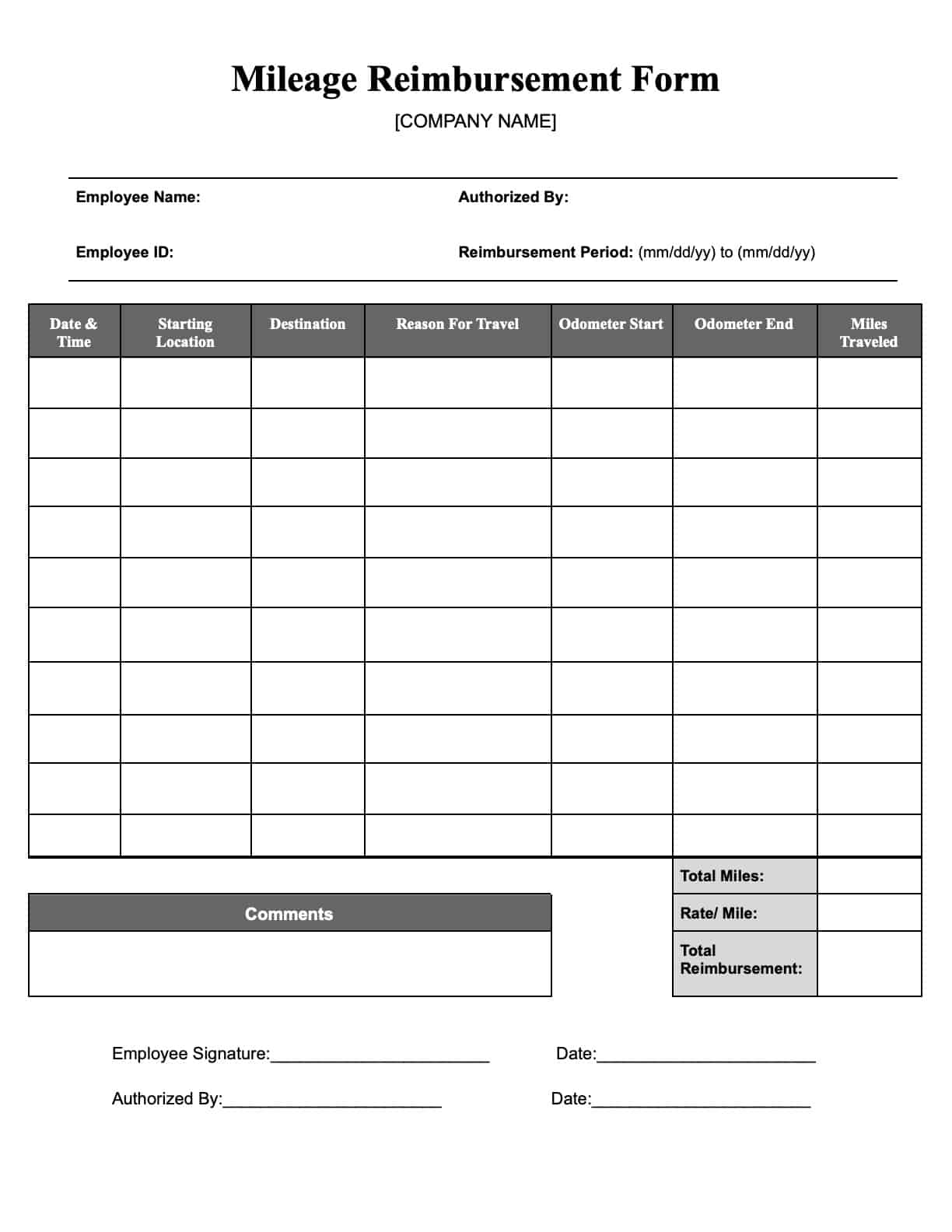

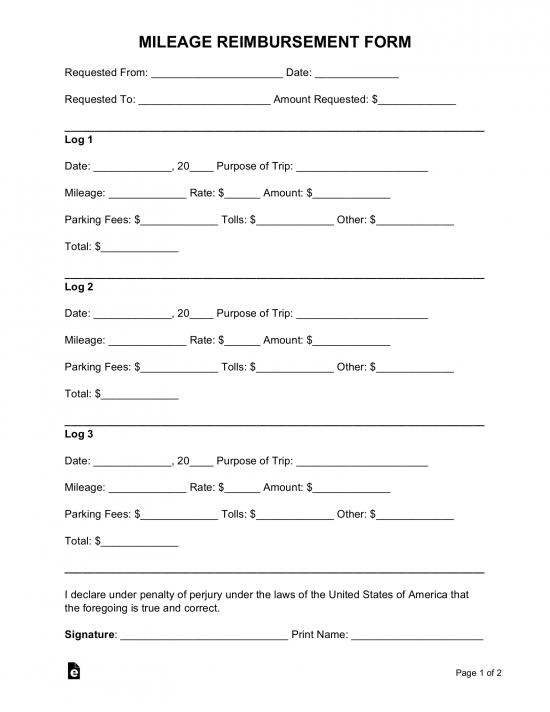

Free Mileage Reimbursement Form 2023 IRS Rates PDF Word EForms

https://eforms.com/images/2020/01/IRS-Mileage-Reimbursement-Form.png

Effective July 1 through Dec 31 2022 the standard mileage rate for business travel will be 62 5 cents per mile up 4 cents from the 58 5 cents per mile rate As of 2024 standard mileage rates that regulate tax free employee reimbursements refer primarily to cars and other gasoline powered vehicles including vans pickups SUVs

Reimbursement Rates and Standard Mileage Rate for Moving Purposes Relocation Allowances 1 What is the purpose of this bulletin This bulletin announces changes to At the end of last year the Internal Revenue Service published the new mileage rates for 2024 New standard mileage rates are 67 cents per mile for business purposes 21

Download State Gas Reimbursement Rate

More picture related to State Gas Reimbursement Rate

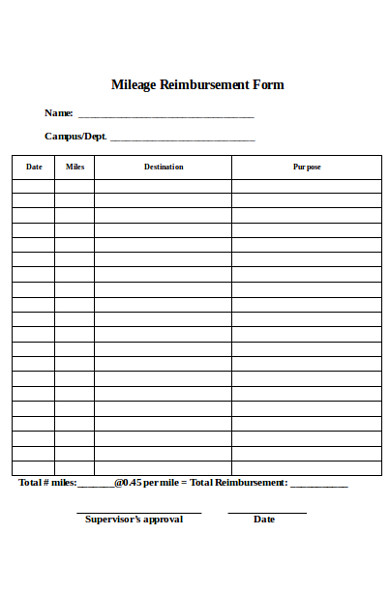

9 Mileage Reimbursement Form Download For Free Sample Templates

https://images.sampletemplates.com/wp-content/uploads/2016/02/24130455/Mileage-Reimbursement-Form.jpg

Gas Reimbursement Form Charlotte Clergy Coalition

https://www.charlotteclergycoalition.com/wp-content/uploads/2018/08/gas-reimbursement-form-auto-mileage-reimbursement-form.jpg

New York State Mileage Reimbursement 2024 Jess Romola

https://static.dexform.com/media/docs/1864/mileage-reimbursement-claim-form_1.png

For 2024 the IRS standard mileage rates are 0 67 per mile for business 0 21 per mile for medical or moving and 0 14 per mile for charity The 2023 standard mileage rate will be 65 5 cents per mile up from 62 5 cents per mile last year The 2023 medical or moving rate will remain at 22 cents per

Six months of CY 2022 effective July 1 2022 to reflect the recent increase in fuel prices As required by 5 U S C 5707 the U S General Services Administration GSA sets the Privately owned vehicle mileage rate The privately owned vehicle mileage reimbursement rate is 0 67 per mile as of January 1 2024 Out of state per diem rates

