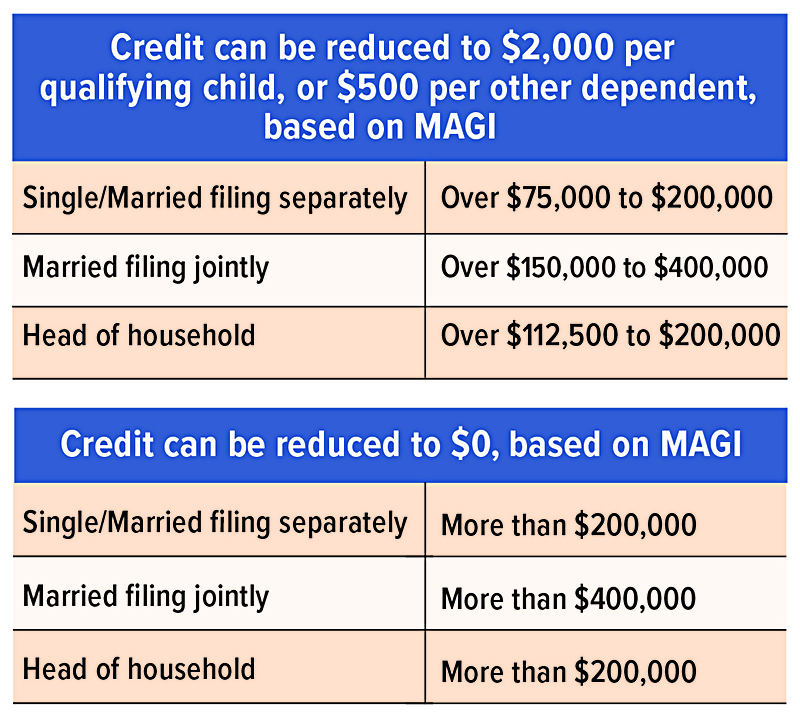

Tax Credit Explained Guidance and forms for claiming or renewing tax credits Including childcare costs payment dates leaving or coming to the UK overpayments and reporting changes

Tax credits are essentially a means of re distributing income by paying money to a families raising children and b working people on low incomes To their critics they are a handout CPA Explains How Tax Credits Work With Examples What are tax credits And how they are different from tax deductions This episode is the answer Become a Tax Client

