Tax Benefits For Heat Pumps Verkko 1 tammik 2023 nbsp 0183 32 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

Verkko 2 tuntia sitten nbsp 0183 32 The window tax tried out in Britain in 1696 The beard tax that was introduced by Peter the Great of Russia in the 1700s Or the salt tax which the French only finally abolished in 1945 There have been some bizarre levies imposed by governments over the centuries When the future economics textbooks are written Verkko 9 syysk 2022 nbsp 0183 32 The HEEHRA program designates rebates for specific appliance purchases and other upgrades One of the most appealing rebates is a provision offering up to 8 000 for heat pumps which despite

Tax Benefits For Heat Pumps

Tax Benefits For Heat Pumps

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pumps-rebates-2019-coastal-energy-122.png

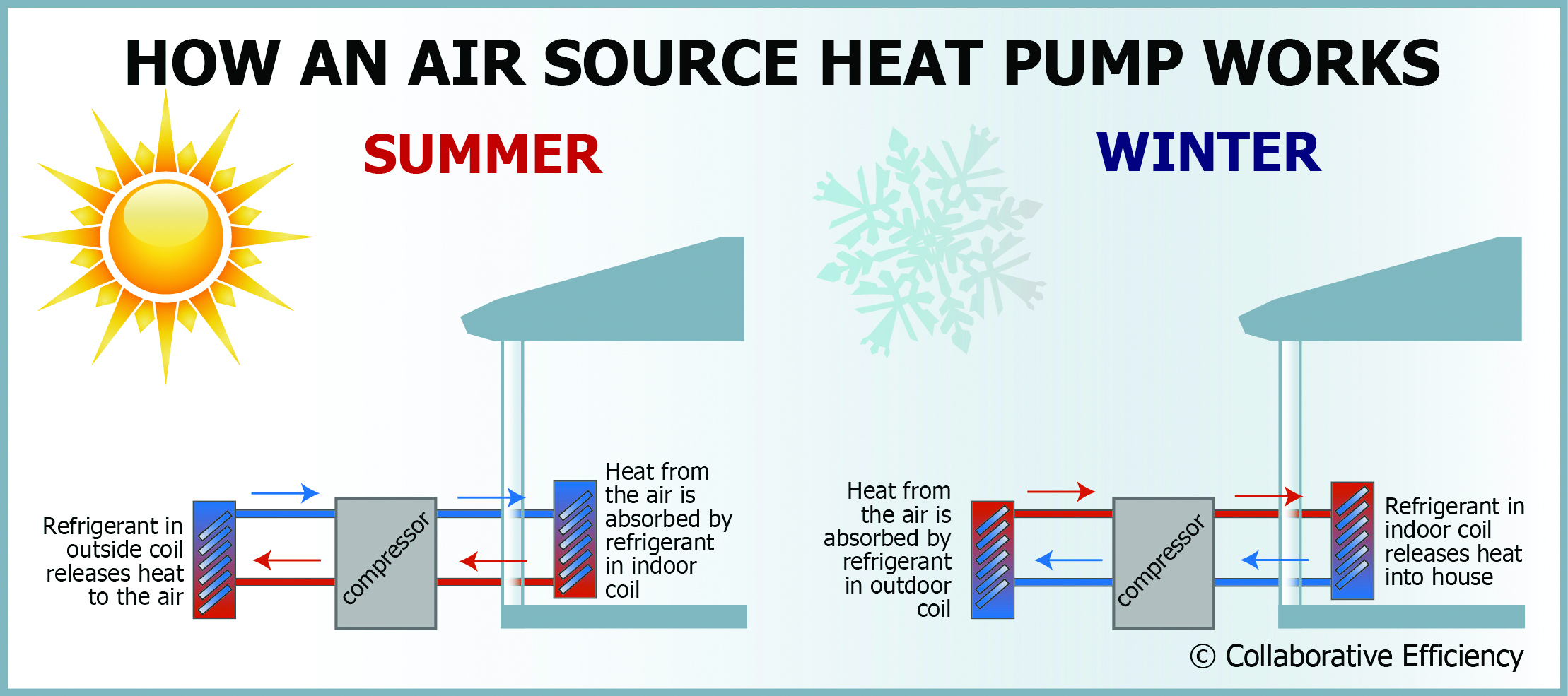

So Why Are Heat Pumps So Important

https://www.sjbmechanical.com/wp-content/uploads/2021/04/SJB-GSHP-1024x683.jpg

Heat Pumps South West Plumbing Services

https://swpsl.co.uk/wp-content/uploads/2022/03/pocketimage.png

Verkko 13 syysk 2022 nbsp 0183 32 Consumers can use a new federal tax credit to get up to 2 000 for the purchase and installation of a heat pump while those who meet the income qualifications for their state rebate program could Verkko 17 maalisk 2023 nbsp 0183 32 Starting in 2023 through the end of 2032 all homeowners will be eligible for a 30 federal tax credit on the total cost of buying and installing their new heat pump with a maximum credit of 2 000

Verkko 18 elok 2022 nbsp 0183 32 The maximum heat pump tax credit is 2 000 Homeowners can take advantage of the heat pump tax credit through at least 2032 Also buying a heat pump water heater can grant you a Verkko 15 jouluk 2023 nbsp 0183 32 Tom Haynes Money Reporter 15 December 2023 1 18pm Homeowners face being hit with a boiler tax as manufacturers attempt to offset the cost of the heat pump rollout Worcester Bosch has

