Tax Credit For New Air Conditioning Rebates Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope

Web 26 juil 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take Web 13 avr 2023 nbsp 0183 32 How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax

Tax Credit For New Air Conditioning Rebates

Tax Credit For New Air Conditioning Rebates

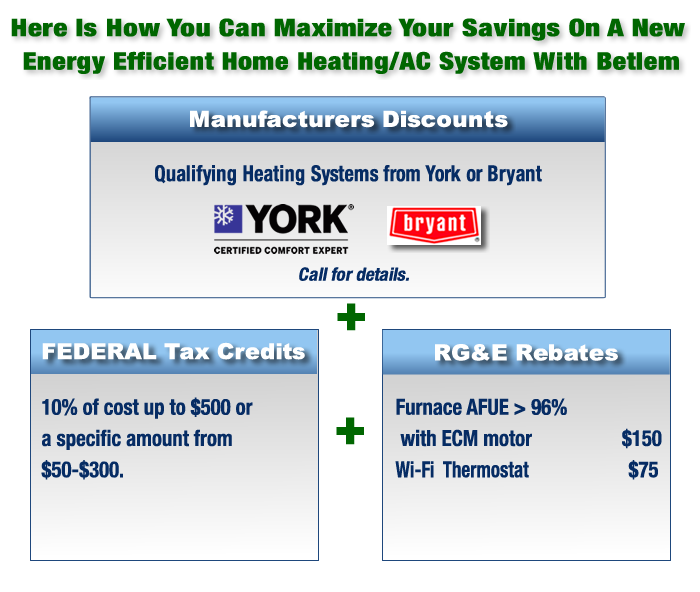

http://www.betlem.com/images/hvac-furnace-air-conditioning-savings-chart-final-9-22-2022.png

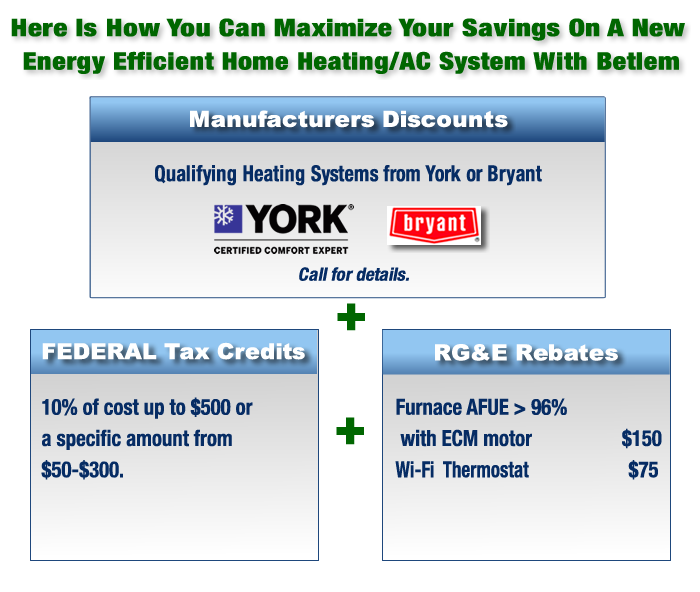

HVAC Tax Credits 2018 2019 Magic Touch Mechanical

https://www.airconditioningarizona.com/wp-content/uploads/2018/12/HVAC_Tax_Credits_-_Rebates.jpg

Energy Efficient Air Conditioning Tax Credits For New AC

https://gulfcoastairsystems.com/wp-content/uploads/SEERrating-1536x1023.jpg

Web 12 janv 2023 nbsp 0183 32 On January 1 2023 new federal tax credits came into effect under the provisions set forth in the Inflation Reduction Act These tax credits cover a wide range Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Web 11 mars 2021 nbsp 0183 32 Written by Josh Mitchell Last Updated on May 30 2023 The US government has extended the energy efficiency tax credit through 2021 Now by purchasing a qualifying HVAC system you can save on Web 6 juin 2023 nbsp 0183 32 Installer une pompe 224 chaleur air air ne donne plus droit 224 un cr 233 dit d imp 244 t depuis 2009 Opter pour une pompe 224 chaleur air eau ou pour une pompe 224 chaleur