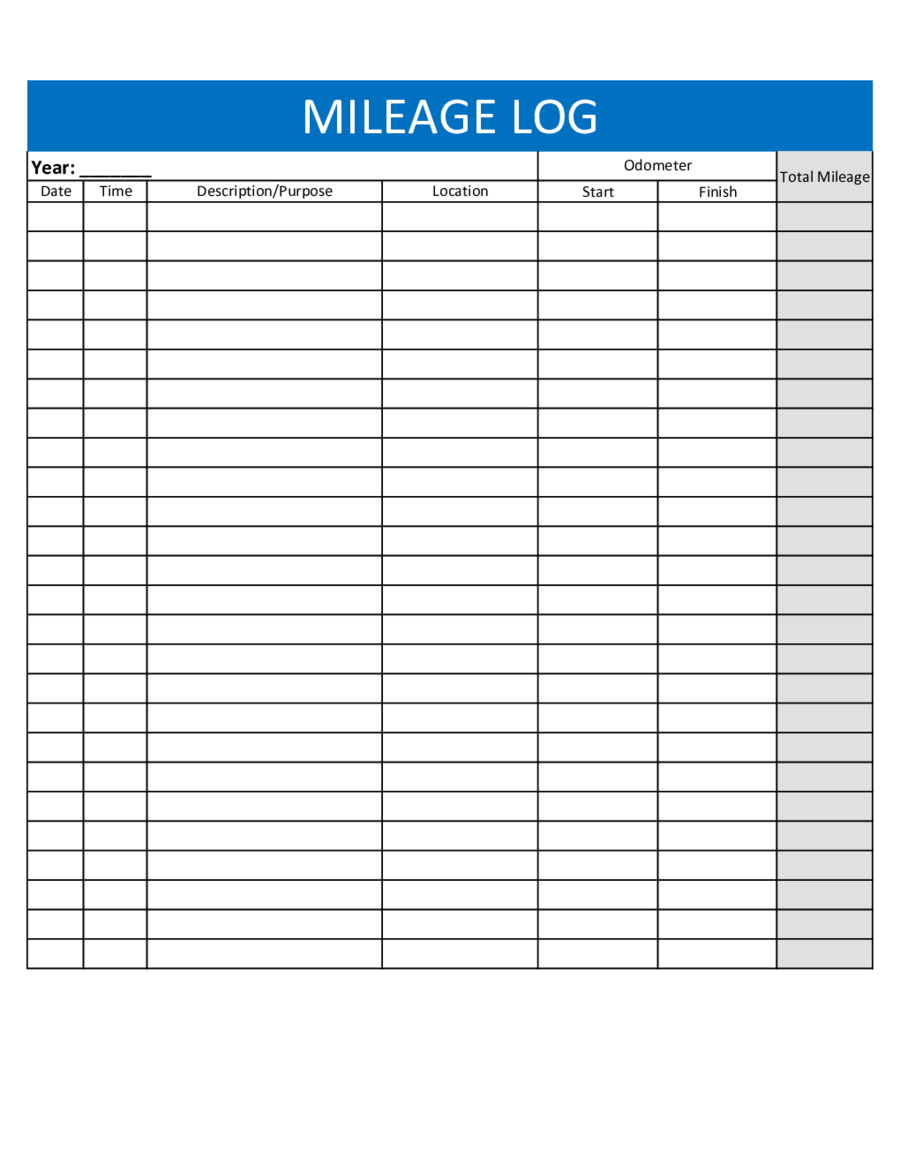

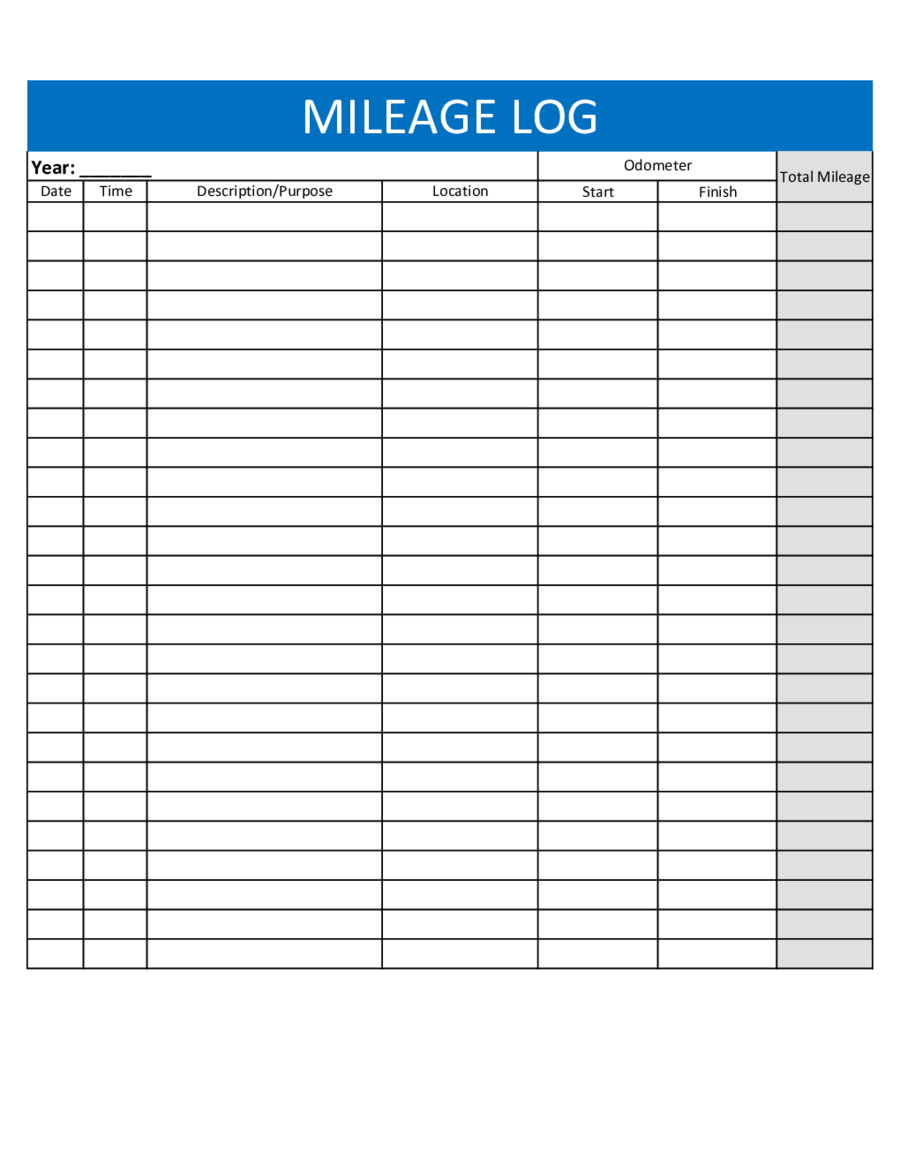

Mileage Reimbursement California 2024 Regan Charissa

https://handypdf.com/resources/formfile/images/yum/mileage-log-template-0136330.png

Mileage Reimbursement Form 8 Download Free Documents In PDF Word

http://images.sampletemplates.com/wp-content/uploads/2016/02/24130455/Mileage-Reimbursement-Form.jpg

https://www.irs.gov/tax-professionals/standard-mileage-rates

17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5

https://www.irs.gov/newsroom/irs-issues-standard...