Download Tax Benefits For Heat Pumps

More picture related to Tax Benefits For Heat Pumps

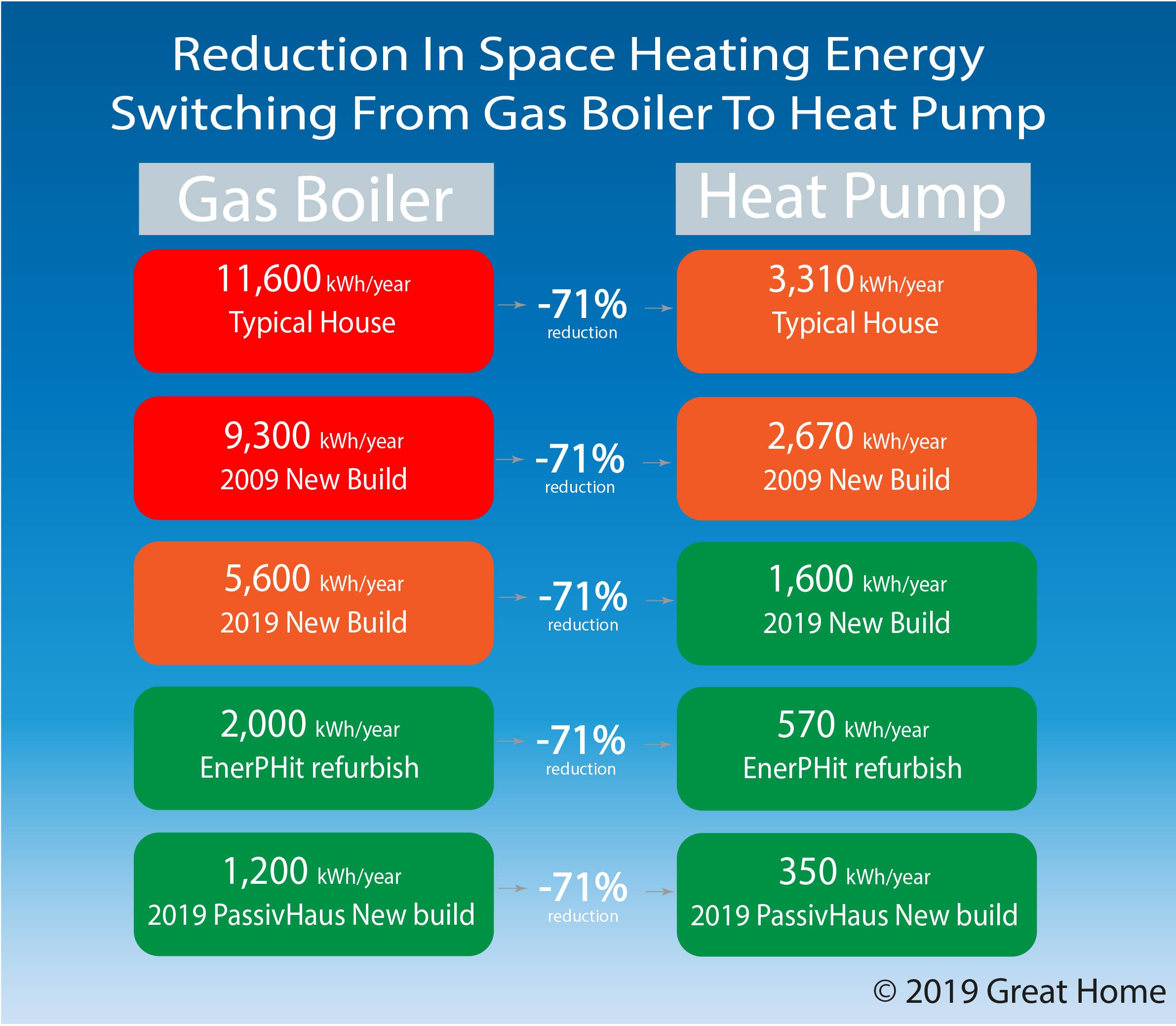

Heat pump benefit 01 2 Great Home

https://great-home.co.uk/cms/mydata/uploads/2019/10/heat-pump-benefit-01-2.jpg

Heat Pumps Wattsmart Savings

https://wattsmartsavings.net/wp-content/uploads/2019/05/thumbnail_measures_heat_pumps-1.png

