Tax Benefit On Home Loan Principal Homebuyers enjoy income tax benefits on both the principal and interest component of the home loan under various sections of the Income Tax Act 1961 Deductions allowed on home loan principal Section 80C Deduction Available for Property construction property purchase Can be claimed for Self occupied rented deemed to

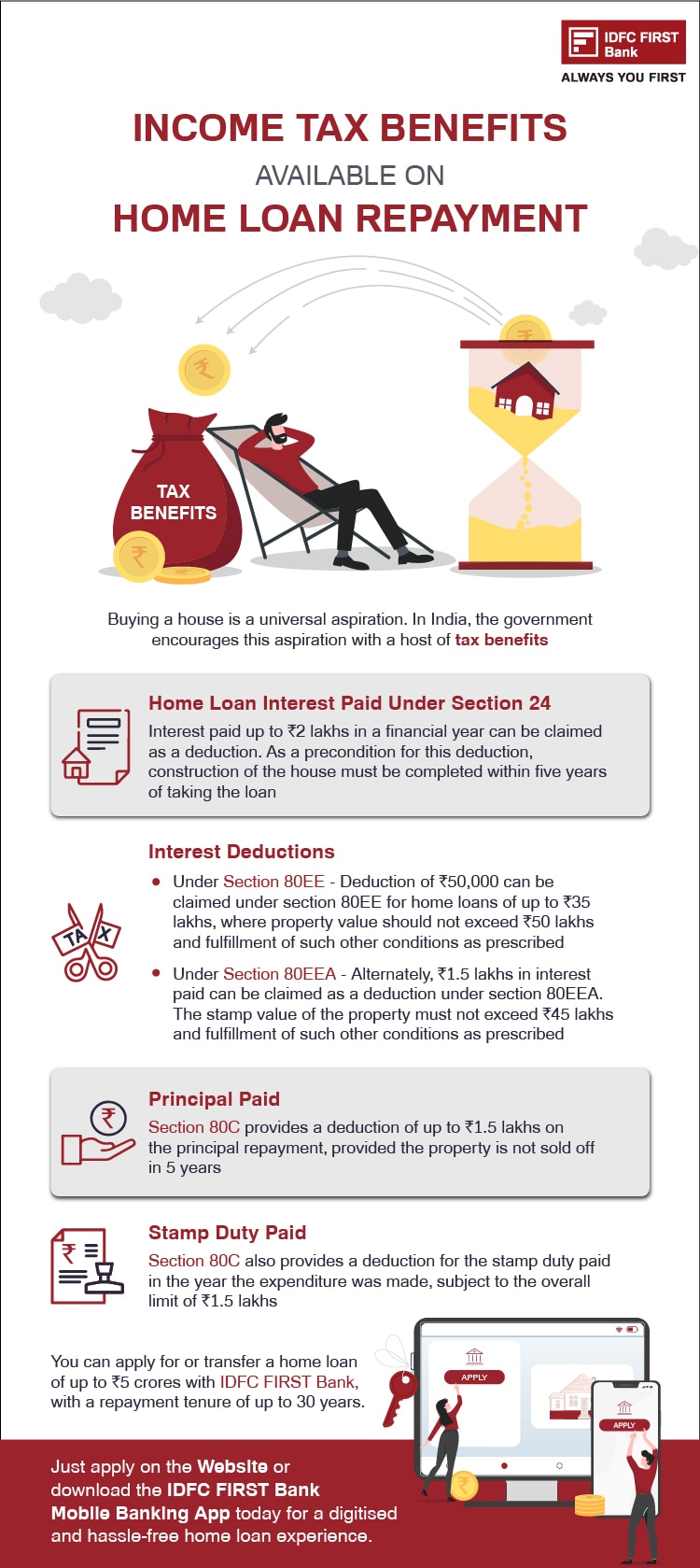

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b Yes the home loan principal is part of Section 80C of the Income Tax Act Under this section an individual is entitled to tax deductions on the amount paid as repayment of the principal component of the housing loan

Tax Benefit On Home Loan Principal

Tax Benefit On Home Loan Principal

https://assetyogi.b-cdn.net/wp-content/uploads/2017/06/income-tax-benefit-on-second-home-loan-889x500-768x432.jpg

Home Loan Tax Benefit Usa Home Sweet Home Insurance Accident

https://housing.com/news/wp-content/uploads/2016/04/Home-Loans-Tax-Benefits-if-you-own-Multiple-Homes-blog.png

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

https://i.ytimg.com/vi/TqmeyW7QUDY/maxresdefault.jpg

Home loan is eligible for tax benefits as follows Tax deductions on principal repayment Under Section 80C Under section 80 c of the Income Tax Act tax deduction of a maximum amount of up to Rs 1 5 lakh can be availed per financial year on the principal repayment portion of the EMI If you took a home loan and are still living in a rented place you will be entitled to 1 Tax benefit on principal repayment under Section 80C 2 Tax benefit on interest payment under Section 24 3 House Rent Allowance HRA benefit Of course you can claim tax benefits on the home loan only if your home is ready to live in during that

All joint owners can individually avail of tax benefits on a joint home loan provided certain conditions are met Let s examine them It s pertinent to note that ownership of the property is a prerequisite to availing any tax benefits against the property Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs 1 50 000 under Section 80EEA Principal repayment can be claimed under Section 80C

Download Tax Benefit On Home Loan Principal

More picture related to Tax Benefit On Home Loan Principal

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/Home-Loan-Comparison-768x513.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-design-14.png

It offers various benefits on the repayment of a Home Loan through tax deductions under the Income Tax Act 1961 Here is understanding these benefits better What comprises a Home Loan There are two components in a Home Loan repayment the principal amount and the interest paid on the loan amount You can avail of tax benefits on both It can be beneficial to identify which components of your Home Loans can be taxed and which can be eligible for a rebate Simply put you can avail of an exemption on your Home Loan principal and the interest payments under Section 80C and Section 24 b

A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property section 24 allows a deduction on the interest paid on a house loan up to a maximum of Rs 2 lakh in a given fiscal year Let s break down the tax benefit on the principal amount of your home loan If you re operating under the old tax system you re eligible for a deduction on the principal component of your Home Loan s EMI under section 80C of the Income Tax Act

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

https://homefirstindia.com/app/uploads/2022/07/Untitled-1.png

https://housing.com/news/home-loans-guide-claiming-tax-benefits

Homebuyers enjoy income tax benefits on both the principal and interest component of the home loan under various sections of the Income Tax Act 1961 Deductions allowed on home loan principal Section 80C Deduction Available for Property construction property purchase Can be claimed for Self occupied rented deemed to

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b

Home Loan Tax Benefits Interest On Home Loan Section 24 And

Home Loan Tax Exemption Check Tax Benefits On Home Loan

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Pin P Home Improvement And Construction Blogs

Income Tax Benefit On Home Loan Your Quick Guide On Tax Exemption

Here s Everything You Need To Know About Tax Benefit On Home Loan

Here s Everything You Need To Know About Tax Benefit On Home Loan

Income Tax Benefits On Home Loan Mothish Kumar Property Coach YouTube

When To Claim Tax Benefit On Home Loan And HRA Both BusinessToday

Indiabulls Home Loans Tax Benefit On Home Loan Top Up

Tax Benefit On Home Loan Principal - As a home loan borrower you can claim tax exemption on principal repayment every year under Section 80C interest payments under Section 24 b and an additional benefit on interest under Section 80EE if you are a first time homebuyer