Tax Credit For Hvac Heat Pump Learn how to claim a 30 tax credit for installing eligible air source heat pumps in your principal residence between 2023 and 2032 Find out the eligibility criteria annual limits and other incentives for energy efficiency upgrades

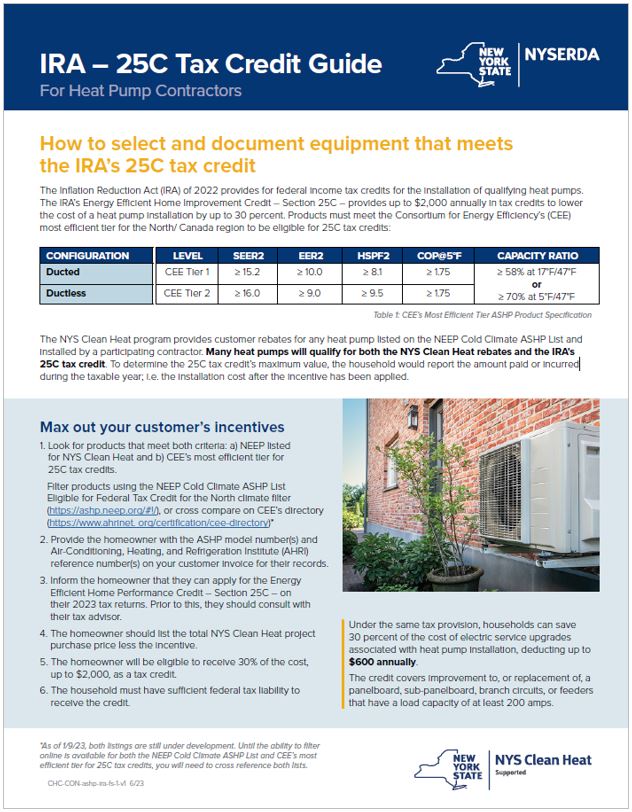

The credit is limited to certain amounts per taxpayer and per tax year A taxpayer may claim a total credit of up to 3 200 with a general total limit of 1 200 and a separate total limit of 2 000 for electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves or boilers that meet certain As we approach January 1 2025 the Consortium for Energy Efficiency CEE has announced key updates to the Residential Electric HVAC Specifications which will impact tax credit eligibility for heat pumps and other high performing HVAC systems This revision aims to simplify specifications and set a clearer standard for national market transformation with the primary

Tax Credit For Hvac Heat Pump

Tax Credit For Hvac Heat Pump

https://www.symbiontairconditioning.com/wp-content/uploads/2020/06/money-ac-graphic-2.png

Georgia And Federal Tax Credits For HVAC 2023 Reliable Heating Air

https://octanecdn.com/reliableairnew/reliableairnew_782044049.png

Heat Pump Tax Credit Magic Touch Mechanical

https://airconditioningarizona.com/wp-content/uploads/2023/03/Heat_Pump_Tax_Credit_2023.jpg

It includes tax credits for heat pumps heat pump water heaters weatherization electric panel upgrades solar and battery storage Learn how to save up to 3 200 annually on taxes for energy efficient home upgrades with the Inflation Reduction Act of 2022 Find out how to claim the credits for heat pumps windows insulation solar wind geothermal fuel cells and battery storage

Learn how to claim tax credits for energy improvements to your home such as solar panels insulation or heat pumps Find out the eligibility requirements credit amounts and resources for the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit Learn how to qualify for federal tax credits on HVAC systems purchased and installed between 2023 and 2034 Find out the criteria rates and benefits for different types of heating and cooling units such as air source heat pumps boilers furnaces and air conditioners

Download Tax Credit For Hvac Heat Pump

More picture related to Tax Credit For Hvac Heat Pump

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

How To Find Federal Tax Credits Rebates For HVAC Upgrades

https://www.blueheatingandcooling.com/wp-content/uploads/2016/10/BHC-taxcredits.jpg