WASHINGTON The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for

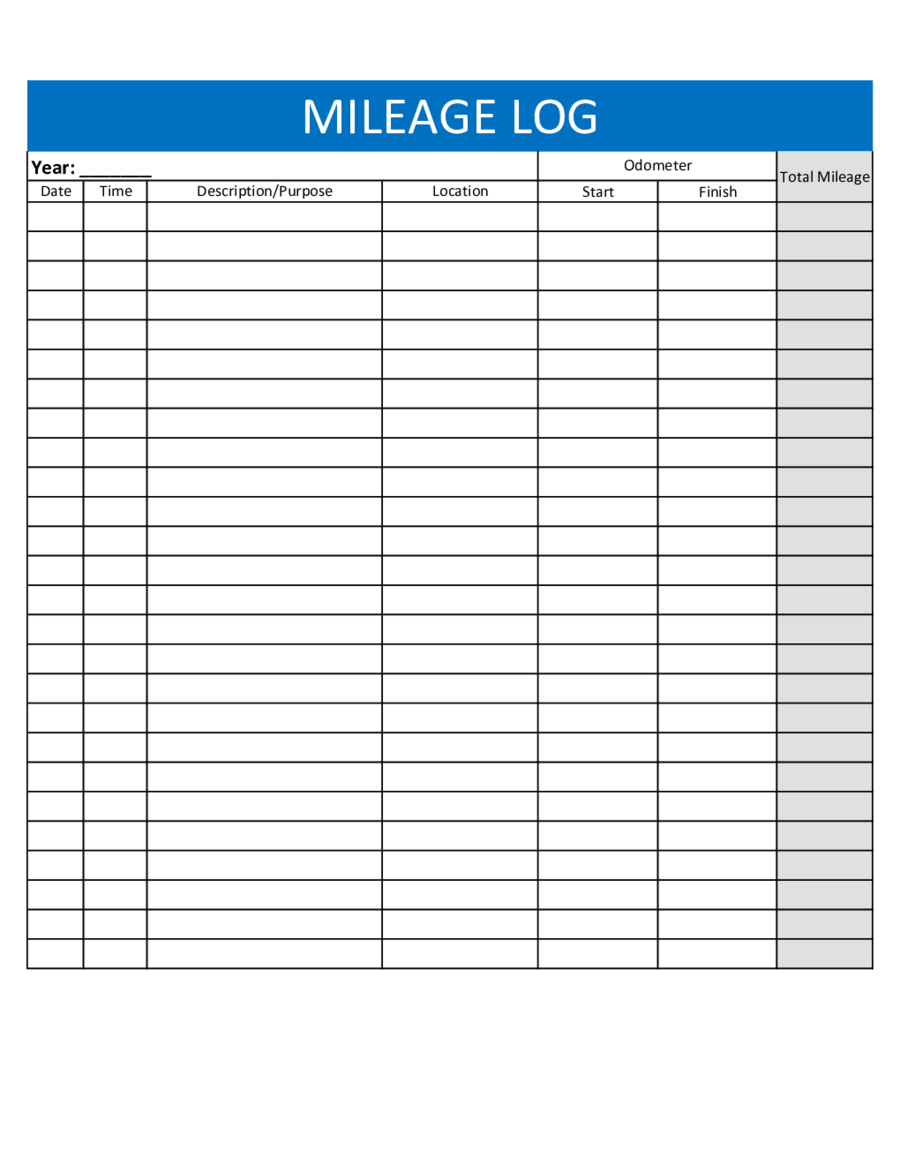

2020 Mileage Log Fillable Printable Pdf Forms Handypdf Throughout

Mileage Reimbursement California 2024 Regan Charissa

Mileage Forms 2024 Esther Karalee

Mileage Reimbursement Amount For 2021 Mileage Reimbursement 2021

FREE 12 Mileage Reimbursement Forms In PDF Ms Word Excel

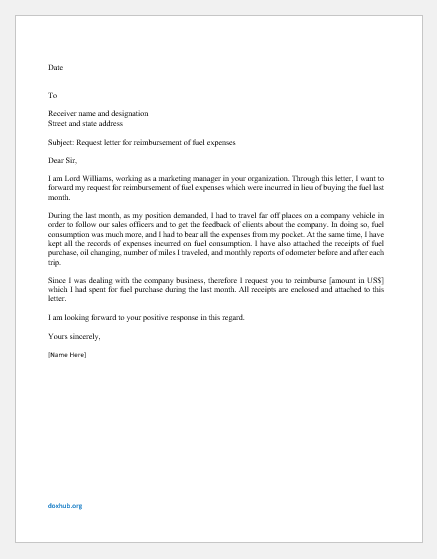

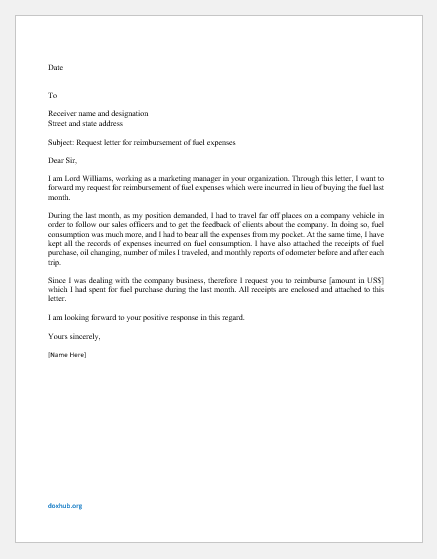

Letter For Additional Compensation For A Job Well Done Document Hub

Letter For Additional Compensation For A Job Well Done Document Hub

How To Calculate Gas Reimbursement The Tech Edvocate

Example Mileage Reimbursement Form Printable Form Templates And Letter

Free Mileage Reimbursement Form 2023 IRS Rates PDF Word EForms

State Gas Reimbursement Rate - Reimbursement Rates and Standard Mileage Rate for Moving Purposes Relocation Allowances 1 What is the purpose of this bulletin This bulletin announces changes to