Tax Break Low Income Web One of the majors is to provide the low income class with more assurances More income obtained by tax breaks could potentially provide this population fragment with a greater proportion of welfare Otherwise tax breaks are commonly used to promote education the environment health care unemployed but even to support eco farming

Web Updated December 15 2022 Reviewed by Margaret James Fact checked by Jared Ecker What Is a Tax Break The term tax break refers to a benefit the government offers that reduces your total tax Web 22 Feb 2022 nbsp 0183 32 Despite being called the low and middle income tax offset very low earners would get nothing Those on less than 18 200 had no tax to refund The rest would get up to 530 later lifted to

Tax Break Low Income

Tax Break Low Income

https://www.nj.com/resizer/lRa6SGDZ66Fi1j22la1uJXtIhG8=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.nj.com/home/njo-media/width2048/img/politics_impact/photo/ccac16jpg-3143d822ba10016a.jpg

A Lucrative Tax Break For Manufacturers The Domestic Production

https://blog.concannonmiller.com/hubfs/mfg emblem-TAX BENEFITS copy.png#keepProtocol

Income Tax Free Of Charge Creative Commons Financial 3 Image

https://pix4free.org/assets/library/2021-04-28/originals/income_tax.jpg

Web 29 M 228 rz 2022 nbsp 0183 32 In 2019 the highest earning 20 percent of households received about half of the benefit of the major tax expenditures while the lowest earning 20 percent of households received just under 10 percent However the comparison flips when the benefits are measured as a share of income Web 7 Jan 2022 nbsp 0183 32 Rather our results are most consistent with Piketty et al s 2014 argument that lower taxes on top incomes induce the rich to bargain more aggressively to increase their own rewards to the direct detriment of those lower down the income distribution Turning to our null results on economic growth and unemployment it is more difficult to

Web 26 Apr 2021 nbsp 0183 32 Meanwhile the lowest 20 received only a 0 3 bump in after tax income and a 40 break in federal taxes The second quintile got a 1 income boost and a 320 reduction in their tax bill Web Tax breaks The U S Tax Code is structured to provide assistance to lower income taxpayers As a low income filer you might be entitled to various credits and deductions for which other taxpayers don t qualify Certain situations in particular such as having children or making retirement plan contributions are considered when credits are

Download Tax Break Low Income

More picture related to Tax Break Low Income

Child Business Tax Break Deal Could Lead To Negotiations On Trump Tax Cuts

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1mUrDH.img?w=2000&h=1333&m=4&q=93

Income Tax Consultant Malaysia Kuantan

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=151571854292136

Income Tax Income Tax Credit Www gotcredit With An Act Flickr

https://live.staticflickr.com/8276/30023384350_3fa5295abc_b.jpg

Web 23 Feb 2022 nbsp 0183 32 This tax season millions of low income Americans are eligible for a one time tax break that could save them big bucks The federal Earned Income Tax Credit which is aimed at people Web Vor 2 Tagen nbsp 0183 32 The global minimum which applies to groups with over 750 million euros 820 million in annual turnover aims in particular to discourage big multinationals from booking profits in low tax

Web 16 Nov 2022 nbsp 0183 32 A tax break is a popular way to refer to federal tax credits and deductions because they help you get a break on how much you owe in taxes A tax credit reduces how much you owe in taxes and may be delivered in the form of a tax refund A tax deduction reduces the overall amount of taxable income you have and it adjusts how Web Sun 7 Jan 2024 08 05 EST Rishi Sunak has said he wants to cut taxes for working people further this year possibly cutting welfare payments to fund it The prime minister said on Sunday his

The Local Tax Break Many Retirees Don t Know About but Should

https://images.wsj.net/im-596788/?width=1278&size=1

Income Tax Overview Booklet CIBC Private Wealth Page 2

https://view.publitas.com/39896/1424428/pages/d646d165-01a2-40c3-ab00-9956e1989714-at1600.jpg

https://en.wikipedia.org/wiki/Tax_break

Web One of the majors is to provide the low income class with more assurances More income obtained by tax breaks could potentially provide this population fragment with a greater proportion of welfare Otherwise tax breaks are commonly used to promote education the environment health care unemployed but even to support eco farming

https://www.investopedia.com/terms/t/tax-break.asp

Web Updated December 15 2022 Reviewed by Margaret James Fact checked by Jared Ecker What Is a Tax Break The term tax break refers to a benefit the government offers that reduces your total tax

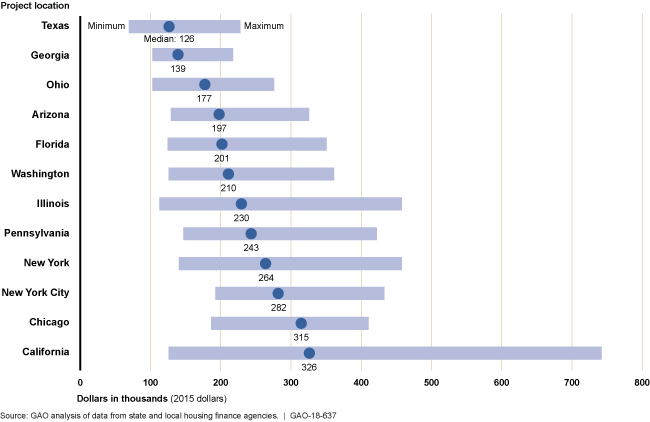

Low Income Housing Tax Credit Improved Data And Oversight Would

The Local Tax Break Many Retirees Don t Know About but Should

Filing Of Income Tax Return Lahore

WHICH IS BETTER TAX CREDITS OR TAX DEDUCTIONS Tax Professionals

Low And Middle Income Earners About To Be Hit With A Massive Tax

Low And Middle Income Earners About To Be Hit With A Massive Tax

Six Overlooked Tax Breaks For Individuals Montgomery Community Media

Tax Reduction Company Inc

Tax Break Lure For Foreign based Companies Geraldton Guardian

Tax Break Low Income - Web 22 Okt 2022 nbsp 0183 32 The lamington tax offset which gives low and middle income earners a tax break of between 255 and 1 080 was first announced as a temporary measure in 2018 It was extended by the