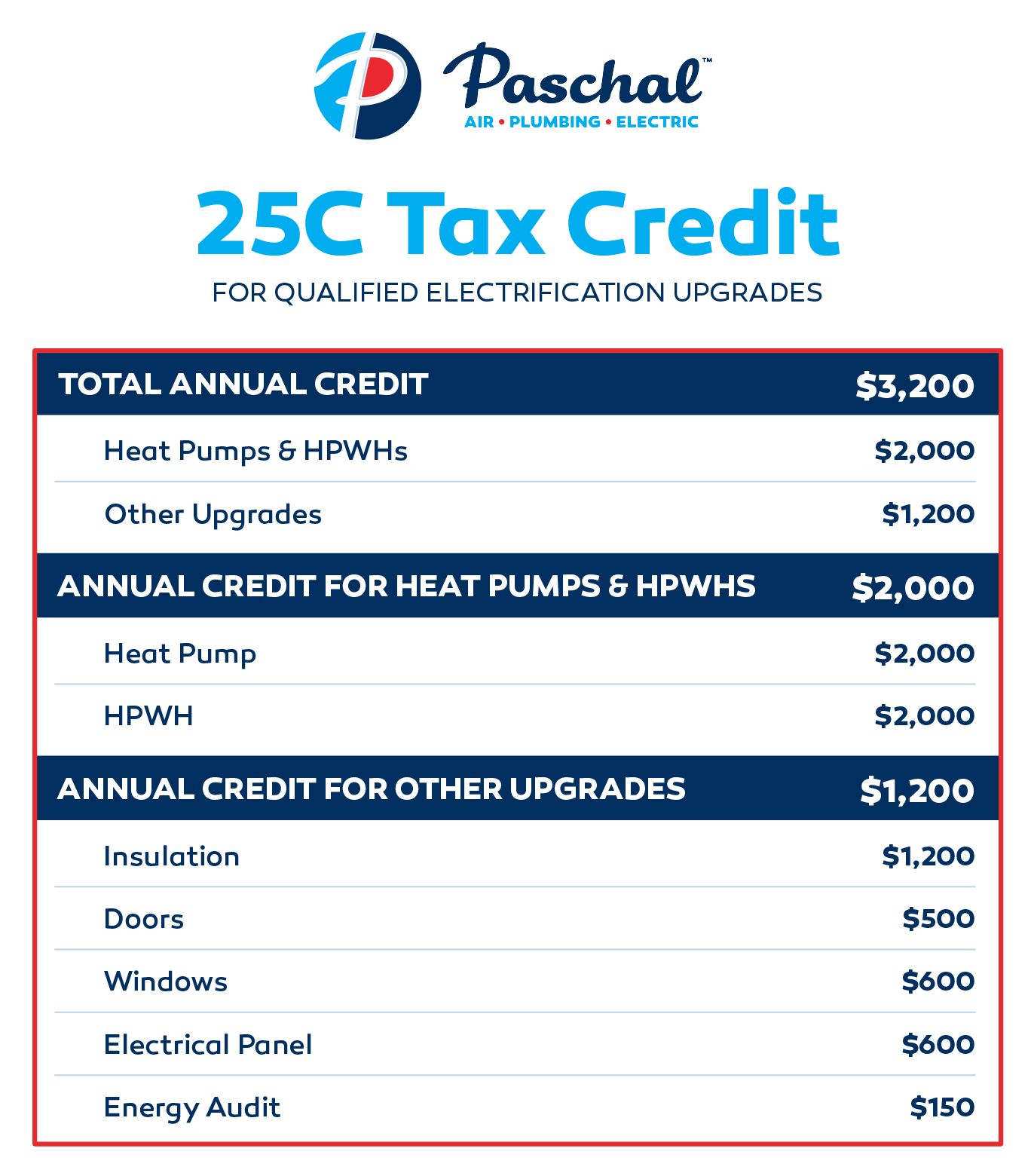

25C Residential Energy Efficiency Tax Credit Paschal Air Plumbing

https://gopaschal.com/wp-content/uploads/2023/02/2023FEB_25c-Tax-Credit-WEB-1-e1677179515383.png

If you install an efficient heat pump you are eligible for a federal tax credit that will cover 30 up to 2 000 of the heat pump cost and installation This tax credit through the Inflation Reduction Act is available through 2032 and is capped at 2 000 per year Learn how to claim tax credits for energy efficient home improvements such as solar panels heat pumps insulation and more Find out the eligibility requirements product standards and annual limits for 2023 2032 tax years

The renewed Energy Efficient Home Improvement Tax Credit 25C program increases the HVAC tax credit limit for installing CEE Top Tier high efficiency equipment it is retroactive to January 1 2022 and approved until 2032 Eligible equipment includes Heat pumps and heat pump water heaters The following HVAC tax credits could be available if your state submits an application and has it approved Air Source Heat Pumps Tax Credit Available 30 of the total project cost up to 2 000 Eligibility Requirements South All heat pumps that are Energy Star certified North Heat pumps designated as Energy Star Cold Climate units with

New Tax Law Provides Added Incentive For Upgrading HVAC Systems

http://sandermechanical.com/wp-content/uploads/2018/01/Infographic-HVAC-Now-Qualifies-for-Section-179-Small-Business-Expensing-w-Logo.jpg

300 Federal Tax Credit For Heat Pumps Alaska Heat Smart

https://akheatsmart.org/wp-content/uploads/2022/04/heat-pump-indoor_300.jpg

https://www.energystar.gov › ... › air-source-heat-pumps

Learn how to claim a 30 tax credit for installing eligible air source heat pumps in your principal residence between 2023 and 2032 Find out the eligibility criteria annual limits and other incentives for energy efficiency upgrades

https://www.irs.gov › newsroom › treasury-and-irs...

The credit is limited to certain amounts per taxpayer and per tax year A taxpayer may claim a total credit of up to 3 200 with a general total limit of 1 200 and a separate total limit of 2 000 for electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves or boilers that meet certain

HVAC Tax Credit 2022 2023

New Tax Law Provides Added Incentive For Upgrading HVAC Systems

Federal Tax Credit For HVAC Systems How Does It Work And How To Claim

Federal Tax Credit For HVAC Systems How Does It Work And How To Claim

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

Heat Pumps How Federal Tax Credits Can Help You Get One

Heat Pumps How Federal Tax Credits Can Help You Get One

300 Federal Tax Credit For Air Conditioners Kobie Complete

Installer Reference Materials Resources Clean Heat Connect NYS

2023 Residential Clean Energy Credit Guide ReVision Energy

Tax Credit For Hvac Heat Pump - Learn how to claim tax credits for energy improvements to your home such as solar panels insulation or heat pumps Find out the eligibility requirements credit amounts and resources for the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit