Tax Relief Explained Tax relief means reducing your tax burden which can include providing tax reductions or extending tax filing deadlines Tax relief can be instituted at the federal state or local level Some tax relief measures are permanent while others apply to temporary situations such as a natural disaster or the COVID 19 pandemic

You can claim tax reliefs in addition to any personal tax free allowances that you are entitled to which means you ll take home more of your income and pay less tax This guide explains which tax reliefs are available how they work and Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax relief

Tax Relief Explained

Tax Relief Explained

http://phl.hasil.gov.my/img/PELEPASAN_CUKAI_2020_2.jpg

Tax Relief Explained CUInsight

https://www.cuinsight.com/wp-content/uploads/2020/02/kelly-sikkema-SiOW0btU0zk-unsplash.jpg

.jpg)

EIS Tax Relief EIS Scheme Explained

https://uploads-ssl.webflow.com/5bf8086dc176116541ad2553/6194c0966ddf308b44f64258_Get advanced assurance from HMRC (2).jpg

Tax relief You can get tax relief on private pension contributions worth up to 100 of your annual earnings You ll either get the tax relief automatically or you ll have to claim it Overview You might be able to claim tax relief if you use your own money for things that you must buy for your job you only use these things for your work You cannot claim tax relief if

There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the relief at source method is always used Pension tax relief explained Every UK resident under the age of 75 can add money to a pension and get tax relief Find out how to boost your retirement savings