Tax Credit Explained

Tax Credit Explained

https://www.broadridgeadvisor.com/images/origres/FI3_ChildTaxCredit_0821.jpg

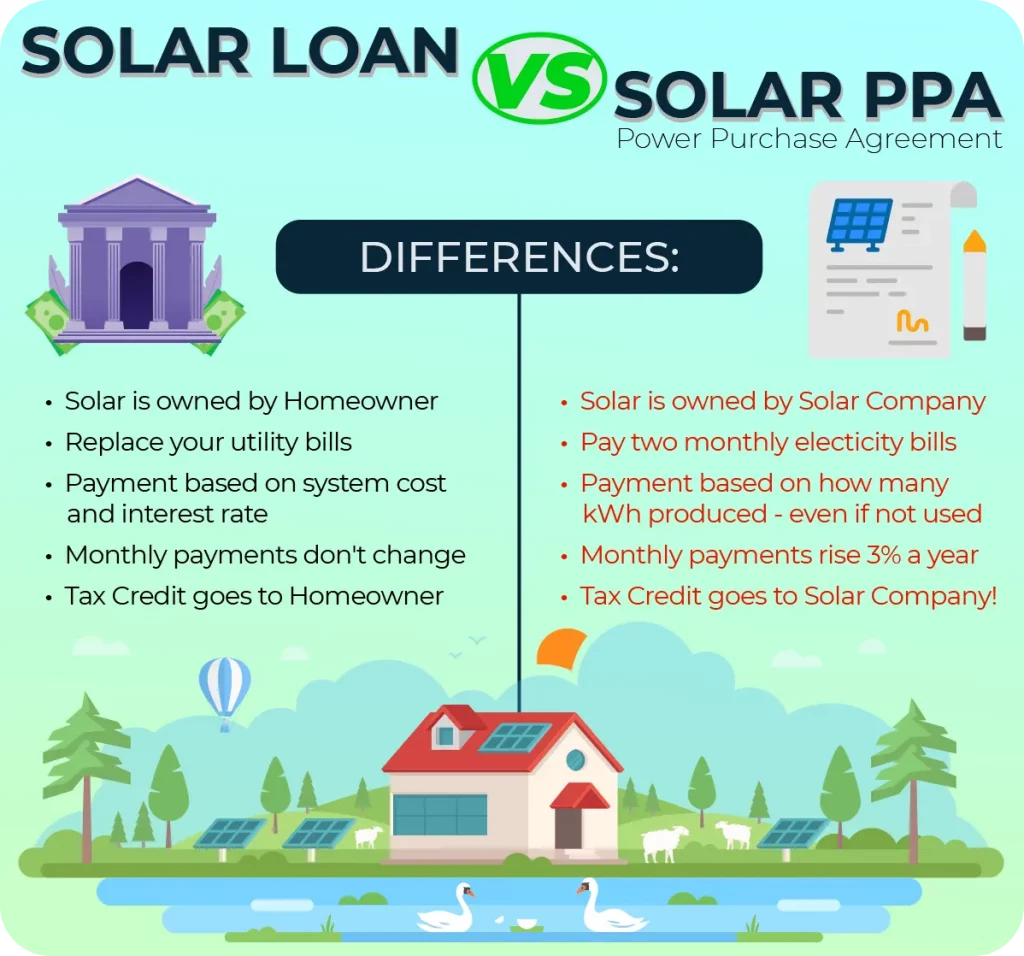

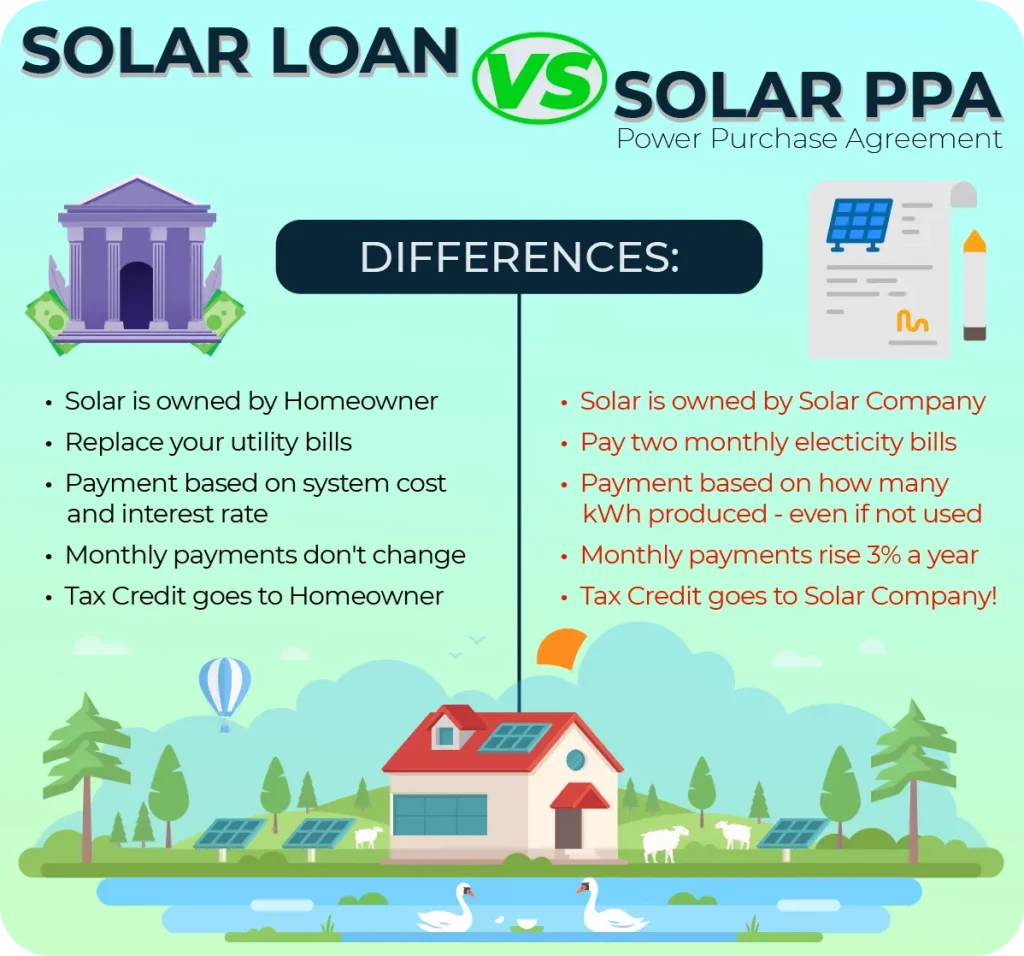

Alternative Financial Options For Going Solar Advantages And

https://homesolarsimplified.com/wp-content/uploads/2023/08/Solar-Loan-vs-PPA-1024x956-1.webp

The Savers Tax Credit Explained

https://www.getrichslowly.org/uploadedfiles/2016/11/Savers-Tax-Credit-Explained.png

