Tax Incentives For Heat Pumps Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax

There is a 1 200 aggregate yearly tax credit maximum for all building envelope components home energy audits and energy property Electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves and biomass boilers have a separate aggregate yearly credit limit of 2 000 Beyond the tax incentive you also could be eligible for up to 1 750 for a heat pump water heater and 8 000 for a heat pump for space heating and cooling Both incentives would be in the

Tax Incentives For Heat Pumps

Tax Incentives For Heat Pumps

https://lanity.store/cdn/shop/files/brandmark-design-10.png?height=628&pad_color=f5f5f5&v=1689028374&width=1200

The Homeowners Guide To Tax Credits And Rebates

https://blog.constellation.com/wp-content/uploads/2016/12/tax-credits-geothermal-heat-pumps-768x183.png

Expired Tax Credits Expected To Be Renewed 2022 04 14 ACHR News

https://www.achrnews.com/ext/resources/2022/04-April/Heat-Pump-Tax-Credit.jpg?1649877799

To help the country and individuals move away from fossil fuels the federal government included tax credits in the Inflation Reduction Act that can help cover the cost of purchase and installation of heat pumps and other energy saving appliances IRA provides a 30 tax credit for families investing in clean energy systems like solar electricity solar water heating wind geothermal heat pumps fuel cells and battery storage for their homes This can result in valuable savings

Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year Air Source Heat Pumps Heat Pump Water Heaters Biomass Stoves or Boilers About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates These rebates which include the Home Efficiency Rebates and Home Electrification

Download Tax Incentives For Heat Pumps

More picture related to Tax Incentives For Heat Pumps

P L Heating Rebates Tax Credits

https://pandlheating.com/wp-content/uploads/2015/08/DSC_0366-625x416.jpg

0870 242 7772

https://www.mmaxx.com/banner/financial-incentives.png

Tax Incentives A Guide To Saving Money For U S Small Businesses

https://www.freshbooks.com/wp-content/uploads/2022/04/tax-incentives-examples.jpg

All taxpayers Heat pump tax credit up to 2 000 As of January 1 2023 if you install a new air source heat pump in your primary residence and it meets certain efficiency requirements you ll be eligible for a federal tax credit of up to 2 000 or 30 of the installation cost whichever is less Nice Now there s a new incentive for Americans to get heat pumps from last year s federal climate legislation An IRS spokesperson told NPR that there are now credits that can translate to up to

Heat pump federal tax credit 2024 Starting in 2023 continuing this year and through the end of 2032 all homeowners will be eligible for a 30 federal tax credit on the total cost of buying and installing their new heat pump with a maximum credit of 2 000 As of 2024 most homeowners in Cali are eligible for a few thousand dollars in incentives towards the cost of a heat pump KEY TAKEAWAYS High efficiency heat pumps and mini splits are eligible for a federal tax credit up to 2 000

FEDERAL TAX INCENTIVES For Commercial Geothermal Heat Pumps DocsLib

https://data.docslib.org/img/4471205/federal-tax-incentives-for-commercial-geothermal-heat-pumps.jpg

So Why Are Heat Pumps So Important

https://www.sjbmechanical.com/wp-content/uploads/2021/04/SJB-GSHP.jpg

https://www.energystar.gov/.../air-source-heat-pumps

Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax

https://www.irs.gov/pub/taxpros/fs-2022-40.pdf

There is a 1 200 aggregate yearly tax credit maximum for all building envelope components home energy audits and energy property Electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves and biomass boilers have a separate aggregate yearly credit limit of 2 000

