Tax Benefit On Electric Vehicles The updated 2024 edition offers a comprehensive look at the tax benefits and incentives for electric vehicles and charging infrastructure in the 27 EU member states Iceland Norway Switzerland and the United Kingdom

From 1 April 2025 drivers of electric and low emission cars vans and motorcycles will need to pay vehicle tax in the same way as drivers of petrol and diesel vehicles Those who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to transfer

Tax Benefit On Electric Vehicles

Tax Benefit On Electric Vehicles

https://static01.nyt.com/images/2022/12/29/multimedia/29EV-LIST-1-7403/29EV-LIST-1-7403-videoSixteenByNine3000.jpg

All You Need To Know About Electric Vehicle Tax Credits CarGurus

https://static.cargurus.com/images/article/2017/05/26/10/20/all_you_need_to_know_about_tax_credits_for_electric_and_hybrid_vehicles-pic-4169818146229685017-1600x1200.jpeg

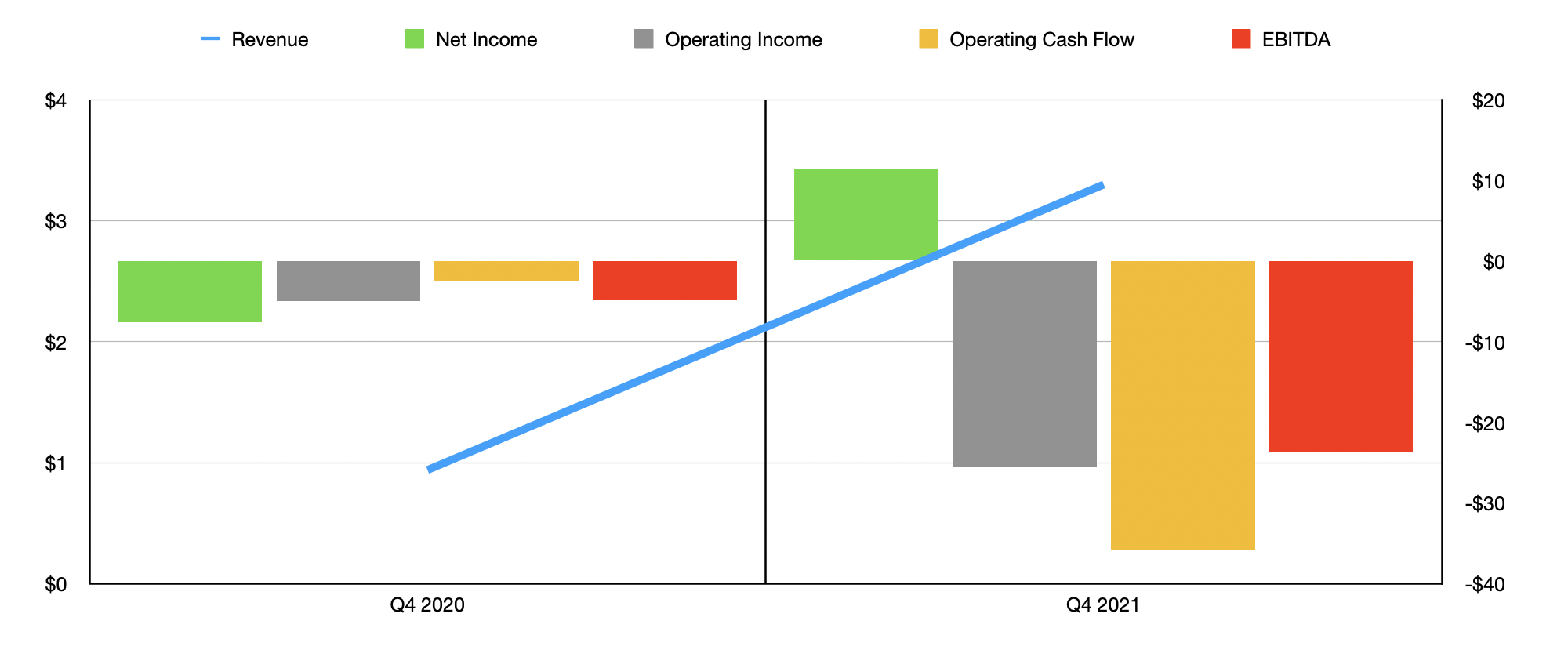

Car Company Expects To Lose Billions On Electric Vehicles In 2023

https://ijr.com/wp-content/uploads/2023/03/GettyImages-1338836445-scaled.jpg

The IRS has given automakers a little more wiggle room around which electric vehicles will qualify for a federal tax credit worth up to 7 500 The change which gives companies a few more If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax credit is available to both

Purchase incentives for electric vehicles are currently available in 21 EU member states This page provides an overview of the various tax benefits related to acquisition ownership and company cars and purchase incentives for each of the 27 EU member states If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

Download Tax Benefit On Electric Vehicles

More picture related to Tax Benefit On Electric Vehicles

RWC Offers All in one EV Compliance

https://lirp.cdn-website.com/345896f2/dms3rep/multi/opt/RWC_hybrid_board-1920w.JPG

These 34 Electric Cars Won t Qualify For Biden s New EV Tax Credits

https://www.carscoops.com/wp-content/uploads/2022/08/EVs-tax-credits.jpg

ETO Motors Deploys Over 50 EVs In India s First Electric Vehicle City

https://i.pinimg.com/originals/15/53/3a/15533adac7b73294e64c51507c84fe09.jpg

Federal EV tax credits in 2024 top out at 7 500 if you re buying a new car and 4 000 if you re buying a used car while the bank or the automaker s finance company can take a 7 500 tax If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car However certain restrictions and conditions concerning the loan issuer and the electric vehicle must be followed in order to claim the 80EEB deduction For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible

Tax Credits For Electric Vehicles Are About To Get Confusing The New

https://static01.nyt.com/images/2022/12/28/multimedia/28ev-credits-1-5aaf/28ev-credits-1-5aaf-videoSixteenByNine3000.jpg

2023 EV Tax Credit How To Save Money Buying An Electric Car Money

https://img.money.com/2022/12/News-Save-buying-electric-car-using-tax-credits.jpg?quality=85

https://www.acea.auto/fact/electric-cars-tax...

The updated 2024 edition offers a comprehensive look at the tax benefits and incentives for electric vehicles and charging infrastructure in the 27 EU member states Iceland Norway Switzerland and the United Kingdom

https://www.gov.uk/guidance/vehicle-tax-for...

From 1 April 2025 drivers of electric and low emission cars vans and motorcycles will need to pay vehicle tax in the same way as drivers of petrol and diesel vehicles

Tax Benefits On Business Loans In India India Today

Tax Credits For Electric Vehicles Are About To Get Confusing The New

Tax Benefit From Electric Vehicle

Insurance For All Types Of Vehicles Electric Included Markham Brokers

Tax Credit For Electric Vehicles Khou

Tax Benefit On Electric Vehicle

Tax Benefit On Electric Vehicle

Hard Facts On Electric Vehicles Favor Fleet Usage Electric Green

Buying An Electric Vehicle Here s How Much TAX BENEFIT You Can Claim

Xos Stock A Binary Play On Electric Vehicles NASDAQ XOS Seeking Alpha

Tax Benefit On Electric Vehicles - If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax credit is available to both