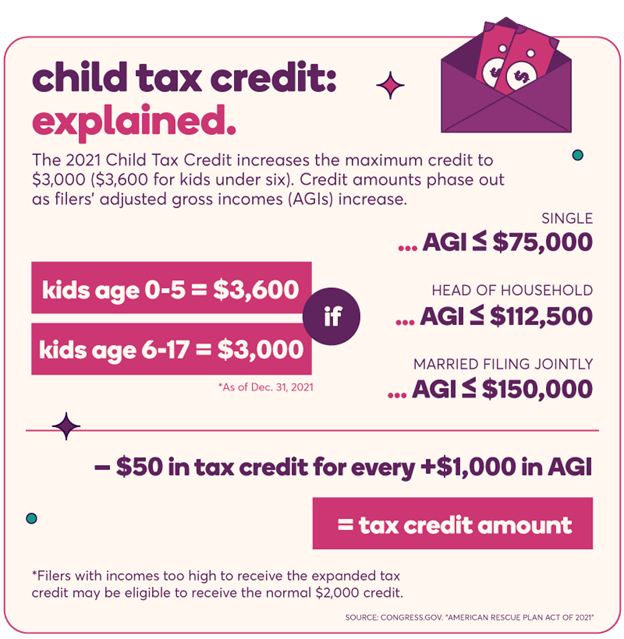

A tax credit is a provision that reduces a taxpayer s final tax bill dollar for dollar A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayer s tax bill directly Tax credits are subtracted directly from a person s tax liability they therefore reduce taxes dollar for dollar Credits have the same value for everyone who can claim their full value Most tax credits are nonrefundable that is they cannot reduce a filer s income tax liability below zero

What Is a Nonrefundable Tax Credit A nonrefundable tax credit is a reduction in the amount of income taxes that a taxpayer owes It can reduce the amount owed to zero but no further In Tax credits are a type of financial incentive offered by the government to reduce an individual s or a company s tax liability They directly reduce the amount of tax owed dollar for dollar as opposed to tax deductions which lower the amount of taxable income

Download Tax Credit Explained

More picture related to Tax Credit Explained

Tax Credit Explained YouTube

https://i.ytimg.com/vi/ytiJRBO99MI/maxresdefault.jpg

What Is Input Tax Credit In GST YourSelfQuotes

https://www.yourselfquotes.com/wp-content/uploads/How-to-Claim-Input-Tax-Credit-Under-GST-1024x670.png

GST Input Tax Credit Explained With Interesting Animation YouTube

https://i.ytimg.com/vi/cm-dxTaJKRs/maxresdefault.jpg

What are tax credits Tax credits are payments from the government administered by HM Revenue and Customs There are two types of tax credit If you re responsible for at least one child or young person you may qualify for Child Tax Credit Tax credits are tax breaks that lower how much you owe to the government They can be nonrefundable refundable and partially refundable

[desc-10] [desc-11]

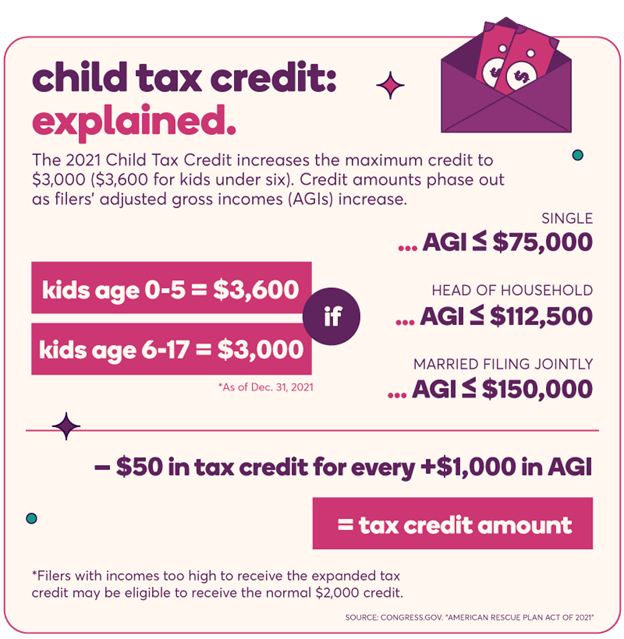

Advanced Child Tax Credit Explained Haynie Company

https://www.hayniecpas.com/wp-content/uploads/2021/04/Advanced-Child-Tax-Credit-Explained.png

Tax Credit Explained

https://image.slidesharecdn.com/taxcreditpowerpoint2-090326111807-phpapp02/95/tax-credit-explained-1-728.jpg?cb=1238067845

https://www.gov.uk/government/collections/tax...

Guidance and forms for claiming or renewing tax credits Including childcare costs payment dates leaving or coming to the UK overpayments and reporting changes

https://www.bbc.co.uk/news/business-33224896

Tax credits are essentially a means of re distributing income by paying money to a families raising children and b working people on low incomes To their critics they are a handout

Tax Credit Explained

Advanced Child Tax Credit Explained Haynie Company

Federal EV Tax Credit Explained YouTube

Education Tax Credits The Lifetime Learning Tax Credit Explained Tax

Federal Tax Credit For Installing Solar Panels Tax Walls

The Federal Solar Tax Credit Explained Sunshine Plus Solar

The Federal Solar Tax Credit Explained Sunshine Plus Solar

Tax Credit Universal Credit Impact Of Announced Changes House Of

Tax Credit Explained

Employee Retention Credit For Employers Meadows Urquhart Acree And

Tax Credit Explained - [desc-14]