Free Of Charge Creative Commons Tax Incentives Image Financial 3

FEDERAL TAX INCENTIVES For Commercial Geothermal Heat Pumps DocsLib

Heat Pumps Wattsmart Savings

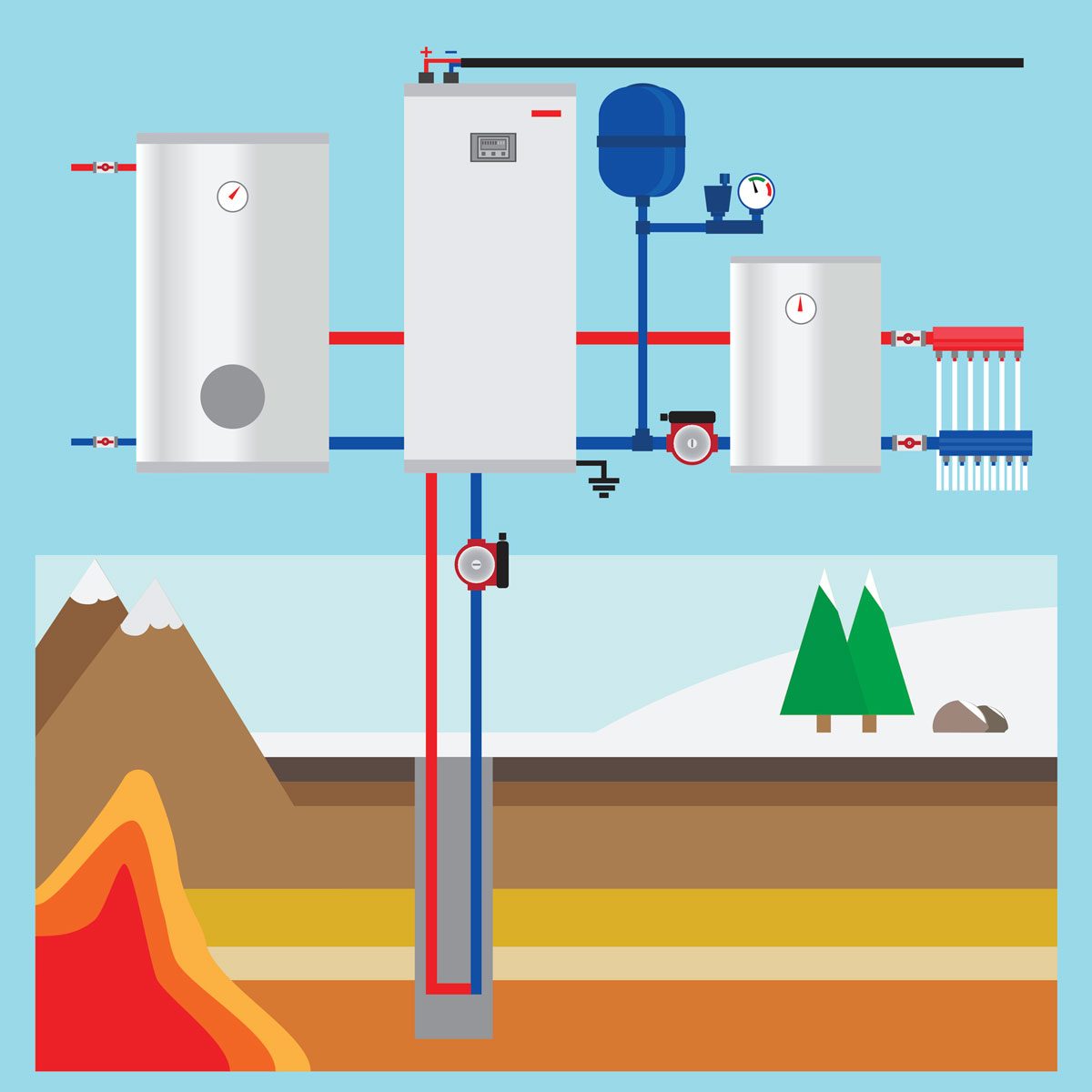

A Guide To Geothermal Heat Pumps Family Handyman

Ensure The Efficiency Of Your Heat Pump Shield It From Snow Blowing

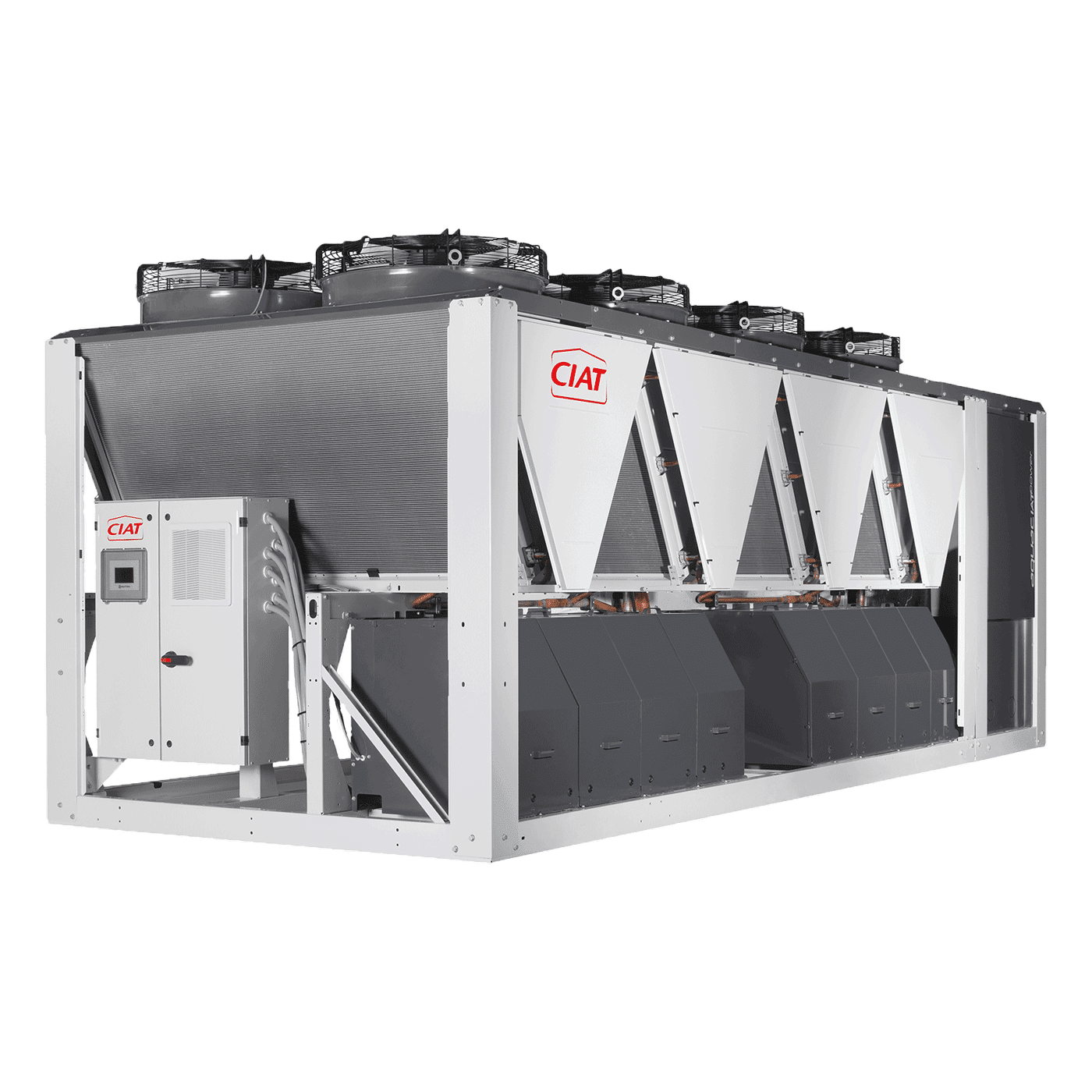

Heat Pumps Chillers CIAT United Kingdom

Heat Pumps Chillers CIAT United Kingdom

What Texans Needs To Know About Heat Pumps

Electric Heat Pumps Use Much Less Energy Than Furnaces And Can Cool

Process Integration Study Advanced Industrial Heat Pump Applications

Tax Incentives For Heat Pumps - About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates These rebates which include the Home Efficiency Rebates and Home Electrification