Tax Credit Eligible Heat Pumps What Products are Eligible Heat pumps are either ducted or non ducted mini splits Eligibility depends on whether you live in the north or south Ducted South All heat pumps that have earned the ENERGY STAR label North Heat pumps designated as ENERGY STAR Cold Climate that have an EER2 10 Ductless mini splits

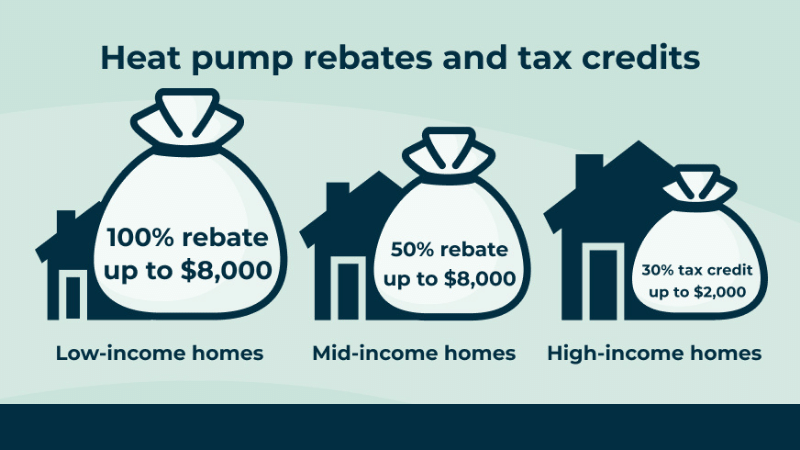

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit is nonrefundable which means taxpayers cannot get back more from the credit than what is owed in taxes and any excess credit cannot be carried to future tax years Residential Clean Energy Credit Beginning January 1 2023 the amount of the credit is equal to 30 of the sum of amounts paid by the taxpayer for certain qualified expenditures including 1 qualified energy efficiency improvements installed during the year 2 residential energy property expenditures during the year and 3 home energy audits during the year

Tax Credit Eligible Heat Pumps

Tax Credit Eligible Heat Pumps

https://comfortcontrolspecialists.com/wp-content/uploads/2023/06/CCS-Air-Source-Heat-Pumps-Tax-Credit-750x420.jpg

Tax Credits Offered For Heat Pump Installation YouTube

https://i.ytimg.com/vi/j5EODeZMn-0/maxresdefault.jpg

Meet The New 179D And 45Q Two US Tax Benefits Aimed At Helping

https://costar.brightspotcdn.com/dims4/default/2462239/2147483647/strip/true/crop/1615x1077+0+0/resize/1615x1077!/quality/100/?url=http:%2F%2Fcostar-brightspot.s3.amazonaws.com%2F72%2Fb9%2F67d1479b42fea10d7e5dbbf0e283%2Fsolar.jpg

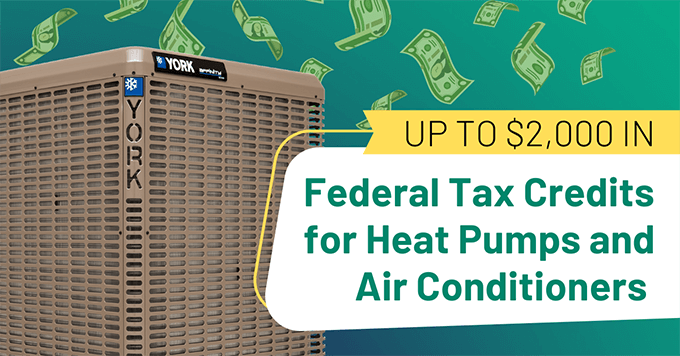

Total Annual Limit The 2 000 heat pump credit can be combined with credits up to 1 200 for other qualified upgrades made in one tax year Effective Date Products purchased and installed between January 1 2023 and December 31 2032 Tax Credit An amount taxpayers can claim on their federal tax return to reduce income tax owed This credit covers 30 percent of the cost of home improvements such as qualifying heat pumps which are eligible for a credit of up to 2 000 as well as upgraded windows doors insulation biomass stoves water heaters and boilers which are subject to certain annual caps

Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year Air Source Heat Pumps Heat Pump Water Heaters Biomass Stoves or Boilers This tax credit is good for 30 percent of the total cost of what you paid for your heat pump including the cost of labor up to 2 000 and it would be available through the

Download Tax Credit Eligible Heat Pumps

More picture related to Tax Credit Eligible Heat Pumps

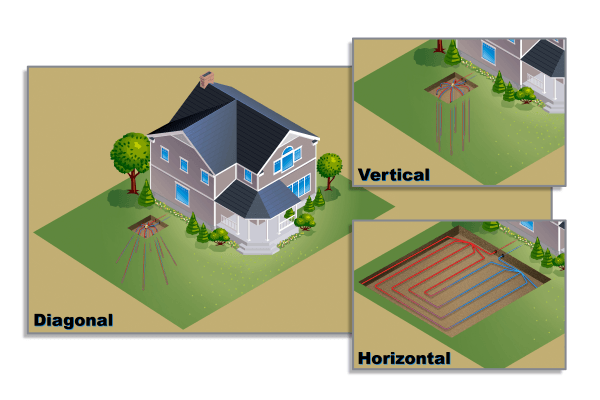

Tax Credits For Geothermal Heat Pumps

https://twinairllc.com/wp-content/uploads/2020/02/Tax-Credit.jpg

Nova Scotia Power Rebates On Heat Pumps PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pump-rebates-atmosphere-climate-control-specialists-71.png

Tax Credits Incentives And Technical Assistance For Geothermal Heat

https://www.energy.gov/sites/default/files/2023-05/2679-geothermal-heatpumps-overview-2023.png

What is an energy tax credit An energy tax credit is a refund or rebate offered to homeowners who make commitments to energy efficiency It allows individuals businesses and organizations to save money on their taxes when they invest in renewable energy technologies such as solar panels wind turbines geothermal systems and more Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps Eligible models as listed above are qualified and dependent upon specific system combinations

How much is the heat pump tax credit Quick cheat sheet HVAC system heat pump tax credits 2022 Up to 300 2023 through 2032 30 of your project costs up to 2 000 with an additional 600 tax credit for electric panel upgrades if needed to support heat pump installation Heat pump water heater tax credits 2022 Up to 300 Heat pump federal tax credit 2024 Starting in 2023 continuing this year and through the end of 2032 all homeowners will be eligible for a 30 federal tax credit on the total cost of buying and installing their new heat pump with a maximum credit of 2 000

38MURA

https://images.carriercms.com/image/upload/v1663856010/payne/products/heat-pumps/compact-heat-pump-38MURA.png

Your Guide To The Heat Pump Tax Credit Rebates In 2023 Rapid

https://rapidhvactn.com/wp-content/uploads/2022/10/IMG_1761.jpg

https://www.energystar.gov/.../air-source-heat-pumps

What Products are Eligible Heat pumps are either ducted or non ducted mini splits Eligibility depends on whether you live in the north or south Ducted South All heat pumps that have earned the ENERGY STAR label North Heat pumps designated as ENERGY STAR Cold Climate that have an EER2 10 Ductless mini splits

https://www.irs.gov/newsroom/irs-home-improvements...

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit is nonrefundable which means taxpayers cannot get back more from the credit than what is owed in taxes and any excess credit cannot be carried to future tax years Residential Clean Energy Credit

Federal Tax Credits For Air Conditioners Heat Pumps 2023

38MURA

Heat Pump Tax Credit Reddit PumpRebate

Heat Pump Tax Credit Retroactive PumpRebate

Low Income Households Should Get Free Heat Pumps Experts Usave co uk

How Can You Optimize The Energy Efficiency Of A Heat Pump System

How Can You Optimize The Energy Efficiency Of A Heat Pump System

The Inflation Reduction Act pumps Up Heat Pumps Hvac

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

Geothermal Heat Pumps Eligible For Tax Credit Of 30 Coldcraft Inc

Tax Credit Eligible Heat Pumps - This credit covers 30 percent of the cost of home improvements such as qualifying heat pumps which are eligible for a credit of up to 2 000 as well as upgraded windows doors insulation biomass stoves water heaters and boilers which are subject to certain annual caps