Download Tax Relief Explained

More picture related to Tax Relief Explained

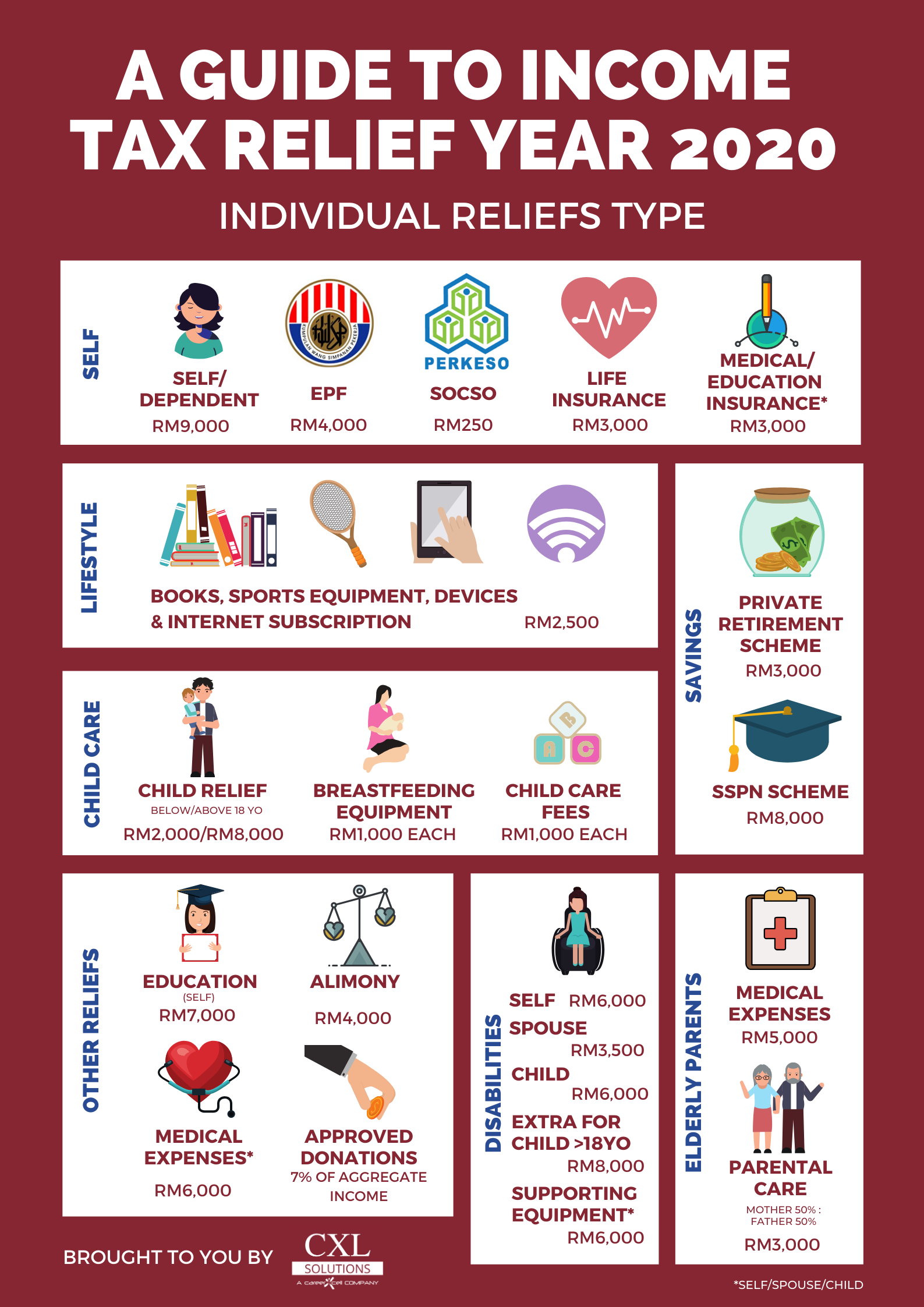

Breaking It Down Income Tax Relief For The Year 2020 YA 2019 CXL

https://cxlgroup.com/wp-content/uploads/2020/02/5ad298_fa36b68799e848d9abafe02d6ac0f197_mv2_d_1587_2245_s_2.png

Creative Industry Tax Reliefs Explained

https://www.myriadassociates.com/media/o3yczhxl/creative-tax-relief-graphic-03.png

Creative Industry Tax Reliefs Explained

https://www.myriadassociates.com/media/mbxhm4p5/creative-tax-relief-graphic-01.png?anchor=center&mode=crop&width=1174&height=600&rnd=132906852410200000

How does pension tax relief work You can essentially contribute 100 into your pension and it only costs 80 This means when you pay into your pension from your pay packet or make a one off contribution you ll get a boost from the government in the form of tax relief What is pension tax relief how it works how to claim pension tax relief tax free pension allowances and claiming higher rate tax relief Pensions are one of the most tax efficient ways to save for your future In this article we ll explain everything you need to know about tax relief on pensions in simple everyday terms

Tax relief on UK pensions When you re thinking about how much money to save into your pension plan it s important to understand how pension tax relief works You can receive pension tax relief on any personal contributions that you make up to 100 of your salary What is buy to let mortgage interest tax relief The way landlords must declare their rental income has changed resulting in many facing higher tax bills While borrowing money through a buy to let mortgage was once a major tax advantage it s no longer the case

EIS Tax Reliefs Explained Part One Income Tax Relief

https://info.sapphirecapitalpartners.co.uk/hs-fs/hub/217255/file-18555607-jpg/images/5857156048_0fb35a8266_b.jpg?width=546&height=408&name=5857156048_0fb35a8266_b.jpg

R D Tax Relief Explained Legislate

https://global-uploads.webflow.com/5ff6e329cfeb43d004ee0f63/623066b9eb02492c3ee360b4_Copy of Blog Thumbnail Simple-7.png

https://www.thebalancemoney.com/what-is-tax-relief-5218284

Tax relief means reducing your tax burden which can include providing tax reductions or extending tax filing deadlines Tax relief can be instituted at the federal state or local level Some tax relief measures are permanent while others apply to temporary situations such as a natural disaster or the COVID 19 pandemic

https://www.which.co.uk/.../tax-reliefs-a3NId6X0P10X

You can claim tax reliefs in addition to any personal tax free allowances that you are entitled to which means you ll take home more of your income and pay less tax This guide explains which tax reliefs are available how they work and

Gift Aid Tax Relief Explained In Under 5 Mins YouTube

EIS Tax Reliefs Explained Part One Income Tax Relief

The Super deduction Tax Relief Explained Aardvark Accounting

R D Tax Relief Explained ECOVIS Wingrave Yeats

Personal Tax Reliefs Year 2022 Taxguards Advisory

R D Tax Relief Explained White Label Resources

R D Tax Relief Explained White Label Resources

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals

Self Employed Pension Tax Relief Explained Penfold Pension

Tax Reliefs And Changes To Expect From YA2020 YH TAN ASSOCIATES PLT

Tax Relief Explained - The tax relief postpones until February 3 2025 various tax filing and payment deadlines that occurred beginning on August 1 2024 in Florida August 4 2024 in Georgia and South Carolina and August 5 2024 in North Carolina As a result affected individuals and businesses will have until February 3 2025 to file returns and pay any