Tax Benefit On Electric Car Loan Verkko 8 hein 228 k 2021 nbsp 0183 32 Tax Benefit MOST IMPORTANT THING You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric

Verkko 5 tammik 2023 nbsp 0183 32 Presently the interest on loans sanctioned to purchase electric vehicles up to March 31 2023 is eligible for maximum deduction of up to Rs 1 5 lakh Verkko 12 lokak 2023 nbsp 0183 32 Investing in an electric car is a smart decision that will not only benefit the environment but will also give you access to tax benefits With an electric car

Tax Benefit On Electric Car Loan

Tax Benefit On Electric Car Loan

https://img.money.com/2022/12/News-Save-buying-electric-car-using-tax-credits.jpg?quality=85

Tax Benefit For Electric Car Loans Under Sec 80EEB What Are The Real

https://www.personalfinanceplan.in/wp-content/uploads/2019/08/20190806_electric-car-loan-80eeb-tax-benefit.jpg

A Guide To Company Car Tax For Electric Cars CLM

https://www.clm.co.uk/wp-content/uploads/2019/07/Company-Car-Tax-Tables-10th-july-2019-before2020-1200x1746.png

Verkko 19 lokak 2023 nbsp 0183 32 If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax Verkko 23 tammik 2023 nbsp 0183 32 Drivers who may not be able to afford a brand new EV can still benefit from the tax credit When buying a used electric vehicle costing up to 25 000

Verkko 26 jouluk 2023 nbsp 0183 32 Spain 1 148 collected the least tax per vehicle whereas Belgium 2 892 collected the most This figure was 1 625 in France 1 764 in Germany Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 A 7 500 tax credit for electric vehicles will see substantial changes in 2024 It will be easier to get because it will be available as an instant rebate at

Download Tax Benefit On Electric Car Loan

More picture related to Tax Benefit On Electric Car Loan

Section 80EEB Of Income Tax Act Deduction Tax Benefits

https://navi.com/blog/wp-content/uploads/2022/12/Section-80EEB.webp

Electric Car Loans Novuna Personal Finance

https://www.novunapersonalfinance.co.uk/media/lmnha0jo/electric-car-plugged-into-charging-station.jpg?anchor=center&mode=crop&width=660&height=335&rnd=133198201447230000

Electric Vehicle Loans Home Energy Scotland

https://www.homeenergyscotland.org/wp-content/uploads/2021/01/GettyImages-1291216664-2048x1152.jpg

Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 Why the 7 500 electric vehicle tax credit may be easier and harder to get in 2024 Published Thu Dec 28 2023 10 09 AM EST Updated Thu Dec 28 Verkko 13 maalisk 2023 nbsp 0183 32 Section 80EEB of the Income Tax Act offers a tax deduction benefit of up to 1 5 lakh on the interest component of a loan taken to purchase an electric

Verkko 22 jouluk 2023 nbsp 0183 32 About 80 million will be used to build new data centers in Ohio North Carolina and Texas as part of a plan to increase the company s total megawatts by Verkko 12 elok 2019 nbsp 0183 32 Under Section 80EEB you can get tax benefit of up to Rs 1 5 lacs for the interest paid towards the loan taken to purchase an electric vehicle The benefit

Car Tax Changes 2020 New Benefit in kind Updates Can See Motorists

https://cdn.images.express.co.uk/img/dynamic/24/590x/secondary/benefit-in-kind-rates-2402298.jpg?r=1586171543836

New Penalty 2022 Header

https://www.taxexpert.co.uk/wp-content/uploads/Friday-Tax-Tip-Website-Image-21.jpg

https://taxguru.in/income-tax/purchase-electric-vehicle-tax-benefits...

Verkko 8 hein 228 k 2021 nbsp 0183 32 Tax Benefit MOST IMPORTANT THING You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric

https://economictimes.indiatimes.com/wealth/personal-finance-news/...

Verkko 5 tammik 2023 nbsp 0183 32 Presently the interest on loans sanctioned to purchase electric vehicles up to March 31 2023 is eligible for maximum deduction of up to Rs 1 5 lakh

20190806 section 80eeb electric car loan tax benefit interest paid 1 5

Car Tax Changes 2020 New Benefit in kind Updates Can See Motorists

Stage Two Of The Local Electric Vehicle Infrastructure Fund Energy

COP27 U S In Talks With EU On Electric Car Tax Credits

Electric Vehicle Loan Interest 80EEB HRWorks User Guide HRWorks

Tax Benefits On Business Loans In India India Today

Tax Benefits On Business Loans In India India Today

Hybrid Or Electric Car Loan Calculation Stock Photo Image Of

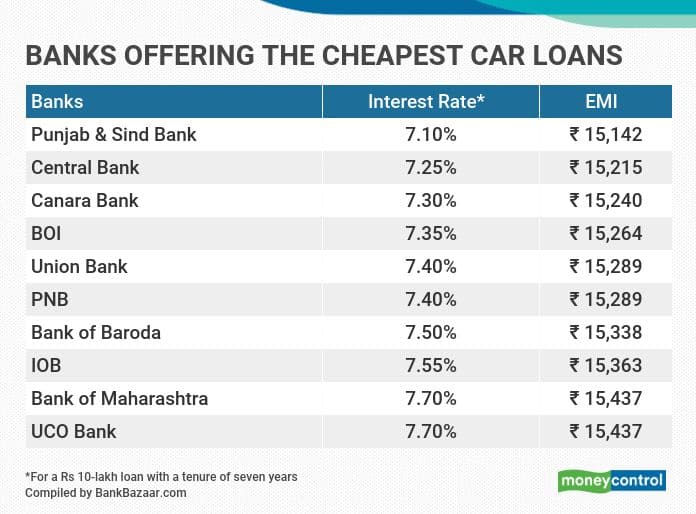

Here Are The Banks That Offer The Cheapest Car Loans

What Are The Tax Benefits On Business Loan In India

Tax Benefit On Electric Car Loan - Verkko 18 jouluk 2021 nbsp 0183 32 Tax deductions on loan for EVs When paying off an EV loan a total tax exemption of up to Rs 1 50 000 is available under section 80EEB This tax break