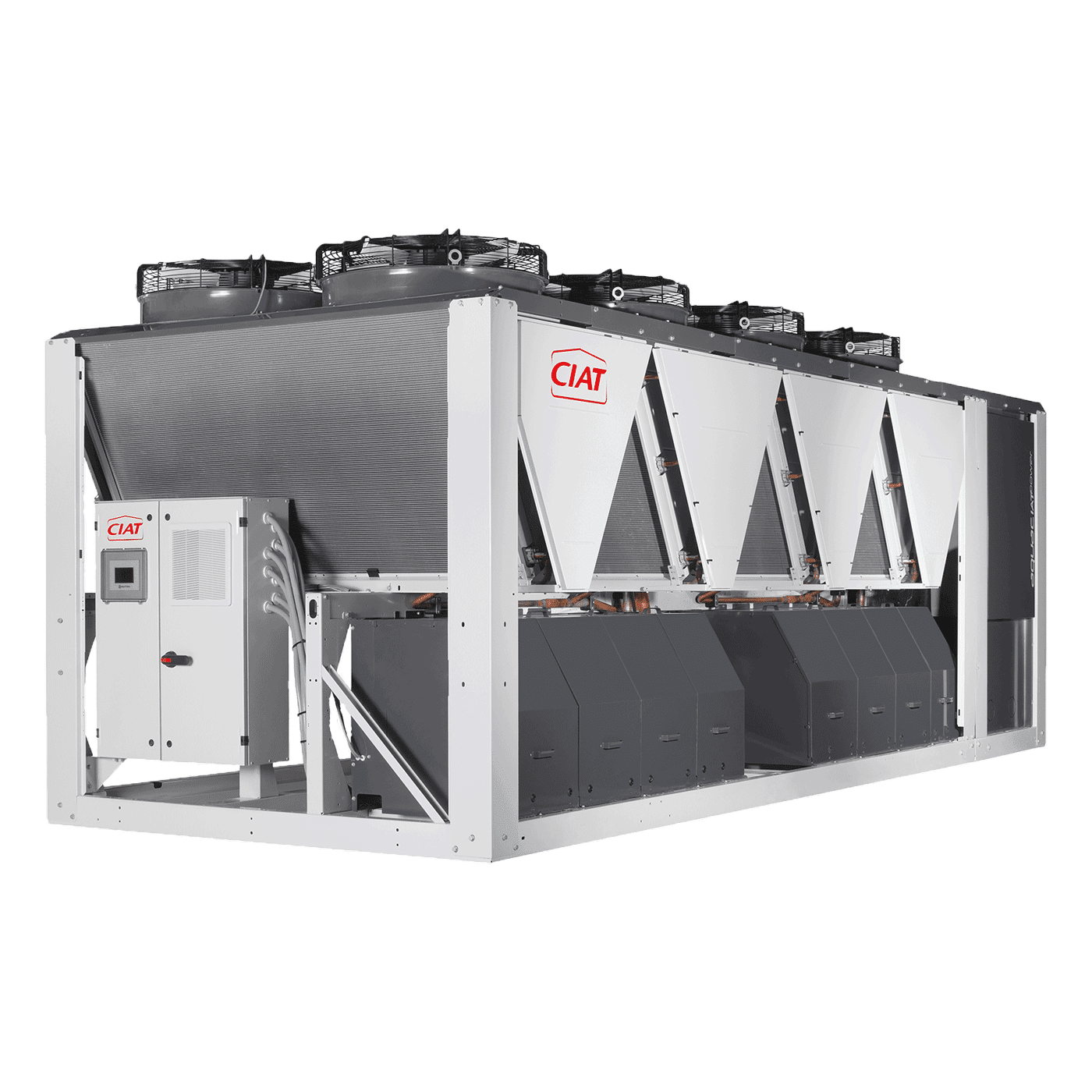

Heat Pumps Chillers CIAT United Kingdom

https://images.carriercms.com/image/upload/w_auto,c_scale,q_auto,f_auto/v1670254037/ciat/products/heat-pumps-and-chillers/ciat-aquaciat-power-heat-pump-air-cooled-water-chiller-1.png

Verkko 22 elok 2022 nbsp 0183 32 IRA provides a 30 tax credit for families investing in clean energy systems like solar electricity solar water heating wind geothermal heat pumps fuel cells and battery storage for their homes This can result in valuable savings Verkko 4 toukok 2023 nbsp 0183 32 Heat pumps water heaters biomass stoves and boilers Home energy audits of a main home The maximum credit that can be claimed each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150

Verkko 11 jouluk 2023 nbsp 0183 32 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Verkko The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the maximum federal tax credit for installing a heat pump increased to 30 of your project

Heat Pump Policy Toolkit Part 3 The Role Of Government Policy For

https://i.ytimg.com/vi/43gL5ZgJitw/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGBggZShdMA8=&rs=AOn4CLCWWiJCgIG62XUMDntlGk6SJCMP0g

Congress Extends Tax Benefits For Geothermal Heat Pumps Colorado

https://www.cogeothermal.com/wp-content/uploads/2020/09/image1-3-1510x1200.jpeg