Download Tax Credit For New Air Conditioning Rebates

More picture related to Tax Credit For New Air Conditioning Rebates

Air Conditioner Tax Rebate Air Conditioner Tax Credits Beaufort Air

http://brownsarticair.com/wp-content/uploads/2020/08/federaltaxcredit.png

Air Conditioner Tax Rebate Air Conditioner Tax Credits Beaufort Air

https://pharoheating.com/wp-content/uploads/2016/01/April-2013.png

Air Conditioning Installation Denver CO Dalco Heating Air

https://www.dalcohvac.com/wp-content/uploads/2020/04/Big_Tax_DHA3-1024x587.jpg

Web Heat pump water heater tax credit 2023 30 of your project costs up to 2000 If you installed a qualifying heat pump HVAC system or water heater in 2022 or earlier you may be eligible for a tax credit of up to 300 Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Web 16 janv 2023 nbsp 0183 32 The Federal Energy Tax Credit is a specified amount that the homeowner can subtract from the taxes owed to the IRS to help offset the cost of HVAC Web 30 d 233 c 2022 nbsp 0183 32 Tax Credits for Homeowners Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022

https://www.symbiontairconditioning.com/wp-content/uploads/2020/06/money-ac-graphic-2.png

Central Air Conditioner Rebates Central Air Conditioning Cps Energy

https://i.pinimg.com/originals/28/39/aa/2839aa4fd56d1fc6cc0103981341b3e1.jpg

https://www.energystar.gov/about/federal_tax_credits/central_air...

Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take

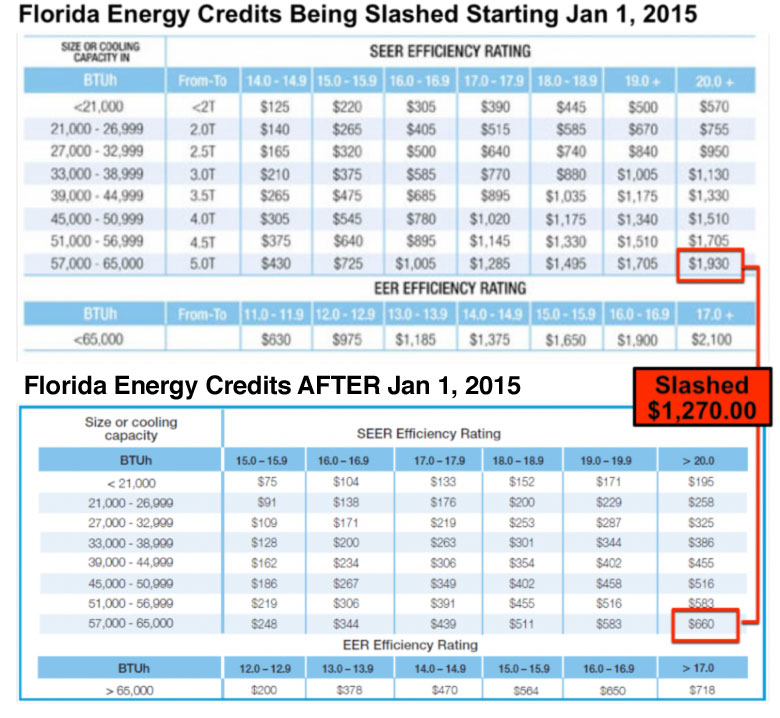

Scottsdale Air Lennox Rebate 2015

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022

Federal Tax Credits For Air Conditioners Heat Pumps 2023

How To Find Federal Tax Credits Rebates For HVAC Upgrades

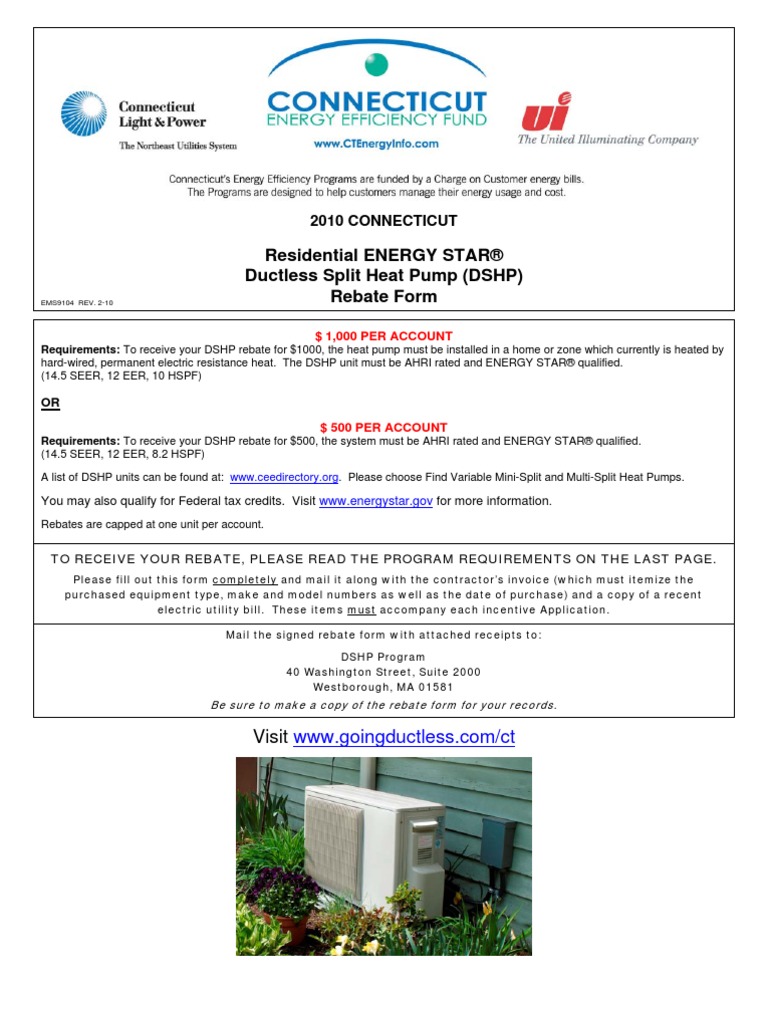

Rebate Form Air Conditioning Invoice

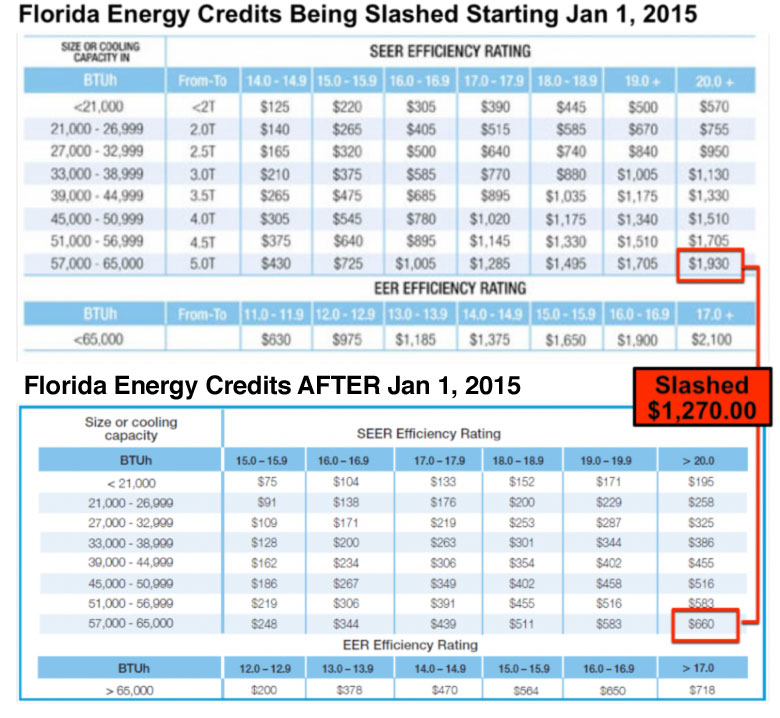

FPL Rebate Program Slashed And Will Cost Homeowners More To Replace AC

FPL Rebate Program Slashed And Will Cost Homeowners More To Replace AC

Government Rebate For New Air Conditioner KnowYourGovernment

Rebates Modesto Turlock Valley Air Conditioning CA

HVAC Tax Credits 2018 2019 Magic Touch Mechanical

Tax Credit For New Air Conditioning Rebates - Web 12 janv 2023 nbsp 0183 32 On January 1 2023 new federal tax credits came into effect under the provisions set forth in the Inflation Reduction Act These tax credits cover a wide range