https://www.irs.gov/credits-deductions/energy-efficient-home...

Verkko 1 tammik 2023 nbsp 0183 32 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

https://news.yahoo.com/boiler-tax-exposes-truth-heat-134311777.html

Verkko 2 tuntia sitten nbsp 0183 32 The window tax tried out in Britain in 1696 The beard tax that was introduced by Peter the Great of Russia in the 1700s Or the salt tax which the French only finally abolished in 1945 There have been some bizarre levies imposed by governments over the centuries When the future economics textbooks are written

What Texans Needs To Know About Heat Pumps

Heat Pump Policy Toolkit Part 3 The Role Of Government Policy For

Electric Heat Pumps Use Much Less Energy Than Furnaces And Can Cool

Ducted Heat Pump Auckland Best Ducted Heat Pump 2021

HEAT PUMPS UNDERFLOOR HEATING Ambiente UFH

Process Integration Study Advanced Industrial Heat Pump Applications

Process Integration Study Advanced Industrial Heat Pump Applications

Industrial Products B me

Heat Pumps South West Plumbing Services

Benefits Of Air Source Heat Pumps Colorado Country Life Magazine

Tax Benefits For Heat Pumps - Verkko 15 jouluk 2023 nbsp 0183 32 Tom Haynes Money Reporter 15 December 2023 1 18pm Homeowners face being hit with a boiler tax as manufacturers attempt to offset the cost of the heat pump rollout Worcester Bosch has